ID: PMRREP35311| 172 Pages | 15 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

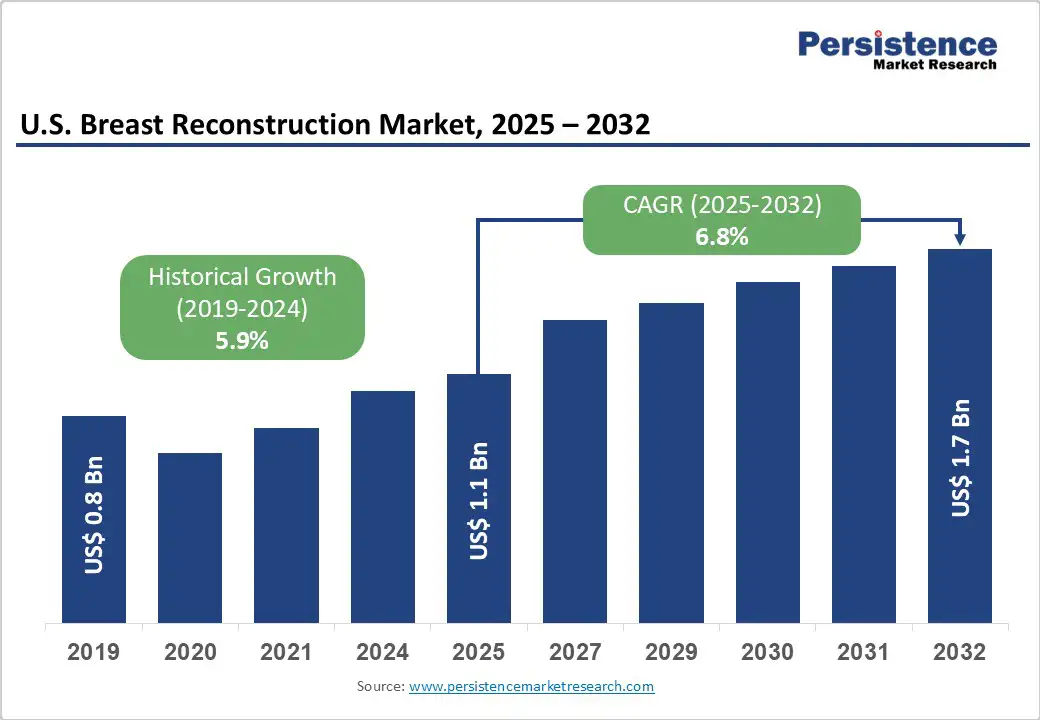

The U.S. breast reconstruction market size is likely to be valued at US$ 1.1 billion in 2025, and is estimated to reach US$ 1.7 billion by 2032, growing at CAGR of 6.8% during the forecast period 2025 - 2032.

Rising breast cancer prevalence, mastectomy rates, and patient demand for aesthetic restoration. Advancements in implants, autologous techniques, and reimbursement support fuel growth.

Trends include 3D imaging, minimally invasive methods, biologics, and specialized training programs improving accessibility across hospitals, clinics, and academic centers.

| U.S. Breast Reconstruction Market Attribute | Key Insights |

|---|---|

| U.S. Breast Reconstruction Market Size (2025E) | US$ 1.1 Bn |

| Market Value Forecast (2032F) | US$ 1.7 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.9% |

Advancements in implant and autologous reconstruction techniques have significantly shaped the U.S. Breast Reconstruction market. For example, use of autologous breast reconstruction (ABR) rose from 26.6% to 56.5% between 2009 and 2016, as patients and surgeons increasingly favor tissue-based methods.

Deep inferior epigastric perforator (DIEP) flap procedures specifically increased by 28% from 2016-2019, accounting for nearly 69% of all autologous procedures in that period.

On the implant side, recent FDA-approved innovations include the Mentor MemoryGel Enhance line, expanding available implant volumes up to 1445 cc to better accommodate diverse body types and mastectomy extents.

Moreover, safety data from more than 55,000 subjects in post-approval studies showed no statistically significant increase in rare adverse events, such as cancer or connective tissue disease, for silicone versus saline implants in the reconstruction context.

These improvements, greater natural aesthetic outcomes via autologous techniques, larger and more customizable implants, and robust safety evidence are likely to cement patient preference and aid market growth.

Complications and the need for revisions pose a significant barrier in breast reconstruction, impacting not only outcomes but also patient willingness and healthcare costs. For instance, in a study of 24,506 post-mastectomy reconstructions (84% implant-based, 16% autologous), about 10.0% of patients experienced a major complication. Implant reconstructions carried a higher risk when done immediately vs. delayed 8.8% vs. 5.3% respectively.

Another source shows that among 2,343 patients, overall complications occurred in 32.9%, reoperative complications in 19.3%, and wound infections in 9.8% within two years following reconstruction. Autologous techniques generally had higher odds of any complication vs. expander-implant (EI) methods. Moreover, in implant-based reconstructions following radiation therapy, overall complication rates exceed 40%, far above the ≈14% among those without radiation.

Among patients who had complications, 23.1% had complications, and 67.1% of those underwent elective revision surgery. Even patients without complications averaged over two procedures to reach satisfactory reconstruction. These complications and revision rates increase costs, prolong recovery, and reduce patient satisfaction, serving as key restraints on market growth.

Advances in 3D printing & custom implants offer a strong opportunity for the U.S. breast reconstruction market, backed by promising early-stage data. For example, Weill Cornell researchers developed 3D-printed, bioresorbable scaffolds for nipple reconstruction that maintain long-lasting projection in preclinical models, using polymers already approved for human devices.

Another case: a 3D-printed poly-4hydroxybutyrate (P4HB) scaffold filled with costal cartilage preserved nipple projection significantly better at six months compared to non-scaffold reconstructions. In a small clinical trial by BellaSeno, 19 women who had prior implant complications received 3D-printed scaffolds; one year later, they retained 87% of breast volume with no major complications.

Additionally, NIH and other bodies are funding work to develop personalized, bioresorbable nipple-areolar complex (NAC) constructs to match native projection and aesthetics. These developments suggest custom 3D printed implants and scaffolds could reduce complication rates, improve aesthetic outcomes, and meet the demand for personalized reconstruction options.

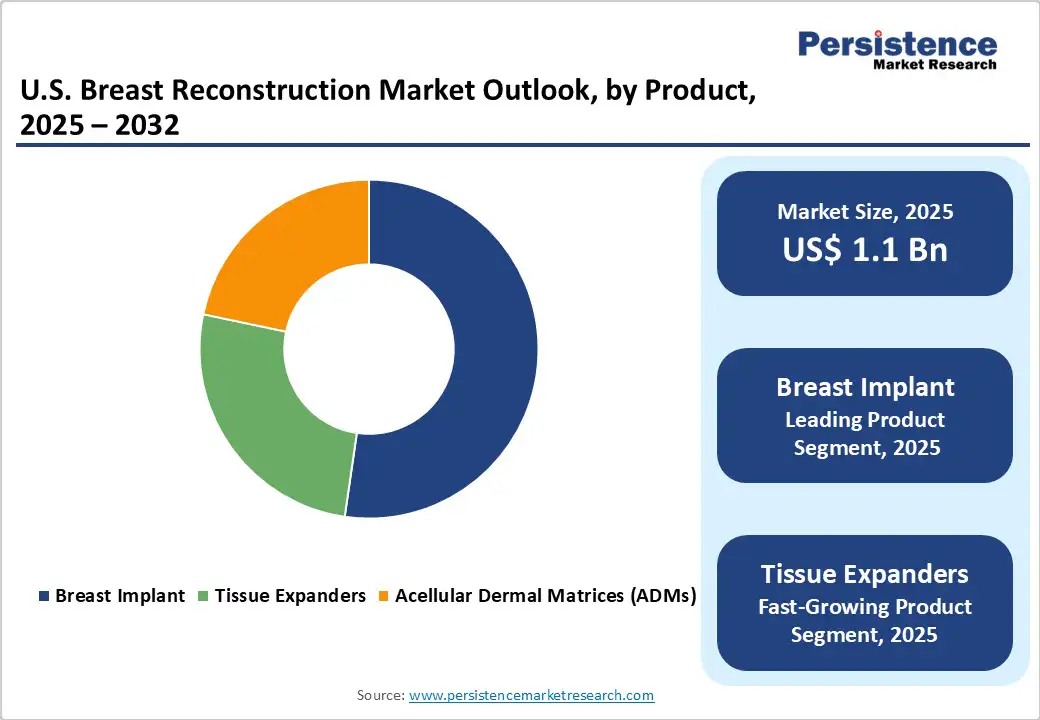

Breast implants are likely to lead the market with around 52.3% share in 2025, due to their widespread adoption, shorter operative times, and faster recovery compared with autologous procedures. Implant-based reconstruction accounts for approximately 81% of all post-mastectomy reconstructions in the country.

Advancements in implant technology, including cohesive silicone gel implants, varying shapes, and sizes, have enhanced aesthetic outcomes and patient satisfaction. They also eliminate donor site morbidity associated with tissue-based methods, making them more appealing to both patients and surgeons.

While autologous reconstructions such as DIEP flaps offer natural results, they are technically complex, require longer surgery and recovery, and need specialized surgical expertise. These factors make implants the preferred choice, driving their dominance in the U.S. breast reconstruction market.

Hospitals are poised to lead the U.S. market due to their comprehensive infrastructure, specialized surgical teams, and capacity to manage complex cases. Academic medical centers and hospitals offer a multidisciplinary approach, integrating plastic surgeons, oncologists, and support staff to provide comprehensive care.

This collaborative model enhances patient outcomes and supports complex reconstructive techniques, such as autologous tissue flaps and microsurgical procedures.

More importantly, hospitals are well-equipped to handle the financial and logistical aspects of breast reconstruction, including insurance coordination and post-operative care. This capability ensures that patients receive timely and effective treatment, further solidifying hospitals' dominance in the U.S. breast reconstruction market.

The U.S. Breast Reconstruction market landscape is competitive, led by pharmaceutical and healthcare giants such as Mentor, Allergan, Sientra, Establishment Labs, and GC Aesthetics. Focus areas include implant innovation, autologous techniques, acellular dermal matrices, and 3D surgical planning. Emerging players emphasize personalized implants, minimally invasive procedures, and patient-centric solutions across hospitals and specialty clinics.

The U.S. breast reconstruction market size is projected to be valued at US$ 1.1 billion in 2025.

Rising breast cancer prevalence, increasing mastectomies, advanced implants and autologous techniques, favorable insurance coverage, and growing patient awareness drive the market.

The U.S. Breast Reconstruction market is poised to witness a CAGR of 6.8% between 2025 and 2032.

Key opportunities include 3D-printed custom implants, regenerative biologics, minimally invasive procedures, AI-assisted planning, outpatient reconstruction, and rising patient awareness programs.

Major market players include Mentor Medical Systems B.V. (Johnson & Johnson), Allergan, Inc. (AbbVie), Sientra, Inc., Ideal Implant Incorporated, and Others.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By End User

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author