ID: PMRREP34179| 199 Pages | 13 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

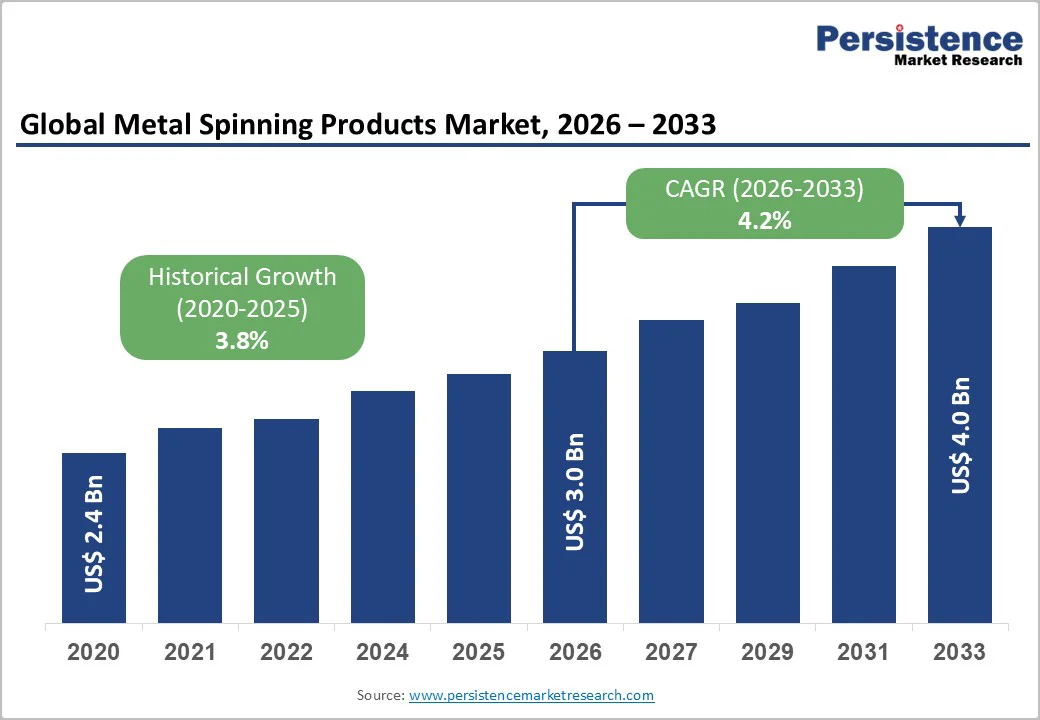

The global metal spinning products market size is likely to be valued at US$ 3.0 billion in 2026 and is estimated to reach US$ 4.0 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2026−2033. The market’s expansion is driven by increased adoption of precision-engineered metal components across the automotive, aerospace, and construction industries. Rising demand for lightweight and durable materials, especially aluminum and stainless steel, further supports market growth. Technological advancements in computer numerical control (CNC) metal spinning and rising investments in industrial manufacturing capabilities strengthen long-term market prospects

| Key Insights | Details |

|---|---|

| Metal Spinning Products Market Size (2026E) | US$ 3.0 Bn |

| Market Value Forecast (2033F) | US$ 4.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.2% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.8% |

Increasing Demand for Precision-Engineered Components in Manufacturing

Growing adoption of precision-engineered components for manufacturing operations across automotive, aerospace, industrial machinery, and energy applications is strengthening demand for metal spinning products. The process supports complex geometries, high structural stability, and thin-wall configurations, making it suitable for performance-critical parts such as cones, housings, reflectors, and pressure-resistant shells. Industries seeking enhanced reliability, lightweight construction, and efficient material utilization continue to prioritize metal-spun components to meet evolving engineering and regulatory standards.

Demand is further supported by the need for customization, shorter production cycles, and flexible tooling capabilities. Metal spinning accommodates both prototype development and high-volume production, enabling manufacturers to respond quickly to product variations and technical specifications. Its compatibility with a wide range of metals, including aluminum, steel, stainless steel, and specialty alloys, broadens application potential. The process aligns with sustainability-driven manufacturing goals through low waste generation and high material efficiency, positioning it as a preferred forming method across diverse industrial environments.

Material Supply Constraints and Cost Fluctuations

Material supply constraints and cost fluctuations act as a central restraint as metal-forming operations depend heavily on consistent access to high-quality raw metals such as aluminum, steel, stainless steel, copper, and specialty alloys. Any disruption in mining, smelting, or global logistics reduces material availability, leading to production delays, higher procurement risks, and limited capacity planning. Volatile input prices directly affect manufacturing margins, complicating long-term contracts and creating uncertainty in pricing strategies. Fluctuating energy costs and shifts in global commodity trade policies further intensify pressure on raw material stability.

Manufacturers face operational inefficiencies when sourcing cycles become unpredictable, as frequent price revisions challenge budgeting accuracy and resource allocation. Fluctuations also impact inventory strategies, forcing companies to absorb higher holding costs or face stock shortages. These issues elevate total production expenditure, reduce cost competitiveness, and influence the adoption of alternative forming processes. Persistent volatility restricts strategic investments in new tooling and process upgrades, tightening the overall supply environment and shaping a cautious industry outlook for stakeholders.

Adoption of Advanced Materials and Technologies

The shift toward advanced materials and next-generation manufacturing technologies opens a strategic pathway for producers to elevate product performance and capture high-value applications. Lightweight alloys, high-strength metals, and engineered composites enable superior dimensional stability, corrosion resistance, and thermal tolerance. These attributes support precise forming, tighter tolerances, and longer service life, which are essential for sectors such as aerospace, energy systems, industrial machinery, and premium consumer products. Companies integrating these materials gain the ability to supply differentiated components with higher functional value and stronger reliability standards.

Modern technologies such as computer-numerical-control forming (CNC forming), automated tooling, and digital simulation strengthen manufacturing agility and production consistency. These capabilities support rapid prototyping, complex geometries, custom configurations, and optimized production cycles. Integration of these technologies reduces scrap, minimizes manual variation, and enhances repeatability, enabling suppliers to meet performance-driven specifications. The transition toward advanced materials and precision technologies positions manufacturers to command premium pricing, improve operational efficiency, and align output with emerging engineering requirements, creating a clear pathway for long-term competitive advantage.

Product Type Insights

Cylindrical components are projected to secure the largest share of approximately 42% in 2026, supported by their extensive deployment across automotive systems, heating, ventilation & air conditioning (HVAC) equipment, industrial machinery, and aerospace storage units. Their uniform geometry enhances forming efficiency, reduces material loss, and delivers strong structural reliability, making them the preferred choice for large-scale production. This segment is expected to maintain leadership as industries continue to prioritize components that ensure predictable performance, broad alloy compatibility, and favorable production economics, reinforcing the dominance of cylindrical designs across core applications.

Custom-shaped products are anticipated to expand at the fastest pace from 2026 to 2033, driven by a rising shift toward precision-engineered configurations in aerospace structures, electronic housings, defense-grade components, and emerging mobility platforms. Advancements in CNC-enabled spinning systems allow manufacturers to design intricate contours with controlled tolerances, supporting applications where traditional shapes cannot meet evolving performance requirements. The segment is forecast to accelerate as enterprises pursue advanced geometries for lightweighting, improved aerodynamics, and enhanced system integration, positioning custom-shaped solutions as a focal point for next-generation engineering demands.

Material Insights

Aluminum spinning products are expected to retain a leading 35% share in 2026, supported by strong adoption across automotive platforms, aerospace assemblies, industrial equipment, and consumer applications. Aluminum enables significant weight reduction, contributing to improved fuel efficiency, enhanced structural balance, and alignment with engineering standards for advanced performance requirements. Its strong formability, stable thermal behavior, and cost-efficient processing strengthen utilization in large-volume production cycles. Industries continue to prioritize aluminum for components demanding durability, corrosion resistance, and optimized strength-to-weight ratios, reinforcing its position as the most commercially influential material category in 2026.

Stainless steel spinning products are anticipated to record the fastest expansion through 2033 due to their rising demand across construction infrastructure, electrical equipment, food-grade vessels, and precision engineering applications. Stainless steel offers strong corrosion resistance, high tensile strength, and suitability for harsh operating environments, supporting wider deployment as urban development, industrial automation, and electronics manufacturing scale upward. Its capability to maintain dimensional stability in high-temperature and high-stress settings positions it as a preferred choice for sectors requiring reliability and long lifecycle performance. Growing investment in durable, safety-compliant components is accelerating the shift toward stainless steel solutions.

Application Insights

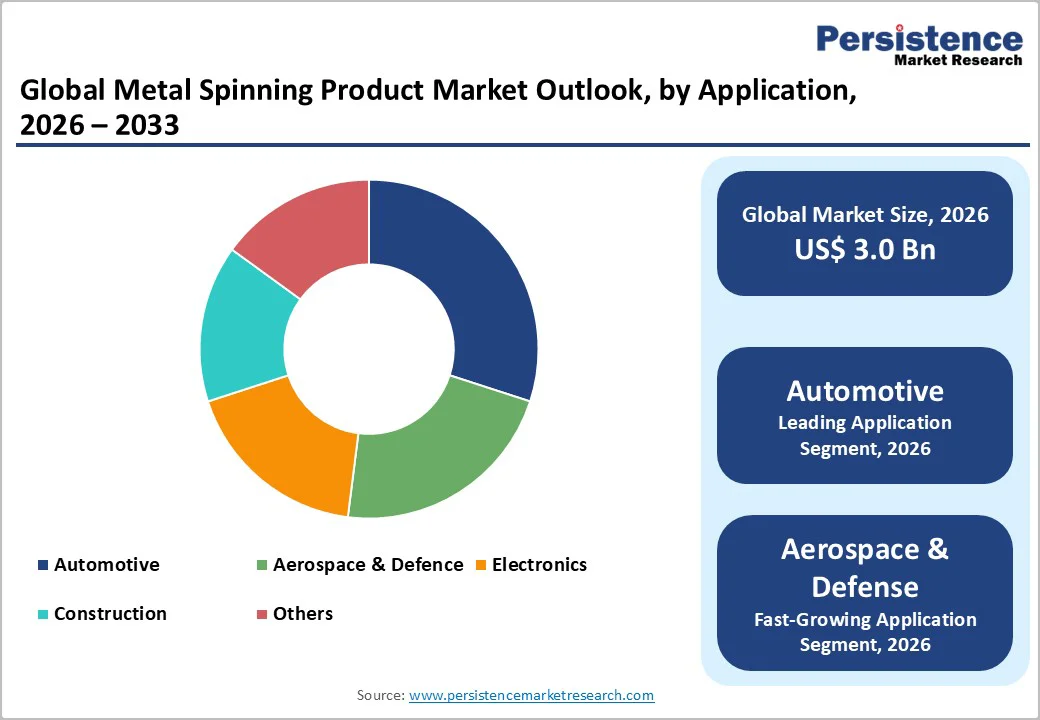

The automotive segment is projected to retain a leading 30% of the metal spinning products market revenue share in 2026, boosted by high-volume production of exhaust systems, wheel components, and structural parts. Automotive manufacturers prioritize reliability, dimensional precision, and material efficiency, making spinning processes ideal for cost-effective, durable components. The segment’s focus on lightweighting, fuel efficiency, and regulatory compliance further strengthens adoption. Strong integration across both passenger and commercial vehicle platforms ensures that automotive remains the primary contributor to overall demand.

The aerospace & defense segment is anticipated to grow at the fastest pace during the 2026-2033 forecast period, fueled by increasing requirements for engine components, landing gear assemblies, and specialized structural parts. High-performance specifications, tight tolerances, and lightweight requirements favor spinning processes capable of producing precision components with superior strength-to-weight ratios. Expansion is driven by manufacturers’ pursuit of efficiency, safety, and durability in both commercial aviation and defense applications, positioning the segment as a key growth area for advanced engineering solutions.

North America Metal Spinning Products Market Trends

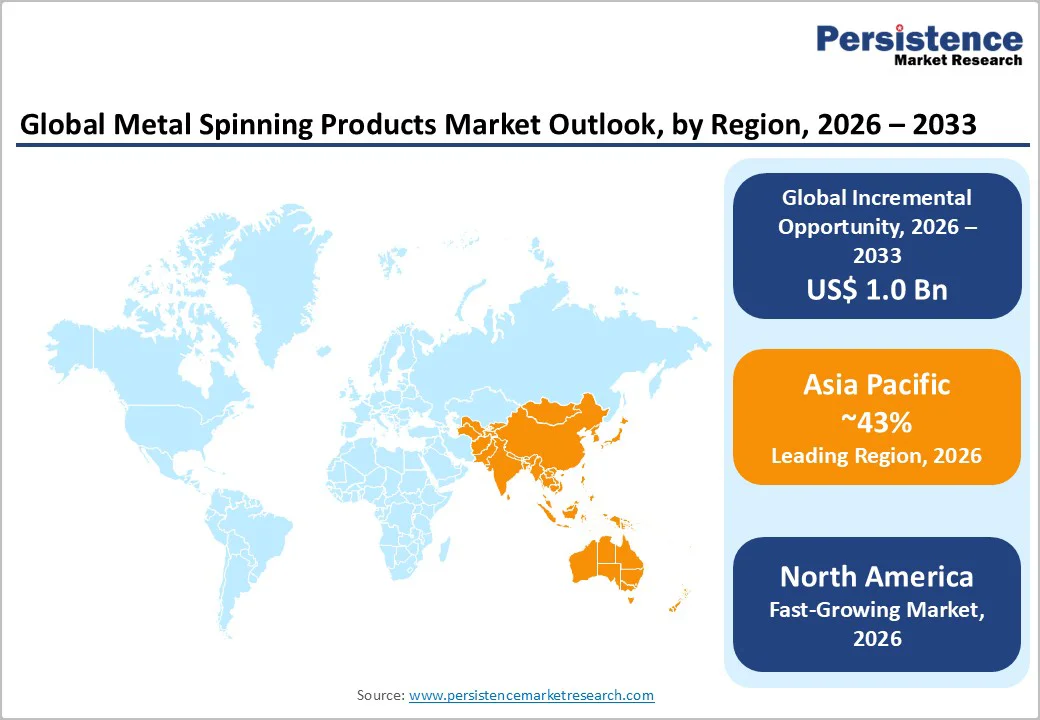

North America is poised to emerge as the fastest-growing market for metal spinning products due to an increasing regional demand for high-performance components across aerospace, defense, and advanced industrial machinery sectors. Regional manufacturers are focusing on precision-engineered solutions that require complex geometries, tight tolerances, and superior strength-to-weight ratios. Adoption of advanced manufacturing technologies, including CNC-controlled spinning, automation, and digital simulation, allows producers to meet the rising demand for custom and high-value components.

Investment in modernization of infrastructure and the expansion of high-tech industrial facilities is further accelerating growth. The region benefits from a strong engineering talent pool and advanced R&D capabilities that support innovation in materials and process efficiency. Increased focus on lightweighting, sustainability, and safety standards in both commercial aviation and defense applications drives the need for sophisticated spinning components. Combined with strong industrial support and collaboration between manufacturers and end-users, these factors position North America as the fastest-growing hub for advanced metal spinning products.

Europe Metal Spinning Products Market Trends

Europe represents a significant market for metal spinning products, driven by advanced manufacturing industries, aerospace engineering, automotive production, and precision machinery sectors. The region is known for high-quality engineering standards and strict regulatory requirements, which increase demand for durable, precise, and corrosion-resistant spinning components. Manufacturers focus on producing both standardized and complex custom-shaped products to meet stringent performance and safety specifications in aerospace, defense, and automotive applications.

Technological adoption is a key factor supporting growth in Europe. Investment in CNC-controlled spinning systems, automation, and digital simulation allows manufacturers to achieve intricate designs with tight tolerances and improved material efficiency. The region’s well-established R&D centers and skilled workforce promote innovation in alloys, lightweight components, and sustainable production processes. Collaboration between manufacturers and industrial clients also strengthens supply chains, enabling faster delivery of high-performance components. These factors collectively position Europe as a mature and strategically important market with steady demand for advanced metal spinning products.

Asia Pacific Metal Spinning Products Market Trends

Asia Pacific is projected to dominate in 2026, commanding approximately 43% of the metal spinning products market share. This leadership is supported by the robust industrial ecosystem in the region, which integrates raw material availability, advanced manufacturing infrastructure, and high-volume production capabilities. China, Japan, and India have established themselves as global hubs for automotive, aerospace, and heavy machinery manufacturing, creating sustained demand for high-precision spinning components. Competitive labor costs, growing investment in industrial automation and CNC-based metal forming technologies, and proximity to both component suppliers and end-use industries reduce lead times and operational costs, reinforcing Asia Pacific as the dominant supplier of spinning products worldwide.

A critical factor driving this dominance is the focus on technological adoption and customization capabilities in the region. Manufacturers are increasingly leveraging advanced alloys, automated tooling, and digital simulation to produce intricate geometries that meet sector-specific performance requirements. Supportive government initiatives promoting industrial growth, export incentives, and infrastructure development further encourage the expansion of high-precision metal fabrication units. These elements position Asia Pacific as the most competitive region, capable of addressing both large-scale production needs and emerging high-value applications in aerospace, automotive, and industrial machinery sectors.

The global metal spinning products market structure is moderately fragmented, comprising both established industrial manufacturers and specialized spinning companies. Leading players are estimated to account for 35% of global market share, while the remaining portion is held by regional producers. The market structure allows smaller and niche companies to compete by offering tailored solutions, catering to specific industry requirements, and responding quickly to custom orders.

Competition in the market is primarily driven by technological capability, material expertise, and the ability to deliver customized components. Market leaders maintain an edge through automation, advanced CNC machining, and integrated design capabilities, which enhance precision, production efficiency, and product quality. Continuous investment in innovation ensures their dominance and ability to meet evolving industrial demands.

The global metal spinning products market is projected to reach US$ 3.0 billion in 2026.

Rising demand for lightweight, high-precision, and durable components across automotive, aerospace, industrial machinery, and defense applications is driving the market.

The market is poised to witness a CAGR of 4.2% from 2026 to 2033.

Adoption of advanced materials, customization capabilities, automation and CNC technologies, and growth in aerospace, automotive, and defense sectors are key market opportunities.

CITIC Dicastal Wheel Manufacturing, Standex ETG, Samuel Metal Spinners, Wenzel Metal Spinning, and Helmut Rübsamen (INDUS Holding) are some of the key players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author