ID: PMRREP35113| 185 Pages | 30 Jan 2025 | Format: PDF, Excel, PPT* | Healthcare

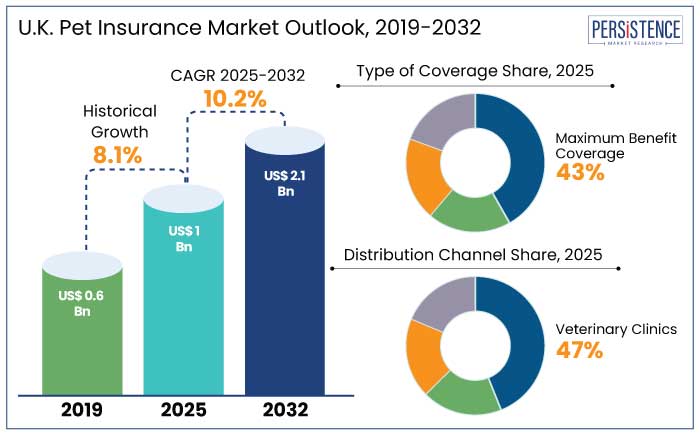

The U.K. pet insurance market is estimated to reach a size of US$ 1,721.8 Mn in 2025. The industry is likely to exhibit a CAGR of 10.2% through 2032 to attain a value of US$ 2,162.2 Mn by 2032.

Insurers are offering tailored policies based on pet breed, age, and medical history. Preventative care plans, covering vaccinations, dental care, and wellness check-ups, are anticipated to account for 30% of policies by 2030. Rising veterinary treatment costs are making pet insurance more attractive with a projected increase of 6% to 8% annually.

AI-driven tools for policy customization and real-time claims processing are likely to enhance customer experience. While dogs and cats are the primary focus, niche markets for exotic pets are witnessing growth as well. The segment is predicted to expand by 12% annually owing to increased demand for specialized coverage.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

U.K. Pet Insurance Market Size (2025E) |

US$ 1,721.8 Mn |

|

Projected Market Value (2032F) |

US$ 2,162.2 Mn |

|

U.K. Market Growth Rate (CAGR 2025 to 2032) |

10.2% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

8.1% |

Maximum benefit coverage is set to account for a share of 43% in 2025. This growth is attributed to its cost-effective and comprehensive coverage. This type of coverage offers substantial protection for specific conditions up to a set financial limit.

The above-mentioned features make it especially appealing to owners of younger pets or those looking to manage recurring health issues. Unlike expensive lifetime coverage, maximum benefit coverage policies often have lower premiums, contributing to their popularity. For example,

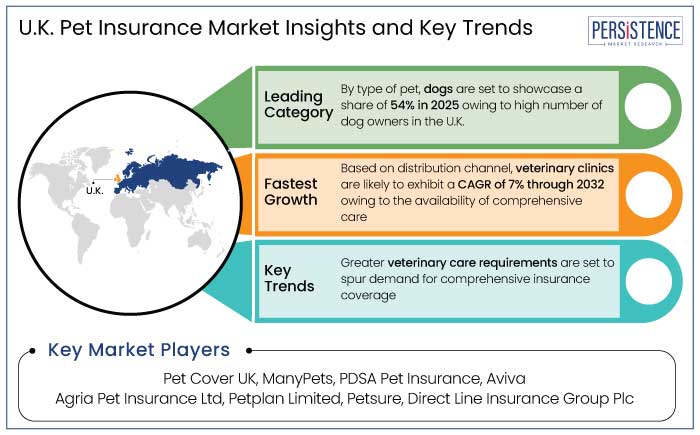

Dogs are predicted to emerge as the leading type of pet with a share of 54% in 2025. High number of dog owners in the U.K., with 28% of U.K. adults owning a dog, contribute to this growth. Continued popularity of dogs, along with their high veterinary care needs, makes them a significant driver of pet insurance demand.

Dogs often require comprehensive coverage owing to their susceptibility to various health conditions, like joint issues, dental problems, and chronic illnesses. This leads owners to invest in insurance policies to manage potential costs. The large proportion of dog owners remains a dominant force in the market, contributing to their substantial market share in pet insurance.

Veterinary clinics are likely to hold a share of 47% in 2025 owing to their essential role in providing comprehensive care for pets, thereby driving the demand for insurance coverage. For example,

As pet ownership continues to rise, particularly for dogs and cats, the need for veterinary care grows, leading pet owners to seek insurance to help manage potential healthcare costs. Increasing demand for veterinary services, coupled with the rising costs of pet treatments, ensures that veterinary clinics remain a key driver of the pet insurance market, reinforcing their central role in the pet care ecosystem. Owing to the aforementioned factors, the segment is likely to witness a CAGR of 7% through 2032.

The U.K. pet insurance market has seen consistent growth owing to increasing pet ownership and a rising awareness of the importance of pet health insurance. For instance,

Growing recognition of high costs associated with veterinary care, including treatments, surgeries, and diagnostic procedures, is a key driver prompting pet owners to seek insurance to mitigate these expenses. Focus on pet wellness and preventive care is further fueling demand for comprehensive coverage that includes routine check-ups, vaccinations, and alternative therapies.

The market presents several opportunities for insurers, including the potential to offer customizable and flexible policies. Integration of digital platforms, mobile apps, and telemedicine services assist in enhancing customer experience.

The U.K. pet insurance market growth was steady at a CAGR of 8.1% during the historical period from 2019 to 2023. Growth during the period was attributed to rising pet ownership, increasing veterinary costs, and surging awareness of the benefits of insurance.

Pet insurance was a niche offering but the increase in veterinary care costs drove demand for pet insurance. As pets are being increasingly regarded as family members, demand for insurance has surged significantly.

In the forecast period, growth in the market is predicted to be fueled by an increasing number of pet owners. Innovations in veterinary care have increased the lifespan of pets, further increasing the need for pet insurance. Insurers are focusing on offering flexible and customizable policies that address specific needs, including preventive care, behavioral therapy, and alternative treatments.

Rising Pet Ownership and Humanization of Pets to Spur Demand

Since the onset of the COVID-19 pandemic, pet ownership in the U.K. has surged. Social isolation and the search for companionship during lockdown were key motivators, making pets invaluable sources of emotional support. For example,

The ‘humanization’ of pets has driven demand for services like pet insurance, as owners seek to protect their pets’ health and well-being. As pets continue to support mental health and combat loneliness, pet insurance is increasingly seen as a crucial tool to manage the costs and responsibilities of modern pet ownership.

Increasing Veterinary Costs to Augment Demand

A recent review by the Competition and Market Authority (CMA) revealed that veterinary costs in the U.K. have been on the rise, with pet owners facing exorbitant fees. The CMA reports that vet fees have outpaced general inflation, posing financial challenges for pet owners amid the cost-of-living crisis. This drive pet owners to seek comprehensive pet insurance to cover up the surging fees. For example,

Industry consolidation has altered the competitive landscape, with large corporate groups owning half of U.K. veterinary practices, decreasing local competition and limiting consumer choice. These rising expenses are leading pet owners to consider pet insurance to manage the unpredictable costs of veterinary care. For instance,

Limited Coverage for Pre-existing Conditions to Restrict Appeal

For first-time buyers of pet insurance in the U.K., limited coverage for pre-existing conditions remains a key deterrent. Most policies exclude any injuries, illnesses, or chronic conditions that existed before the policy's inception.

The restriction can be especially frustrating for pet owners with animals suffering from manageable chronic conditions, as coverage is typically denied for any treatment related to these issues. Claims made during the ‘waiting period,’ a brief window after policy purchase, are also excluded, further limiting immediate benefits.

Preventive and routine treatments, like vaccinations, flea and tick control, dental care, and spaying or neutering, are often not covered, requiring out-of-pocket payments for ongoing basic care. While some policies provide partial end-of-life or emergency care benefits, elective procedures, pregnancy-related care, and international treatment are frequently not included. This lack of comprehensive coverage for pre-existing and preventative conditions can make pet insurance less appealing for owners seeking full financial protection for their pets.

Customizable Policies with Wellness and Preventive Care to Create Avenues

The market is witnessing an increasing demand for customizable policies that incorporate wellness care, preventive treatments, and telemedicine services. Pet owners are becoming proactive about their pets' health, seeking comprehensive coverage that goes beyond emergency care. For example, insurers like Petplan and Agria are already offering policies that cover wellness services, catering to the growing trend of proactive pet care.

The integration of telemedicine enables pet owners to consult veterinarians remotely, providing convenience and accessibility. This enhances the value of insurance policies. As pet owners become more health-conscious about their pets, the demand for flexible and all-inclusive policies is likely to continue to drive growth.

Rise of InsurTech Solutions to Open the Door to Success

Growth of digital and InsurTech solutions presents a significant opportunity owing to developments in technology. Pet insurance providers are increasingly adopting digital platforms, mobile apps, and AI-driven solutions to enhance customer experience and streamline processes.

For instance, companies like Bought By Many are leveraging unique technologies to offer tailored policies and a seamless claim experience through mobile apps. This enables quick claims processing and real-time customer support.

InsurTech innovations like telemedicine for pets are making veterinary consultations more accessible and convenient, further adding value to pet insurance policies. As consumers demand flexibility and convenience, insurers embracing digital solutions to simplify purchasing, claims, and customer interactions will be well-positioned for growth.

The U.K. pet insurance market is rapidly rising as industry leaders adopt innovative strategies to gain new growth opportunities. Key players are diversifying their service offerings through regional expansion. They are also investing in research and development to meet the evolving needs of pet owners.

By focusing on customization, digital tools, and efficient claims processing, insurers are enhancing customer experience. This proactive approach is fueling continued growth in the sector, making the U.K. pet insurance industry one of resilience and innovation.

Recent Developments in the U.K. Pet Insurance Industry

The U.K. pet insurance industry is estimated to reach a value of US$ 2,162.2 Mn by 2032.

The industry is being propelled by rising pet ownership, increasing veterinary costs, and surging awareness regarding the benefits of pet health insurance.

Leading players include Pet Cover UK, ManyPets, and PDSA Pet Insurance.

The market is projected to record a CAGR of 10.2% through 2032.

A prominent opportunity lies in the increasing demand for customizable policies that include wellness care, preventive treatments, and telemedicine services.

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Type of Coverage

By Type of Pet

By Distribution Channel

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author