ID: PMRREP6170| 172 Pages | 15 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

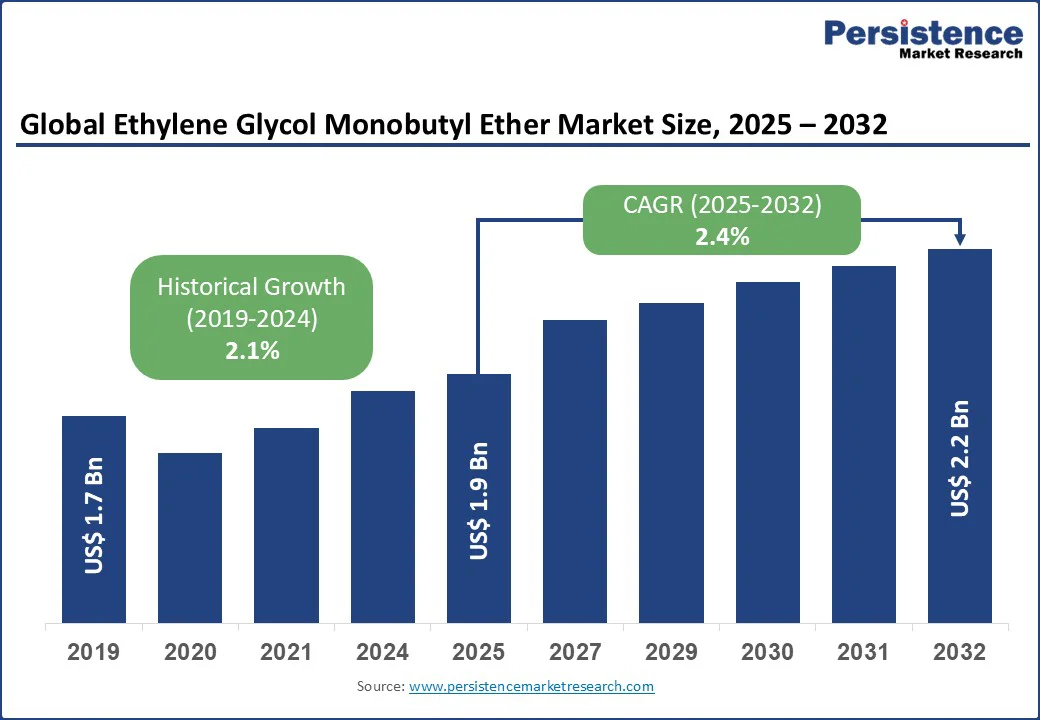

The global ethylene glycol monobutyl ether (EGBE) market size is likely to be valued at US$1.9 bn in 2025 and is expected to reach US$2.2 bn by 2032, growing at a CAGR of 2.4% during the forecast period from 2025 to 2032.

Key Industry Highlights

| Global Market Attribute | Key Insights |

|---|---|

| Ethylene Glycol Monobutyl Ether Market Size (2025E) | US$1.9 Bn |

| Market Value Forecast (2032F) | US$2.2 Bn |

| Projected Growth (CAGR 2025 to 2032) | 2.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 2.1% |

The key driver is the increasing demand for paints, coatings, and eco-friendly solvents in industrial, automotive, and construction applications. Rapid urbanization, infrastructure development, and industrial expansion in the Asia Pacific and North America are fueling consumption.

The ethylene glycol monobutyl ether (EGBE) market is witnessing strong growth driven by its increasing use as a solvent in paints and coatings. Rising construction activity, expanding automotive production, and industrial development are fueling the demand for high-performance coatings that deliver durability and smooth application.

EGBE functions as a coalescing agent in water-based paints, enhancing film formation and finish quality while supporting the industry’s transition toward low-VOC and waterborne systems. This shift is particularly relevant as industries and consumers prioritize sustainable and eco-friendly materials to reduce environmental impact.

Government initiatives are accelerating this trend by enforcing stricter emission standards. For instance, the U.S. Environmental Protection Agency, under the Clean Air Act, has established regulations that limit VOC levels in architectural and industrial coatings. Such measures are encouraging manufacturers to adopt solvents such as EGBE, which not only improve coating performance but also comply with sustainability and emission reduction targets.

The growth of the ethylene glycol monobutyl ether (EGBE) market faces challenges due to stringent regulatory restrictions. Environmental agencies across major economies are tightening standards on solvent usage to reduce volatile organic compound (VOC) emissions and limit worker exposure to hazardous chemicals. These regulations increase compliance costs for manufacturers and restrict the use of EGBE in certain applications, particularly in paints, coatings, and cleaning agents, thereby slowing overall market expansion.

Another significant restraint is raw material price volatility. EGBE production depends on petrochemical feedstocks, which are highly sensitive to crude oil price fluctuations and supply chain disruptions. Unpredictable costs affect profit margins and create uncertainties for manufacturers, often leading to reduced investments and inconsistent production output.

The ethylene glycol monobutyl ether (EGBE) market is set to benefit from rising demand in the pharmaceutical sector. EGBE is increasingly used as a solvent and chemical intermediate in drug formulations and processing, owing to its excellent solvency, miscibility, and stability. With global healthcare spending on the rise and pharmaceutical production expanding to meet growing needs, especially in developing regions, the demand for high-quality solvents such as EGBE is expected to strengthen in the coming years.

Emerging markets present another promising growth avenue, as rapid urbanization, industrialization, and infrastructure development drive consumption of paints, coatings, and cleaning agents where EGBE is widely applied. Increasing regulatory alignment with global environmental standards also supports the adoption of eco-friendly solvents, positioning EGBE for steady expansion in the Asia Pacific, Latin America, and the Middle East.

Industrial grade ethylene glycol monobutyl ether (EGBE) is expected to hold around a 60% share in 2025, supported by its wide use in paints, coatings, industrial cleaners, and other applications. Its effectiveness in improving flow, dissolving resins, and reducing viscosity makes it a preferred choice across construction, automotive, and general manufacturing. Growing infrastructure and industrial activity continue to sustain its dominance.

Pharmaceutical grade EGBE, while smaller in overall share, is anticipated to be the fastest-growing segment. Its increasing use as a solvent and intermediate in drug production, along with rising pharmaceutical manufacturing in emerging economies, is driving demand. Stricter quality standards in medicine production are also encouraging the adoption of this high-purity grade.

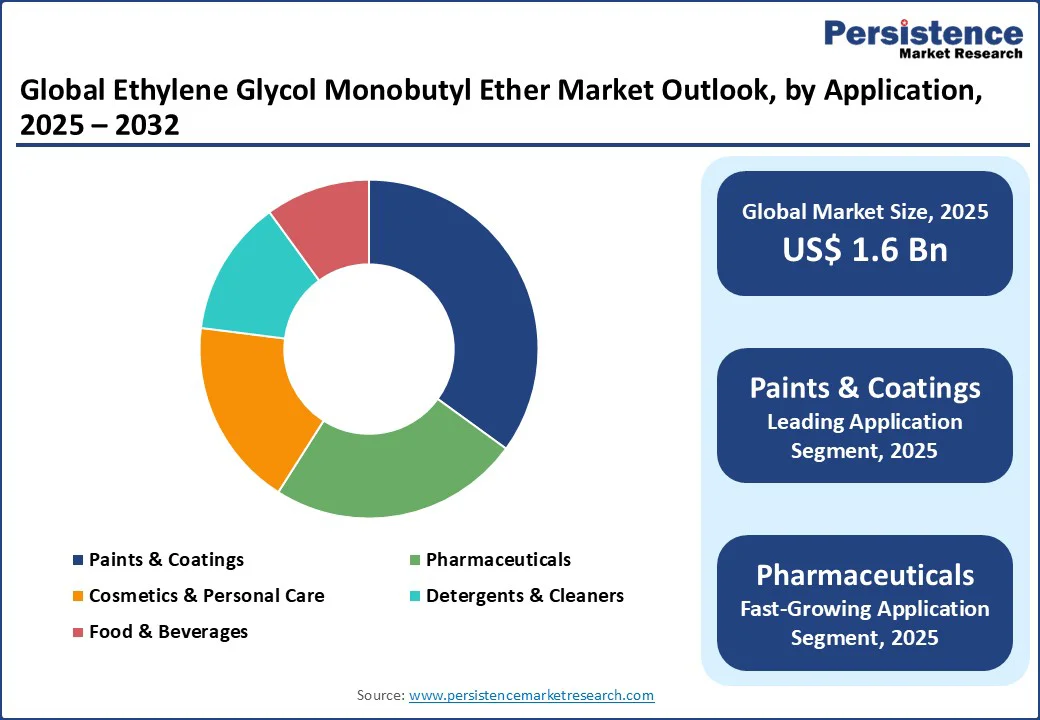

In 2025, paints and coatings are projected to account for about 35% of the ethylene glycol monobutyl ether (EGBE) market. This dominance comes from its role as an effective solvent and coalescing agent, widely used in architectural paints, automotive finishes, and industrial coatings. Rising construction activity and the push for durable, water-based, and low-VOC formulations continue to strengthen demand in this segment.

Pharmaceutical applications, though smaller in current market share, are expected to expand at the fastest pace. The use of EGBE as a solvent and processing aid in drug manufacturing is increasing, supported by higher healthcare spending, stricter quality standards, and the rapid growth of pharmaceutical production in emerging economies

Construction is expected to dominate the ethylene glycol monobutyl ether (EGBE) market in 2025 with a 30% share. The segment benefits from the extensive use of EGBE in paints, coatings, adhesives, and surface treatments that are essential for residential, commercial, and infrastructure projects. Its ability to improve application properties and durability makes it a preferred solvent in building materials, and the ongoing pace of urbanization and infrastructure development supports sustained demand.

Pharmaceuticals are anticipated to be the fastest-growing end-use segment. EGBE is increasingly utilized as a solvent and processing aid in drug manufacturing, aligning with the global rise in healthcare spending and expanding production capacity in emerging markets. Stricter quality and purity standards in medicine formulation are further encouraging adoption in this sector.

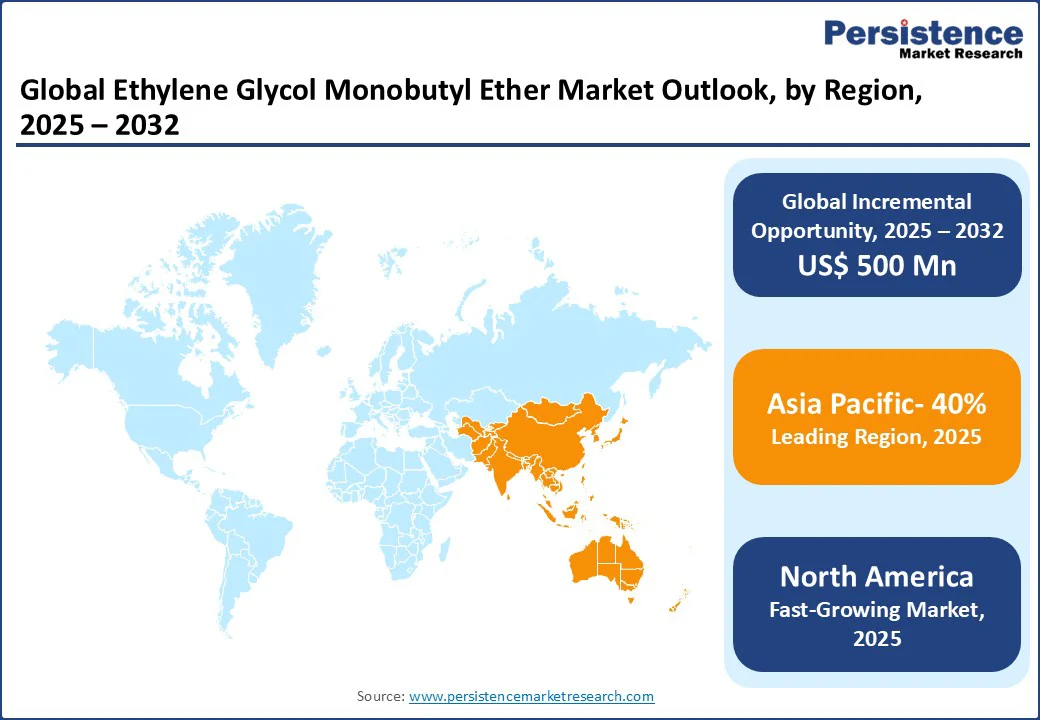

North America is projected to be the fastest-growing region in the ethylene glycol monobutyl ether (EGBE) market in 2025, supported by strong demand across construction, automotive, pharmaceuticals, and industrial cleaning applications.

The region’s well-established paints and coatings industry, combined with rising adoption of water-based and low-VOC formulations, is driving steady consumption. Expanding pharmaceutical manufacturing, particularly in the United States, further boosts the need for high-purity solvents, while ongoing infrastructure upgrades and housing developments contribute to higher usage in construction materials.

Additionally, stringent environmental regulations and technological advancements are encouraging industries to adopt safer and more efficient solvent systems, reinforcing the growth outlook for EGBE in North America compared with other global region

Europe holds a notable share in the ethylene glycol monobutyl ether (EGBE) market, supported by its mature industrial base and strong demand from paints, coatings, and cleaning applications. The region’s emphasis on sustainable solutions and strict environmental standards has encouraged greater use of water-based and low-VOC products, where EGBE plays a key role as a solvent and coalescing agent.

Additionally, the presence of leading automotive and pharmaceutical industries sustains steady consumption across multiple end-use sectors. While growth is moderate compared to emerging markets, Europe remains a significant contributor to global EGBE demand due to its regulatory-driven and innovation-focused approach.

Asia Pacific is expected to dominate the ethylene glycol monobutyl ether (EGBE) market in 2025, holding around 40% share. The region’s leadership is driven by rapid industrialization, large-scale construction activities, and expanding automotive and manufacturing sectors in countries such as China, India, and South Korea.

Rising urbanization and infrastructure development continue to fuel demand for paints, coatings, and cleaning agents, where EGBE is widely applied. Additionally, the fast-growing pharmaceutical industry in emerging economies is creating new avenues for consumption. Strong economic growth, availability of raw materials, and expanding production capacity further reinforce the Asia Pacific’s position as the leading regional market.

The global ethylene glycol monobutyl ether (EGBE) market is moderately consolidated, with a few large manufacturers holding a significant share while regional producers cater to localized demand. Companies are focusing on capacity expansion, cost optimization, and technological improvements to strengthen their market position.

Strategic moves such as mergers, partnerships, and investments in eco-friendly production are becoming common as firms respond to rising demand from paints, coatings, pharmaceuticals, and industrial applications across both developed and emerging markets.

The ethylene glycol monobutyl ether market is projected to reach US$1.6 bn in 2025, driven by demand in paints, coatings, and pharmaceuticals.

Rising demand for paints, coatings, and eco-friendly solvents fuels market growth.

The ethylene glycol monobutyl ether market will grow from US$1.6 bn in 2025 to US$2.1 bn by 2032, with a CAGR of 3.9% by 2032.

Growth in pharmaceuticals and emerging market expansion drive opportunities in sustainable applications.

Leading players include Formosa Petrochemical, Covestro, INEOS, ExxonMobil, Shell, LyondellBasell, Eastman Chemical, Dow Chemical, and BASF.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Grade Type

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author