ID: PMRREP34185| 200 Pages | 27 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

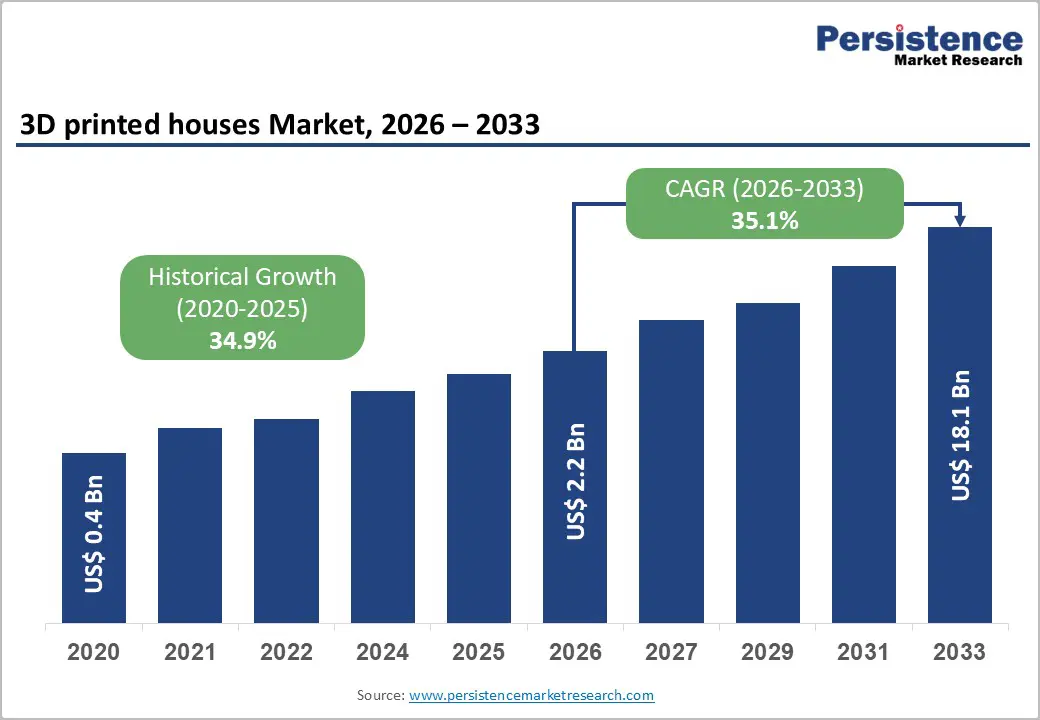

The global 3D printed houses market size is likely to be valued at US$2.2 billion in 2026 and is expected to reach US$18.1 billion by 2033, growing at a CAGR of 35.1% during the forecast period from 2026 to 2033, driven by housing shortages, rapid urbanization, and rising construction costs, which are pushing governments and private developers to explore faster and more affordable building methods. Advances in large-scale concrete 3D printers, material formulations, and automation have enabled construction time reductions and significant labor cost savings compared to conventional methods. Sustainability is another critical driver, as 3D printing minimizes material waste, lowers carbon emissions, and supports energy-efficient building designs. Growing regulatory recognition and pilot approvals in key markets are accelerating adoption, while public-private partnerships for affordable housing projects strengthen long-term market prospects.

| Global Market Attributes | Key Insights |

|---|---|

| 3D Printed Houses Market Size (2026E) | US$2.2 Bn |

| Market Value Forecast (2033F) | US$18.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 35.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 34.9% |

Technological Advancements in Additive Manufacturing

Innovations in large-scale 3D concrete printers, robotic arms, and extrusion systems have significantly improved printing speed, precision, and structural integrity. Modern printers can now fabricate entire building shells within days, reducing construction timelines by over half compared to conventional methods. Enhanced software integration, including Building Information Modeling (BIM) and AI-based design optimization, allows architects and engineers to create complex, customized structures with minimal material waste. Improvements in printable concrete formulations, such as fast-setting, fiber-reinforced, and weather-resistant mixes, have increased durability and compliance with building safety standards. These technologies enable consistent quality, lower labor dependency, and improved on-site efficiency, making 3D printed housing a viable solution for addressing housing shortages, especially in urban and disaster-prone regions.

Advancements in additive manufacturing are expanding the scope and scalability of 3D printed housing projects worldwide. The development of hybrid construction techniques, which combine 3D printing with conventional reinforcement and finishing methods, has enhanced structural performance and regulatory acceptance. Automation and remote-controlled printing systems allow construction in challenging environments, including remote and disaster-affected areas, reducing reliance on skilled labor. Progress in multi-material printing supports the integration of insulation, conduits, and architectural features directly into printed structures, streamlining post-construction processes.

Regulatory and Standardization Hurdles

Many national and local building codes were designed for conventional construction methods and do not adequately address additive manufacturing processes, materials, or structural validation. Developers often face lengthy approval timelines, project-by-project evaluations, and uncertainty around compliance requirements. Differences in standards related to load-bearing capacity, fire resistance, durability, and long-term performance further complicate adoption. In several regions, the absence of clear guidelines for 3D printed concrete mixes, layer bonding, and printer calibration creates hesitation among regulators, insurers, and financial institutions. This regulatory ambiguity increases project risk and costs, discouraging smaller developers and limiting widespread adoption, particularly in residential housing markets where safety certification is critical.

The lack of standardization poses challenges for scaling 3D printed housing solutions across regions. Standards vary widely between countries, forcing companies to redesign structures and materials to meet local requirements, which reduces efficiency and increases operational complexity. Limited availability of standardized testing methods for printed structures also affects market confidence and slows integration into mainstream construction. While organizations such as building code councils and standards bodies are beginning to introduce guidelines for additive construction, progress remains uneven and gradual. Overcoming these hurdles will require coordinated efforts between technology providers, construction firms, and regulators to establish consistent building codes and standards that ensure safety, quality, and scalability across 3D-printed housing projects.

Integration with Sustainable Materials and Smart Technologies

Advances in low-carbon concrete, recycled aggregates, bio-based composites, and geopolymer materials are enabling builders to reduce the environmental footprint of housing projects while maintaining structural performance. Additive manufacturing allows precise material placement, minimizing waste and optimizing resource use compared to traditional construction. This capability supports green building certifications and sustainability mandates increasingly adopted by governments and urban planners. The use of locally-sourced and recyclable materials lowers transportation emissions and construction costs, making 3D printed housing especially attractive for affordable and rural housing programs.

The integration of smart technologies further enhances the long-term value proposition of 3D printed houses. Additive manufacturing enables the seamless embedding of smart sensors, energy-efficient systems, and IoT-enabled infrastructure directly into building designs. Features such as smart energy management, automated climate control, and real-time structural monitoring improve operational efficiency and occupant comfort while reducing lifecycle costs. These capabilities are particularly attractive for smart city developments and disaster-resilient housing initiatives. Digital design tools combined with 3D printing allow customization of smart layouts without increasing construction time or costs.

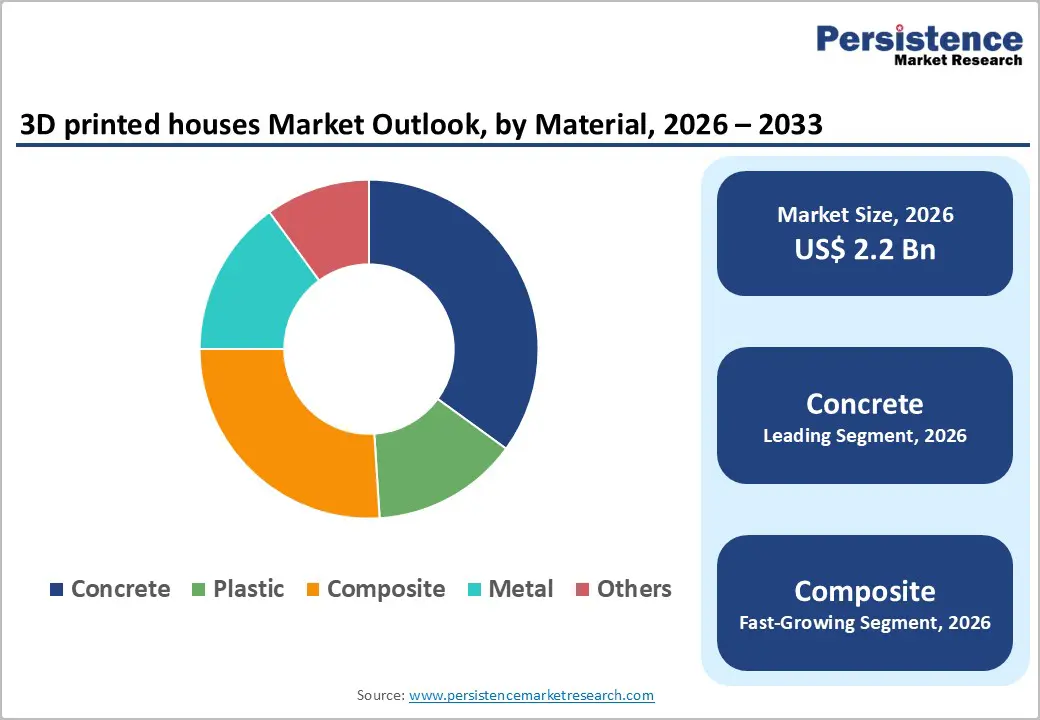

Material Type Insights

The concrete segment is expected to lead the 3D printed houses market, accounting for approximately 55% of revenue in 2026, driven by its high structural strength, cost efficiency, compatibility with extrusion-based printing technologies, and widespread acceptance under existing building codes for large-scale residential and infrastructure construction. Concrete also aligns well with existing building regulations and safety expectations, making it the most widely accepted material among regulators, developers, and financiers. The material’s adaptability to customized architectural designs and reduced material wastage further strengthen its dominance. For example, the use of 3D-printed concrete in Dubai’s landmark printed office development, which demonstrated faster construction timelines and enhanced design flexibility while maintaining structural compliance.

Composites are likely to represent the fastest-growing segment in 2026, supported by increasing demand for lightweight, sustainable, and high-performance construction solutions. These materials enable improved thermal efficiency, design flexibility, and reduced environmental impact compared to traditional options. The growing focus on bio-based and recycled composite formulations aligns strongly with global green building objectives, making them attractive for next-generation housing projects. Additive manufacturing enables precise fiber placement and optimized material use, improving structural performance while reducing waste. For instance, European modular housing projects are increasingly adopting composite-based 3D printing to deliver energy-efficient designs with lower carbon footprints.

Application Insights

The residential segment is projected to lead the market, capturing around 60% of the revenue share in 2026, supported by the rising demand for affordable, rapid, and customizable housing solutions. Urban population growth and housing shortages have pushed governments and private developers to adopt 3D printing as a viable alternative to conventional construction. Residential projects benefit from shorter build times, lower labor dependency, and flexible design capabilities, making them ideal for single-family homes and community housing developments. The ability to standardize layouts while maintaining customization further enhances adoption. For example, the residential housing initiatives undertaken by companies such as SQ4D have demonstrated the feasibility of delivering durable and cost-efficient homes using additive manufacturing.

The infrastructure segment is expected to be the fastest-growing application in 2026, supported by rising government emphasis on resilient, rapidly deployable public structures. Additive manufacturing allows the production of complex infrastructure components with enhanced durability and shorter construction timelines, making it well-suited for bridges, shelters, and public facilities. Its ability to function in challenging environments while minimizing material waste further increases its attractiveness for public sector projects. A notable example is China’s growing adoption of 3D printing in infrastructure development, where additive construction methods are being explored to deliver durable and time-efficient public works.

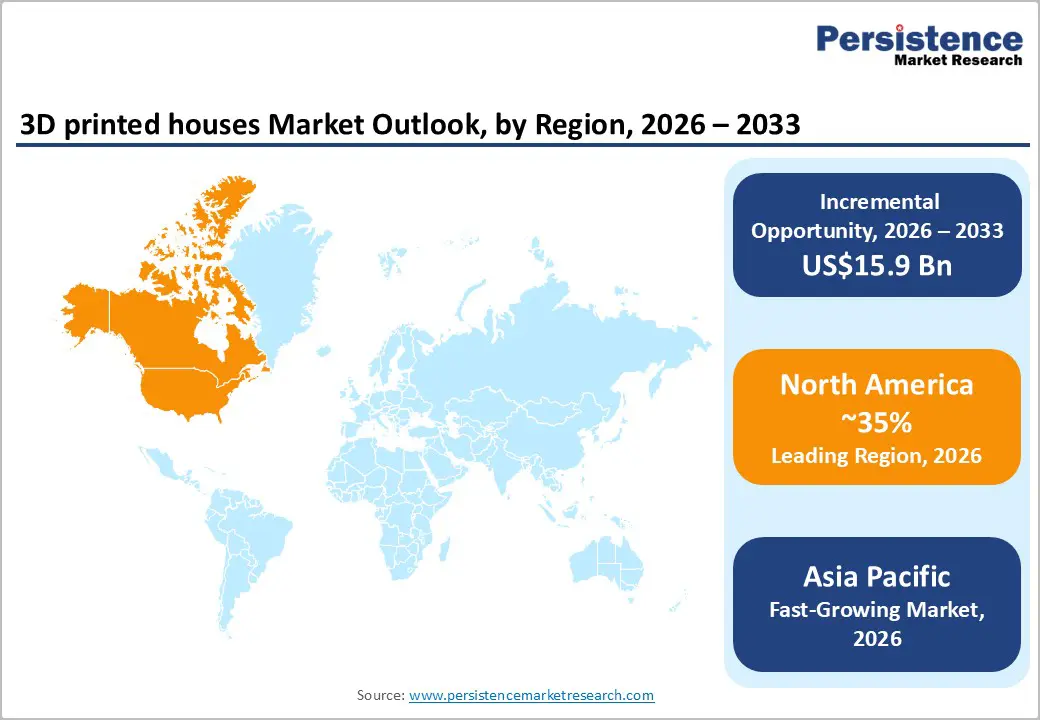

North America 3D Printed Houses Market Trends

North America is projected to lead the market, capturing approximately 35% share in 2026, driven by strong demand for affordable and sustainable housing, ongoing technological adoption, and supportive urban innovation initiatives. A key trend is the transition from experimental pilot projects to community-scale deployments, with builders and developers increasingly integrating 3D printing into conventional construction workflows. Residential construction remains the primary focus, particularly projects aimed at reducing costs and timelines, with extrusion-based concrete printing widely adopted due to its structural reliability and alignment with regulatory standards in the U.S. and Canada.

North American builders are also leveraging digital design tools and automation to enhance customization and respond more quickly to market demands. A notable example is ICON’s expansion in Texas, where the company is moving beyond isolated projects to develop multiple residential communities using its advanced 3D printing systems. Projects such as the Wolf Ranch community near Georgetown demonstrate how 3D-printed concrete housing can improve material efficiency, durability, and climate resilience at scale. Commercial applications of 3D printing are emerging, with innovative non-residential structures constructed using robotic layering techniques, highlighting the growing exploration of markets beyond residential housing.

Europe 3D Printed Houses Market Trends

Europe is poised to become a significant market for 3D printed housing in 2026, driven by strong regulatory support for sustainable construction, growing adoption of eco-friendly materials, government-backed pilot initiatives, and rising demand for affordable, energy-efficient housing in urban areas. The precision and efficiency of 3D printing reduce material waste and enable the use of sustainable inputs such as recycled concrete, bio-based composites, and locally adapted materials, reinforcing Europe’s reputation for environmentally responsible construction practices.

Governments and industry players are actively promoting pilot projects and research programs that demonstrate the potential of 3D printing for residential, commercial, and public infrastructure applications. These developments reflect Europe’s shift from experimental deployments toward systematic integration of 3D printing into mainstream construction, guided by policy and sustainability objectives.

A notable example is PERI 3D Construction’s pioneering project in Germany, which delivered Europe’s first publicly funded multi-family housing development using 3D concrete printing in collaboration with COBOD’s large-format systems. This initiative highlights how additive manufacturing is moving beyond small prototype homes to larger-scale, socially impactful housing projects that align with sustainability goals while addressing the growing need for affordable housing.

Asia Pacific 3D Printed Houses Market Trends

The Asia Pacific region is expected to be the fastest-growing market for 3D-printed houses in 2026, driven by rapid urbanization, government initiatives supporting affordable housing, and strong manufacturing advantages that make additive construction increasingly feasible. Rising urban populations and housing demand are motivating governments in key countries, including China, India, and Singapore, to fund pilot projects and implement policy frameworks that promote the use of 3D printing technologies for both residential and public infrastructure projects, addressing efficiency and sustainability objectives.

Lower material costs and scalable production capacity in the region enhance competitiveness, allowing developers to shorten construction timelines and reduce the overall project costs compared with traditional methods. The emphasis on sustainable, automated construction aligns with broader climate and urban development strategies, positioning Asia Pacific as a hub for innovation in 3D-printed housing solutions. For instance, Winsun, a leading Chinese additive construction company, has pioneered large-scale 3D-printed building systems using recycled construction waste, reflecting China’s focus on combining sustainability with rapid construction innovation. Winsun’s projects illustrate how regional companies are leveraging government support and advanced manufacturing technologies to scale 3D-printed houses from prototypes to larger structures and community housing developments.

The global 3D printed houses market exhibits a moderately fragmented structure, driven by rapid technological advancements, diversified material innovations, and strong regional adoption across residential and infrastructure segments. A mix of established firms and agile startups is shaping market dynamics, with players focusing on enhancing printing capabilities, material efficiency, and end to end construction solutions. Companies are exploring partnerships with builders, governments, and research institutions to accelerate deployment and address housing shortages with sustainable and cost effective solutions.

With key leaders including ICON, Apis Cor, COBOD International, Mighty Buildings, Winsun, XtreeE, SQ4D, CyBe Construction, WASP, and other emerging players, the market reflects both concentration at the top and broad participation from niche innovators. These players compete through intensive research and development, strategic alliances, sustainability initiatives, and diversification of service offerings, aiming to reduce build time, improve structural performance, and expand geographic reach. Differentiation often hinges on proprietary printing systems, specialized materials, integrated digital design platforms, and scalable construction models that cater to varying customer needs.

Key Industry Developments:

The global 3D printed houses market is projected to reach US$2.2 billion in 2026.

Rapid urbanization, housing shortages, technological advancements in additive manufacturing, cost-efficient construction, and growing demand for sustainable and customizable housing solutions.

The 3D printed houses market is expected to grow at a CAGR of 35.1% from 2026 to 2033.

The adoption of sustainable and eco-friendly building materials, integration of smart home technologies, expansion of affordable housing projects, large-scale infrastructure applications, and government-supported urban development initiatives.

ICON, COBOD International, Apis Cor, WASP, Mighty Buildings, SQ4D, and XtreeE are the leading players.

| Report Attributes | Details |

|---|---|

| Historical Data | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author