ID: PMRREP33436| 299 Pages | 9 Jul 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

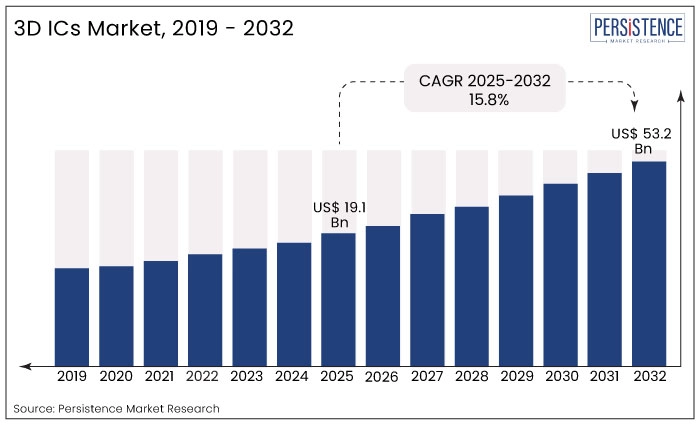

The global 3D ICs market was valued at US$17.3 Bn in 2024. According to Persistence Market Research, sales of 3D ICs are expected to reach US$19.1 Bn and is expected to reach US$53.2 Bn by 2032, growing at a CAGR of 15.8% from 2025 to 2032. A growing number of portable devices, and the rising need for solutions that improve performance and reduce the turnaround time, have contributed to the growth of 3D integrated circuits.

Three-dimensional integrated circuits offer enhanced functionalities, efficiency, and potential for high-density packaging. In addition to reducing signal delays, it allows for faster communication on the chip. As a result, the market for 3D ICs is expected to grow in demand.

A 3D IC package provides faster signal transmission due to shortened logic and memory chips interconnections. Compared with other IC technologies such as system-on-a-chip or package-on-package, 3D-ICs exhibit better vertical and heterogeneous integration density. It is expected that these factors will lead to an increase in the market demand for 3D ICs.

Compared to 2D ICs, 3D ICs provide higher speed, reduced footprint, and improved functionality at a similarly reduced power level. Among the key driving forces for market growth is the widespread use of 3D integrated circuits, such as those used in automotive, aerospace, communications, and telecommunication.

Power consumption is one of the most significant concerns for electronics manufacturers. With 3D ICs, signals and power can be routed more efficiently through multiple layers of circuits, resulting in reduced power consumption.

As compared to traditional 2D ICs, 3D ICs can also perform better. More complex circuits can be created with shorter signal paths by stacking layers of circuits on top of each other.

| Report Attributes | Details |

|---|---|

|

3D ICs Market Size (2025) |

US$19.1 Bn |

|

Projected Market Value (2032) |

US$53.2 Bn |

|

North America Market Growth Rate (2025 to 2032) |

40.2% |

|

Projected Growth (CAGR 2025 to 2032) |

15.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

10.4% |

As per Persistence Market Research (PMR), the global 3D ICs Industry is expected to witness a CAGR of 15.8% from 2025 to 2032. The market registered a CAGR of 10.4% in the historical period from 2019 to 2024.

The use of advanced IC packaging systems and the integration of IoT and artificial intelligence (AI) technologies into products are also becoming increasingly popular among manufacturers. Additionally, ongoing product diversification and the growing need for high-bandwidth memory (HBM) are boosting the growth of the market.

The TSV 3D IC system is a highly advanced packaging technology that will likely go head-to-head with existing packaging systems. Developing 2D and 3D ICs for the TSV technology through the collaborative effort of the downstream, midstream, and upstream IC vendors is imperative. As a result of providing performance and power efficiency, 3D ICs can help meet this demand.

With the rapid growth in electronics, the market for 3D ICs on the market has been experiencing rapid growth. With the growth of smartphones and the demand for convenient, fast, and compact products, 3D integrated circuits are gaining popularity. The market for 3D ICs is growing significantly due to technological advances, the internet of things, and 5G networks.

Rapid advancements in 3D packaging technology and high-speed memory chips in current mobile devices are expected to increase demand. As more outsourcing semiconductor assembly and testing (OSAT) companies enter the 3D IC market, the complexity of ICs will rise. High investment in research and development to expand the scope of innovation in the coming years.

The 3D IC market will likely benefit from the development of electric vehicles, industrial equipment, and infrastructure as the market grows. The proliferation of smartphones, wearables, and other gadgets, along with 3D ICs, is influencing the market at a rapid pace. A significant ICT market demand would also increase the value of the 3D integrated circuit market.

Growing popularity of Smart Home Security Systems will drive Sales of 3D ICs

A significant share of the global 3D IC market is expected to be held by the United States. With technological advancements, the demand for integrated circuits is expected to grow, resulting in the 3D IC market's expansion during the forecast period.

According to the report’s projections, the United States 3D IC market will likely be worth US$ 8.2 billion by 2032. From 2019 to 2024, the United States experienced a CAGR of 9.8%, and from 2025 to 2032, it is anticipated that the rate of growth will increase by 7%.

Data analytics and security systems contribute significantly to market revenues. Aside from easy access to raw materials, improved infrastructure and a growing demand for 3D integrated circuits have also contributed to the growth of the 3D integrated circuit market.

The high demand for electronics has prompted the need for cutting-edge technologies and semiconductor devices. Increasing remote working, operation from remote locations, and digitizing block websites are likely to increase market demand for 3D ICs.

Stronger Demand for Packaging Technologies and Consumer Electronics to Drive Growth

According to Persistence Market Research, the Chinese market for 3D ICs will reach US$ 2.2 billion by 2032. The Chinese market is expected to expand at a CAGR of 9.1% from 2025 to 2032. Japan is projected to reach US$ 1.9 billion in 2032 with a CAGR of 7.6% by the end of the forecast period.

Japan and China are both affluent countries that have densely populated urban areas that are highly constrained in terms of space. Thus, compact and efficient electronics are in high demand. By stacking multiple layers of circuits on top of each other, 3D ICs provide a way to achieve more functionality in a smaller space, allowing small devices to perform a variety of tasks.

The development of 3D integrated circuits has been a major investment for both Japan and China in recent years. For example, Japan has launched programs such as the "3D Power Alliance" to encourage the development and adoption of 3D ICs, while China includes 3D ICs in its high-tech manufacturing plans to boost the country's economy.

Silicon on insulator (SOI) is Expected to generate significant sales

A significant amount of growth is expected in the silicon-on-insulator market over the next decade. According to the forecast, the market is expected to grow at a CAGR of 8% from 2025 to 2032. The ability of SOI to limit thermal and parasitic capacitance production is expected to increase its market demand.

Silicon-on-insulator (SOI) technology is rapidly becoming an important component of 3D ICs. This is attributed to its enhanced performance. Improved thermal performance, low power consumption, and improved electrical performance are some of the benefits of SOI technology for 3D ICs.

SOI technology can be used to integrate heterogeneous systems, which are the foundation for providing the 3D ICs are expected to grow in demand. The growing demand for 3D ICs on the market is making SOI technology more and more valuable.

Growth of Consumer Electronics at Residential and Commercial Spaces to Grow Demand for 3D ICs

3D ICs applications are expected to grow significantly in consumer electronics. The segment is expected to expand at a CAGR of 8.1% during the forecast period. Based on historical projections, between 2019 and 2024, the growth rate reached 11.3%.

Microchips and wafer-level packaging are becoming increasingly popular in microelectronics, such as gaming consoles, sensors, and home appliances. Additionally, the need for power-efficient integrated circuits and advanced electronics architecture is driving the market.

3D IC technology is being extensively integrated into a number of smart home devices, such as fan controllers, window sensors, smart smoke detectors, and energy monitors. Growing demand for security has increased market demand for 3D ICs in security locks, temperature sensors, and more.

Penetration of 5G Network-enabled Devices to propel demand

The combination of digitalization and miniaturization has created opportunities for wafer-level packaging through innovative and cost-effective packaging methods. As wafer-level packaging offers technological superiority over traditional packaging approaches, manufacturers are likely to obtain an edge over the competition. As integrated circuit manufacturing processes advance and people learn about wafer-level packaging solutions, this packaging is likely to become more prominent.

Consumers and manufacturers have become increasingly dependent on packaging innovations to meet their changing needs. Globally, packaging has impacted almost all industries, and each has experienced a change in its packaging design. Besides packaging for the overall product, companies in the semiconductor and technology industries also use packaging for manufacturing the final product.

Strategic partnerships are being established between manufacturers of 3D ICs and other companies in the electronic industry. By enhancing its technological capability, expanding its product offerings, and increasing its market presence, they aim to increase its market share. Combining the strengths of these companies would allow them to develop innovative products and solutions.

The performance and capabilities of their products are being improved by investing heavily in research & development by a few other firms. New products are also being launched as part of companies' attempts to gain a competitive edge.

According to estimates, the global 3D IC market was worth US$17.3 Bn in 2024.

3D ICss in 2025 is expected to generate an industry revenue of US$19.1 Bn.

Globally, the market for 3D ICs is expected to reach US$53.2 Bn by 2032.

The 3D IC market is expected to grow at a compound annual growth rate of 15.8% during the forecast period.

3D ICs grew at a compound annual growth rate of 10.4% between 2019 and 2024, according to a report.

Consumer electronics sales will account for a significant revenue of 8.1% CAGR by 2025.

Japanese 3D ICs are forecast to grow at a CAGR of 7.6% over the forecast period.

| Attribute | Details |

|---|---|

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

| Report Highlights |

|

| Customization and Pricing |

Available upon Request |

By Substrate:

By 3D Technology:

By Application:

By Component:

By Product:

By Region:

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author