ID: PMRREP12877| 210 Pages | 13 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

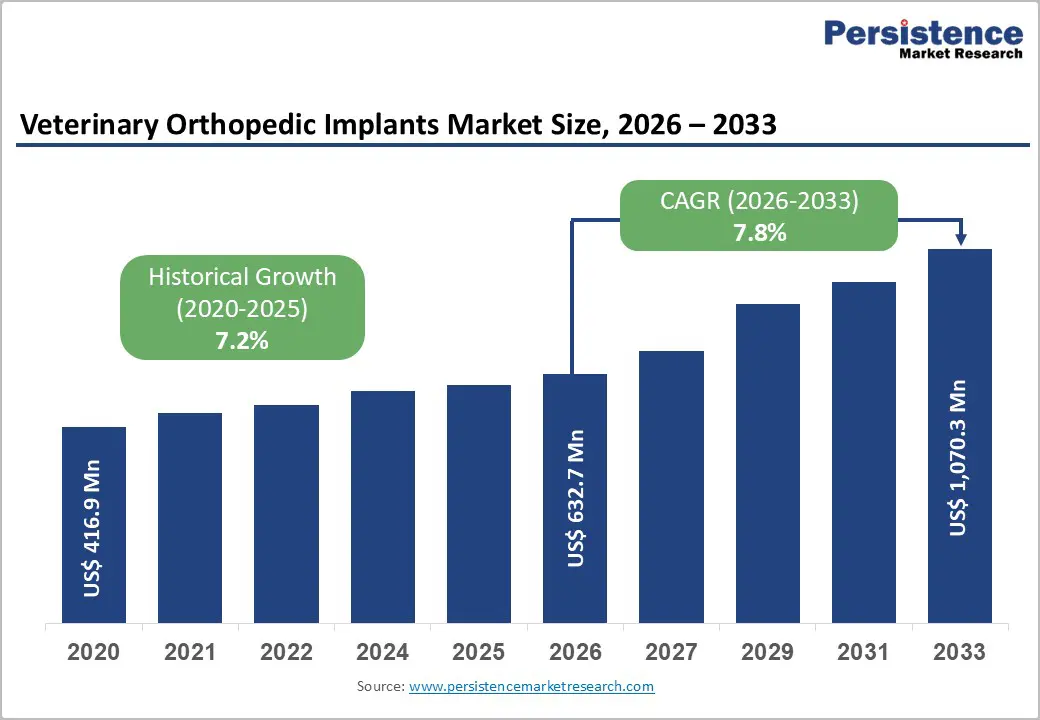

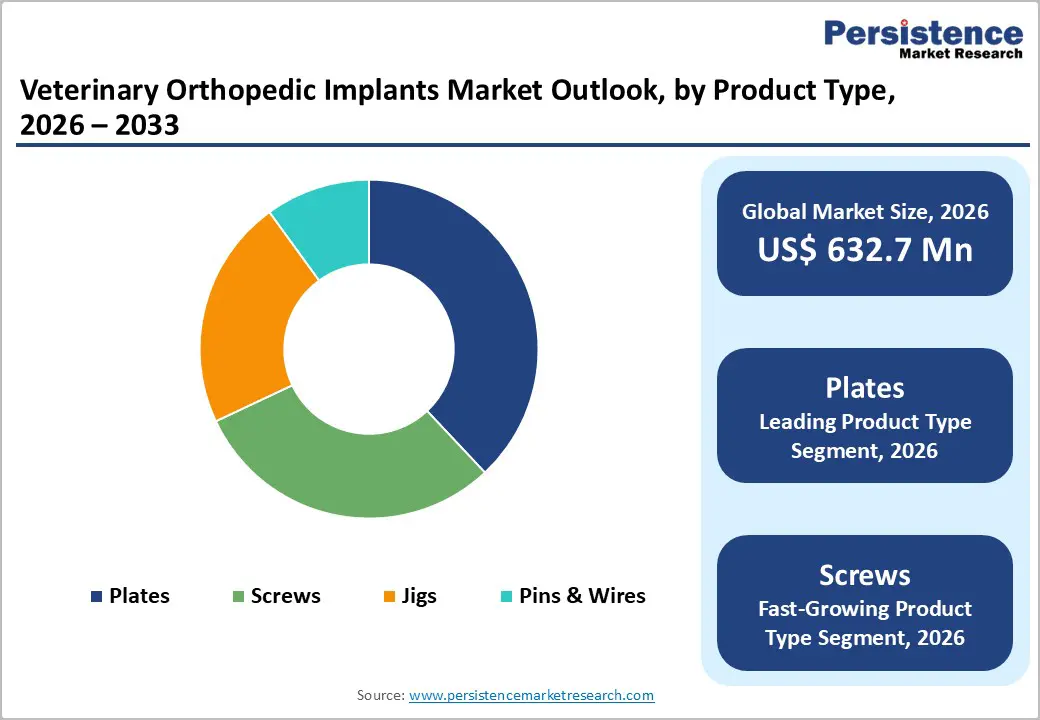

The global veterinary orthopedic implants market size is expected to be valued at US$ 632.7 million in 2026 and projected to reach US$ 1,070.3 million by 2033, growing at a CAGR of 7.8% between 2026 and 2033.

Veterinary orthopedic implants are widely used to treat musculoskeletal conditions in animals, including bone fractures, joint disorders, and ligament injuries. These implants play a critical role in stabilizing broken bones, supporting joint repair, and restoring mobility in companion animals. The market is expanding rapidly due to the growing global pet population, particularly dogs and cats, and the increasing humanization of pets. Pet owners are becoming more conscious of animal health and are willing to spend more on advanced veterinary treatments, which is strengthening demand for orthopedic implants and surgical interventions.

A key market trend is the rising incidence of trauma-related injuries in pets caused by road accidents, falls, fights, and sports-related activities. As veterinary diagnostics and surgical capabilities improve, more fractures are being treated surgically rather than conservatively. Advancements in implant materials, such as lightweight metals and anatomically contoured plates, are improving surgical outcomes and recovery times. Additionally, the expansion of specialized veterinary clinics and referral hospitals is supporting greater adoption of orthopedic implants, driving steady market growth worldwide.

| Report Attribute | Details |

|---|---|

|

Veterinary Orthopedic Implants Market Size (2026E) |

US$ 632.7 million |

|

Market Value Forecast (2033F) |

US$ 1,070.3 million |

|

Projected Growth CAGR (2026-2033) |

7.8% |

|

Historical Market Growth (2020-2025) |

7.2% |

Driver- Rising Pet Humanization and Technological Advancements in Veterinary Orthopedics

The increasing rate of pet ownership and the growing trend of pet humanization are major drivers of the veterinary orthopedic implants market. Companion animals, particularly dogs and cats, are increasingly regarded as family members, leading owners to seek advanced medical treatments comparable to human healthcare. Orthopedic conditions such as fractures, cruciate ligament injuries, hip dysplasia, and joint disorders are commonly observed in pets due to aging, obesity, road accidents, and physical activity. As a result, veterinarians are performing a higher number of orthopedic surgeries that require implants such as plates, screws, pins, and wires. Pet owners’ willingness to invest in surgical interventions that improve mobility, reduce pain, and enhance quality of life has significantly increased procedure volumes, directly supporting demand for veterinary orthopedic implants.

In parallel, advancements in implant technology are accelerating market growth. The use of high-strength materials such as titanium alloys and stainless steel has improved implant durability and biocompatibility. Innovations, including locking compression plates, cannulated screws, and anatomically contoured implants, provide better fixation stability and faster recovery for animals. Emerging techniques such as 3D-printed, patient-specific implants further enhance surgical precision and outcomes. These technological improvements increase clinician confidence, expand treatment options, and encourage broader adoption of orthopedic implants across veterinary practices, strengthening long-term market growth.

Restraint- High Cost of Veterinary Orthopedic Implants and Surgical Procedures

The high cost associated with veterinary orthopedic implants and related surgical procedures remains a significant restraint on market growth. Advanced implants, such as locking plates, specialized screws, and customized fixation systems, substantially increase overall treatment costs. Complex orthopedic surgeries can cost several thousand dollars per case, making them unaffordable for many pet owners, particularly in low- and middle-income regions. The financial burden is further intensified by limited availability of pet insurance coverage, which often excludes or partially reimburses orthopedic procedures. As a result, owners may delay treatment or opt for conservative management instead of surgical intervention.

Economic barriers are especially prominent in emerging markets, where disposable income levels are lower, and spending on advanced veterinary care is limited. For large animals, the cost-benefit consideration becomes even more restrictive, as treatment expenses may exceed the animal’s economic value. These factors contribute to reduced adoption of veterinary orthopedic implants in cost-sensitive regions, limiting market penetration and slowing overall growth despite rising awareness and advancements in implant technologies.

Opportunity- Rising Pet Ownership and Advanced Orthopedic Care in Veterinary Medicine

The growing global population of companion animals presents a significant opportunity for the veterinary orthopedic implants market. Increasing pet ownership, particularly in urban and middle-class households, is driving demand for advanced veterinary care, including surgical interventions for fractures, ligament injuries, and joint disorders. Pet owners are increasingly willing to invest in procedures that improve mobility, reduce pain, and enhance the quality of life for their animals. This shift in attitude, combined with rising awareness of animal health and wellness, is creating a robust market for implants such as plates, screws, pins, and wires. Additionally, the growing number of specialized veterinary hospitals and referral clinics equipped with advanced surgical facilities provides a strong channel for implant adoption.

Technological advancements in implant design and materials further amplify market opportunities. Innovations such as 3D-printed patient-specific implants, biocompatible titanium alloys, and locking compression systems improve surgical precision, recovery times, and treatment outcomes. These developments encourage broader clinical adoption, especially in regions where veterinary services are expanding rapidly. Emerging markets in the Asia Pacific, Latin America, and the Middle East present high-growth potential, driven by increasing disposable incomes, modern veterinary infrastructure, and the humanization of pets, making these regions key targets for market expansion.

Plates represent the leading product type in the veterinary orthopedic implants market, accounting for approximately 38% market share in 2026. Their dominance is largely attributed to their versatility in managing a wide range of fractures and joint stabilization procedures. Compression plates and locking plates are extensively used in canine orthopedic surgeries, particularly for cruciate ligament repairs and complex load-bearing fractures. The high incidence of trauma-related injuries in dogs, including road accidents and sports-related injuries, has increased the demand for reliable and durable plating systems. Variants such as T-plates and L-plates are widely preferred due to their adaptability in treating anatomically complex fractures and smaller bone structures. Plates offer superior stability, promote faster healing, and reduce post-operative complications, making them a standard choice in veterinary surgical practice. Continuous advancements in plate design and material strength are expected to further reinforce their adoption across companion animal orthopedic procedures.

Veterinary hospitals dominate the distribution channel segment, holding over 60% market share in 2025. Their leadership is driven by the availability of advanced diagnostic imaging, specialized surgical theaters, and trained veterinary orthopedic surgeons capable of handling complex procedures. These hospitals manage a high volume of trauma, fracture, and joint-related cases that require sophisticated implants such as plates and screws. Multidisciplinary teams and access to post-operative care further strengthen their role as primary treatment centers. In contrast, veterinary clinics account for a smaller share, largely focusing on less complex orthopedic interventions and conservative treatments. Clinics typically handle minor fractures or refer to advanced cases to hospitals. The growing number of specialized veterinary hospitals, particularly in urban areas, continues to support higher implant usage, positioning hospitals as the dominant distribution channel in the veterinary orthopedic implants market.

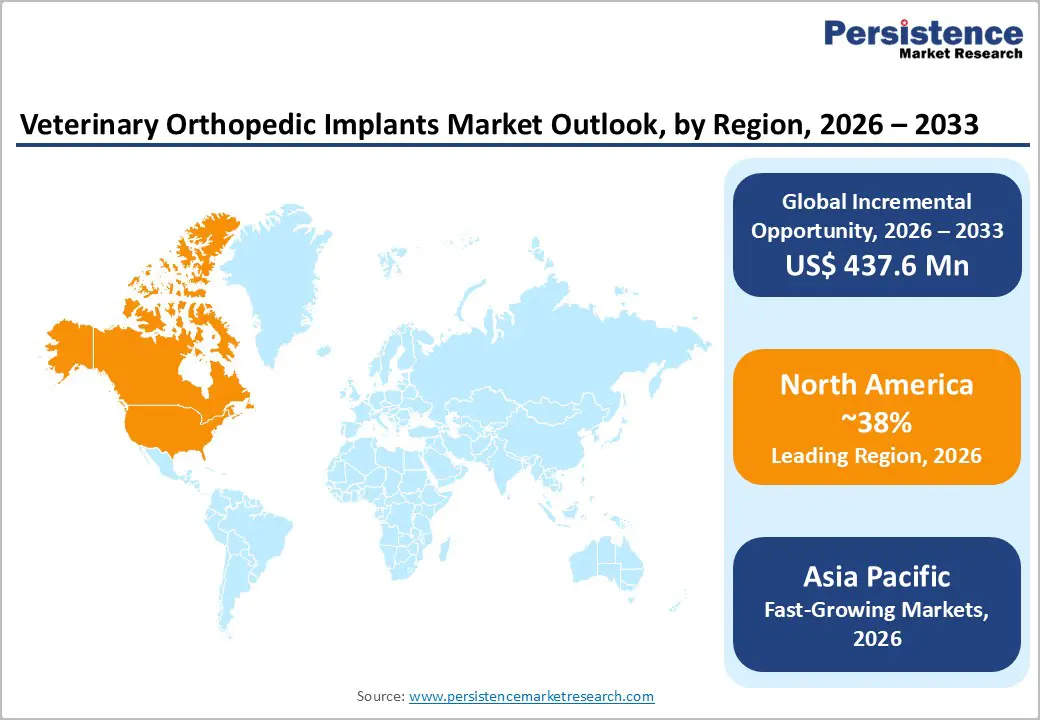

North America Veterinary Orthopedic Implants Market Trends and Insights

North America represents a mature and well-established market for veterinary orthopedic implants, supported by a high concentration of companion animals and advanced veterinary care standards. The region benefits from widespread availability of specialized veterinary hospitals, board-certified orthopedic surgeons, and access to sophisticated diagnostic tools such as digital radiography and CT imaging. A strong culture of preventive and interventional veterinary care encourages early surgical treatment of fractures, ligament injuries, and joint disorders in pets.

Additionally, higher disposable incomes and increasing penetration of pet insurance plans support the adoption of advanced orthopedic procedures using plates, screws, and fixation systems. Technological innovation is another defining trend, with manufacturers introducing anatomically contoured implants and locking plate systems tailored for companion animals. Regulatory oversight and established distribution networks ensure consistent product quality and availability. Together, these factors sustain steady demand for veterinary orthopedic implants across the United States and Canada, reinforcing North America’s position as a leading regional market.

Asia Pacific Veterinary Orthopedic Implants Market Trends and Insights

The Asia-Pacific veterinary orthopedic implants market is experiencing rapid growth, driven by changing attitudes toward pet ownership and improving veterinary infrastructure. Urbanization and rising middle-class populations are driving higher spending on animal healthcare, particularly in China, Japan, India, and Australia. The number of private veterinary clinics and referral centers offering orthopedic services is increasing, expanding access to surgical treatments for fractures and joint injuries. Cost-sensitive markets in the region are showing growing interest in affordable implant options, including standard plates, pins, and wires. In addition, increasing awareness of animal welfare and advancements in veterinary education are encouraging earlier intervention for orthopedic conditions. Local manufacturers are entering the market with competitively priced products, improving availability across emerging economies. As veterinary services continue to modernize and pet care standards rise, Asia Pacific is expected to register the fastest growth in demand for veterinary orthopedic implants during the forecast period.

Market Structure Analysis

The veterinary orthopedic implants market is moderately consolidated, with a small number of established players accounting for a significant portion of global revenues. Leading companies such as DePuy Synthes and Arthrex Vet Systems maintain strong market positions through continuous product innovation, broad implant portfolios, and well-developed distribution networks. Manufacturers are actively investing in research and development, focusing on advanced materials, 3D-printed patient-specific implants, and biologic-enhanced solutions to improve surgical outcomes. Strategic acquisitions and geographic expansions are being used to strengthen market presence and access new customer bases. Biocompatibility, implant durability, and the ability to offer customized solutions have emerged as key competitive differentiators. In addition, companies are increasingly adopting direct-to-clinic supply models to improve product availability, reduce costs, and enhance relationships with veterinary hospitals and specialty clinics.

Key Market Developments

The global veterinary orthopedic implants market is expected to reach US$ 9.4 million in 2026.

Rising pet humanization and ownership, especially dogs, boosts demand for implants treating ligament injuries.

North America leads with 38% share in 2025.

Rising pet ownership and increasing demand for advanced orthopedic surgeries in companion animals across emerging markets present major growth opportunities.

AmerisourceBergen Corporation (Cencora, Inc.), Arthrex Vet Systems, B. Braun, and BlueSAO are among the top players in the market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

Product Type

Application

End User

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author