ID: PMRREP25732| 192 Pages | 13 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

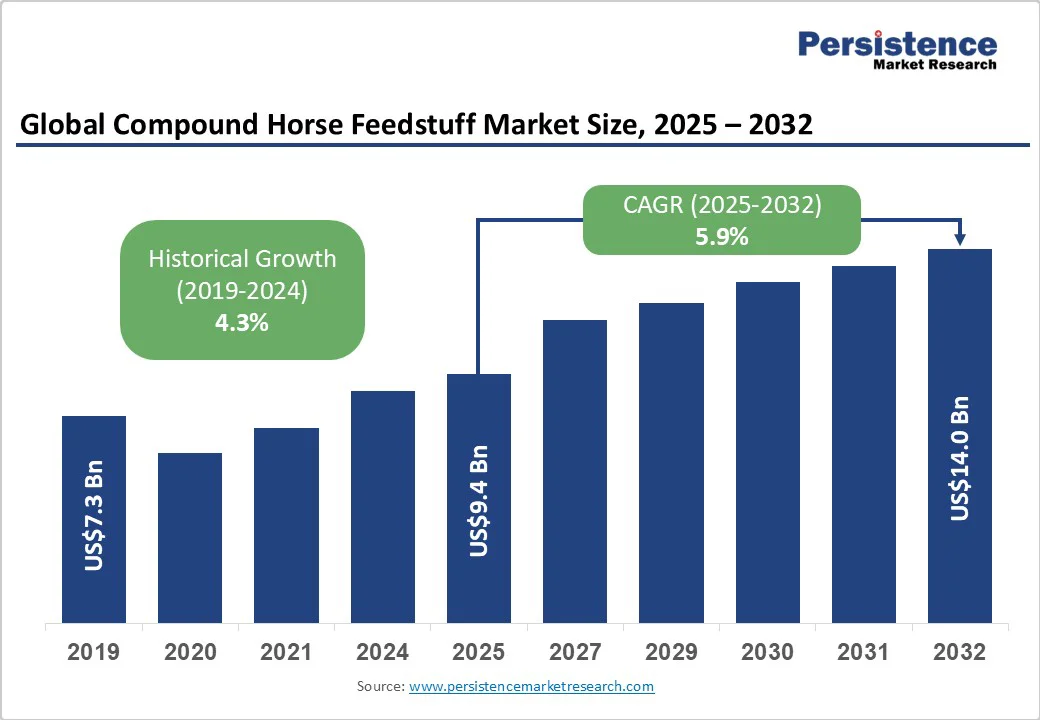

The global compound horse feedstuff market size is expected to reach US$9.4 billion by 2025. It is projected to reach US$14.0 billion by 2032, growing at a CAGR of 5.9% during the forecast period of 2025-2032, driven by increasing participation in equestrian sports. It is pushing demand for performance-focused feeds that improve endurance, muscle recovery, and gut health.

| Key Insights | Details |

|---|---|

|

Compound Horse Feedstuff Market Size (2025E) |

US$9.4 Billion |

|

Market Value Forecast (2032F) |

US$14.0 Billion |

|

Projected Growth (CAGR 2025 to 2032) |

5.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.3% |

The rising popularity of equine sports, such as show jumping, dressage, endurance racing, and polo, is fueling the demand for compound horse feedstuffs. These disciplines require high-performing horses with strong endurance and stamina, which in turn, push the requirement for nutrition-rich feed formulations. The U.K., the U.S., and Germany have seen a steady rise in equestrian events and ownership of sport horses.

For example, the U.S. Equestrian Federation reported a consistent increase in membership registrations in 2024, reflecting renewed interest in competitive riding. Feed manufacturers are responding by developing specialized performance feeds that contain amino acids, probiotics, and energy-boosting ingredients to support muscle recovery and gut health.

The surging premiumization trend in the broad pet nutrition industry is influencing the market for compound horse feedstuff. Horse owners are now viewing their animals as companions and athletes, prompting a shift toward high-quality, scientifically balanced feed formulations. This shift is visible in developed markets such as the U.S., U.K., and Germany, where consumers are willing to pay more for organic, non-GMO, and additive-free products.

In 2024, several brands, including Spillers and Cavalor, expanded their premium lines to feature natural antioxidants, omega-rich oils, and customized nutrient blends, aiming to improve performance and longevity. The focus is also shifting toward digestive health, joint support, and coat conditioning through the use of functional ingredients. This rising demand for premium feeds reflects the broad consumer trend of prioritizing health, sustainability, and traceability in animal nutrition.

One of the major challenges for the market is the risk of toxin contamination, especially from mycotoxins produced in improperly stored grains and feed ingredients. Horses are highly sensitive to such contaminants, which can lead to colic, liver damage, or reduced performance. Climate variations and inconsistent raw material quality have further intensified the problem in recent years.

For instance, studies conducted by the European Food Safety Authority in 2024 highlighted an increase in mycotoxin occurrence in feed grains due to fluctuating humidity levels. To address this, manufacturers must invest in novel testing methods, detoxification techniques, and traceability tools, which often increase production costs. The surging emphasis on feed safety and consumer awareness also places pressure on producers to maintain stringent quality control.

Tightening regulations on medication residues in animal feed pose another important hurdle for compound horse feedstuff manufacturers. Several regions, including the EU and North America, have reinforced zero-tolerance policies for cross-contamination between medicated and non-medicated feeds. This requires feed mills to upgrade equipment, adopt dedicated production lines, and maintain strict cleaning protocols, thereby raising operational complexity and costs.

The updated Canadian Feed Regulations, introduced by the CFIA in 2023, further emphasized the importance of compliance with carryover prevention measures in equine feeds. Even minor trace residues can lead to disqualification in competitive sports or pose health risks to horses, making regulatory adherence crucial. Small producers often struggle to meet these compliance standards, which can restrict market entry and slow growth.

The expansion of equine-assisted therapy centers worldwide is creating fresh opportunities for compound horse feedstuff producers. These centers utilize horses for physical, emotional, and mental rehabilitation, requiring healthy and calm animals that are maintained through balanced nutrition. Over the past few years, there has been a notable increase in therapeutic riding programs, particularly in the U.S., Canada, and certain parts of Europe.

Organizations such as PATH International have been reporting steady membership growth. Such centers prefer compound feeds that promote temperament stability, immunity, and wellness. Manufacturers are now formulating feeds with high fiber content, natural supplements, and low-starch compositions to cater to the specific nutritional requirements of therapy horses, supporting the market’s expanding role in healthcare and rehabilitation.

The increasing popularity of subscription-based sales models presents a key opportunity for compound horse feedstuff manufacturers. As horse owners seek convenience and consistency in feed supply, various brands are adopting direct-to-owner delivery models that ensure timely replenishment and personalized nutrition plans. This approach also enables companies to collect data on feeding patterns, preferences, and horse health, allowing them to customize future ranges.

For instance, U.K.-based Baileys Horse Feeds and Bluegrass Horse Feed have recently introduced subscription options with customizable packages and doorstep delivery. These models strengthen brand loyalty, reduce dependency on distributors, and appeal to tech-savvy owners who prefer online purchasing. The trend aligns with the broader digital transformation in the pet care industry, where e-commerce platforms are revolutionizing how animal nutrition products are marketed and consumed.

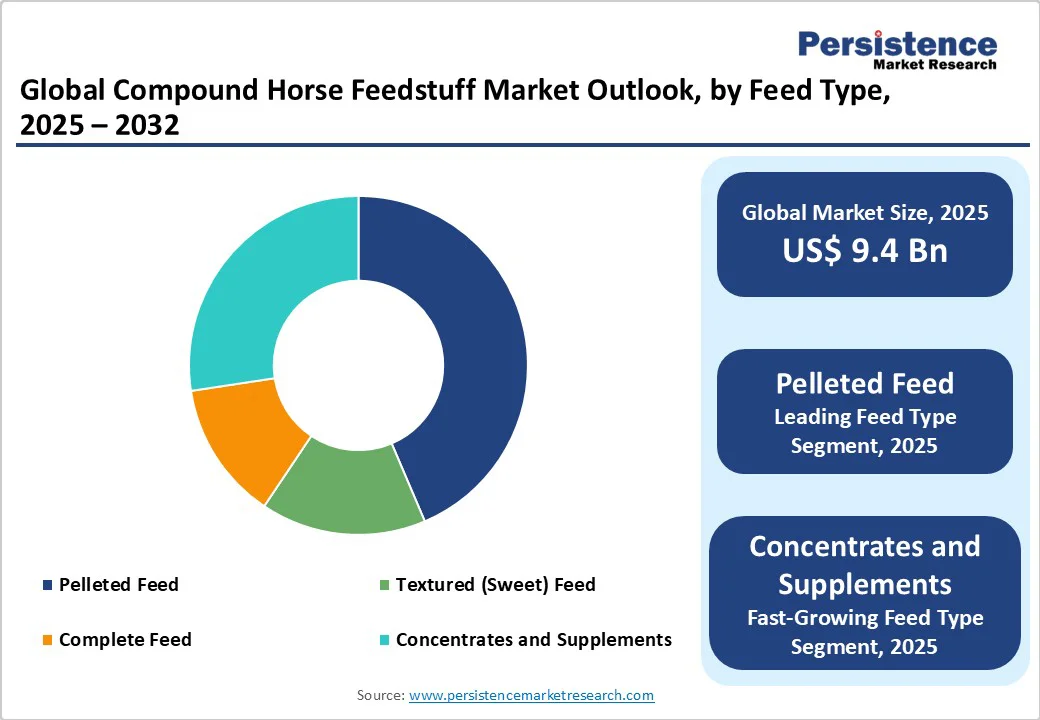

Pelleted feed is predicted to account for approximately 43.6% of the share in 2025, owing to its uniform composition, improved digestibility, and convenience in handling. The pelleting process enhances nutrient absorption and minimizes ingredient separation, ensuring horses receive a balanced diet in every bite. It also reduces wastage as pellets are less likely to be blown away or sorted by picky eaters compared to textured or mash feeds.

Concentrates and supplements are speculated to witness steady growth, backed by their role in supporting performance, recovery, and targeted health benefits for horses. These products are valuable for sport and working horses that require extra energy, protein, and micronutrients beyond forage diets. The growing emphasis on gut health, joint strength, and immune resilience has driven the use of specialized additives, including prebiotics, amino acids, and vitamin blends.

Cereal-based formulas are expected to hold a share of about 56.3% in 2025, as they provide a reliable source of easily digestible energy, which is essential for active, working, and sport horses. Grains such as oats, barley, and maize are rich in carbohydrates that support endurance and quick recovery during high-intensity performance.

Protein meals are experiencing substantial growth due to their crucial role in muscle development, tissue repair, and coat health. As equine nutrition becomes increasingly performance-oriented, protein-rich formulations are being utilized to optimize stamina and promote post-exercise recovery.

Dry feeds are anticipated to account for nearly 73.1% of the share in 2025, as they provide better storage stability, reduced spoilage risk, and easier transportation compared to moist or liquid feeds. Their low moisture content prevents mold formation, which is a common concern in humid regions.

Cubes/blocks are poised to witness considerable growth due to their convenience, nutritional consistency, and suitability for outdoor or group feeding. These compressed forms of forage or compound feed ensure horses receive balanced nutrition over an extended period, making them ideal for grazing environments or travel.

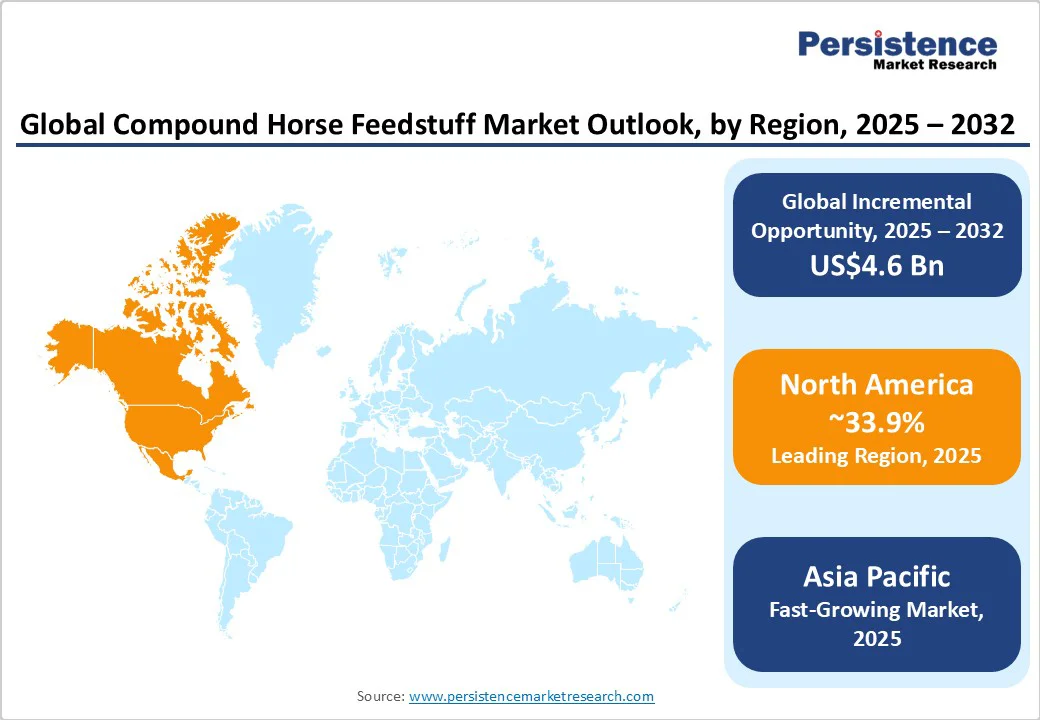

In 2025, North America contributed approximately 33.9% of the share, primarily due to its large horse population and active participation in equestrian sports. Owners now demand specialized feeds that support performance, recovery, and health. Brands such as Purina, Nutrena, and ADM focus on premium feeds that include gut-friendly probiotics, controlled-starch energy blends, and forage-based nutrition, all customized for sport and recreational horses.

Regulatory standards in Canada and the U.S. are augmenting improvements in feed safety, traceability, and quality. For example, Canada’s updated Feed Regulations require strict nutrient labeling and contamination prevention, prompting manufacturers to enhance their production practices and compliance measures.

The Asia Pacific region is experiencing steady growth, driven by increasing equine populations, rising disposable income, and a surge in interest in equestrian sports. China, India, and Australia are experiencing a surge in horse ownership, resulting in a high demand for specialized nutrition. For instance, in China, the equine industry is expanding, with a focus on improving the health and performance of horses through scientifically formulated feeds.

This trend is further supported by developments in feed technology and a shift toward premium products. Local manufacturers are responding to this demand by developing region-specific formulations that cater to the unique climatic and nutritional requirements of horses in the Asia Pacific. These formulations often include locally sourced ingredients, ensuring cost-effectiveness and sustainability.

Europe remains a key hub for compound horse feedstuffs, driven by a rich equestrian heritage, stringent animal welfare standards, and growing demand for specialized nutrition. Germany, France, and Italy are at the forefront, emphasizing performance-oriented and health-focused formulations. For instance, Germany is bolstered by a growing focus on breeding and sport horses, with an emphasis on formulations that enhance gut health.

Italy's market is characterized by a preference for Mediterranean feedstuffs such as grains, legumes, and herbal additives, reflecting regional feeding patterns. Europe is witnessing a shift toward premiumization, with increasing consumer interest in maximizing horse performance and health via scientifically developed feed. This trend is evident in the high demand for feeds customized to specific requirements such as senior care, breeding, and performance.

The global compound horse feedstuff market is characterized by a moderate concentration of key players, including Purina Animal Nutrition, Spillers Horse Feeds, GAIN Equine Nutrition, Nutrena Animal Feeds, and Bailey’s Horse Feeds. These companies are focusing on innovation, sustainability, and digital engagement to capture long-term growth. For instance, Purina Animal Nutrition launched a new line of organic horse feed in June 2023, reflecting the industry's shift toward natural and sustainable feeding practices.

The compound horse feedstuff market is projected to reach US$9.4 Billion in 2025.

Rising equestrian sports participation and the expansion of therapy centers are the key market drivers.

The compound horse feedstuff market is poised to witness a CAGR of 5.9% from 2025 to 2032.

Shift toward personalized nutrition and the launch of eco-friendly feed options are the key market opportunities.

Archer-Daniels-Midland, Cargill Inc., and Kent Corporation are a few key market players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Feed Type

By Ingredient Type

By Form

By Horse Age

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author