ID: PMRREP33210| 218 Pages | 12 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

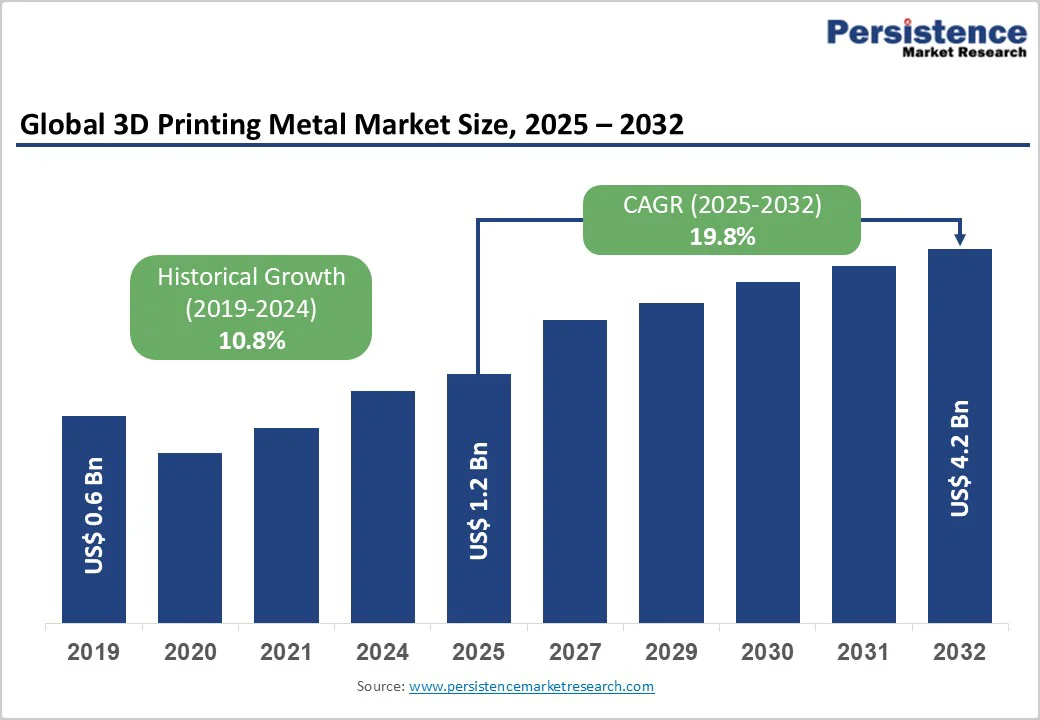

The global 3D printing metal market size was valued at US$ 1.2 billion in 2025 and is projected to reach US$ 4.2 billion by 2032, growing at a CAGR of 19.8% between 2025 and 2032.

Growing adoption of metal additive manufacturing across aerospace and defense sectors requiring lightweight high-performance components, and increasing demand for customized medical implants and prosthetics are some of the prominent factors driving market growth.

Rising focus on sustainable manufacturing, reducing material waste, and expanding applications across automotive and industrial equipment sectors further accelerate 3D printing metal demand.

| Key Insights | Details |

|---|---|

| 3D Printing Metal Market Size (2025E) | US$ 1.2 Bn |

| Market Value Forecast (2032F) | US$ 4.2 Bn |

| Projected Growth CAGR (2025 - 2032) | 19.8% |

| Historical Market Growth (2019 - 2024) | 10.8% |

The aerospace and defense sector remains one of the strongest demand generators for metal additive manufacturing, significantly driving global market growth. This industry increasingly relies on 3D printing metals due to its ability to produce lightweight, high-strength, and geometrically complex components that cannot be manufactured using traditional methods.

With aerospace companies targeting up to 20-25% improvements in fuel efficiency, lightweight structural parts made through additive manufacturing are becoming essential. Metal Additive Manufacturing supports rapid prototyping, part consolidation, and the creation of intricate lattice structures that reduce weight while preserving mechanical integrity.

Defense organizations are also adopting 3D printed metals for mission-critical applications such as engine parts, turbine blades, and customized components for drones and aircraft. As global defense budgets rise and airline fleets expand, the need for durable yet lightweight metal components is accelerating.

This sector’s shift toward performance optimization, cost reduction, and on-demand manufacturing will continue to propel the 3D printing metal market in the coming years.

The rapidly expanding use of metal additive manufacturing in the healthcare industry is another major driver of the global 3D printing metal market. Medical device manufacturers increasingly utilize metal AM to produce customized implants, orthopedic devices, dental crowns, and patient-specific surgical tools with superior precision.

itanium and its alloys, known for their biocompatibility and corrosion resistance, are among the most widely used metals in this segment. The demand for personalized implants continues to rise, driven by the growing aging population and increasing prevalence of orthopedic and dental disorders.

Metal AM enables healthcare providers to create anatomically accurate implants that match patients’ bone structures, reducing surgery time and improving recovery outcomes. The technology facilitates the production of porous structures that enhance bone integration, offering better long-term implant performance.

With advancements in surgical planning, biomaterials, and digital healthcare workflows, the integration of metal 3D printing into clinical applications will continue to accelerate worldwide.

Metal 3D printing equipment initial costs exceeding US$ 500,000 to over US$ 1 million restricting market entry for small and medium enterprises. Metal powder materials costing significantly higher than conventional manufacturing feedstock, increasing production expenses.

Ongoing maintenance and consumable costs for metal 3D printing systems are impacting operational profitability. Qualification and certification requirements extend product development timelines and increase costs. Limited supplier ecosystem for specialized metal powders, creating supply chain vulnerabilities.

Metal additive manufacturing production speeds remain significantly slower than conventional manufacturing methods, limiting high-volume applications. Build platform size limitations restricting component dimensions and production batching.

Post-processing requirements, including support structure removal and surface finishing, extend total production timelines. Quality, consistency, and material property variability require rigorous testing protocols before production deployment.

Sustainability-driven manufacturing priorities and the rising need for lightweight components are creating substantial opportunities for metal additive manufacturing in global industries. Metal AM enables a significant reduction in material waste, often 50-90% lower than conventional subtractive methods, directly supporting circular economy principles and eco-efficient production.

In the automotive sector, the push for improved fuel efficiency and lower emissions is accelerating the adoption of metal 3D printing for complex, lightweight components that enhance vehicle performance. Aerospace sustainability roadmaps targeting a 50% reduction in aircraft fuel consumption by 2050 are reinforcing the demand for optimized lightweight structures that metal AM can uniquely deliver.

Regulatory pressures related to environmental compliance are further incentivizing manufacturers to adopt cleaner, more efficient production technologies. Corporate sustainability commitments and ESG frameworks are prioritizing lower-waste processes and resource-efficient manufacturing workflows, making metal AM a strategic fit.

The shift toward supply chain localization and distributed, on-demand production helps reduce transportation emissions while strengthening regional manufacturing resilience. these sustainability-driven forces provide a strong, long-term tailwind for the growth of the metal 3D printing market.

Metal alloy powders are the most widely used feedstock in the global 3D printing metal market, accounting for roughly 58% of the total market share. Their dominance is primarily driven by their superior mechanical properties, including high strength, corrosion resistance, and thermal stability, which make them suitable for a wide range of industrial applications.

Unlike pure metals, alloys can be engineered to meet specific performance requirements, allowing manufacturers to optimize parts for aerospace, automotive, healthcare, and industrial machinery.

Metal alloy powders support complex geometries and lightweight structures, which are increasingly demanded in sectors focused on fuel efficiency, sustainability, and design innovation.

The flexibility in composition, combined with the growing adoption of additive manufacturing for high-value components, has made metal alloy powders the preferred choice for manufacturers seeking reliability and performance in 3D printed metal parts. This strong market preference is expected to continue, reinforcing alloy powders as a central segment in the metal AM materials landscape.

Powder Bed Fusion (PBF) is the leading production process in the global 3D printing metal market, capturing approximately 68% of total market adoption. Its dominance is driven by technology maturity, precision, and versatility across a wide range of applications.

PBF processes, including Selective Laser Melting (SLM) and Direct Metal Laser Sintering (DMLS), enable the fabrication of highly complex geometries, intricate lattice structures, and parts with excellent mechanical properties, which are essential for aerospace, automotive, and healthcare industries. The process also allows for efficient material utilization, reducing waste and supporting sustainability goals, while providing high reproducibility and surface quality.

PBF technology supports both prototyping and low-to-medium volume production, making it a preferred choice for industries seeking flexibility and speed without compromising performance. The established reliability and broad industrial acceptance of Powder Bed Fusion continue to solidify its position as the most widely adopted metal additive manufacturing process, driving market growth and innovation.

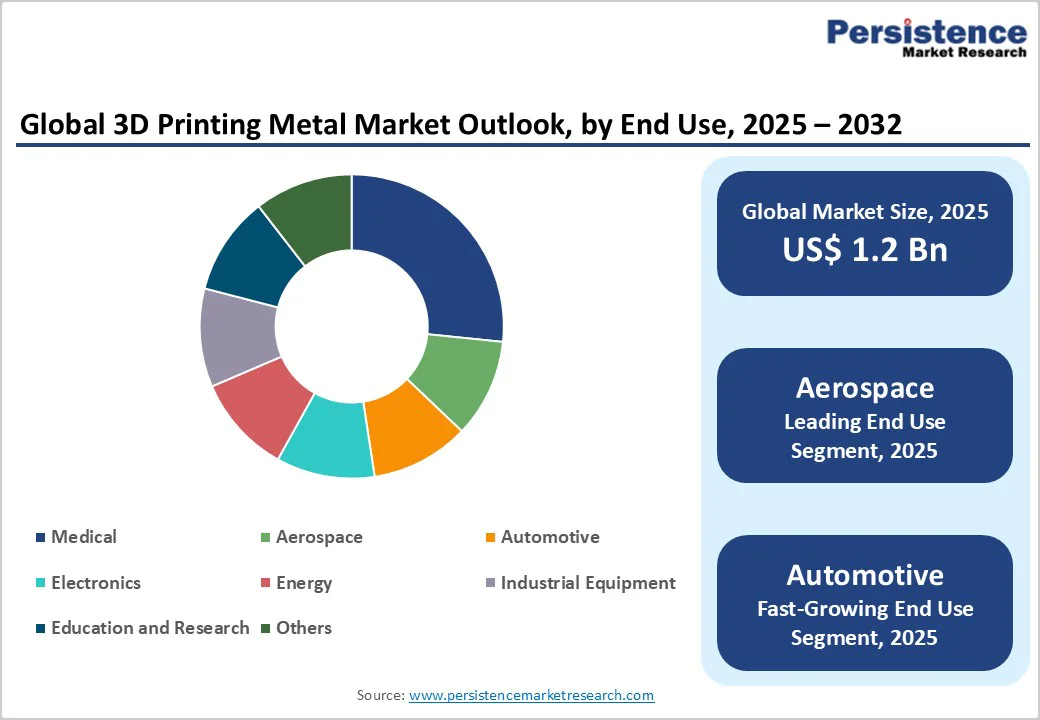

Aerospace remains the leading end-use segment in the global 3D printing metal market, accounting for approximately 43% of total market demand. This dominance is driven by the sector’s need for high-performance, lightweight, and geometrically complex components that are critical to aircraft efficiency, safety, and fuel economy.

Metal additive manufacturing enables the production of parts such as turbine blades, structural brackets, engine components, and lattice structures that are difficult or impossible to manufacture using traditional methods.

The aerospace industry’s stringent requirements for material strength, thermal resistance, and precision make metal 3D printing an ideal solution, supporting rapid prototyping and small-batch production without compromising performance.

The sector’s focus on fuel efficiency and sustainability, with goals like reducing aircraft fuel consumption by up to 50% by 2050, further accelerates the adoption of metal AM technologies. As a result, aerospace continues to be the largest and most strategic consumer of 3D printed metal components, driving technological advancements and market growth.

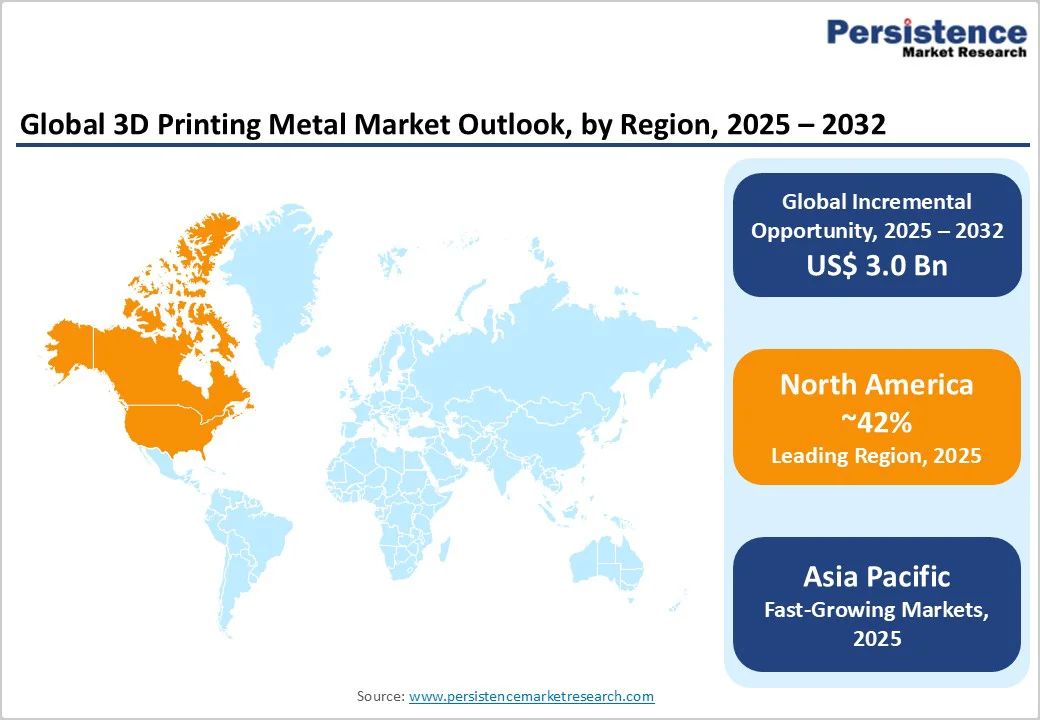

North America continues to hold a leadership position in the global 3D printing metal market, largely due to its concentration of aerospace manufacturing and a highly advanced industrial ecosystem.

The United States alone accounts for 65-70% of the regional market share, reflecting its dominance in aerospace production and substantial R&D investments in additive manufacturing technologies. Major aerospace players such as Boeing, Lockheed Martin, and Raytheon are driving consistent demand for metal 3D printing, particularly for lightweight, high-performance, and complex structural components.

Beyond aerospace, the region’s medical device manufacturing sector is expanding rapidly, with companies like Boston Scientific and Medtronic increasingly adopting metal additive manufacturing for customized implants, surgical tools, and rapid prototyping of high-precision devices.

The combination of strong industrial infrastructure, supportive R&D capabilities, and early adoption in high-value sectors ensures North America remains a critical hub for innovation and growth in the global metal 3D printing market.

Europe exhibits strong technological leadership and robust industrial adoption in the 3D printing metal market, supported by its advanced engineering capabilities and innovation-driven manufacturing ecosystem. The region benefits from a well-established network of aerospace, automotive, and industrial machinery manufacturers that are early adopters of metal additive technologies.

Germany stands as the clear leader within Europe, driven by its highly developed manufacturing base, strong engineering expertise, and continued investment in Industry 4.0 and digital production technologies. German companies are prioritizing supply chain resilience initiatives, including localized production and on-demand manufacturing, which further accelerate metal AM adoption.

Europe’s strict regulatory environment and sustainability focus are pushing industries toward lightweight components, resource-efficient production, and reduced material waste, areas where metal 3D printing offers significant advantages. With ongoing research investments, strong collaboration between industry and academia, and leadership in machine and material development,

Europe continues to strengthen its position as a key innovation hub in the global metal additive manufacturing landscape.

Asia Pacific is rapidly emerging as the fastest-growing region in the global 3D printing metal market, driven by expanding industrial manufacturing, rising technology adoption, and increasing investments across key application sectors.

Countries such as China, Japan, South Korea, and India are accelerating their use of metal additive manufacturing as part of broader strategies to strengthen industrial competitiveness and move toward advanced production technologies. The region benefits from strong government support, lower manufacturing costs, and the rapid establishment of local AM research centers and production facilities.

China, in particular, is expanding its presence through large-scale adoption in aerospace, automotive, and tooling segments, supported by its fast-growing metal powder production capabilities. Meanwhile, Japan and South Korea are leveraging their expertise in precision engineering, electronics, and automotive innovation to adopt metal AM for high-performance components.

The surge in regional manufacturing expansion, combined with growing demand for lightweight materials and increased localization of supply chains, positions Asia Pacific as the primary growth engine for the global 3D printing metal market over the coming decade.

The global 3D printing metal market demonstrates moderate consolidation, with a handful of leading powder manufacturers holding a significant share of industry revenue. Major players such as Sandvik AB, ATI Powder Metals, Höganäs AB, and Rio Tinto collectively command approximately 45-50% of the market, supported by their extensive production capacities, strong supply chain networks, and long-standing relationships with aerospace, automotive, and industrial clients.

Beyond these leaders, tier-two participants like American Axle & Manufacturing and Carpenter Powder Products play an essential role in serving specialized regional markets, particularly through custom alloy development tailored to specific performance requirements.

Competitive dynamics are further shaped by vertical integration strategies, where equipment manufacturers and materials companies increasingly consolidate upstream and downstream capabilities to strengthen market presence and improve cost efficiency. Emerging Asian manufacturers, particularly in China and South Korea, are leveraging cost advantages, rapid scaling capabilities, and growing expertise in metal powder production to expand their regional footprint.

The global 3D printing metal market was valued at US$ 1.2 billion in 2025 and is projected to reach US$ 4.2 billion by 2032, representing a CAGR of 19.8% during the forecast period.

The primary factors driving demand for 3D printing metal are the need for lightweight, high-performance components and the growing adoption of complex, custom, and precision parts across aerospace, automotive, and healthcare sectors.

Metal Alloy Powders command approximately 58% market share, driven by superior performance characteristics including titanium, nickel-based, and stainless steel alloys supporting demanding aerospace and medical applications requiring enhanced strength and biocompatibility.

North America maintains market leadership with 42% global market share, driven by aerospace industry concentration, medical device manufacturing dominance, advanced R&D ecosystem, and government support programs sustaining regional leadership position.

Industrial equipment and energy sector adoption represents highest-value opportunity through sustainability initiatives, supply chain resilience requirements, on-demand manufacturing enabling distributed production, and specialized component customization supporting emerging revenue streams.

Market leaders include Sandvik AB (Sweden) with comprehensive metal powder portfolio, ATI Powder Metals (United States) specializing in high-performance alloys, and Höganäs AB (Sweden) leveraging advanced manufacturing capabilities, collectively representing approximately 45-50% market concentration.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Metal Powder

By Shape

By Production Process

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author