ID: PMRREP33067| 200 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

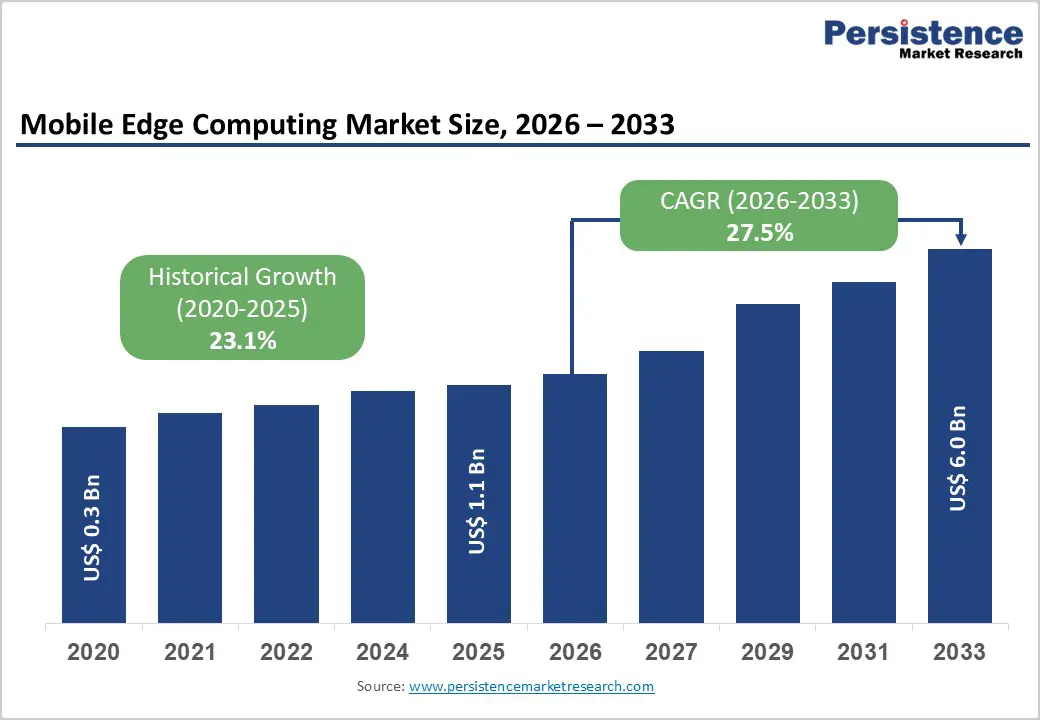

The global mobile edge computing market size is likely to be valued at US$ 1.1 billion in 2026 and projected to reach US$ 6.0 billion by 2033, growing at a CAGR of 27.5% between 2026 and 2033.

The robust expansion is driven primarily by escalating demand for ultra-low-latency applications, the explosive growth of 5G network deployments, and the proliferation of IoT devices across industries. Enterprises and telecommunications providers are increasingly recognizing that processing data closer to the source significantly reduces bandwidth consumption, enhances real-time decision-making capabilities, and improves overall operational efficiency. This paradigm shift represents a fundamental evolution in how organizations manage data processing and connectivity in the digital age.

| Key Insights | Details |

|---|---|

| Mobile Edge Computing Size (2026E) | US$ 1.1 Bn |

| Market Value Forecast (2033F) | US$ 6.0 Bn |

| Projected Growth CAGR (2026 - 2033) | 27.5% |

| Historical Market Growth (2020 - 2025) | 23.1% |

The growing adoption of ultra-low-latency applications across consumer and enterprise segments is a critical catalyst for the expansion of the mobile edge computing market. Applications requiring sub-20 millisecond latency, including augmented reality (AR), virtual reality (VR), autonomous vehicles, and real-time gaming, cannot be adequately serviced by traditional centralized cloud infrastructure. Industry data indicates that 5G networks combined with edge computing can reduce latency from over 100 milliseconds to under 10 milliseconds, enabling immersive experiences previously considered technically infeasible.

Furthermore, research demonstrates that motion-to-photon latency below 15-20 milliseconds is essential to prevent motion sickness in VR applications, driving enterprises to adopt distributed edge architectures. This fundamental requirement has catalyzed substantial investments in edge infrastructure deployment across North America, Asia Pacific, and Europe, positioning low-latency processing as a primary value proposition for Mobile Edge Computing solutions.

The proliferation of connected Internet of Things (IoT) devices, coupled with accelerating 5G network rollouts, has created unprecedented demand for distributed computing infrastructure. Simultaneously, governments and telecommunications providers are investing heavily in 5G infrastructure expansion, with India deploying over 4.69 lakh 5G Base Transceiver Stations as of February 2025 and China advancing its New Infrastructure initiative. This convergence of massive device proliferation and next-generation network deployment has necessitated a fundamental architectural shift toward distributed computing. By processing data at the network edge rather than transmitting all information to centralized data centers, organizations can achieve significant bandwidth optimization, reduce operational costs, and enable real-time analytics capabilities that were previously unattainable.

Implementation of a comprehensive mobile edge computing infrastructure requires substantial capital investments in distributed hardware, edge nodes, and specialized networking equipment across multiple geographic locations. Organizations must deploy edge servers, routers, switches, controllers, and gateways, each of which represents a significant financial commitment. Additionally, the complexity of managing distributed edge infrastructure across potentially hundreds or thousands of locations introduces operational challenges, including redundancy requirements, failover mechanisms, and consistent governance frameworks. Small and medium-sized enterprises, despite recognizing the strategic value of edge computing, often lack the financial resources to undertake such deployments independently, potentially limiting market adoption across certain customer segments.

The mobile edge computing ecosystem currently lacks universally accepted technical standards and consistent hardware specifications, creating significant barriers to widespread deployment and vendor interoperability. Multiple architectural frameworks, including ETSI Multi-access Edge Computing (MEC) specifications and 3GPP edge computing standards, coexist without complete harmonization, forcing organizations to navigate complex technical landscapes. Furthermore, the absence of standardized software platforms and unified orchestration mechanisms complicates integration efforts and increases deployment complexity. Organizations attempting to build hybrid edge architectures leveraging multiple vendor solutions face substantial interoperability challenges, hindering the adoption of best-of-breed solutions and limiting the flexibility required for enterprise-scale deployments.

The convergence of artificial intelligence (AI) and machine learning (ML) capabilities with distributed edge infrastructure represents one of the highest-growth opportunities within the Mobile Edge Computing market. Edge AI enables real-time inference and decision-making directly at data sources without requiring constant cloud connectivity, addressing critical latency and privacy constraints. Industries including manufacturing, retail, transportation, and smart cities are increasingly deploying edge AI for applications such as predictive maintenance, quality control automation, customer behavior analysis, and real-time surveillance analytics. Research demonstrates that edge AI deployments in manufacturing environments can reduce anomaly-detection times by up to 35 percent and significantly improve predictive maintenance accuracy.

Furthermore, Rockwell Automation’s 9th Annual State of Smart Manufacturing report indicates that manufacturing technology investment increased by 30 percent, with AI/ML delivering superior business outcomes compared to other smart manufacturing technologies. This technological convergence is expected to generate substantial demand for specialized edge hardware accelerators, AI-optimized software platforms, and edge analytics services throughout the forecast period.

Accelerating smart city initiatives and Industry 4.0 transformations are driving unprecedented demand for distributed Mobile Edge Computing infrastructure capable of supporting real-time data processing and autonomous decision-making at scale. Governments globally, including China’s New Infrastructure program, India’s National Digital Communications Policy, and Singapore’s Smart Nation vision, are allocating substantial funding for edge infrastructure development.

Real-world deployments demonstrate compelling value propositions across multiple application domains: smart grid management enables real-time energy optimization and fault detection, intelligent transportation systems support autonomous vehicle coordination and traffic optimization, and environmental monitoring networks enable rapid response to pollution and climate-related threats. The Asia-Pacific mobile/micro data center market is projected to grow at a CAGR of 16% through 2032, reflecting robust investment in edge infrastructure supporting smart city and industrial automation initiatives. This accelerating digital transformation across emerging and developed economies represents a significant growth vector for Mobile Edge Computing market participants throughout the 2026 - 2033 forecast period.

Hardware is the dominant component segment in the mobile edge computing market, holding about 68% market share, as enterprises and telecom operators continue to invest heavily in edge node infrastructure. This includes specialized servers, routers, switches, controllers, and industrial gateways that form the essential foundation for distributed processing. The segment’s leadership is driven by the need for physical infrastructure to run edge workloads, the significant share of hardware in overall deployment costs, and ongoing improvements in processor architecture that enhance performance and power efficiency. Additionally, major industry vendors have introduced purpose-built hardware platforms tailored for edge environments, including compact systems designed for telecom sites and industrial settings.

Location-based services emerge as the leading application segment, leveraging edge computing to deliver proximity-aware experiences with minimal latency. Location-based services rely on positioning technology and data-transfer capabilities enhanced by edge computing and 5G networks, enabling retailers, navigation platforms, and enterprise applications to deliver contextual content based on precise geographic location. This segment benefits from widespread 5G deployment, proliferation of location-aware mobile devices, and proven business cases demonstrating significant return on investment. Retail organizations deploy location-based services to provide personalized product recommendations, optimize store layouts based on customer movement patterns, and enable frictionless checkout experiences. Transportation and logistics companies utilize location-based services for real-time fleet tracking, route optimization, and delivery time prediction.

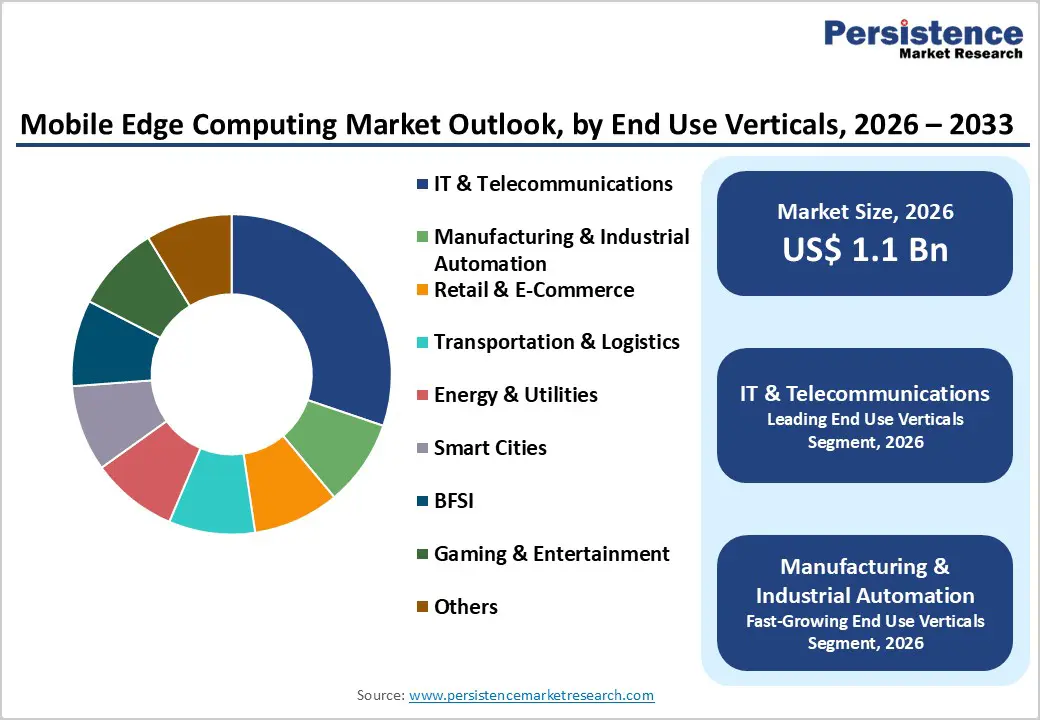

IT & Telecommunications emerges as the dominant vertical, accounting for about 31% of the market share in 2025 within the mobile edge computing market, driven by telecommunications operators’ strategic imperative to optimize network efficiency and enable new service categories. Telecommunications providers deploy edge computing infrastructure to reduce network congestion, minimize backhaul requirements, and allow location-based services and content delivery. The vertical’s leadership reflects telecommunications operators’ control of network infrastructure, their investments in 5G deployments, and their strategic interest in monetizing edge computing capabilities through managed services.

However, manufacturing & industrial automation represents the fastest-growing end-use vertical, reflecting accelerating Industry 4.0 transformations and increasing adoption of Industrial Internet of Things (IIoT) technologies. Manufacturers deploy edge computing to enable real-time predictive maintenance, automated quality control, and autonomous production line optimization. Edge-based condition monitoring can detect equipment anomalies up to 35% faster than traditional cloud-based approaches, preventing costly unplanned downtime and extending asset lifespans.

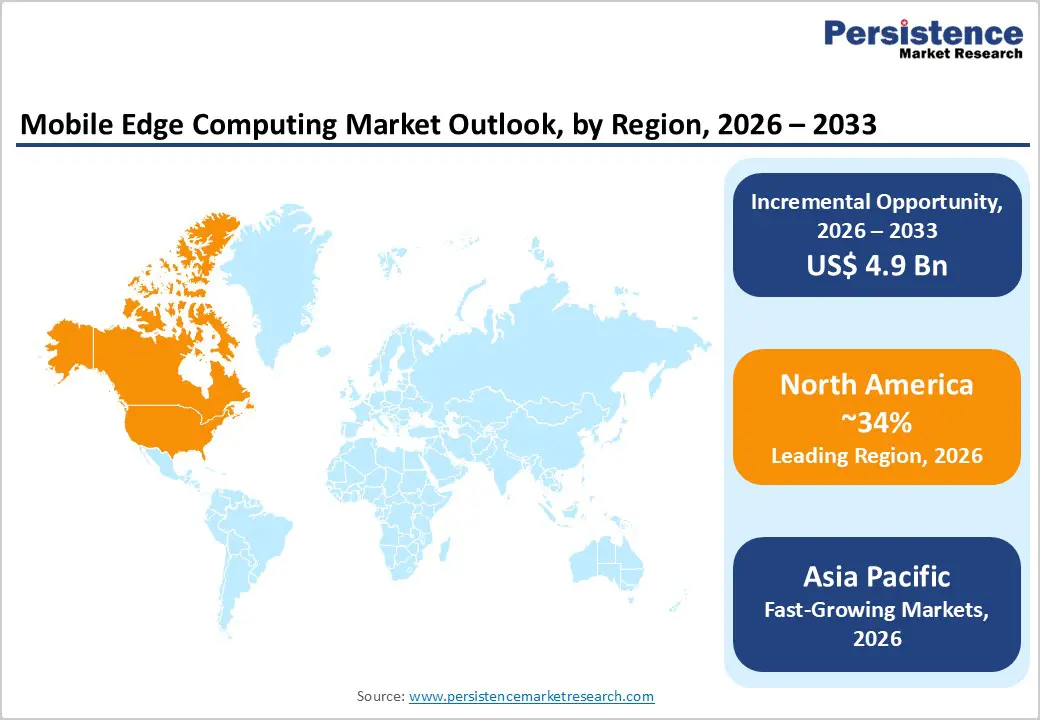

North America maintained the largest 34% market share in global mobile edge computing deployments, anchored by robust 5G adoption, sophisticated telecommunications infrastructure, and substantial investments in industrial automation and smart city initiatives. The region has emerged as a primary innovation hub, with leading technology vendors headquartered in the United States, including Cisco Systems, HPE, Dell Technologies, and Intel Corporation. U.S. telecommunications operators, including Verizon and AT&T, have deployed extensive 5G networks combined with Mobile Edge Computing capabilities, enabling enterprise customers to access ultra-low-latency services.

Federal government initiatives, including the Biden administration’s US$ 269 million allocation to semiconductor manufacturing programs, have strengthened domestic edge hardware capacity and accelerated enterprise adoption. Enterprises across healthcare, financial services, and manufacturing have embraced edge computing for applications including remote patient monitoring, real-time transaction processing, and predictive maintenance of critical equipment.

Europe demonstrates accelerating mobile edge computing adoption driven by regulatory requirements, sustainability mandates, and digital transformation initiatives across the continent. The General Data Protection Regulation (GDPR) has created strong incentives for data localization, positioning edge computing as an architectural solution enabling organizations to process sensitive customer data locally while maintaining compliance with cross-border data transfer restrictions. Multiple European nations have implemented regulatory frameworks that emphasize data sovereignty and localization requirements, creating favorable conditions for the deployment of distributed edge infrastructure.

Furthermore, European telecommunications operators, including Vodafone, Telecom Italia, and Orange, are investing in edge infrastructure to support 5G services and smart city initiatives. Research institutions and government programs across Germany, the United Kingdom, France, and Spain are advancing edge computing standards and conducting pioneering trials in industrial automation, autonomous transportation, and smart cities. The Nokia Veturi Competitive Edge project in Finland invested over €230 million in research and development, strengthening Finland’s position as a global leader in edge computing innovation.

Asia Pacific is the fastest-growing regional market for mobile edge Computing, with a 39% CAGR, driven by explosive 5G rollouts, rapid urbanization, massive IoT device proliferation, and government-mandated digital transformation initiatives. China’s New Infrastructure program prioritizes edge computing infrastructure development as a strategic national priority, allocating substantial resources to distributed data center deployment supporting smart cities, industrial automation, and autonomous vehicle development.

India’s rapid 5G deployment, with 4.69 lakh 5G Base Transceiver Stations deployed as of February 2025, combined with government initiatives including the National Digital Communications Policy, is catalyzing edge infrastructure expansion. India’s edge computing market is forecast to expand at a compound annual growth rate of 42.4% through 2033. Japan’s manufacturing sector has embraced edge computing for precision production and quality control, while Singapore’s Smart Nation vision accelerates edge infrastructure development, supporting smart city and financial services applications. The region’s combination of high population density, rapid investment in digital infrastructure, and large-scale manufacturing operations creates exceptional opportunities for edge computing market participants.

The mobile edge computing market features a moderately consolidated structure, with a handful of large telecom infrastructure suppliers, cloud platforms, and edge hardware providers shaping over half of global revenue. These companies leverage integrated portfolios, long-term operator relationships, and strong R&D capabilities to maintain a competitive advantage. Mid-tier participants and regional specialists compete by offering tailored industry-specific edge solutions, often optimized for manufacturing, logistics, retail, or smart city deployments.

Across the market, business strategies increasingly emphasize ecosystem-driven models that combine hardware, edge orchestration software, and managed services under unified delivery frameworks. Vendors are also prioritizing acquisitions to expand edge AI, containerized workloads, and low-latency networking capabilities. Differentiation is shifting toward software orchestration, energy-efficient edge server design, deployment modularity, and comprehensive lifecycle support. The competitive environment is further shaped by the rapid adoption of Kubernetes-based MEC platforms, modular micro-data center architectures, and AI-enabled real-time edge analytics.

The market is expected to reach US$ 6.0 billion by 2033, growing from US$ 1.1 billion in 2026 at a 27.5% CAGR.

Rising demand for ultra-low-latency applications, rapid 5G expansion, and large-scale IoT proliferation are the key drivers.

Hardware leads the market due to strong investment in edge servers, gateways, and networking equipment.

North America leads the market, supported by advanced 5G rollout and high enterprise adoption.

Edge AI represents the largest opportunity, enabling real-time, low-latency decision-making at distributed nodes.

Key players include Huawei Technologies, Dell Technologies, Cisco Systems, HPE, Intel Corporation, IBM Corporation among others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Application

By Verticals

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author