ID: PMRREP31703| 250 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

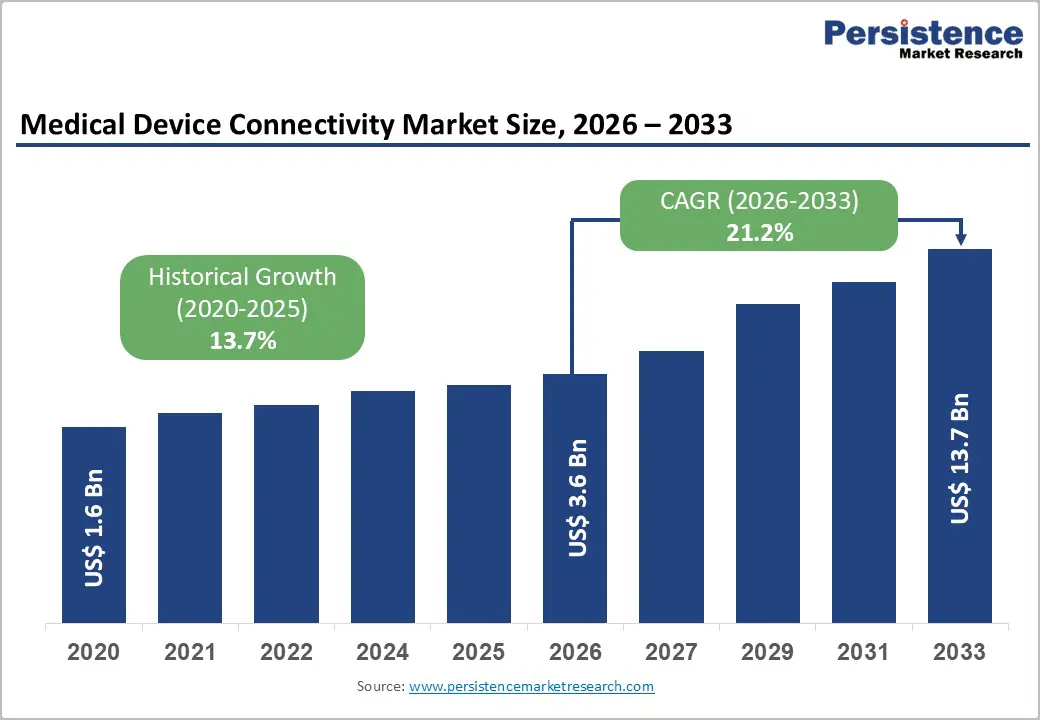

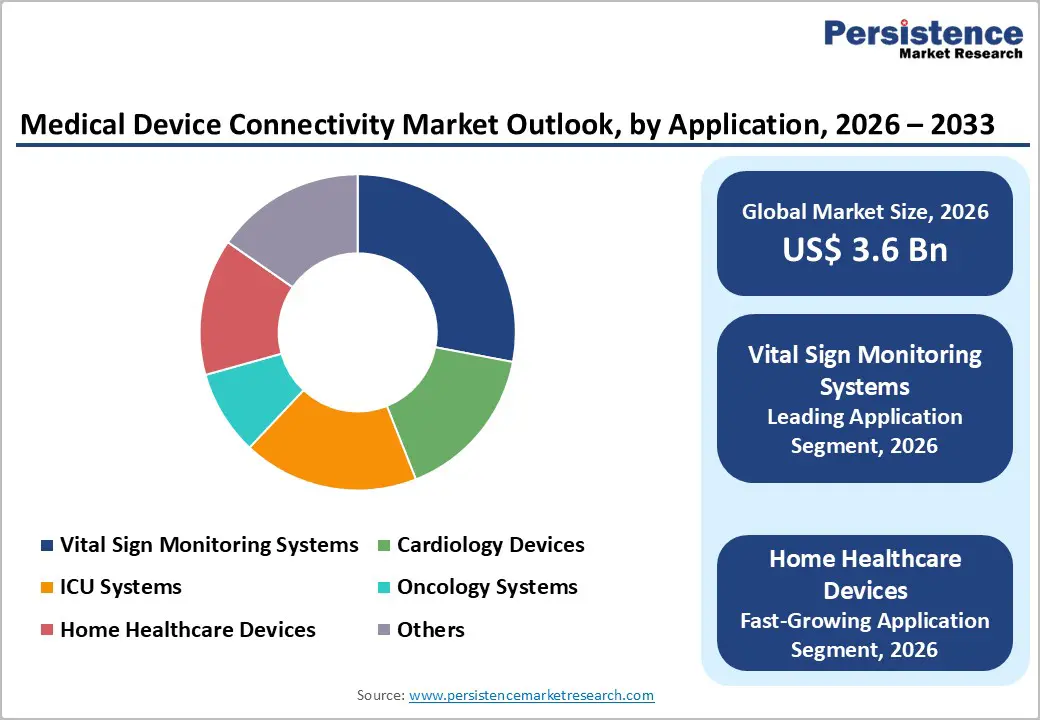

The global medical device connectivity market size is expected to be valued at US$ 3.6 billion in 2026 and projected to reach US$ 13.7 billion by 2033, growing at a CAGR of 21.2% between 2026 and 2033.

The medical device connectivity market is experiencing substantial growth driven by the convergence of remote patient monitoring adoption and advanced interoperability standards. Healthcare systems worldwide are transitioning toward connected care ecosystems, with 71 million Americans (26% of the U.S. population) expected to utilize remote patient monitoring services by 2025, demonstrating strong end-user demand. Additionally, the implementation of HL7 FHIR standards and FDA cybersecurity guidelines (updated in September 2023) mandates secure connectivity protocols, compelling medical device manufacturers to integrate advanced connectivity solutions. The aging global population, coupled with rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, and respiratory conditions, amplifies demand for continuous vital sign monitoring through connected devices, creating substantial market expansion opportunities across healthcare delivery models.

| Global Market Attributes | Key Insights |

|---|---|

| Market Size (2026E) | US$ 3.6 billion |

| Market Value Forecast (2033F) | US$ 13.7 billion |

| Projected Growth CAGR (2026-2033) | 21.2% |

| Historical Market Growth (2020-2025) | 13.7% |

Market Growth Drivers

Rising Adoption of Remote Patient Monitoring and Home Healthcare Solutions

Remote patient monitoring has emerged as a transformative healthcare delivery model, with over 30 million U.S. patients utilizing remote monitoring tools and services by 2024. The Centers for Medicare and Medicaid Services (CMS) reported approximately 150,000 patients enrolled in remote patient monitoring programs in the United States, representing substantial institutional commitment to connected care models. Medical device connectivity solutions enable continuous tracking of vital parameters, reducing hospital readmissions by 38% and emergency room visits by 51%, according to healthcare utilization data. Home healthcare settings are experiencing accelerated adoption, with 45% of wearable medical device market share attributed to home healthcare applications. The convergence of aging populations (projected to grow 47% from 2022 to 2050) with cost-containment imperatives drives investments in connected monitoring infrastructure, directly expanding demand for medical device connectivity platforms that facilitate remote data transmission and clinical decision support.

Regulatory Mandates and Interoperability Standards Enforcement

The FDA issued comprehensive cybersecurity guidance in September 2023 through its "Cybersecurity in Medical Devices: Quality System Considerations and Content of Premarket Submissions" document, establishing mandatory connectivity and interoperability requirements for networked medical devices. This regulatory directive, supported by the Food and Drug Omnibus Reform Act (FDORA) (2023), requires manufacturers to demonstrate devices as "cybersecure" and implement security risk assessment processes. The HL7 FHIR standard has achieved significant adoption, with 95% of U.S. healthcare organizations relying on interoperability standards for health information exchange. Hospital engagement in routine interoperable exchange across all four domains (finding, sending, receiving, and integrating) increased from 28% in 2018 to 43% in 2023, according to Office of the National Coordinator (ONC) data. These regulatory frameworks create non-discretionary adoption pathways for medical device connectivity solutions, establishing baseline requirements that drive consistent market demand across hospital systems, clinics, and healthcare networks seeking FDA compliance and HIPAA-aligned data transmission protocols.

Market Restraints

Cybersecurity and Data Privacy Concerns Limiting Market Adoption

The proliferation of connected medical devices introduces complex cybersecurity vulnerabilities requiring sophisticated security infrastructure and ongoing vigilance. Internet of Medical Things (IoMT) devices face heightened cybersecurity threats, with FDA guidance explicitly requiring vulnerability management, penetration testing, and software patch management protocols throughout device lifecycles. Healthcare organizations report concerns regarding unauthorized access to sensitive patient data, regulatory compliance complexities, and liability exposure associated with security breaches. The implementation of robust encryption, authentication mechanisms, and secure communication protocols increases development costs, integration complexity, and device time-to-market. Small hospitals and rural healthcare facilities, representing 30-40% of institutional care providers, possess limited technical resources and cybersecurity expertise to implement comprehensive connectivity solutions, creating adoption barriers. These security and compliance considerations restrain rapid connectivity adoption among resource-constrained healthcare providers and delay market penetration in emerging economies where cybersecurity infrastructure remains underdeveloped.

Interoperability, Fragmentation, and Standards Heterogeneity

Despite regulatory mandates, healthcare systems operate heterogeneous technology environments with disparate legacy systems, multiple EHR platforms, and inconsistent interoperability implementations. Hospital participation in routine interoperable exchange remains limited, with 43% of hospitals engaging routinely across all interoperability domains as of 2023, while 30% remain not fully interoperable. System-affiliated hospitals report higher interoperability engagement (53%) compared to independent hospitals (22%), indicating fragmented capability deployment across institutional types. Lower-resourced hospitals (small, rural, critical access, and independent institutions) struggle with interoperability implementation, with 55% of independent hospitals remaining not fully interoperable. The prevalence of multiple competing standards, including HL7 v2, HL7 v3, and FHIR, alongside proprietary connectivity solutions, creates integration complexity and delayed implementation timelines. Manufacturers developing medical device connectivity solutions must accommodate multiple standards simultaneously, increasing engineering complexity and reducing market standardization benefits that would otherwise accelerate adoption and reduce implementation costs across diverse healthcare institutions.

Market Opportunities

Artificial Intelligence and Predictive Analytics Integration in Connected Device Ecosystems

Healthcare systems are progressively integrating AI-powered predictive analytics within medical device connectivity platforms, creating differentiated value propositions and driving adoption among healthcare providers prioritizing proactive care management. AI-enabled remote patient monitoring systems generate personalized health insights, detect anomalous patterns in vital parameters, and facilitate early intervention protocols, improving patient outcomes and reducing hospital readmissions by up to 70% in case studies. Cloud infrastructure investments by technology giants (particularly AWS, Microsoft Azure, and Google Cloud) in healthcare IoT capabilities enable scalable deployment of connected medical device ecosystems with automated configuration, reducing implementation complexity. Major healthcare partnerships demonstrate AI integration momentum GE Healthcare deployed smart intensive care units with IoMT sensors for real-time patient monitoring at Apollo Hospitals (India) in 2025, while Philips Healthcare partnered with the UK's National Health Service (NHS) for IoMT-powered remote patient monitoring across multiple hospitals. Machine learning algorithms analyzing large-scale device data streams identify disease progression patterns, optimize treatment protocols, and support clinical decision-making. Medical device connectivity manufacturers integrating AI capabilities position themselves for premium pricing, expanded market share, and customer lock-in effects, particularly within cardiology devices, ICU systems, and oncology monitoring applications where predictive analytics deliver measurable clinical and economic value.

Component Analysis

Solutions represent the dominant component segment within medical device connectivity markets, driven by institutional demand for comprehensive connectivity platforms addressing diverse clinical applications. Medical device connectivity hubs and telemetry solutions enable multi-device communication, real-time data aggregation, and clinical visualization through unified dashboards, supporting hospitals' digital transformation initiatives. Interface devices facilitate seamless integration between legacy medical equipment and modern connectivity infrastructure, enabling existing device populations to participate in connected care ecosystems without complete equipment replacement. The solutions segment commands approximately 58% market share (2025) due to its critical role in healthcare system architecture and recurring software-as-a-service (SaaS) revenue models supporting long-term provider relationships. Hospitals and integrated delivery networks prioritize solutions investments to achieve comprehensive device connectivity coverage across patient care areas (patient wards, ICU, emergency departments, diagnostic centers), enabling real-time vital monitoring and clinical decision support.

End User Analysis

Hospitals represent the dominant end-user segment, capturing 52% market share (2025), driven by extensive medical device populations, complex clinical workflows, and institutional imperatives to achieve comprehensive interoperability and real-time clinical intelligence. Large teaching hospitals and integrated delivery networks invest substantially in medical device connectivity infrastructure supporting multi-building campuses, specialty care centers, and affiliated clinics requiring enterprise-wide connectivity architectures. Hospital adoption accelerates particularly in specialized applications: ICU systems utilizing continuous vital monitoring; cardiology devices requiring real-time arrhythmia detection; oncology systems supporting chemotherapy infusion monitoring; and post-operative recovery suites implementing automated patient surveillance reducing nursing assessment workload. Home healthcare settings represent the fastest-growing end-user segment, expanding at 18-22% CAGR as healthcare delivery models shift toward community-based care, chronic disease management in residential environments, and aging-in-place strategies. Diagnostic centers and ambulatory surgical facilities increasingly deploy connectivity solutions supporting point-of-care diagnostic device integration with central laboratory information systems and physician reporting workflows. Clinics and ambulatory centers leverage medical device connectivity for remote monitoring integration with telehealth platforms, enabling virtual care delivery for chronic disease management and post-discharge follow-up monitoring, reducing hospital readmission rates and improving patient access to continuous care management.

North America Medical Device Connectivity Market Trends and Insights

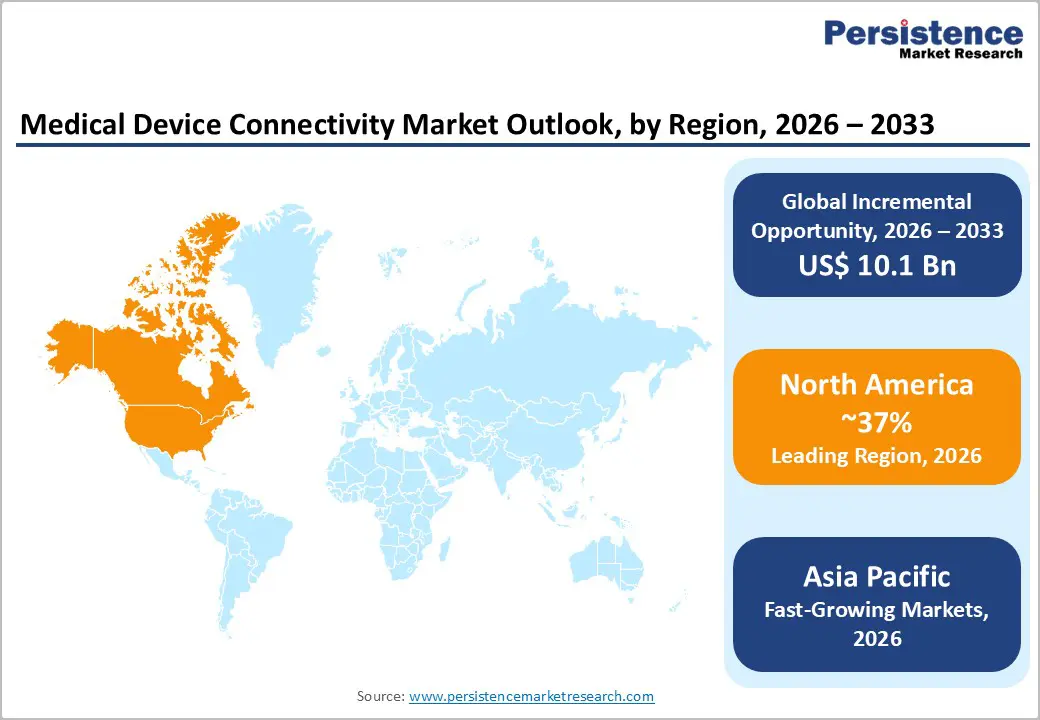

North America dominates the medical device connectivity market, maintaining 37% global market share (2025), reflecting advanced healthcare infrastructure, high digital health adoption rates, and substantial institutional investment in interoperable medical device ecosystems. The United States healthcare system has achieved remarkable remote patient monitoring penetration, with 71 million Americans (26% of the U.S. population) utilizing remote monitoring services by 2025, establishing baseline connectivity demand across hospital systems, home health agencies, and outpatient clinics. The FDA's September 2023 cybersecurity guidance and FDORA regulatory framework establish mandatory device connectivity and interoperability requirements, compelling manufacturers to develop FDA-compliant connectivity solutions and healthcare institutions to upgrade legacy systems achieving regulatory alignment.

Asia Pacific Medical Device Connectivity Market Trends and Insights

Asia-Pacific represents the fastest-growing medical device connectivity market, expanding at a projected 26-28% CAGR (2025-2032), driven by expanding healthcare infrastructure investments, rising chronic disease prevalence, and accelerating digital health adoption across emerging economies. China dominates regional market dynamics, commanding 34% Asia-Pacific market share (2023), with aggressive government investments in smart healthcare infrastructure and IoMT device deployment supporting national health modernization strategies. India's expansion of AI-integrated IoMT device capabilities for diagnostic support and patient monitoring addresses healthcare access constraints in rural and underserved regions, with GE Healthcare Apollo Hospitals partnerships exemplifying regional innovation momentum.

Japan advances robotic IoMT device integration within hospital settings, enhancing patient care efficiency and clinical outcomes through autonomous monitoring and therapeutic interventions. Manufacturing advantages across Asia-Pacific, including lower production costs, expanding electronics component supply chains, and growing contract manufacturing capabilities, enable medical device connectivity solution production, distribution, and customization, supporting regional healthcare institutions and facilitating market entry for emerging domestic manufacturers. Increasing venture capital investment in Asia-Pacific digital health startups (particularly telehealth platforms, remote monitoring software, and wearable sensor technology) accelerates innovation ecosystems, fostering rapid iteration cycles and competitive solution development. Government health technology initiatives, particularly in China supporting telemedicine integration and India promoting AI-driven diagnostic platforms, establish policy environments incentivizing connectivity adoption, creating favorable conditions for medical device manufacturers targeting regional growth opportunities, and establishing long-term market positions within the world's most populated and rapidly expanding healthcare delivery systems.

Market Structure Analysis

The medical device connectivity market is moderately consolidated, with competition driven by technological capability, interoperability strength, and compliance with healthcare data standards. Players compete by offering scalable platforms that enable seamless integration across diverse medical devices and hospital information systems. Emphasis on cybersecurity, real-time data transmission, and cloud-based analytics is intensifying competitive differentiation. Vendors are increasingly focusing on workflow optimization, remote monitoring enablement, and value-based care support to strengthen adoption.

Key Market Developments

The global medical device connectivity market was valued at US$ 1.98 billion in 2022.

The market for medical device connectivity is estimated to surge at 25.2% CAGR through 2033.

Demand for medical device connectivity is forecasted to climb to US$ 23.26 billion by 2033-end.

Demand for medical device connectivity in India is projected to rise at a CAGR of 27.3% over the forecast period.

North America held a dominant market share of 25.9% in 2022.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn/Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Component

Technology

Application

End User

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author