ID: PMRREP35482| 191 Pages | 14 Jul 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

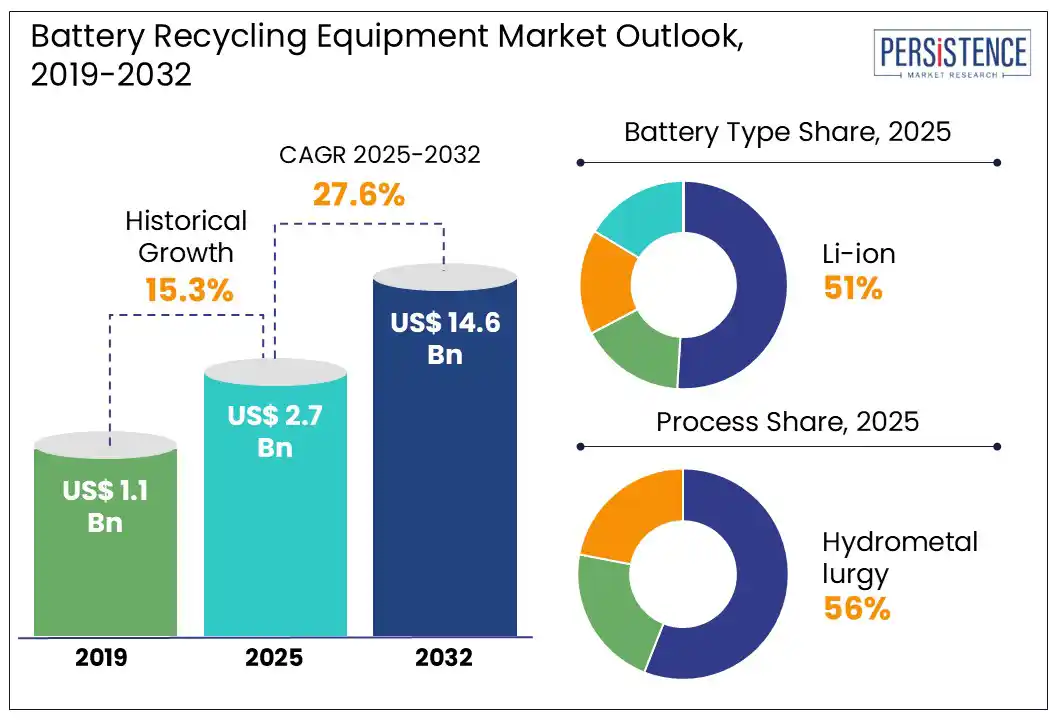

The global battery recycling equipment market size is likely to be valued at US$ 2.7 Bn in 2025, and is expected to reach US$ 14.6 Bn, growing at a CAGR of 27.6% by 2032.

Battery recycling equipment plays a critical role in the sustainable management of spent batteries, particularly as the global demand for electric vehicles (EVs) and portable electronics continues to surge. These specialized systems are designed to safely and efficiently process end-of-life batteries, recovering valuable materials such as lithium, cobalt, and nickel while minimizing environmental impact. The battery recycling equipment market is witnessing robust growth, driven by the rapid expansion of lithium-ion battery usage and increasingly stringent environmental regulations worldwide.

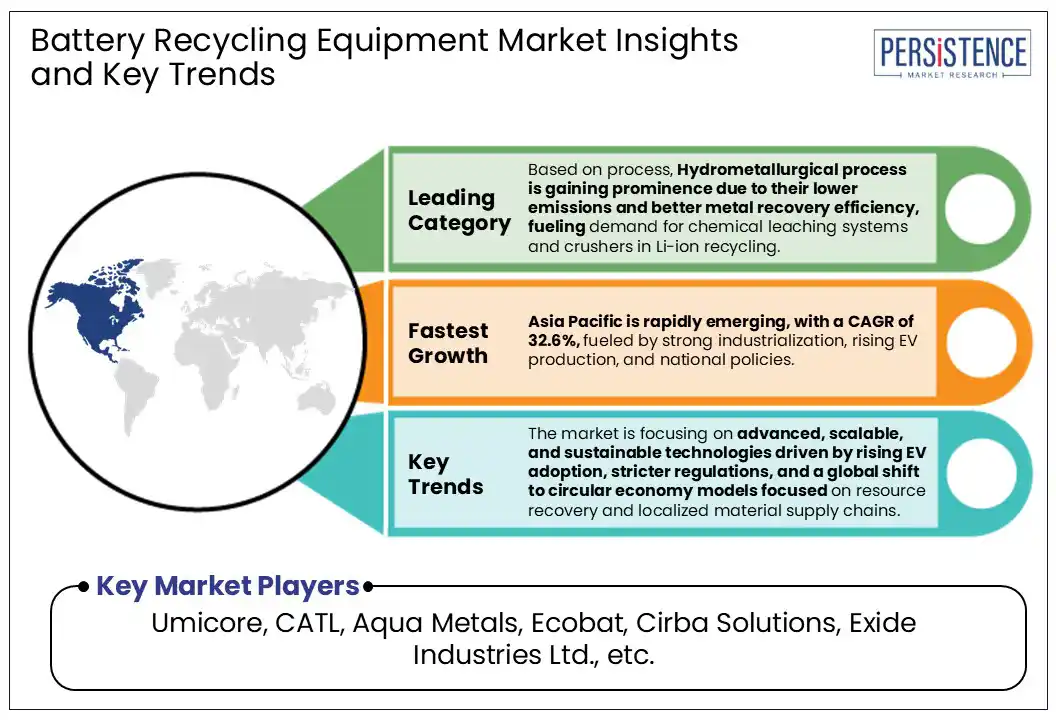

Moreover, the market is gradually shifting towards advanced, scalable, and sustainable technologies to meet the growing demand for safe recycling solutions. This change is driven by increasing EV battery waste, stringent environmental regulations, and the global emphasis on resource recovery and localized supply chain systems.

Key Industry Highlights:

|

Market Attribute |

Key Insights |

|

Battery Recycling Equipment Market Size (2025E) |

US$ 2.7 Bn |

|

Projected Market Value (2032F) |

US$ 14.6 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

27.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

15.3% |

The battery recycling equipment market is experiencing robust growth, driven by the growing adoption of EVs across the globe. With millions of EV batteries projected to reach end-of-life over the next decade, the need for efficient recycling infrastructure has become critical.

Governments across key regions, particularly in North America and Europe, are actively supporting the market growth by investing in the infrastructure development for lithium-ion battery recycling. Supporting government initiatives, OEMs are responding with targeted initiatives to manage this growing waste stream and recover valuable materials by partnering with the market players. For instance, in December 2023, Toyota partnered with Cirba Solutions to expand its U.S. EV battery recycling infrastructure, targeting up to 95% recovery of critical minerals such as lithium and cobalt. This closed-loop initiative, anchored at a Delaware processing plant, slashes logistics costs by around 70% and supports sustainable supply chains.

The market faces a significant challenge due to high capital requirements and complex technological demands. The continuously developing technologies, complicated systems along with growing geopolitical tensions are hindering the market growth.

Recycling Li-ion batteries, in particular, require several equipment such as shredders, crushers, leaching reactors, and metal recovery systems. Such equipment, in a fully operational facility, especially for battery recycling is highly expensive. Furthermore, the battery recycling systems must comply with strict environmental and safety standards. These regulations further increases setup and operational costs.

The battery chemistries are diverse and constantly evolving, which forces the market players to use flexible and technically advanced processing lines capable of handling varied materials. Hydrometallurgical and pyrometallurgical processes, while efficient, demand accurate control over the systems and skilled labor, which creates barriers for small and mid-sized firms.

The rising attention from global regulatory committees toward a circular economy presents a significant opportunity for the market. The governments are executing stringent policies to promote battery reuse, material recovery, and waste minimization. Such efforts will help to minimize the dependence on mined metals and increase the use of recycled metals.

According to the EU Commission, Global demand for batteries is increasing rapidly and is set to increase 14 times by 2030. The EU could account for 17% of that demand. To increase the battery reuse, the EU’s Battery Regulation mandates minimum recycling efficiency rates and the use of recovered materials in new battery production.

The market players are working towards following the regulations provided by the governments. For instance, in June 2025, in honor of World Environment Day (June 5), Cirba Solutions worked to enhance education on the importance of battery recycling and making battery recycling more accessible to the greater public. Cirba Solutions hosted battery recycling collection events at its Mesa, Ariz, and Wixom, Mich, facilities that are free for the public to participate in by dropping off their end-of-life batteries for recycling.

Li-ion batteries are leading the battery recycling equipment market, owing to their widespread use in EVs, consumer electronics, and energy storage systems. The more often use of these batteries and their continuous consumption is providing a large amount of batteries for recycling.

The Li-ion batteries are generating strong demand for specialized recycling technologies such as shredders, crushers, and hydrometallurgical processing units. The high recovery value of critical minerals such as lithium, cobalt, and nickel further strengthens the commercial viability of Li-ion battery recycling.

The market players are investing heavily in Li-ion battery recycling to support the growing demand from the market.

For instance, in April 2025, Ecobat, a global leader in battery recycling, announced the successful commissioning of three cutting-edge lithium-ion battery recycling facilities within just one year. Located in Hettstedt, Germany; Casa Grande, Arizona; and Darlaston, England, these facilities are now fully operational, contributing significantly to the global transition to a circular battery economy. Together, the three plants are capable of processing up to 10,000 tons of lithium-ion batteries annually, with plans to scale capacity to 25,000 tons.

Hydrometallurgy process dominated the battery recycling equipment market, driven by its high recovery efficiency, lower environmental impact, and compatibility with Li-ion battery materials. It is a method that uses chemical solutions to extract valuable metals like lithium, cobalt, and nickel from used batteries. Instead of burning batteries or dumping them, this process dissolves metals in liquid solutions and recovers them for reuse.

The rising demand for sustainable and scalable recycling solutions has accelerated the adoption of hydrometallurgical systems, including leaching reactors, filtration units, and other equipment.

The market players are investing in the process technology with innovations and marketing, to expand their market reach. For instance, in June 2025, CATL plans to bring its battery swap and recycling technology to Europe amid a global battle to secure a more sustainable EV supply chain.

Shredders and crushers leads the battery recycling market, as they serve a critical function in the initial stage of battery processing. The initial stage includes mechanical crushing of the batteries into small pieces for efficient separation of valuable materials.

Shredders and crushers are particularly vital in lithium-ion battery recycling, where pre-processing provides easier separation with the help of screens and magnetic separators. The widespread integration of shredding and crushing units across hydrometallurgical and mechanical recycling lines underscores their centrality.

The market players are continuously expanding their market by establishing new facilities in the demanding regions. For instance, in March 2024, the U.S. government initiated a battery recycling project with Cirba Solutions. Under the project, a US$74 Million investment from the Infrastructure Investment and Jobs Act helped Cirba Solutions to open and operate a new battery recycling facility in Lancaster, Ohio.

North America stands out as a key region in the battery recycling equipment market, driven by a strong policy push, rising EV adoption, and increasing investment in domestic recycling infrastructure. The regional market, especially U.S. battery recycling market is continuously growing due to expanding manufacturing sites from the market players and growing support from the government.

The U.S. government has introduced major funding programs under the Bipartisan Infrastructure Law and the Inflation Reduction Act to secure critical mineral supply chains and support closed-loop battery ecosystems. These efforts are translating into large-scale deployment of advanced equipment such as shredders, crushers, and hydrometallurgical systems.

The market players are participating in the programs launched by the government. For instance, in September 2024, Cirba Solutions, a leader in battery recycling and materials management, negotiated an award of up to $200 Mn from the U.S. Department of Energy (DOE). This funding, part of the Bipartisan Infrastructure Law, supports the development of a cutting-edge lithium-ion battery recycling facility in Columbia, South Carolina.

Europe plays an important role in the battery recycling equipment market, supported by robust regulatory frameworks and a mature recycling infrastructure. The region’s strong focus on environmental sustainability drives the expansion of manufacturers in the region.

The EU’s Battery Regulation mandates high recycling efficiencies and the recovery of critical materials such as lead, lithium, and cobalt, directly driving demand for advanced equipment like separation units, furnaces, and metal recovery systems. European countries are also supported by the large clean energy generation targets introduced by the EU to limit the overall carbon footprint from various industries.

The market players are collaborating with raw material suppliers to improve the circular economy in the region. For instance, in December 2024, Li-Cycle Holdings Corp. announced that the Company and Glencore International AG, a leading producer, recycler and marketer of nickel and cobalt for the production of lithium-ion batteries, are resuming their collaboration to assess the technical and economic viability of developing a new Hub facility in Portovesme, Italy, including a concept and pre-feasibility study.

Asia Pacific is rapidly emerging as a high-growth region in the battery recycling equipment market, fueled by strong industrialization and rising EV production. The regional government, especially China and South Korea is improving the policies focused on environmental sustainability and resource security.

Countries such as India and Japan are investing heavily in localized recycling infrastructure to reduce dependence on imported raw materials and manage surging volumes of dead batteries. The region is increasingly adopting the treatment and recovery technologies designed for both Li-ion and nickel-cadmium batteries.

The market players are partnering and collaborating with other manufacturers to improve the recycling technology. For instance, in June 2025, Ace Green Recycling, Inc., a leading provider of sustainable battery recycling technology solutions, announced its signing of a collaboration agreement with The Owens Group Pty Ltd, a leading lead battery recycler based in Perth, Australia, to advance sustainable battery recycling opportunities in Australia.

The global battery recycling equipment market is moderately consolidated, due to the rapid advancement of technology, evolving regulatory requirements, and the growing need for infrastructure. Market players are competing to develop modular and efficient recycling solutions that can process a variety of battery chemistries.

With strict environmental regulations in place, companies are focusing on producing equipment that meets stringent safety, emissions, and recovery efficiency standards. Innovation in areas such as automated shredding, advanced material separation, and hydrometallurgical processing is becoming a key differentiator.

Yes, the market is set to reach US$ 14.6 Bn by 2032.

The global growing adoption of EVs is propelling the battery recycling equipment market growth.

India is estimated to witness a CAGR of 31.7% in forecast period.

Umicore is considered the leading player of the battery recycling equipment market.

The rising focus of governments on establishing a circular economy through regulation and initiatives presents a significant opportunity for the battery recycling equipment market.

|

Report Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Battery Type

By Process

By Equipment

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author