ID: PMRREP34008| 223 Pages | 11 Feb 2026 | Format: PDF, Excel, PPT* | Healthcare

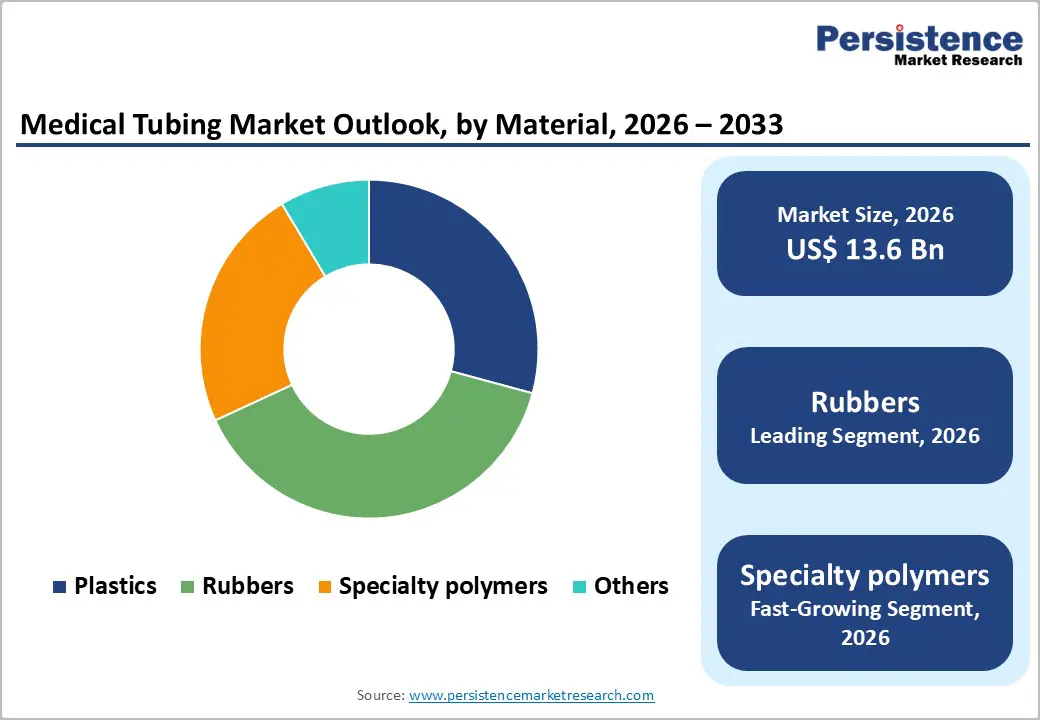

The global medical tubing market is estimated to grow from US$ 13.6 Bn in 2026 to US$ 23.3 Bn by 2033. The market is projected to record a CAGR of 8.0% during the forecast period from 2026 to 2033.

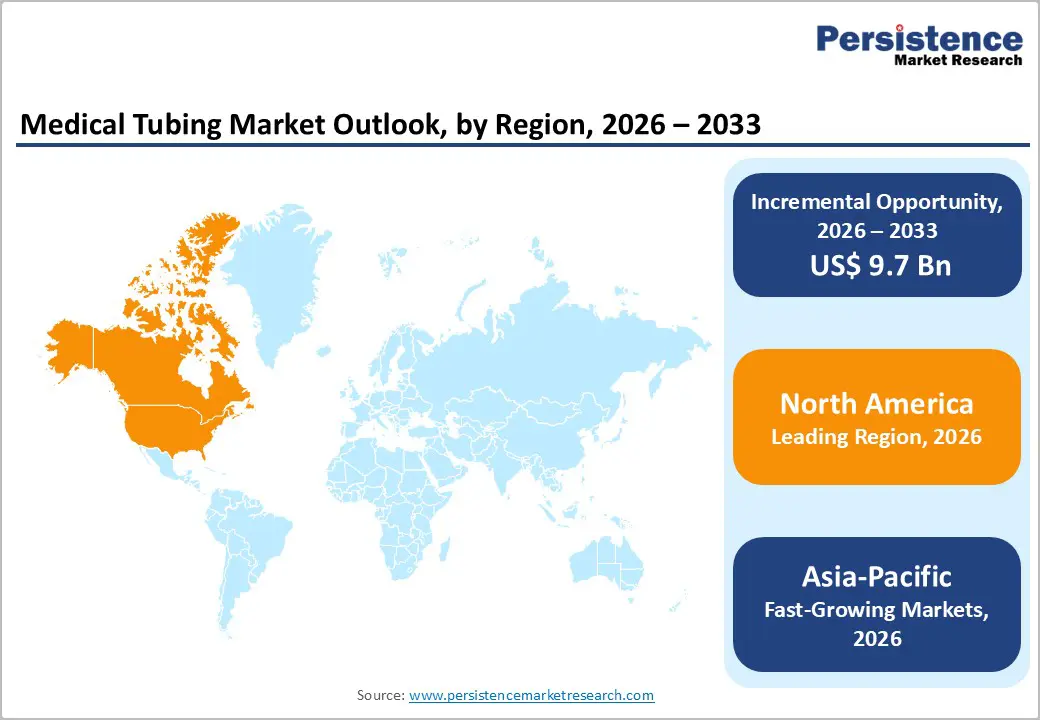

The global medical tubing market is expanding rapidly, fueled by aging populations, rising chronic disease prevalence, and growing demand for remote patient monitoring. North America leads, backed by advanced healthcare infrastructure and FDA regulations. Asia-Pacific is the fastest-growing region, driven by smartphone penetration, government digitization policies, local device manufacturing, and increased investment in AI-enabled healthcare technologies.

| Key Insights | Details |

|---|---|

|

Global Medical Tubing Market Size (2026E) |

US$ 13.6 Bn |

|

Market Value Forecast (2033F) |

US$ 23.3 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

8.0% |

|

Historical Market Growth (CAGR 2020 to 2025) |

7.1% |

Globally and in major markets, chronic and age-related diseases are rising sharply. In the United States in 2023, 76.4% of adults (about 194 million people) reported at least one chronic condition (such as heart disease, diabetes, hypertension), and 51.4% reported multiple chronic conditions, with rates increasing significantly with age. Among older adults (65+), 93% had one or more chronic conditions and 78.8% had two or more, highlighting the intensifying chronic disease burden.

In India, chronic illness is also common among the ageing population: ~55% of Indians over age 60 suffer from at least one chronic disease (e.g., hypertension, diabetes, heart disease), with many having multimorbidity. This demographic growth and disease burden create sustained demand for medical consumables, especially catheters, IV lines, and tubing required in long-term care, dialysis, and outpatient therapies.

Manufacturing and distributing medical tubing falls within the broader medical device regulatory landscape, which is highly stringent to protect patient safety. In the United States, the Food and Drug Administration (FDA) enforces comprehensive pre-market clearance and quality system regulations for devices, including tubing used in catheters, vascular access, and infusion systems. Compliance with such frameworks (e.g., device classification, Good Manufacturing Practices, biocompatibility testing) is mandatory before market entry, and non-compliance can lead to product holds, market delays, or recalls all of which can increase time-to-market and costs.

At the international level, device safety and performance standards like IEC 60601 for electrical medical equipment (often including integrated tubing components) set core safety expectations that manufacturers must meet, requiring extensive documentation, risk assessments, and testing protocols to achieve certification.

These complex, multi-layered regulatory requirements, while essential for quality and safety, constrain market agility and innovation in medical tubing. Smaller manufacturers often need substantial investment in regulatory affairs expertise and quality management systems, slowing product development and limiting participation. Delays in approvals, compliance costs, and the need for ongoing post-market surveillance collectively dampen competitive entry and can restrain overall market expansion.

Healthcare delivery models are shifting from traditional inpatient settings to outpatient and home care, creating significant demand for medical tubing used in IV infusion, catheter-based therapies, and remote patient support. In the U.S., Medicare’s home infusion therapy benefit (implemented in 2021) now covers professional services, training, and monitoring for home infusion, enabling broader adoption of complex treatments outside hospitals.

Supporting this trend, home infusion therapy services have expanded rapidly: estimates indicate that millions of U.S. patients receive home infusion, reducing hospital stays and improving patient convenience. Parallel expansion in outpatient infusion centers and ambulatory care demonstrates a pivot toward decentralized care delivery systems with corresponding rise in the use of medical tubing for prolonged IV therapies, biologics administration, and chronic disease management outside institutional settings.

This evolution presents a clear opportunity for medical tubing manufacturers to innovate around home and outpatient-optimized tubing systems (lightweight, flexible, easily connectable/disconnectable, and compatible with portable devices). As healthcare systems globally emphasize cost-effective, patient-centered care outside hospitals, demand for tubing supporting long-term infusion, home-based therapy, and remote monitoring is poised to grow substantially.

Rubbers are leading with 38.9% share in 2025, dominate medical tubing because of their biocompatibility, flexibility, and sterilization resilience. The U.S. National Institutes of Health notes that silicone rubber is widely used in medical implants, catheters, and tubing due to its stability across sterilization methods (autoclave, EtO, gamma) and low tissue reactivity. Silicone’s Shore A hardness range enables soft, kink-resistant tubing essential for intravenous, drainage, and respiratory applications.

FDA guidance on medical polymer biomaterials highlights that elastomeric materials like silicone and rubber compounds are preferred where patient comfort, chemical inertness, and durability are critical. These material properties reduce complications (e.g., thrombosis, irritation), increasing clinical adoption. Because safety and performance are mandated by regulators, rubber-based tubing remains the default for most patient-contact applications.

Single-lumen tubing dominates because it is simpler, cost-effective, and clinically sufficient for most routine applications such as IV infusion, fluid drainage, and oxygen delivery. Healthcare standards (e.g., CDC intravenous therapy guidelines) emphasize minimizing complexity in vascular access to reduce infection and handling errors goals best met with single-lumen systems. A single channel limits dead space, making flushing and sterilization more reliable, which the CDC identifies as critical for infection prevention in intravascular devices.

Regulatory device classifications (e.g., FDA 510(k) listings) show single-lumen catheters and tubing vastly outnumber multi-lumen equivalents because they meet the majority of clinical indications without added structural complexity. Single-lumen tubing’s wide compatibility with pumps, connectors, and accessories further entrenches its dominance in hospitals, ambulatory centers, and home care.

North America leads the global medical device landscape, accounting for 41.1% of total market value, driven by high healthcare expenditure and advanced clinical infrastructure. In the United States alone, healthcare spending reached about 16.6% of GDP in 2023, the highest among major economies, enabling broad access to diagnostic and therapeutic technologies that rely on medical tubing (e.g., IV lines, catheters). The region also has 6,000+ hospitals and nearly 1 million staffed beds, enhancing continuous demand for consumable devices. Regulatory frameworks such as FDA approvals and Medicare reimbursement further incentivize innovation and adoption of tubing-integrated systems. Strong R&D investment and widespread insurance coverage sustain demand for both acute and chronic care applications requiring medical tubing.

Europe remains a key medical device region, supported by mature universal healthcare systems and strong public health funding. Countries such as Germany, France, and the United Kingdom are major contributors, with extensive hospital networks and preventive care programs that rely on diagnostic and therapeutic devices requiring high-quality medical tubing. Regulatory harmonization under the Medical Device Regulation (MDR) enforces strict safety and performance standards, strengthening clinician confidence and consistent adoption. Investments in digital imaging, minimally invasive procedures, and connected care technologies continue to expand, with many hospitals deploying advanced surgical and interventional systems. Moreover, Europe’s rapidly aging population sustains long-term demand for chronic care therapies where medical tubing is essential.

Asia-Pacific is expanding rapidly, propelled by large and aging populations, increasing healthcare access, and rising chronic disease prevalence. China alone accounts for a substantial portion of regional device demand, and India’s medical technology sector is growing at a double-digit pace due to expanding private and public healthcare investments. Government initiatives like China’s Healthy China 2030 plan aim to significantly expand healthcare service capacity and infrastructure, boosting demand for diagnostic, monitoring, and therapeutic devices that incorporate medical tubing. Urbanization and rising middle-class income levels increase healthcare utilization, while public funding and insurance reforms enhance affordability. As rural healthcare access improves and medical technologies become more widely available, Asia-Pacific’s medical tubing demand continues to outpace other regions.

The medical tubing market features a competitive landscape dominated by global medical device and materials companies focusing on product quality, regulatory compliance, and innovation. Key players compete through advanced material development, customized tubing solutions, strategic partnerships with OEMs, geographic expansion, and investments in biocompatible, high-performance, and sustainable tubing technologies.

In November 2024, MDC acquired Lighteum, a manufacturer of nitinol-based medical components, to strengthen its capabilities in advanced materials and minimally invasive device technologies. The acquisition expanded MDC’s product portfolio and manufacturing expertise, enabling greater support for medical device OEMs requiring high-precision nitinol components.

By Material:

By Application:

By Structure:

By Region:

The global medical tubing market is projected to be valued at US$ 13.6 Bn in 2026.

Rising chronic diseases, aging populations, expanding healthcare infrastructure, and growing demand for minimally invasive procedures.

The global medical tubing market is poised to witness a CAGR of 8.0% between 2026 and 2033.

Growth in home healthcare, emerging markets, advanced materials, customizable tubing, and smart medical device integration.

ActiGraph LLC, AliveCor Inc., Koneksa Health, Altoida Inc., Biogen, Empatica Inc.

|

Attribute |

Details |

|

Forecast Period |

2023 to 2030 |

|

Historical Data Available for |

2018 to 2022 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Material

By Structure

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author