ID: PMRREP2788| 297 Pages | 13 Aug 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

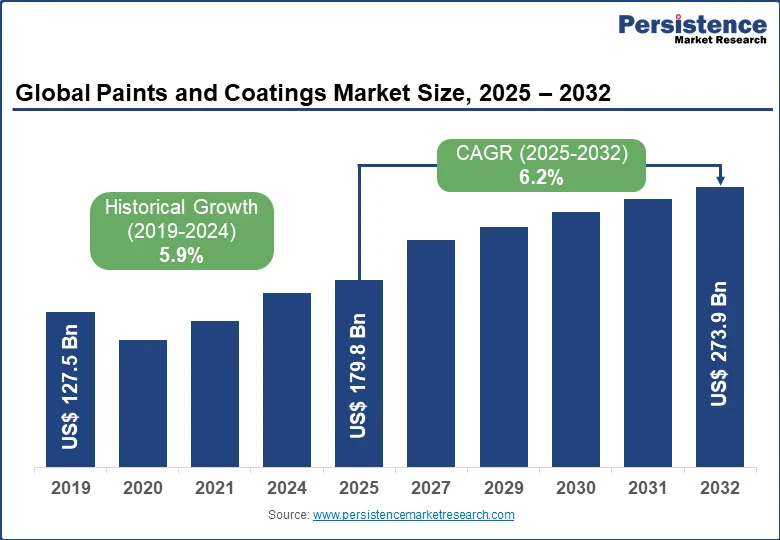

The global paints and coatings market size is poised to experience a sustained 6.2% CAGR during 2025 - 2032. From US$ 179.8 Bn recorded in 2025, the market value is likely to reach US$ 273.9 Bn by 2032.

|

Report Attribute |

Details |

|

Market Size Value in 2025(E) |

US$ 179.8 Bn |

|

Revenue Forecast in 2032(F) |

US$ 273.9 Bn |

|

Value CAGR (2025-2032) |

6.2% |

|

Value CAGR (2019-2024) |

5.9% |

Paints and coatings serve a vital role in protecting, decorating, and enhancing surfaces across various industries. The paints and coatings market report closely examines growth influencing factors to reveal some significant trends, and potential opportunities in front of paints and coatings manufacturers actively seeking strategic assistance.

The market witnessed steady growth during 2019 – 2024, with estimates suggesting the market value of over US$ 179.8 Bn attained in 2025, up from US$ 127.5 Bn in 2019. One of the primary drivers is the rising construction activity, particularly in developing economies like China, and India.

Predominantly fueled by urbanization, and accelerating pace of economic expansion, many of the developing regions have experienced a surge in construction projects recently, both residential and non-residential. This translates to a significant rise in demand for paints and coatings for various applications, from interior and exterior walls to roofs and building facades.

Following the unprecedented pace of urbanization, the worldwide infrastructure boom is another factor creating strong tailwinds for the market growth. Infra projects create substantial demand for paints, coatings, additives, and similar construction chemicals widely used in maintenance and renovation, in addition to the primary application of construction.

While urban environments today emphasize both functionality, and aesthetics, the demand for high-performance products like coatings and paints remains high. Sales of paints and coatings that possess weather resistant properties and have extended lifespan will especially climb up in the years to come.

According to Persistence Market Research, protective coatings are one of the most widely used industrial paint and coating applications. The protective coating market is expected to account for more than 17% of the industrial segment globally due to its rising application in several end-use sectors to protect industrial components.

The industrial market for paints and coatings recorded sales worth US$ 169.8 Bn in 2024 from protective coatings, general industrial, and automotive applications.

With modern consumers becoming increasingly design-conscious, it is clear that they will prioritize durability, as well as aesthetics and durability when it comes to paints and coatings.

The paints and coatings market analysis shows manufacturers are responding to evolving consumer expectations with innovative products that exhibit improved color palettes, broader range of finishes, and longer lifespan of coatings. This trend ensures long-term cost savings for consumers in addition to an enhanced aesthetic look.

As economies in developing regions like India, and southeast Asia continue to expand, construction activities are anticipated to rise. Increased investments in infrastructure development will further propel market growth.

This surge in construction projects will fuel demand for paints and coatings across various applications in both residential and non-residential sectors.

Globally, as disposable incomes rise, consumers are projected to invest more in home improvement projects. This trend will benefit the paints and coatings market as homeowners are likely to spend more on refreshing their living spaces and undertaking renovation projects.

The increased focus on aesthetics and the desire for a well-maintained living environment will further drive demand for high-quality paints and coatings.

The paints and coatings industry is constantly evolving with advancements in resin technology and application techniques. These advancements are expected to lead to the development of high-performance paints and coatings with superior functionality and durability.

Research in self-healing coatings, anti-microbial coatings, and fire-resistant coatings holds immense potential for various applications. These innovative products will not only enhance the protective and aesthetic properties of coatings but also open new market segments.

Governments worldwide are prioritizing investments in infrastructure projects such as roads, bridges, and transportation networks. This focus on infrastructure development will create significant demand for paints and coatings for various purposes.

High-performance coatings with properties like corrosion resistance, weatherproofing chemical resistance will be crucial for protecting these structures and ensuring their longevity.

The paints and coatings industry relies heavily on raw materials like resins, pigments, and solvents. Price fluctuations of these materials can significantly impact production costs and affect manufacturers' profitability. Market players need to develop strategies to mitigate the risks associated with volatile raw material prices.

Paints and coatings have been amongst the leading categories that contribute towards a higher environmental footprint. As environmental concerns continue to soar, the paints and coatings market has been facing stringent regulations on volatile organic compound (VOC) emissions. However, the challenge has an opportunity in store for market players.

This is pushing manufacturers of paints and coatings to innovate eco-friendly painting and coating products that have low or zero VOC content. These environmentally friendly products cater to the growing demand from environmentally conscious consumers, and regulatory bodies, also contributing to improved air quality to a significant extent.

The Environmental Protection Agency (EPA)’s Coatings and Consumer Products Group (CCPG) is drafting regulations for several industrial surface coating processes and composite processes.

National volatile organic compound (VOC) rules or control technique guidelines (CTG) under Section 183(e) of the Act, as well as national emission standards for hazardous air pollutants (NESHAPs) under Section 112 of the Clean Air Act, also known as MACT rules, are all currently being developed as regulations.

More than 85 countries around the world currently have legislative limitations on the amount of lead permitted in paints and coatings.

The market is a highly competitive landscape with established players and new entrants vying for market share. This competition can lead to price wars and margin pressures for manufacturers.

Differentiation through innovation, brand building, and focusing on niche markets can be effective strategies to navigate this competitive environment.

Resins in paints and coatings represent an indispensable component. Acrylic resins continue to secure the largest market share, winning preference over other key categories, i.e., epoxy resins, alkyd resins, and polyurethane (PU) resins.

Acrylic resins are versatile and widely used in waterborne and solvent-borne coatings for their excellent adhesion, durability, and affordability. Extensively used in architectural coatings for both interior and exterior applications, this category continues to witness broader adoption through the end of forecast year.

Wide usage, versatility, and prevalence in the dominant architectural coatings segment strongly suggests continued dominance of this segment in the paints and coatings market.

Specialty resins like fluoropolymers, and silicones cater to specific needs in various industries. Fluoropolymers offer exceptional weather resistance and are used in architectural coatings for high-rise buildings and exposed surfaces.

On the other hand, silicones, with their heat resistance and water repellency, find application in high-temperature industrial settings, and anti-fouling marine paints.

Driven by environmental regulations, and consumer demand for eco-friendly products, waterborne coatings remain the prime performing segment of the market.

These coatings offer lower VOC emissions compared to solvent-borne alternatives, which is earning them the rising popularity in architectural applications.

Stringent environmental regulations on VOC emissions are pushing the industry towards eco-friendly alternatives. Moreover, consumer demand for sustainable products is on the rise. Waterborne coatings benefit as they have lower VOC emissions, making them a more environmentally friendly choice.

Due to stringent regulations surrounding solvent-based technologies being implemented by several governments throughout the world, the water-based segment is anticipated to expand at a CAGR of 5.5% throughout the assessment period, accounting for more than 50% market share.

|

Market Segment by Base |

Market Share (2024) |

|

Water-Based |

>50% |

|

Solvent-Based |

xx% |

|

Powder Coating |

xx% |

Although facing pressure from waterborne alternatives, the solvent-borne coatings segment still holds a significant market share. The faster-drying times, decent flow properties, and ability to deliver high gloss finishes will be the key attributes winning continued preference.

On the flip side, powder coatings also seem to gain traction on the back of their superior durability, higher chemical resistance, and a high-quality finish – especially for industrial applications. Their eco-efficiency due to minimal waste generation during application will be the highlight of this segment’s growth.

Growing focus on aesthetics, and durability in residential and commercial spaces is primarily strengthening sales in this category. The architectural coatings segment accounts for the largest share of the paints and coatings market. These coatings are typically used for both interior and exterior applications on buildings, as well as structures. This includes decorative paints, primers, sealers, and specialty coatings.

The segment comprises a wide range of products like decorative paints, primers, sealers, and specialty coatings. Rising construction activity, especially in fast-developing economies, pacing urbanization, and rapid infrastructural developments that collectively foster the demand for new housing units, and renovation projects will drive growth in this segment of the market.

The paints and coatings market in India, China, Germany, and the US are identified as the leading pockets for manufacturers, and investors.

The presence of a large and growing population, coupled with continued economic expansion and government initiatives on infrastructure development, ensures Asia Pacific's position as the dominant market for paints and coatings in the foreseeable future.

This region is expected to remain the undisputed leader in the market, which is clearly attributed to the exploding pace of urbanization, and booming infrastructural developments.

The growth of construction industry, mounting demand within residential sector, and notably rising disposable income of consumers in the subcontinent are all accounting for the solid growth prospects of the region in paints and coatings industry.

With growing environmental awareness, regulations on VOC emissions are becoming stricter in this region. Paints and coatings manufacturers are thus focusing on developing and adopting eco-friendly waterborne coatings.

China, India, and ASEAN countries are more likely to be at the forefront of demand generation as they witness increased public and private spending on infrastructure development.

In spite of prior worries about how the industry would fair in the event of a global pandemic, the Chinese market managed to register around 5.7% annual growth in 2022. In 2023, China's total sales of paints and coatings roughly exceeded US$45 Bn.

China is expected to dominate both the East Asian, and global markets for paints and coatings. It is expected that the country will have a 78% market share in East Asia.

The country's rapid infrastructural growth, low-cost housing, commercial housing, and building projects are expected to enhance demand for paints and coatings in China.

The Chinese market is still fragmented even if there are sizable local and international rivals. Key businesses in China are anticipated to link more with distributors, and service channel providers as the market continues to consolidate.

Key companies across China are focusing on overcoming industrial hurdles such strategic changes, a dynamic business climate, high-quality products, after-sales service, and others in order to enhance total demand for the product.

On the other hand, the markets for paints and coatings in India is expected to reach US$ 12.4 Bn in value by 2032. India's makers of paints and coatings have benefited from the flat pricing trend in raw materials despite difficult economic conditions, a significant decline in the value of their currency, and supply chain disruptions post-pandemic.

India's demand for paints and coatings has been improving since Q3 2022 and the market here has seen major preferential shifts like the one from traditional whitewash towards high-quality colorful paints, especially in tier-II/III towns.

Lower-quality enamels, putty, and distemper all seem to have bright prospects. The Indian market is also characterized by a fierce corporate climate of competition, with major corporations focusing on implementing various strategies to take advantage of the market's rising regional demand.

|

Market Segment by Technology |

Market Share (2024) |

|

North America |

xx% |

|

Europe |

xx% |

|

Asia Pacific |

45% |

|

MEA |

xx% |

Greater focus on renovation and maintenance accounts for the significant position of North America in the global market. While large-scale construction projects might not be as frequent as in developing economies, focus on renovation and maintenance of existing buildings and infrastructure will push market growth here.

North America’s paints and coatings companies are at the forefront of technological innovation as they emphasize R&D, leading to the development of high-performance and eco-friendly products that cater to specific industry needs.

Strict environmental regulations in North America continue to push manufacturers to develop low-VOC and eco-sustainable coatings, shaping the market dynamics further. However, market saturation, and pricing competition may create challenges for market growth in the region.

Manufacturers are focused on developing thicker paints with advanced technical characteristics that can be used in place of insulating materials such as glass wool, cotton, and wood to control optimum temperature level. This holds the potential to reduce the problems of space constraints, cost, and installation time.

Various types of paints are increasingly being used for temperature controlling inside a room while being applied on exterior wall surfaces by reducing heat transfer through the walls, thus saving a significant amount of energy.

Manufacturers are also introducing geography specific paints, used according to prevailing weather conditions, such as water and humidity proof paints which can be used in coastal regions where general humidity level is high in most time of the year.

Further, the use of nanotechnology is also spreading its roots in the paints and coatings industry, with hundreds of patents being filed for the coatings industry comprise the use of nanotechnology. This will also be one of the chosen strategic moves of paints and coatings companies.

February 2024

Kansai Helios acquired Weilburger Coatings to strengthen its presence in industrial coatings, particularly non-stick, high-temperature, and railway coatings. The latter has a revenue of around €150 million.

January 2024

MIPA acquired HAERING GmbH's industrial division with an aim to expand its product portfolio, and production capacity. HAERING's industrial coatings will be integrated into MIPA's existing facilities.

January 2024

Kelly-Moore Paints ceased operations. Asbestos legal settlements totaling $600 million forced the closure of the 37th largest global paint company according to 2023 rankings.

January 2024

ALTANA acquired Silberline to enhance its ECKART Division in North America, and Asia with the addition of the latter’s effect pigment expertise.

November 2023

Japan-based company Nippon Paint officially launched its new product - the Nippon Paint projection screen paint. This new product features the brand’s unique paint film technology and environmental-friendly formula, which allows consumers to enjoy an all-new movie viewing experience.

June 2021

AkzoNobel announced acquisition of a Colombia-based paints and coatings company Group Orbis. With this acquisition AkzoNobel targeted an expanded footprint in South & Central America.

The market is estimated at US$ 179.8 billion in 2025.

It is forecast to reach US$ 273.9 billion by 2032.

The market is expected to grow at a 6.2% CAGR during this period.

Key drivers include rising construction activity, urbanization, infrastructure development, and higher disposable incomes.

Developing economies such as China, India, and Southeast Asia are leading growth due to rapid construction and urban expansion.

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Technology:

By Base Type:

By Application:

By Region:

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author