ID: PMRREP33413| 241 Pages | 10 Jun 2024 | Format: PDF, Excel, PPT* | Chemicals and Materials

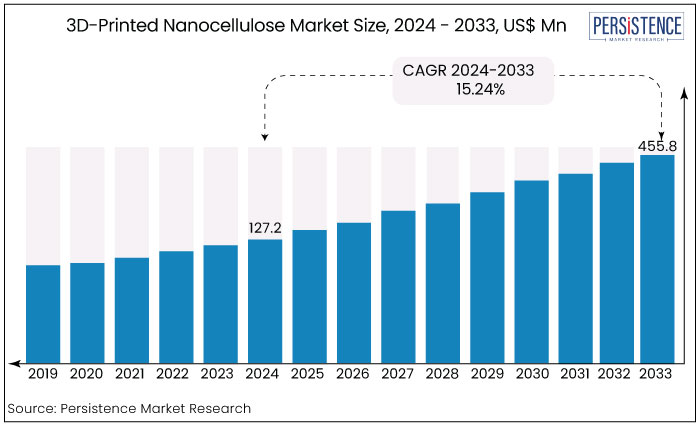

The global market for 3D-printed nanocellulose is expected to rise from US$127.2 Mn estimated in 2024 to US$455.8 Mn by the end of 2033. The market is anticipated to secure a CAGR of 15.24% during the forecast period from 2024 to 2033.

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$127.2 Mn |

|

Projected Market Value (2033F) |

US$455.8 Mn |

|

Forecast Growth Rate (CAGR 2024 to 2033) |

15.24% |

|

Historical Growth Rate (CAGR 2018 to 2023) |

17% |

Key Highlights of the Market

The market is projected to experience substantial growth over the coming years. Factors such as the rising awareness of environmental sustainability, and the increasing adoption of additive manufacturing across industries contribute to the market growth.

Government initiatives supporting innovations in 3D technology, the rising need for organ transplants are the key factors that have helped increase investments in the 3D technology sector. Leading manufacturers of 3D printing materials are focusing on developing innovative products while expanding their geographical reach and diversifying their product lines.

The affordability of 3D printing techniques has enabled startups to manufacture products at lower tooling costs, even for small volumes, allowing them to serve niche market segments. As a result, many new players can compete with established market leaders.

Niche market players are anticipated to revolutionize industries by adopting a unique approach to mass manufacturing, reducing costs, and leveraging customer networks and innovative design as their source of competitive advantage.

Researchers in the healthcare sector have been trying to develop cardiac tissue in patch form with the help of tissue engineering, which can then be implanted directly on to scarred areas. This approach is expected to reduce the need for organ transplants, prevent subsequent cardiac events, and enhance recovery. For example,

There has been a significant increase in research and development activities worldwide over the past decade particularly in the domain of 3D printing technology for product development. This has led to high demand for 3D-printed products in various industrial sectors, including healthcare, food, and electronics.

The historic growth of the 3D-printed nanocellulose market has been promising, with increasing interest in sustainable materials and advanced manufacturing technologies. Nanocellulose, derived from natural sources like wood pulp or agricultural waste, offers advantages such as being lightweight, strong, and environmentally friendly.

Worldwide sales of 3D printed nanocellulose accounted for 1.3% share of the global 3D bioprinting market in 2023 and the cellulose nanofibers held 72.5% share of the global market. From 2028 to 2023, the sales of 3D printed nanocellulose increased at a CAGR of 13%.

The integration of nanocellulose into 3D printing processes has opened new possibilities in various industries, including aerospace, automotive, healthcare, and consumer goods. The growth forecast for the 3D-printed nanocellulose market remains positive.

Factors such as ongoing research and development efforts as well as the growing demand for sustainable and bio-based products, are expected to drive market expansion.

Additionally, advancements in 3D printing technology itself, such as improved printing resolution and speed, are likely to further propel the adoption of 3D-printed nanocellulose in diverse applications.

Increasing Prevalence of Organ Failure

Increasing cases of organ failure are necessitating increased production of 3D-printed implants. 3D printing technology is being explored as a potential solution to the worldwide organ shortage. 3D printing enables printing out virtually any human organ using nanocellulose.

Cell culture, a vital part of regenerative medicine, is another area where demand for 3D printed nanocellulose is growing. Regenerative medicine is a branch of medicine that involves repairing, replacing, or regrowing damaged or diseased cells, tissues, or organs that have been lost or impaired due to congenital defects, aging, disease, or injury.

Personalized medicine utilizes patient information, including their genetic makeup and medical history, to develop tailored treatment options and therapies. This approach can predict how a patient will respond to treatment before undergoing therapy or treatment, resulting in more effective and efficient healthcare.

Growing Demand for Regenerative Medicine

Use of 3D printed nanocellulose has been beneficial in observing cell interactions during the cell culture process. The growing demand for regenerative medicine has benefitted manufacturers of 3D printed nanocellulose to a great extent.

Development of 3D printing technology has made it possible for manufacturers to develop technologically advanced 3D printed products. To obtain a competitive edge, prominent companies like CELLINK and CelluForce have introduced advanced 3D printed nanocellulose.

Product manufacturers are adopting innovative marketing strategies to increase their market share and investing in cutting-edge technologies and innovations to meet the evolving research needs of their customers. These trends are expected to drive the growth of the global market.

Shortage of 3D Printing Equipment

Dearth of skilled professionals in the research and development sector may be attributed to a variety of factors, including inadequate laboratory training, low salary scales, and challenging roles.

A lack of awareness of 3D printed nanocellulose training programs has resulted in a shortage of talented individuals in research laboratories, which has restricted sales of 3D printed nanocellulose.

Shortage of equipment in laboratories due to low government funding for research activities has further limited the growth of the 3D printed nanocellulose market.

Ethical Concerns Related to Combining Human and Non-Human Cells

According to industry experts, the rapid evolution of 3D printing is associated with the risk of intellectual property theft, which is expected to create significant challenges in the future. This could result in a loss of nearly US$100 Bn per year in intellectual property globally.

One must negotiate a license with the patent owner to distribute a 3D-printed version of a patented product, otherwise, the distribution process would be considered a violation of patent laws.

Researchers have been actively working to combine human cells with non-human cells as well as develop non-human cells through 3D printing, which is expected to raise ethical issues over the coming years.

Innovative Material Properties

Nanocellulose, derived from renewable sources like wood pulp, possesses unique properties such as high strength, low weight, and biodegradability. 3D printing allows for the creation of complex structures with precise control over material composition and geometry.

Players can capitalize on these properties to develop novel products across various industries, including aerospace, automotive, healthcare, and consumer goods.

Customization, and Design Flexibility

3D printing enables the production of highly customized and intricate designs that are difficult or impossible to achieve with traditional manufacturing methods.

Nanocellulose-based materials can be tailored to specific requirements, offering design flexibility and customization options for end-users.

This unlocks multiple opportunities in sectors where personalized or specialized products are in demand, such as medical implants, prosthetics, and architectural models.

|

Category |

Market Share in 2022 |

|

Cellulose Nanofibers |

2.5% |

|

Fused Deposition Modeling |

36.4% |

|

Biomedical Application |

45% |

Cellulose Nanofibers Account for Higher Sales

There is high demand for cellulose nanofibers due to their biodegradability and nontoxicity. Cellulose nanofibers accounts for more than 72.5% share of the market as of 2024.

Cellulose nanofibers are an advanced biomass material created by refining their size to the nano level of hundreds of microns. They have been increasingly adopted to create lightweight composites with superior mechanical properties due to their nontoxicity, biodegradability, biological availability, and stiffness.

Fused Deposition Modeling Sought-After 3D Printing Method

Fused deposition modeling (FDM) currently accounts for over 36.4% share of the 3D-printed nanocellulose market. FDM is a 3D printing process that builds a 3D model layer by layer using a building platform that can be used both horizontally, and vertically.

The technology uses thermoplastic material that melts and is then extruded, making it a popular choice for creating 3D organ models.

Biomedical Applications Account for over 45% Share

There is growing demand for biomedical devices, and procedures due to an increase in the patient population and the focus of small businesses on research and development in the 3D printing industry.

These further are resulting in significant product breakthroughs and contributing to the growth of the market.

Demand from Biomedical and Healthcare Industry Heightens Further

Demand for 3D printed nanocellulose for R&D in biomedical and healthcare industry accounts for a market share of more than 59.6%. The biomedical and healthcare industry has been leveraging nanocellulose materials to create products such as 3D printed organs and tissues.

As the demand for 3D bio-printed products grows, companies are increasing their research and development investments to expand their product portfolios.

|

Countries |

Market Share in 2022 |

|

The US |

91% |

|

The UK |

28.7% |

|

China |

49.9% |

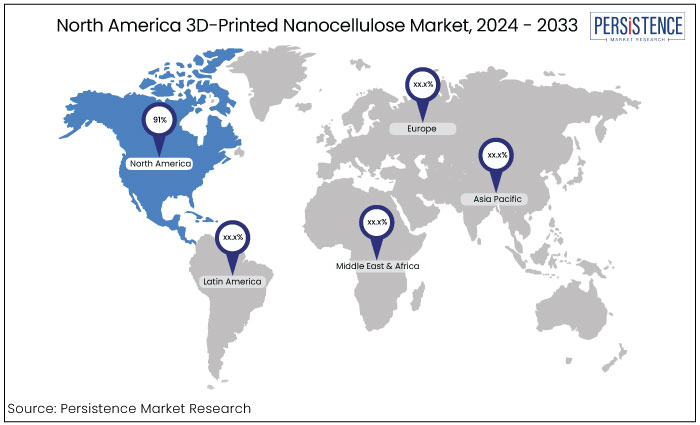

North America Leads the Way in 3D-Printed Nanocellulose

The 3D-printed nanocellulose market was showing promising growth potential in North America. Nanocellulose, derived from renewable sources like wood pulp, offers a sustainable alternative to traditional plastics in 3D printing.

The US accounted for 91% share of the North American 3D printed nanocellulose market in 2022 and the trend will prevail through the end of forecast year.

Increasing cases of organ failure and growing demand for effective solutions have created profitable opportunities for market players as well as researchers in the country.

Advancements in healthcare infrastructure and increasing use of 3D printing technology in research for developing innovative products like 3D printed organs are expected to push the demand for 3D printed nanocellulose in the US.

Sustainability Goals Elevate Market Prospects in Europe

Europe has been at the forefront of sustainability efforts, with increasing awareness about the environmental impact of traditional manufacturing processes and materials.

Nanocellulose, derived from renewable sources like wood pulp, aligns well with Europe's sustainability goals, driving interest and demand for its use in 3D printing applications.

European countries boast significant research and innovation capabilities in the field of nanotechnology and advanced materials. Rising government investments in additive manufacturing drive production of 3D printed nanocellulose in the UK.

The UK held 28.7% share of the European market in 2022. Demand for 3D printing has surged in the UK due to increased investment in research and development to promote innovation.

The public sector is investing millions of dollars in the development of both the underlying technologies and diagnostic platforms and assays.

China’s 50% Share Upholds the Globally Significant Position of East Asia

Manufacturers’ focus on additive manufacturing and 3D printing for nanocellulose research has been increasing in China as researchers seek to unleash the potential of nanocellulose as a promising material in nanostructure fabrication and device fabrication using 3D printing.

Competitive Landscape Analysis

Key manufacturers of 3D printed nanocellulose are actively working towards developing the finest quality products using 3D printing technology.

These leaders are employing various strategies to outperform their competitors such as obtaining product certifications/approvals and mergers and acquisitions.

One common strategy is innovation, where companies invest in research and development to create 3D-printed nanocellulose products.

Strategic partnerships and collaborations with other companies or research institutions enable market players to access new technologies, expand their product portfolios, and enter new markets.

May 2022

CelluForce was awarded conformity certification for the international quality standard by the British Standards Institution, which will aid the company in the manufacturing of its cellulose nanocrystals (CNC) and improve its customer service.

August 2022

BICO acquired Advanced BioMatrix, a company with a leading portfolio of bio-inks and reagents.

Demand for 3D printed nanocellulose is projected to reach US$77.5 million by the end of 2033.

Sales of 3D printed nanocellulose are anticipated to surge at a CAGR of 15.1% from 2024 to 2033.

The US accounted for 91% share of the North American market in 2022.

Some of the key players operating in the market are CELLINK (BICO GROUP AB), UPM Biomedicals, and Novum.

Nanocellulose-based materials offer design flexibility, and customization options, which create opportunity for the market players.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2033 |

|

Historical Data Available for |

2018 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Nanocellulose Type

By 3D Printing Method

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author