ID: PMRREP35294| 200 Pages | 9 May 2025 | Format: PDF, Excel, PPT* | Consumer Goods

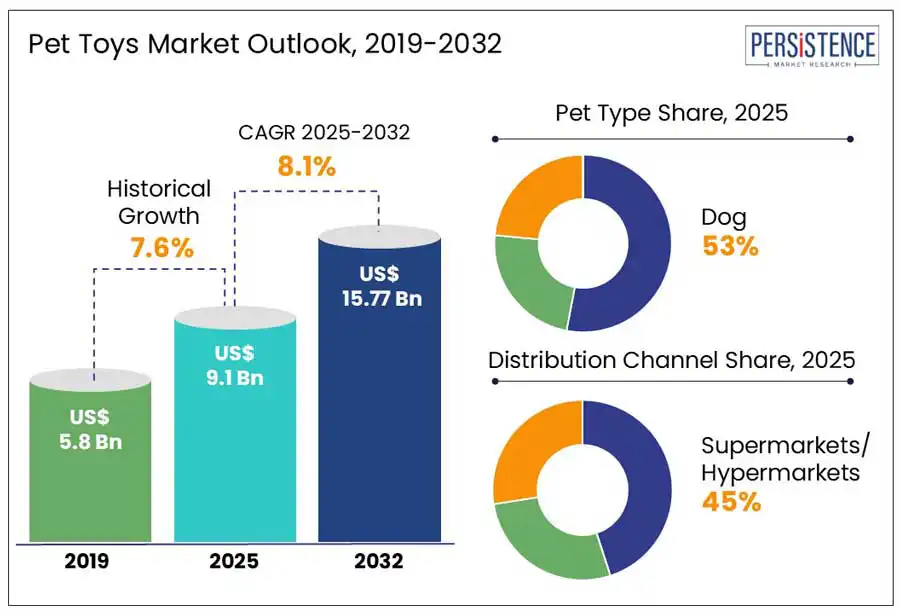

The global pet toys market size is projected to reach from US$ 9.1 Bn in 2025 to US$ 15.77 Bn at a CAGR of 8.1% by 2032. According to the Persistence Market Research report, increase in number of pet adoption, rising demand for sustainable and eco-friendly toys, and growing focus on pet humanization are propelling the market growth. For instance, according to an article published by Forbes in January 2024, about 4.1 million animals are being adopted every year. As the number of people are welcoming pets at their homes, the demand for stimulating and engaging toys is globally gaining traction. Companies such as Petmate, KONG Company, and Benebone are introducing durable, interactive toys and innovative designs that appeal to pet owners and their pets. Overall, the market presents exciting growth opportunities for industry players to cement their position during the forecast period.

Key Industry Highlights

|

Global Market Attribute: |

Key Insights: |

|

Pet Toys Market Size (2025E) |

US$ 9.1 Bn |

|

Market Value Forecast (2032F) |

US$ 15.77 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

8.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

7.6% |

Humanization of pets has become a significant growth driver in the market, as owners increasingly treat their animals as integral family members. This shift is evident in spending behaviors. For instance, in the UK, sales of seasonal pet treats, toys, and food have surged, with online sales at Waitrose increasing by 964% year-on-year, and John Lewis reporting a 98% rise in dog toy sales compared to the previous year. Such trends highlight a growing willingness among pet owners to invest in products that enhance their pets' well-being and happiness. The growing emotional bond between humans and pets has led to a demand for toys that not only entertain but also support mental stimulation and emotional health. Innovations in the market now focus on interactive and enrichment toys designed to alleviate boredom and anxiety in pets. As a result, such initiatives are projected to considerably favor market growth during the foreseeable future.

Fluctuations in the cost of raw materials such as rubber, plastics, and natural fibers present a persistent challenge for companies in the market. These materials form the core components of most pet toys, and their prices are influenced by a range of factors, including global supply chain instability, crude oil price variations, and environmental policies. For example, as per studies, in 2024, disruptions in rubber production due to extreme weather in Southeast Asia, combined with rising oil prices impacting plastic derivatives, led to increased production costs by 20% to 30% for manufacturers.

For companies focused on producing high-quality, durable, and eco-friendly toys, fluctuating prices of raw materials poses a greater burden, as they are often less able to cut costs without compromising on product standards. Therefore, in the competitive and quality-driven space, price instability in raw materials is anticipated to limit growth prospects to a certain limit.

Direct-to-consumer (DTC) and subscription-based models are transforming how pet toys are marketed and sold, especially to younger, digitally native pet owners. Millennials and Gen Z, who now make up a significant portion of global pet parents, prefer convenient, personalized, and seamless shopping experiences, something traditional retail often fails to provide. DTC channels allow companies to bypass intermediaries and build direct relationships with customers, offering better pricing, quicker feedback loops, and more custom product experiences. Subscription boxes, in particular, have found success by delivering curated toy assortments based on pet size, breed, or play style, enhancing the sense of care and novelty for both pets and their owners.

What makes these models even more compelling is their ability to gather rich consumer data, enabling continuous product refinement and marketing personalization. Brands can track preferences, repeat behavior, and engagement levels, then use that insight to adjust toy designs or introduce new features such as eco-friendly materials or enrichment-focused toys. Additionally, recurring delivery models foster long-term customer loyalty while ensuring steady revenue streams for companies.

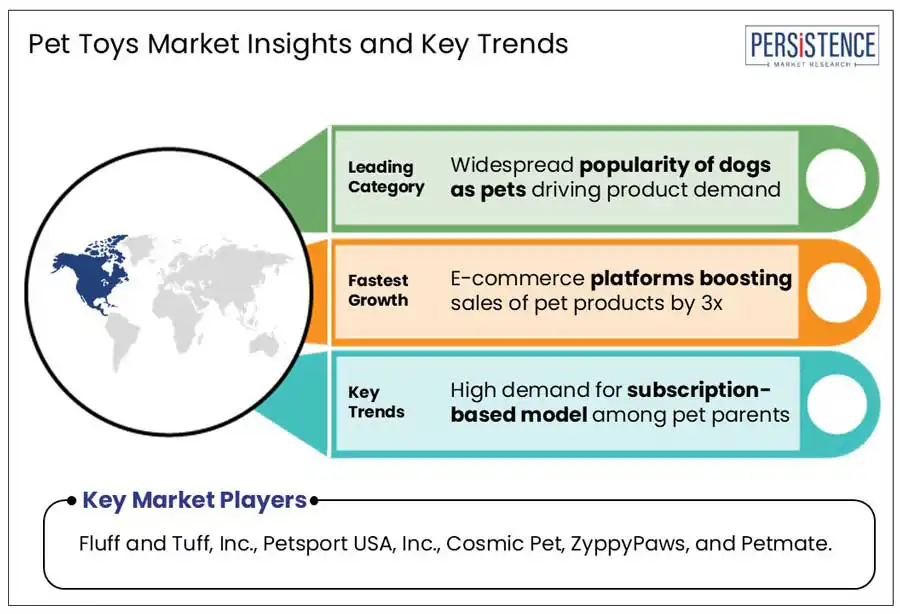

By pet type, the market is bifurcated into dog, cat, and others. Among these, the dog segment is projected to hold a revenue share of about 53% in 2025. This is primarily due to the widespread popularity of dogs as pets across global markets, particularly in North America and Europe. Dog toys are diverse, including chew toys, interactive toys, fetch toys, and training tools, which cater to a variety of pet behaviors and preferences. Dog owners are particularly inclined to invest in toys that promote physical exercise, mental stimulation, and training.

On the other hand, cat segment is experiencing fastest growth in the forthcoming years. As more cat owners seek products that keep their pets engaged and mentally stimulated, demand for cat toys is witnessing an uptick globally. Moreover, presence of smaller living spaces in urban areas is turning out to be practical choice for cats as pets, which in turn, is driving the segment’s growth between 2025 and 2032.

Based on distribution channel, the supermarkets/hypermarkets segment is anticipated to hold a revenue share of about 45% in 2025 and further dominate. Retail outlets offer a wide range of pet products under one roof, providing convenience for consumers who prefer in-person shopping. Large chains such as Walmart, Tesco, and Carrefour continue to hold a significant share due to their extensive reach, established consumer trust, and ability to offer competitive pricing. Additionally, supermarkets and hypermarkets often benefit from high foot traffic, allowing them to attract customers who may make impulse buys while shopping for other products.

Online segment, on the other hand, is the fastest-growing, driven by the shift in consumer shopping behaviors, especially since the COVID-19 pandemic. E-commerce platforms such as Amazon, Chewy, and Petco have seen substantial growth in pet product sales, including toys, as more pet owners opt for the convenience of shopping from home.

North America is anticipated to hold a revenue share of about 33% in 2025 and dominate further. Consumers in this region increasingly treat pets as family members, driving demand for premium, interactive, and enrichment-focused toys. Additionally, the strong presence of specialty pet retailers, well-integrated e-commerce platforms, and subscription-based services further supports sustained growth.

U.S. pet toys market is projected to witness substantial growth, fueled by a solid presence of advanced pet product ecosystem, which includes a wide network of retailers, veterinary professionals, and pet influencers driving consumer behavior. American pet owners are early adopters of tech-enhanced and personalized pet toys, often prioritizing enrichment value over cost. Pet parents here are highly responsive to trends such as eco-conscious consumption and mental stimulation for indoor pets, pushing brands to continuously innovate.

The market in Asia Pacific is likely to emerge as the fastest growing region in the forthcoming years. This growth is attributed to rapid rise in pet adoption, urbanization, and lifestyle changes. With nuclear families and single-person households on the rise, especially in major cities, pet companionship is becoming increasingly common. This shift is creating new consumer segments looking for toys that not only entertain pets but also support their physical and mental health.

China pet toys industry is experiencing steady growth, driven by a powerful convergence of urbanization, rising disposable incomes, and the cultural shift toward pet humanization. The country is witnessing explosive growth in pet ownership, especially among millennials and Gen Z consumers in tier 1 and tier 2 cities, who treat pets as family and seek high-quality, functional, and emotionally engaging products.

Europe is anticipated to witness substantial growth in the market from 2025 to 2032. Consumers here are placing greater emphasis on pet enrichment, leading to rising demand for innovative toys that support physical activity, mental stimulation, and behavioral wellness. Sustainability is also a major driver, as environmentally conscious pet parents seek out toys made from natural, recyclable, or biodegradable materials. Additionally, product safety regulations in the region are prompting companies to invest in high-quality manufacturing and non-toxic materials.

Germany pet toys industry is projected to register considerable growth during the forecast period. German pet owners are highly selective, often favoring toys that are not only durable and multifunctional but also support long-term pet health. The market is also being shaped by local innovation, with several homegrown brands developing toys customized to breed-specific behaviors and age-related needs.

The global pet toys market is moderately fragmented and shaped by companies adopting growth strategies such as product innovation, strategic partnerships, and acquisitions. Various companies are investing in research and development activities to develop sustainable pet toys through use of recycled materials. Moreover, companies are also strengthening their market position through omnichannel distribution, including e-commerce, direct-to-consumer models, and subscription-based offerings. Such initiatives are anticipated to aid companies cement their position in the market during the forecast period.

The global market is projected to value at US$ 9.1 Bn in 2025.

The market is driven by rising trend of pet humanization, where pets are treated as family members, leading to increased spending on toys that promote mental and physical stimulation.

The market is poised to witness a CAGR of 8.1% from 2025 to 2032.

The key market opportunities include the growing popularity of direct-to-consumer and subscription models, which offer personalized shopping experiences, and the increasing demand for sustainable, eco-friendly toys.

Major players in the pet toys industry include, Fluff and Tuff, Inc., Petsport USA, Inc., Cosmic Pet, ZyppyPaws, and Petmate.

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Pet Type

By Distribution Channel

By Product

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author