ID: PMRREP14962| 209 Pages | 15 Nov 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

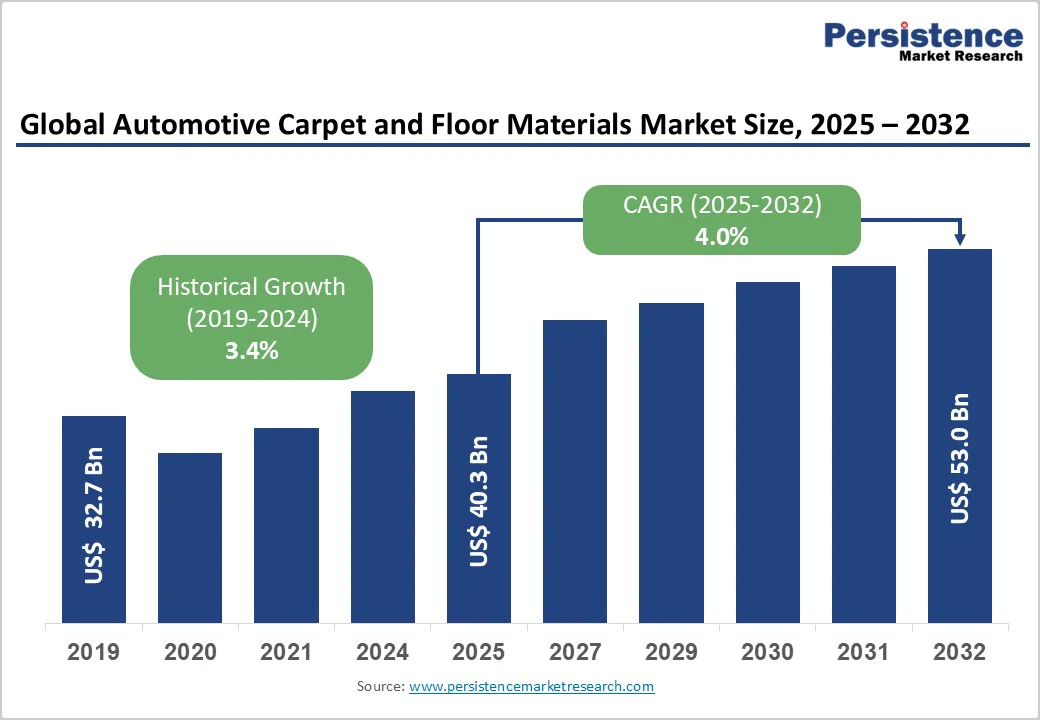

The global automotive carpet and floor materials market size is likely to be valued US$ 32.7 Billion in 2025, estimated to US$ 40.3 Billion by 2032, growing at a CAGR of 4.0% during the forecast period from 2025 to 2032, driven by the increasing prevalence of vehicle interior customization, rising demand for comfort and aesthetics, and advancements in durable materials. The need for noise reduction and thermal insulation, particularly in passenger cars, has significantly boosted the adoption of automotive carpet and floor materials across various demographics. The market is further propelled by innovations in synthetic rubber and textile fabrics, catering to preferences for lightweight and eco-friendly options. The growing acceptance of automotive carpet and floor materials as essential for premium interiors, particularly in EVs, is a key growth factor.

| Key Insights | Details |

|---|---|

| Automotive Carpet and Floor Materials Market Size (2025E) | US$40.3 Bn |

| Market Value Forecast (2032F) | US$53.0 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.0% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.4% |

The rising prevalence of vehicle interior customization and the growing demand for comfort-oriented materials are transforming the automotive carpet and floor materials market. Consumers increasingly view their vehicles as personal spaces, driving interest in customized interiors that reflect style, comfort, and functionality. This trend is especially strong in premium and electric vehicles, where interior quality and acoustic performance are key differentiators.

Manufacturers are responding by offering modular flooring systems, color and texture variations, and high-performance materials such as plush textiles, nonwoven fabrics, and soft-touch polymers that enhance comfort and aesthetics. The aftermarket segment is also expanding as car owners seek personalized upgrades for sound insulation, durability, and luxury feel. Innovations in anti-microbial, odor-resistant, and easy-to-clean materials add practical value, appealing to consumers prioritizing hygiene and convenience. OEMs and independent suppliers alike are leveraging this trend to introduce custom-fit, eco-friendly, and ergonomic designs that improve cabin experience.

The high costs associated with development and sourcing of automotive carpet and floor materials pose a significant restraint on market growth. Developing these materials requires advanced weaving, rigorous durability testing, and specialized treatments for stain resistance. These processes involve substantial financial investment, often exceeding millions of dollars, which can be a barrier for smaller suppliers. Regulatory bodies impose stringent requirements for VOC emissions and recyclability.

Compliance with these standards, along with the need for certified facilities, increases overall costs and extends development timelines. For instance, certifying eco-textiles for EVs can take years, with costs escalating due to multiple phases of emission trials. Smaller firms struggle against players like DuPont. Complexity of multi-layer constructions adds to production challenges, deterring innovation in cost-sensitive regions.

Advancements in lightweight and recycled materials present significant growth opportunities for the automotive carpet and floor materials market. Manufacturers are increasingly adopting polypropylene, polyethylene terephthalate (PET), thermoplastic elastomers (TPE), and nonwoven composites to reduce overall vehicle weight without compromising durability or comfort. These materials offer enhanced acoustic insulation, thermal stability, and flexibility, making them ideal for modern vehicle interiors, including electric and hybrid models.

The shift toward recycled polymers and bio-based fibers such as those derived from recycled plastics, natural jute, and hemp is driven by growing environmental regulations and automakers’ commitment to carbon neutrality. Companies like Autoneum and DuPont are pioneering innovations in closed-loop recycling systems and eco-friendly composites that minimize waste while maintaining performance standards. Additionally, advancements in molding and fiber processing technologies have improved the strength-to-weight ratio and design versatility of carpets and floor mats.

Textile Fabrics dominates the market, accounting for 55% of the share in 2025. Its dominance is driven by aesthetic appeal, softness, and versatility, making it preferred for passenger cars. Textile fabrics, such as those from Unitex India Pvt Ltd, provide premium feel, ensuring compatibility. Its customization and comfort make it preferred for manufacturers.

Synthetic Rubber is the fastest-growing segment, driven by durability and increasing adoption in commercial vehicles. Synthetic rubber offers water resistance, appealing for heavy-duty. Focus on rugged innovation accelerates adoption in Asia Pacific and North America.

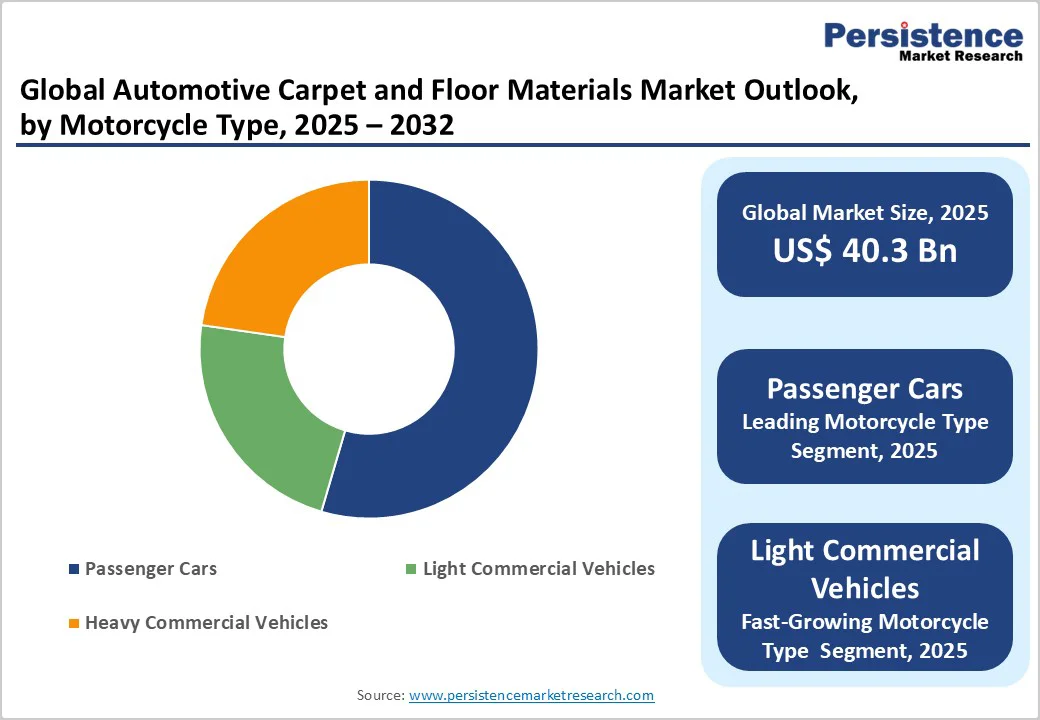

Passenger Cars leads the market, holding 60% of the share in 2025. capturing around 60% share in 2025. Their dominance stems from high production volumes, broad model availability, and increasing integration of premium interior materials. Growing consumer demand for comfort, aesthetics, and noise reduction in both mass-market and luxury vehicles continue to drive this segment’s leadership.

Light Commercial Vehicles is the fastest-growing segment, fueled by fleet modernization and rising use in delivery vans. Demand for durable, easy-to-clean, and noise-reducing flooring enhances vehicle comfort and longevity. These factors, along with increasing last-mile delivery operations, are accelerating the segment’s rapid expansion.

Original Equipment Manufacturers dominates the market, contributing nearly 70% of revenue in 2025. Their leadership stems from widespread factory integration and the ability to provide bulk, standardized supplies directly to automakers. OEM products ensure a precise fit, consistent quality, and compliance with design specifications, making them the preferred choice for new vehicle production.

Independent Suppliers is the fastest-growing segment, due to rising demand for aftermarket customization and vehicle interior upgrades. Consumers prefer these suppliers for their wide variety, flexible designs, and cost-effective options compared to OEM parts. Competitive pricing and faster availability make independent suppliers the preferred choice for personalized, high-quality automotive carpet and flooring solutions.

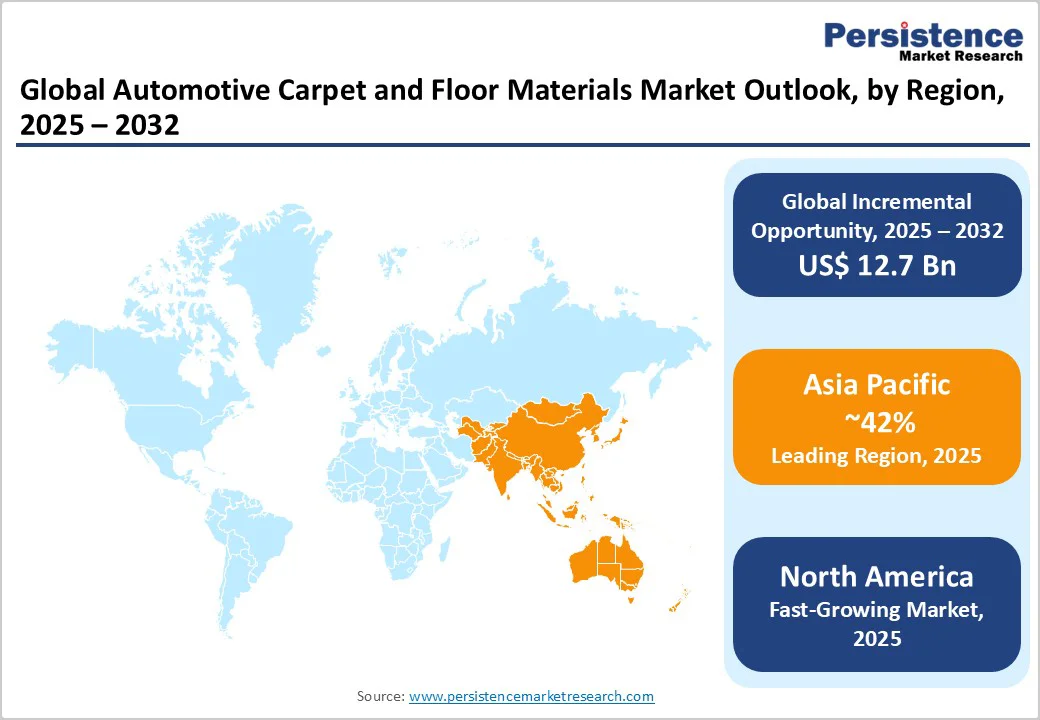

Asia Pacific is dominate the market accounting 42% share in 2025, driven by expanding vehicle production and rising consumer demand for comfort and aesthetics. Countries such as China, India, Japan, and South Korea are leading contributors, supported by a robust automotive manufacturing base and increasing investments from global OEMs. The region’s rapid shift toward electric vehicles (EVs) and premium car segments has boosted demand for lightweight, noise-insulating, and sustainable flooring materials.

Manufacturers are focusing on nonwoven, tufted, and composite carpets that improve acoustic performance and energy efficiency. Growing environmental awareness is accelerating the use of recycled polymers, bio-based fibers, and low-VOC materials to comply with stringent emission and sustainability standards. Local producers such as Unitex India Pvt Ltd are gaining market share through cost-effective, region-specific solutions. Partnerships between domestic suppliers and global automotive brands are further enhancing innovation and product quality.

North America is projected to account for nearly 20% of the global Automotive Carpet and Floor Materials Market in 2025, supported by strong automotive production, high consumer spending, and an increasing preference for comfort and luxury interiors. The U.S. and Canada dominate the regional market, driven by demand for SUVs, pickup trucks, and electric vehicles (EVs) that require durable, lightweight, and noise-reducing flooring systems. Leading companies such as DuPont, Autoneum, and Dorsett Industries are investing heavily in advanced polymer technologies, acoustic insulation, and recycled material innovations to meet evolving OEM requirements.

The region’s focus on sustainability is encouraging the use of eco-friendly and recyclable carpets that reduce environmental impact while enhancing vehicle aesthetics. The rapid adoption of EV platforms is pushing manufacturers to design flooring materials that optimize cabin acoustics and thermal management. The aftermarket sector is also growing, with consumers seeking customized, high-quality floor mats and carpets for personalization and comfort.

Europe holds 20% share in 2025, supported by strong EU eco-standards and collaborative initiatives. Driven by the region’s mature automotive industry and stringent environmental regulations, manufacturers are increasingly adopting eco-friendly, recycled, and bio-based materials to align with the EU’s circular economy goals. Major players such as Autoneum, DuPont, and Hayashi Telempu are leading through continuous R&D investments, focusing on lightweight, sound-absorbing, and thermally efficient flooring systems suitable for electric and hybrid vehicles.

The rise of electric mobility and luxury vehicle segments in Germany, France, and the U.K. is fueling demand for high-performance carpets that enhance comfort and acoustic insulation. European automakers are collaborating with material suppliers to integrate closed-loop recycling systems and reduce carbon footprints across production cycles. The aftermarket for customized and high-durability floor materials is also expanding, particularly in Western Europe.

The global automotive carpet and floor materials market is highly competitive, featuring a mix of global textile leaders and regional specialists. In developed markets such as North America and Europe, major players such as Autoneum and DuPont maintain dominance through strong research and development capabilities, extensive OEM networks, and advanced material innovations. Their focus on lightweight, durable, and noise-reducing flooring materials supports premium and electric vehicle production.

The Asia Pacific region is witnessing rapid growth driven by regional manufacturers such as Unitex India Pvt Ltd, which capitalize on localized production, cost efficiency, and tailored solutions to meet diverse vehicle demands. The market’s direction is increasingly shaped by sustainability, with companies emphasizing the use of recycled and bio-based materials to reduce environmental impact. Strategic partnerships, acquisitions, and collaborations between OEMs and material suppliers are accelerating product innovation.

The global automotive carpet and floor materials market is projected to reach US$40.3 Billion in 2025.

The rising prevalence of vehicle interior customization and demand for comfort materials are key drivers.

The market is poised to witness a CAGR of 4.0% from 2025 to 2032.

Advancements in lightweight and recycled materials are a key opportunity.

AUTO CUSTOM CARPETS, INC., HAYASHI TELEMPU CORPORATION, Unitex India Pvt Ltd, Autoneum, and DuPont are key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Motorcycle Type

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author