ID: PMRREP26191| 220 Pages | 26 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

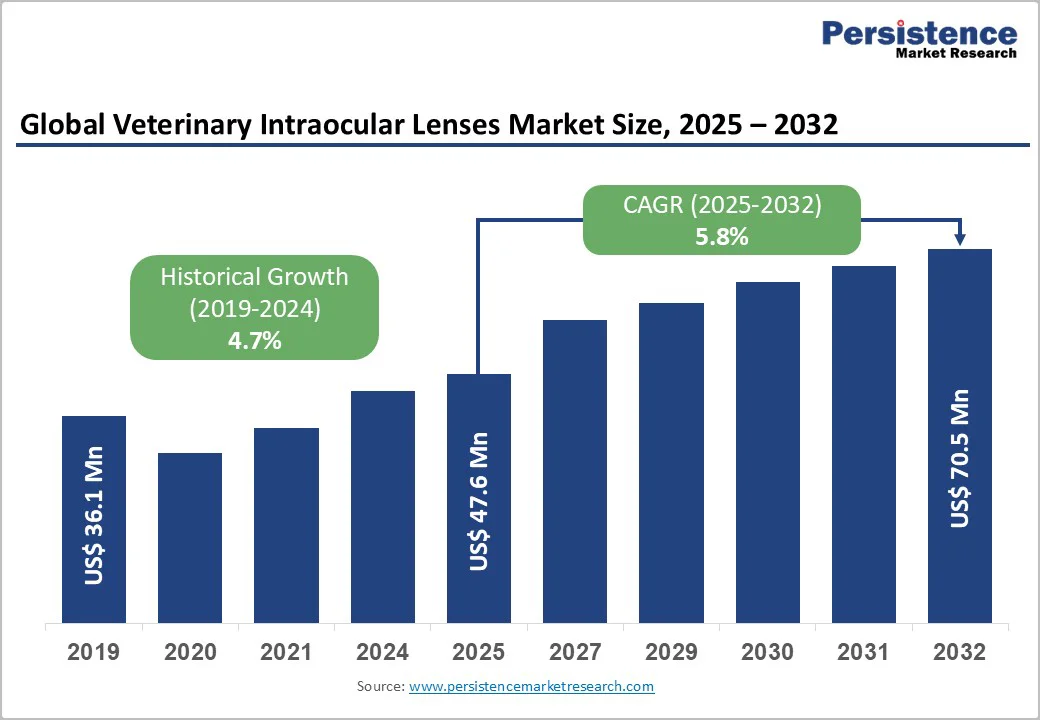

The global veterinary intraocular lenses market is expected to reach US$47.6 million in 2025. It is expected to reach US$70.5 million by 2032, growing at a CAGR of around 5.8% during the forecast period from 2025 to 2032, driven by rising cataract prevalence in companion animals, the expansion of specialty veterinary ophthalmology services, and increasing willingness among pet owners to pursue advanced surgical procedures.

Although small in absolute value relative to the human IOL sector, the market is characterized by specialized product portfolios, concentrated manufacturing capabilities, and growing adoption across North America, Europe, and the Asia Pacific.

| Key Insights | Details |

|---|---|

| Veterinary Intraocular Lenses Market Size (2025E) | US$47.6 Mn |

| Market Value Forecast (2032F) | US$70.5 Mn |

| Projected Growth (CAGR 2025 to 2032) | 5.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.7% |

The number of companion animals diagnosed with cataracts and lens-related disorders continues to rise, primarily due to aging pet populations and more routine ophthalmic screening in veterinary practices. Increasing use of phacoemulsification and intraocular lens implantation has elevated per-procedure product demand, shifting treatment patterns away from medical management alone.

Higher surgery volumes in regions with strong specialty referral networks support growth. Areas with established veterinary ophthalmology centers and broader access to pet insurance demonstrate the highest adoption rates, strengthening overall momentum.

Innovations originally developed for human ophthalmic surgery, such as foldable acrylic lenses, advanced surface coatings, and pre-loaded delivery systems, have been successfully adapted for veterinary applications. These improvements shorten operating times, enhance biocompatibility, and reduce complication risks, making IOL implantation more feasible for a wider range of clinics.

As outcomes improve and surgical efficiency increases, clinics can accommodate a greater number of cases, indirectly supporting market expansion consistent with mid-single-digit growth expectations. Companies that customize human-grade technologies for canine, feline, and equine ocular anatomy are capturing the growing demand for premium, performance-oriented devices.

Pet ownership is rising in many global regions, and owners increasingly view advanced medical and surgical care as part of routine pet well-being. Greater willingness to invest in elective and specialty procedures, combined with higher per-pet spending, strengthens demand for veterinary IOLs.

Although total procedure volumes remain niche, each case carries relatively high value, particularly when premium lens types or comprehensive surgical packages are used. This trend is most evident in North America and fast-growing areas of the Asia Pacific, where companion animal spending continues to climb, and specialty services are expanding.

Despite growing interest, veterinary IOL procedures remain limited compared with those in human ophthalmology. Many general clinics perform only a few cataract surgeries per year, reducing economies of scale for suppliers. Cost sensitivity also affects adoption, as some pet owners decline surgery due to price considerations, especially in low-income or shelter settings. These factors help explain the market’s relatively modest size, even as growth remains steady.

Regulatory frameworks for veterinary medical devices vary significantly across regions, influencing approval timelines and market access. In addition, many areas lack sufficient training programs for veterinary ophthalmic surgery, resulting in uneven adoption of advanced procedures. In regions with fewer specialists, the time required to scale IOL use can be measured in years, temporarily slowing market penetration despite strong long-term clinical acceptance.

Large urban centers across Asia Pacific and Latin America are experiencing rising pet populations and rapid development of veterinary infrastructure. Increasing the penetration of IOL procedures in major referral hospitals by even a few percentage points could generate several million dollars in incremental revenue over a five-year period, significant relative to the market’s current size. Tailored training programs, flexible pricing, and strategic partnerships with high-volume clinics can elevate adoption in these high-growth regions.

Premium product variants, including toric and specialty lenses, hydrophobic acrylic options, and pre-loaded delivery systems, enable suppliers to raise average revenue per case. Bundled surgical kits that combine IOLs with consumables and diagnostic tools streamline workflow for veterinary surgeons, reducing barriers to adoption. Even modest conversion of standard surgeries to premium packages can lift selling prices by mid-single-digit percentages, improving margins in a market constrained by volume.

The development of more trained veterinary ophthalmic surgeons is essential for long-term market expansion. Collaborations with veterinary schools, academies, and specialist referral centers can accelerate surgeon training and increase the adoption of advanced IOL techniques. Investments in certification programs, continuing education, and sponsored fellowship initiatives strengthen product loyalty and expand the addressable procedure base over a three to seven-year horizon.

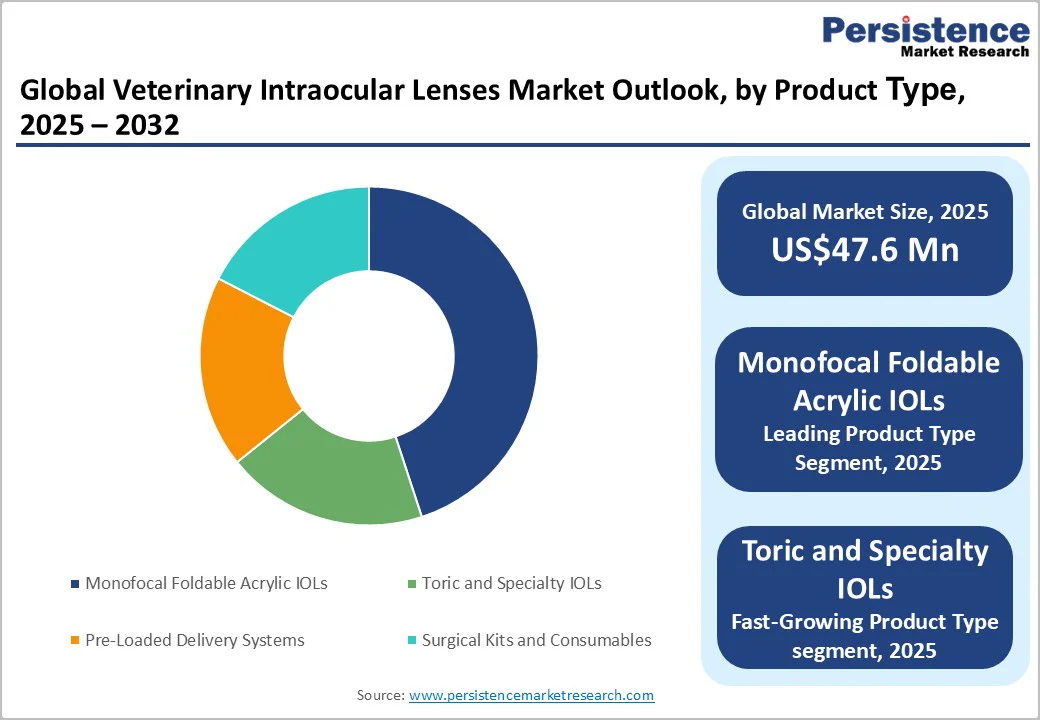

Monofocal foldable acrylic intraocular lenses (IOLs) lead revenue in the veterinary IOL market, driven by reliable postoperative outcomes, broad surgical applicability, and lower production costs. In most canine cataract cases, particularly age-related or hereditary, the focus is on restoring distance vision, reinforcing monofocal preference.

Many manufacturers provide presterilized, ready-to-implant lenses, streamlining surgical workflow. A wide diopter range allows customization for breeds ranging from small companion dogs to working breeds such as German Shepherds. Their consistent success in restoring functional vision makes monofocal foldable acrylic IOLs the preferred choice for general-practice veterinary ophthalmology, maintaining dominance in both unit sales and market revenue.

Specialty lenses, including toric models for astigmatism correction, represent the fastest-expanding segment. These systems streamline implantation by eliminating manual loading, which lowers handling risk and shortens operating room time, an advantage in high-volume referral centers.

Specialty designs are increasingly used for service dogs, guide dogs, and performance animals where post-surgical visual quality has a direct functional impact. Species-specific enhancements, such as equine-compatible diameters or feline-appropriate curvature adjustments, are gaining interest in advanced practices. Premium hydrophobic acrylic materials and aspheric optical profiles appeal to clinics seeking higher-fidelity outcomes.

Canine intraocular lenses (IOLs) dominate the veterinary IOL market, driven by the higher prevalence of cataracts in dogs and strong owner willingness to pursue surgical correction. Breeds such as Miniature Poodles, Cocker Spaniels, and Siberian Huskies are genetically predisposed, increasing procedure volumes.

Veterinary ophthalmology has historically focused on canine ocular anatomy, resulting in a wide range of dog-specific lens designs and diopter options. Commercial catalogs offer multiple canine SKUs optimized for anterior chamber depth and capsular stability. Working and service dogs often receive timely interventions, further boosting demand, making canine IOLs the largest contributor to global veterinary IOL sales and revenue.

Feline intraocular lens applications, while smaller in scale, are expanding more rapidly than the core canine market. Advances in microsurgical instruments and improved phacoemulsification techniques have made feline cataract surgery increasingly feasible, particularly for diabetic and inflammatory cataract cases.

Clinics in urban centers are reporting a gradual rise in cat owners opting for surgical correction when vision impairment affects quality of life. In regions with established referral networks, these niche segments consistently post above-average growth rates. Continued development of species-tailored devices and broader surgeon training will support long-term expansion.

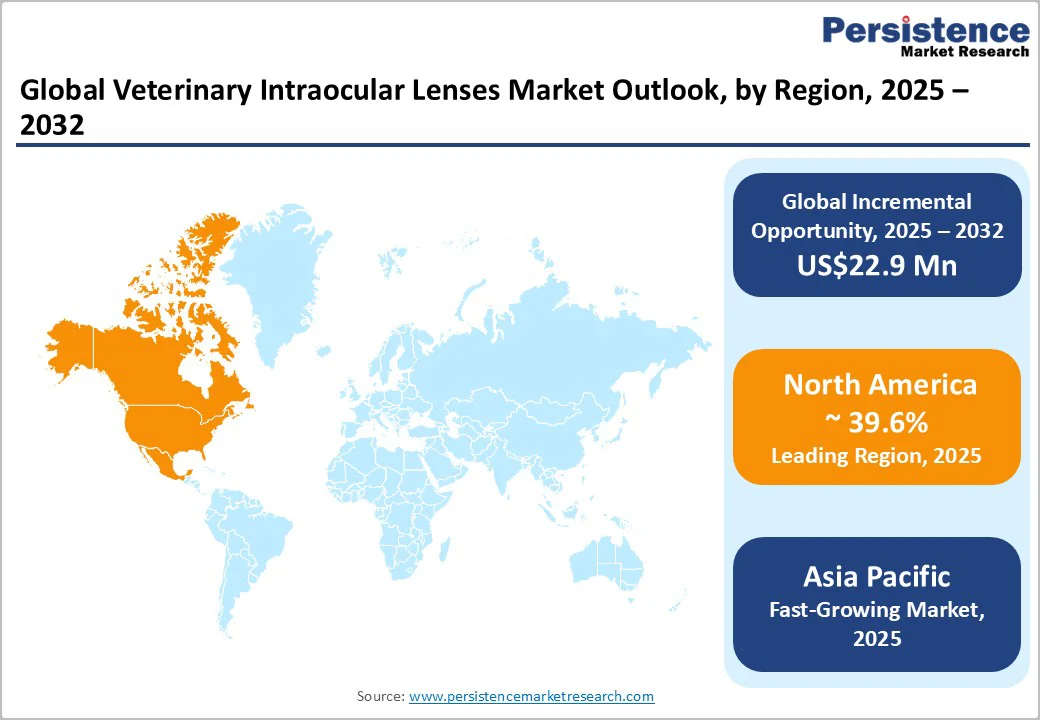

North America is the largest regional market, accounting for over 39.6% of global veterinary intraocular lens procedures, led by the U.S. High pet healthcare spending, widespread access to specialty veterinary services, and strong adoption of advanced procedures form the foundation of regional leadership.

The U.S. hosts numerous veterinary teaching hospitals and referral centers that anchor ophthalmic training and innovation. These institutions play a critical role in disseminating surgical advancements and increasing case volumes.

A well-defined veterinary regulatory environment, combined with the growing availability of pet insurance plans, supports stable demand for cataract surgery and related devices. Although regulations for veterinary devices are generally less complex than those for human devices, compliance with national standards and import norms ensures product quality and safety.

The region’s competitive environment includes a mix of specialized veterinary ophthalmic manufacturers, divisions of larger ophthalmic companies, and regional OEMs. Technical support, training, and documented clinical outcomes are key differentiators.

Investment trends focus on digital surgical planning tools, surgeon training programs, and bundled device offerings. As private equity investment increases in specialty veterinary networks, distributor influence may strengthen, enabling wider and more standardized device adoption across multisite hospital groups.

New product launches, including pre-loaded systems and species-specific lens designs, have accelerated the availability of premium surgical tools, reinforcing the region’s leadership position.

Europe is the second-largest regional market for veterinary intraocular lenses, led by Germany, the U.K., France, and Spain. These countries maintain strong veterinary infrastructures, established referral hospitals, and growing specialty ophthalmology capabilities. The region benefits from an expanding companion animal population, increasing use of advanced diagnostic tools, and high owner willingness to pay for specialized procedures.

Regulatory harmonization through unified European medical device frameworks supports efficient cross-border distribution, although additional national rules still apply to veterinary applications. Access to training programs and continuing education at major veterinary universities strengthens surgeon skill levels and encourages adoption of advanced IOL techniques. Insurance coverage varies by country but remains an important factor in procedure uptake.

Asia Pacific is the fastest-growing region in percentage terms. Rapid urbanization, expanding middle-class populations, and increasing pet ownership are raising demand for advanced veterinary services. Major cities such as Beijing, Shanghai, Tokyo, Mumbai, and Singapore host growing numbers of specialty clinics equipped to perform cataract surgery.

China and Japan lead the regional market revenue. China’s growth stems from expanding clinic networks and rising caseloads, while Japan benefits from higher per-procedure spend and a mature specialty care ecosystem. India and ASEAN markets are emerging quickly, supported by rising disposable incomes and increasing availability of advanced veterinary diagnostics and surgical care.

Regulatory clarity varies widely. Japan maintains long-established device pathways, while China has accelerated its approval processes for clinically validated products. India continues to develop more structured device regulations. Improvements in regulatory systems across the region have lowered barriers to market entry and enabled more predictable commercialization timelines.

The global veterinary intraocular lenses market is moderately fragmented, with a mix of specialized ophthalmic device manufacturers and regional OEMs. No single player dominates globally, and market influence is distributed across mid-sized companies offering animal-specific lenses and surgical accessories.

Buyer power is concentrated in referral hospitals and specialty distributors, which often control product selection and training services. Given the market’s modest overall revenue size, suppliers with strong clinical support, reliable product performance, and comprehensive portfolios maintain a competitive edge.

Leading suppliers emphasize clinical training, product differentiation, and targeted expansion into high-growth regions. Bundled offerings combining IOLs, delivery systems, and consumables reduce surgical complexity and increase adoption. Strategic distributor partnerships and species-specific product lines help address volume constraints and enhance competitive positioning.

The global veterinary intraocular lenses market size in 2025 is estimated at US$47.6 Million, reflecting a steady demand for cataract correction procedures in companion animals, particularly dogs.

By 2032, the veterinary intraocular lenses market is projected to reach US$70.5 Million, supported by the rising adoption of specialty lenses, pre-loaded delivery systems, and expanding access to advanced veterinary ophthalmic care.

Key trends include the rapid adoption of pre-loaded IOL systems, increasing demand for toric and species-specific lens designs, greater utilization of premium materials for improved visual outcomes, and growing interest in feline and equine cataract surgery driven by improved surgical tools and broader ophthalmic training.

The leading product segment is monofocal acrylic foldable IOLs, which account for well over 50% of total procedures due to reliable results, broad applicability, and suitability for most canine cataract cases.

The veterinary intraocular lenses market is projected to grow at a CAGR of 5.8% between 2025 and 2032.

Major players include Bausch + Lomb, Alcon, OcuVet, I-Med Animal Health, and NovaVet.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Animal Type

By Distribution Channel

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author