ID: PMRREP33965| 210 Pages | 17 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

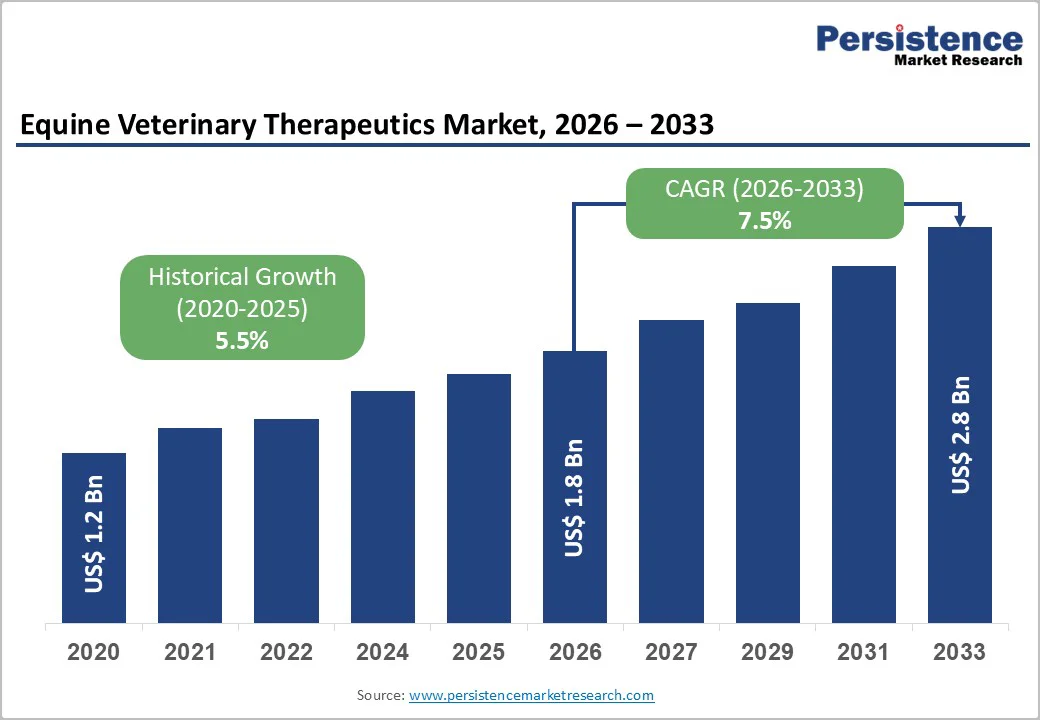

The global equine veterinary therapeutics market size is estimated to grow from US$1.8 billion in 2026 and projected to reach US$2.8 billion by 2033. The market is projected to record a CAGR of 7.5% during the forecast period from 2026 to 2033.

Equine healthcare refers to the diagnosis, preventive care, treatment, and management of various health issues related to horses. As horses are susceptible to injuries and several diseases, equine healthcare plays a vital role in providing suitable therapy and ensuring their longevity and overall enhanced performance.

Equine veterinary therapeutics include a wide range of services, including immunization, dental care, gastroscopy, gynecological care, lameness assessment, respiratory care, and colic therapy. Immunization is an easy treatment method that covers vaccinations for a wide range of health problems in horses, such as equine influenza, tetanus, EHV (equine herpes virus), strangles, ringworm, EVA (equine viral arteries), and West Nile virus (WNV).

| Key Insights | Details |

|---|---|

| Equine Veterinary Therapeutics Market Size (2026E) | US$1.8 Bn |

| Market Value Forecast (2033F) | US$2.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.5% |

| Historical Market Growth (CAGR 2020 to 2024) | 5.5% |

Growing awareness and focus on animal health, supported by increased R&D investments-where animal-health manufacturers spend about 8.5% of sales on innovation-is propelling market growth. Rising human affinity for horses and routine maintenance care are further improving adoption of veterinary products.

Simultaneously, the fast-expanding equestrian sports industry, including racing, show jumping, and dressage, demands peak horse fitness and effective treatment for injuries and infectious risks. Together, these trends are driving strong demand for preventive and therapeutic equine veterinary services and medicines.

Equine veterinary treatment, especially advanced treatments and specialized medicines, can incur high costs. These increased costs associated with therapeutics can become a barrier that restricts horse owners from taking precise treatments.

Furthermore, the equine veterinary medicine sector requires specialized skills, knowledge, and experience due to the scope of this domain and the distinctive anatomy and physiology of horses. However, a scarcity of skilled equine veterinarians is causing challenges to ensure the mandated availability and easy accessibility of experts who can offer efficient care and therapeutics.

Expanding regional areas such as Asia Pacific, and Latin America show notable growth opportunities for the equine veterinary therapeutics market. The increasing interest among people in equestrian sports, extending investments in the equine sector, and advances in healthcare facilities contribute to market expansion in these areas. Advancements in veterinary medicine, such as telemedicine and wearable devices, highlight the novel possibilities for equine healthcare.

The advancements offer a wide range of benefits, including remote consultations, real-time monitoring, early detection of symptoms and health problems, and analysis of health parameters. Further, the introduction of regenerative medicines, such as stem cell therapy and platelet-rich plasma therapy, emerges as a novel treatment option in equine healthcare. These therapies are gaining momentum by showing promising treatment outcomes for musculoskeletal injuries.

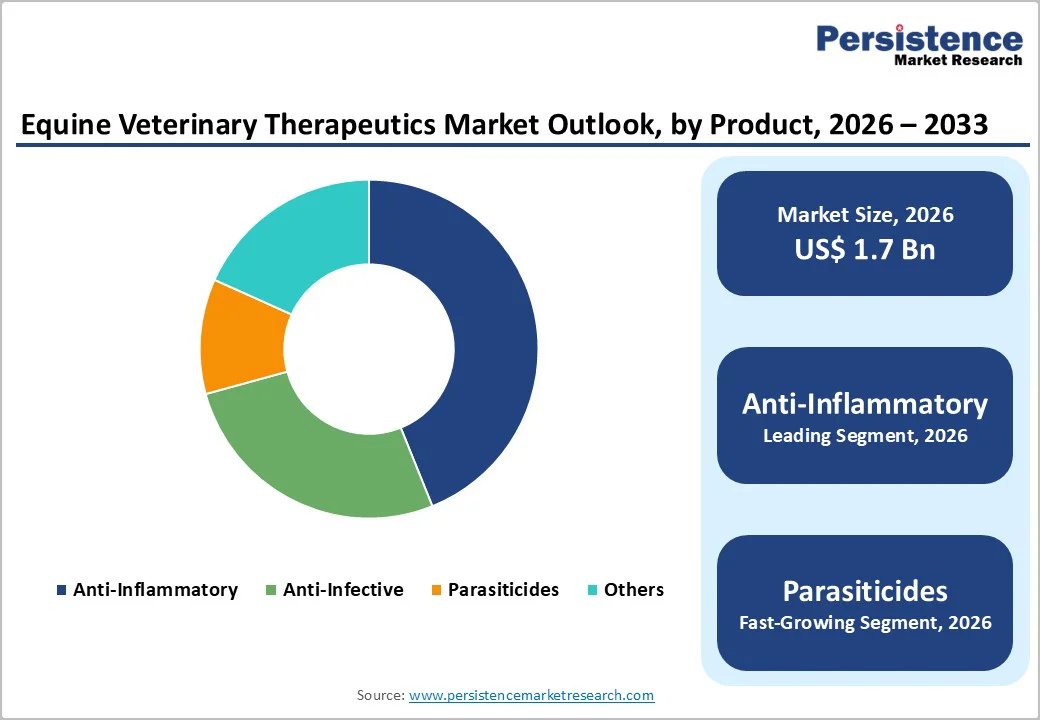

Based on drugs, the equine veterinary therapeutics market is categorized into several types, among which the non-steroidal anti-inflammatory drugs (NSAIDs) held the largest revenue share in 2024.

NSAIDs such as phenylbutazone and flunixin are routinely employed for their analgesic and anti-inflammatory properties to manage a spectrum of conditions in horses, ranging from abdominal to orthopedic pain. The parasiticides segment is integral to the equine veterinary therapeutics market, playing a crucial role in the treatment and prevention of various equine diseases.

Additionally, in this field, Visco supplements are anticipated to witness the fastest market growth over the forecast period, indicating the evolving landscape of therapeutic interventions in equine veterinary medicine.

Veterinary hospitals command the highest share in the equine veterinary therapeutics market because most advanced treatments, surgeries, diagnostics, and emergency care for horses are performed in these specialized facilities. Hospitals maintain immediate access to prescription medicines, biologics, regenerative therapies, and controlled drugs that cannot be purchased independently.

Their in-house pharmacies ensure seamless treatment continuity, while owners prefer hospitals for comprehensive care, expert veterinarians, specialized equipment, and faster recovery outcomes. Since sport, racing, and working horses often require intensive medical attention for injuries and chronic orthopedic issues, hospitals remain the primary point of purchase for high-value therapeutics and ongoing treatment plans.

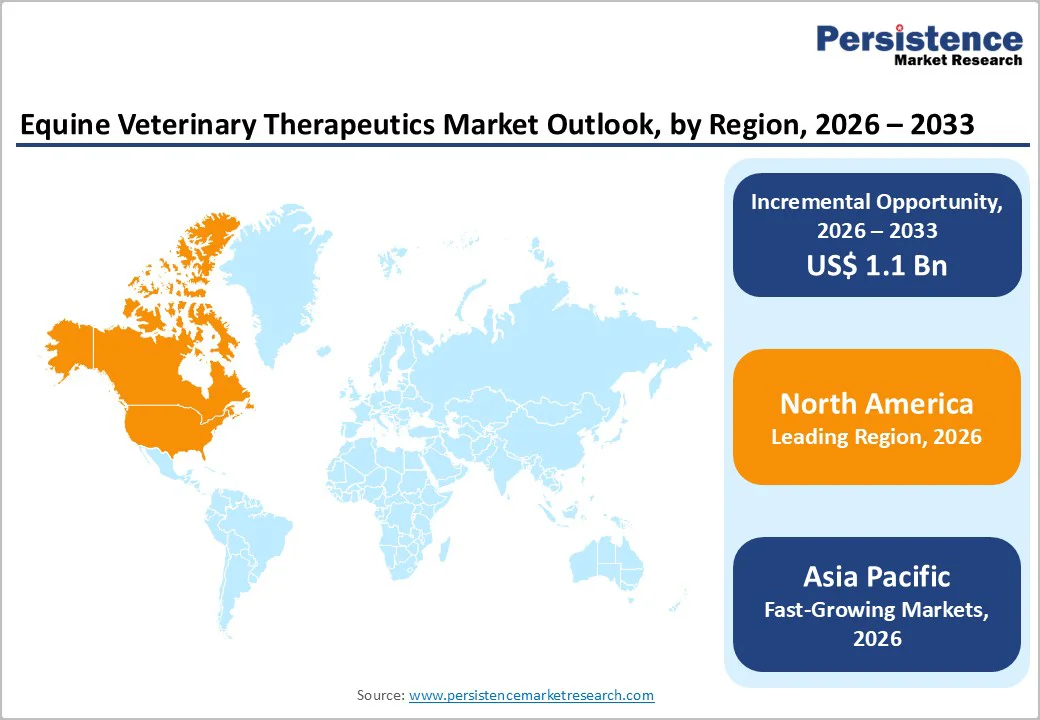

North America leads the equine veterinary therapeutics market owing to its large and economically valuable horse population and a strong culture of equestrian sports. According to FAO, the region housed about 10.96 million horses in 2021, with 10.56 million in the U.S. alone.

The U.S. also has nearly 300 racetracks hosting around 33,567 horse races annually, significantly increasing cases of injuries and performance-related health issues. According to the National Institute of Health, injury rates are highest in jump races at 68.9 per 1,000 starts compared to 8.8 in flat races, highlighting the need for timely and advanced treatment.

High horse import volumes, widespread farms, and strong owner willingness to invest in animal health further reinforce North America’s dominant market position.

Asia Pacific equine veterinary therapeutics market is rapidly emerging due to rising horse ownership, expanding equestrian sports, and growing awareness of animal health. Increasing investments in horse racing, polo, and recreational riding are boosting demand for preventive and therapeutic care. Countries such as China, India, and Australia are witnessing growth in equine hospitals, specialized clinics, and mobile veterinary services.

Moreover, government initiatives supporting livestock and equine welfare, coupled with rising disposable incomes among horse owners, are encouraging adoption of vaccines, anti-infectives, and regenerative therapies. The market is expected to gain momentum as infrastructure, veterinary expertise, and awareness continue to improve.

The equine veterinary therapeutics market report provides valuable insight with an emphasis on the dynamic nature of this market. Key players are primarily focusing on product launches and advancements in this domain.

Further, they focus on several major business approaches, such as mergers, partnerships, acquisitions, and joint ventures, to develop their product offerings. It will also help them boost their market shares across different areas. Manufacturers of equine veterinary therapeutics are embracing novel strategies, including investments in R&D activities, the installation of manufacturing and production facilities, and supply chain management, to strengthen their market position.

The global equine veterinary therapeutics market is projected to be valued at US$1.8 Bn in 2026.

Increasing numbers of horses for sports, recreation, racing, and companionship drive demand for preventive and therapeutic care.

The global market is poised to witness a CAGR of 7.5% between 2026 and 2033.

Use of digital diagnostics, wearable sensors, telemedicine, and AI-driven performance monitoring.

Merck Animal Heath, Affymetrix, Elanco Animal Health, Zoetis (Pfizer Animal Health), and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2024 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Drugs

By Route of Administration

By Services

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author