ID: PMRREP35013| 188 Pages | 2 Feb 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

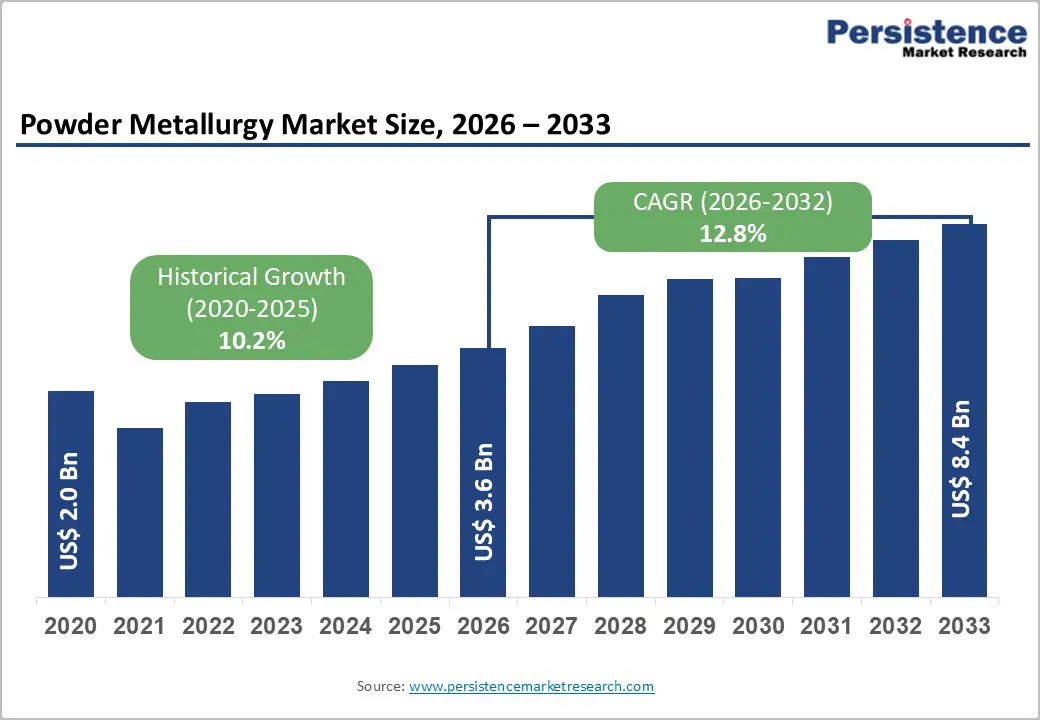

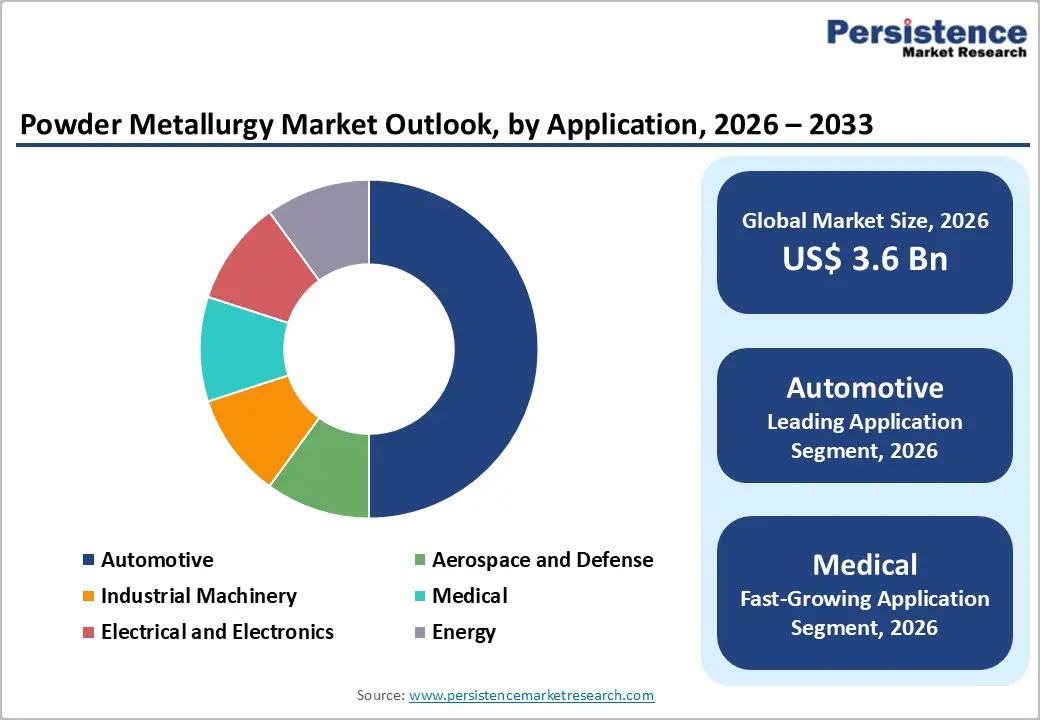

The global powder metallurgy market size is likely to be valued at US$ 3.6 billion in 2026 and is projected to reach US$ 8.4 billion by 2033, growing at a CAGR of 12.8% between 2026 and 2033.

Market expansion is driven by rapid industrialization, unprecedented automotive sector transformation toward electric vehicles and lightweight components, and increasing demand for high-performance titanium and nickel-based components from aerospace and defense industries. Regulatory pressure for sustainability and circular-economy integration, combined with technological advancement in nanostructured powders and advanced alloy development, further sustains market expansion through the forecast period.

| Key Insights | Details |

|---|---|

| Global Powder Metallurgy Market Size (2026E) | US$ 3.6 Bn |

| Market Value Forecast (2033F) | US$ 8.4 Bn |

| Projected Growth CAGR (2026 - 2033) | 12.8% |

| Historical Market Growth (2020 - 2025) | 10.2% |

The automotive sector is undergoing transformation driven by exponential growth in electric-vehicle production and expansion in sports-vehicle manufacturing, creating exceptional demand for powder-metallurgy lightweight components that enable battery efficiency optimization and vehicle performance enhancement. Powder metallurgy techniques, including sintering and metal injection molding, enable the production of complex shapes with superior mechanical properties, making them ideal for EV applications in powertrain components, drivetrain systems, engine elements, and structural parts.

Cost-effectiveness for high-volume production, combined with weight-reduction capability (aluminum sprockets weigh 450 grams versus iron equivalents at 900 grams, yielding a 50% weight advantage), directly supports fuel efficiency, emissions reduction, and extended vehicle range, particularly critical for EV battery performance. Transmission component manufacturing utilizes synchronizer cone rings and sprockets, replacing traditional forging with PM cost reduction while maintaining superior durability and wear resistance. EV drivetrain application expansion, including electric motor components, power electronics cooling systems, and lightweight structural elements, is driving sustained high-volume demand through the forecast period.

The aerospace industry is accelerating demand for turbine blades, gear components, and structural elements that require high strength-to-weight ratios and fatigue resistance, establishing a mission-critical application necessity. Military aircraft component manufacturing, including complex geometries and specialized aerospace applications, is supported by AS9100D certification, demonstrating regulatory compliance for stringent defense-sector requirements.

Powder metallurgy capability enabling advanced cooling channels within printed turbine components, extending part life while improving thermal performance, delivering competitive advantage versus traditional casting solutions. UAV component manufacturing and on-site specialized tool production reduce supply-chain delays and enhance military logistics efficiency. High-temperature superalloy development, including nickel and cobalt-based compositions, enables jet engine component production with unmatched performance characteristics, sustaining aerospace sector market leadership throughout the forecast period.

The powder metallurgy manufacturing process is inherently constrained by powder handling and flowability limitations, which often limit batch sizes to around 10 kilograms, thereby capping production throughput and reducing scalability for high-volume applications. These constraints reduce operational efficiency and increase per-unit production costs compared to conventional metalworking methods. The supply chain for high-purity and alloy-specific metal powders is highly concentrated among a limited number of global suppliers, creating vulnerabilities related to supply security, pricing volatility, and limited sourcing flexibility. This concentration restricts manufacturers’ ability to negotiate costs or rapidly scale production in response to demand fluctuations.

The requirement for high-capacity compaction presses, advanced tooling, and controlled-atmosphere sintering furnaces results in significant upfront capital investment, particularly for mass-production facilities, effectively limiting market participation to large, well-capitalized players and slowing capacity expansion in emerging markets.

Powder-metallurgy components often exhibit residual porosity within their internal structure, which can adversely affect mechanical strength, fatigue resistance, and fracture toughness compared with wrought, forged, or cast metal components. These inherent material limitations restrict the adoption of PM parts in high-load, high-impact, or safety-critical applications such as aerospace structural components or heavy-duty automotive systems.

The PM process involves complex parameter control, including powder particle-size distribution, compaction pressure, sintering temperature, and atmosphere management, which requires specialized technical expertise and precise equipment. This process complexity increases the risk of quality inconsistencies and defect formation, raising production costs and extending development cycles. Consequently, these technical barriers hinder entry for small or emerging manufacturers and limit the speed at which innovative PM solutions can be commercialized across broader industrial applications.

Rising global environmental awareness, coupled with increasingly stringent sustainability and emissions regulations, is creating a significant opportunity for powder metallurgy solutions aligned with circular-economy principles. PM inherently supports near-net-shape manufacturing, minimizing material waste and energy consumption compared to conventional machining and casting processes. The expanding use of recycled metal powders, particularly iron, aluminum, and specialty alloys, enhances sustainability credentials while simultaneously lowering raw material costs, enabling manufacturers to achieve competitive pricing in cost-sensitive industrial and automotive markets.

The shift toward mono-material component designs is gaining regulatory preference, as environmental policies increasingly discourage complex, non-recyclable multilayer structures, positioning PM as an attractive solution for compliance-driven industries. The adoption of water-based binders and advanced, low-VOC coating technologies further supports regulatory alignment in aerospace, medical, and electronics applications, where solvent-based systems face tightening restrictions. Moreover, the strategic collaboration announced in 2024 between GKN and First Phosphate to establish a lithium iron phosphate (LFP) cathode material supply chain, with ambitions to reach 400,000 tons per annum by 2033, highlights the growing role of powder metallurgy in the electric vehicle and energy-storage ecosystem, unlocking long-term demand from battery manufacturing and grid-scale storage markets.

The integration of Industry 4.0 technologies into powder metallurgy production, such as digital twins, AI-driven process optimization, real-time quality monitoring, and predictive maintenance, presents a strong opportunity to enhance manufacturing efficiency, consistency, and scalability, particularly for aftermarket and replacement parts. Digitally enabled PM production lines significantly reduce defect rates, improve material utilization, and ensure high repeatability across large production volumes, making them well-suited for cost-sensitive, high-mix aftermarket applications. Powder metallurgy’s ability to accurately reproduce complex legacy components with tight dimensional tolerances supports the manufacture of reliable replacement parts for automotive, industrial machinery, agricultural equipment, and power tools.

As global installed equipment bases continue to age, demand for durable, precision replacement components is rising, favoring PM manufacturers that leverage smart manufacturing to achieve faster scale-up, lower unit costs, and consistent quality. Early adopters of digitally optimized PM processes are therefore well positioned to capture sustained aftermarket demand while strengthening customer confidence and long-term competitive positioning in global markets.

Ferrous metals, including iron powder and steel powder, command a dominant market position with 79% market share in 2026, driven by exceptional cost-effectiveness, easy availability, and versatile application capability across diverse manufacturing sectors. The steel powder segment, capturing 45% share reflects widespread adoption for automotive components, industrial machinery, and bearing manufacturing applications. Growing steel powder utilization in additive manufacturing, particularly 3D printing applications, enabling complex component production, including automotive chassis and heavy machinery components previously difficult with traditional manufacturing methods.

High-volume automotive engine component production, including connecting rods, camshaft components, transmission synchronizers, and bearing systems, establishes mass-production economics that support cost competitiveness relative to alternative manufacturing processes. Ferrous segment forecasted to grow at a CAGR of 12.6%, reflecting a mature technology market with steady adoption across established applications, while non-ferrous metals are projected to grow at a faster 13.8% CAGR, indicating differentiation growth opportunities in aerospace and medical segments, while maintaining ferrous material dominance throughout the forecast period.

Powder Metal Hot Isostatic Pressing (PM HIP) commanding market dominance with 55% market share in 2023, driven by exceptional capability delivering fully dense, high-quality metal components, combining powder metallurgy advantages with HIP pressure densification. PM HIP process sequence, including powder manufacturing, mixing, compacting, sintering, and hot isostatic pressing, enabling advanced mechanical property achievement with consistency and reproducibility, establishing aerospace and medical application suitability. Metal Injection Molding (MIM) is capturing 47% market share and emerging as the fastest-growing process, reflecting exceptional capability for complex shape production with fine feature definition and near-net-shape accuracy.

Additive Manufacturing (3D Printing) is experiencing explosive growth momentum with powder bed fusion technology enabling unattainable design complexity, including internal cooling channels and lattice structures supporting aerospace engine advancement capability. Binder jetting scaling for high-volume complex metal part production and directed energy deposition for large near-net-shape component manufacturing, expanding additive manufacturing market participation, and supporting process-diversification growth throughout the forecast period.

The automotive sector holds a dominant position, with more than 40% market share, driven by exceptional capabilities in component manufacturing for engine systems, transmission components, and structural parts, leveraging powder-metallurgy precision and cost-effectiveness. Engine component specialization includes pistons, connecting rods, camshafts, oil pump rotors, water pump pulleys, and main bearing caps, representing a high-volume production opportunity with exceptional cost-per-unit economics. Oil-impregnated self-lubricating bearing manufacturing utilizing powder metallurgy porous structure capability for camshaft, connecting rod, and crankshaft bearing applications, delivering enhanced durability and extended service life.

Transmission synchronizer cone ring production replaces traditional forging methodology with PM near-net-shape manufacturing, achieving cost reduction while maintaining precision requirements. EV drivetrain application expansion and lightweight component positioning supporting premium margin opportunity across electric vehicle manufacturers. The aerospace and defense sector is capturing 15-25% combined share with specialized turbine blade manufacturing, gear component production, and structural element applications supporting premium pricing and margin expansion, ensuring multi-sector demand diversification throughout the forecast period.

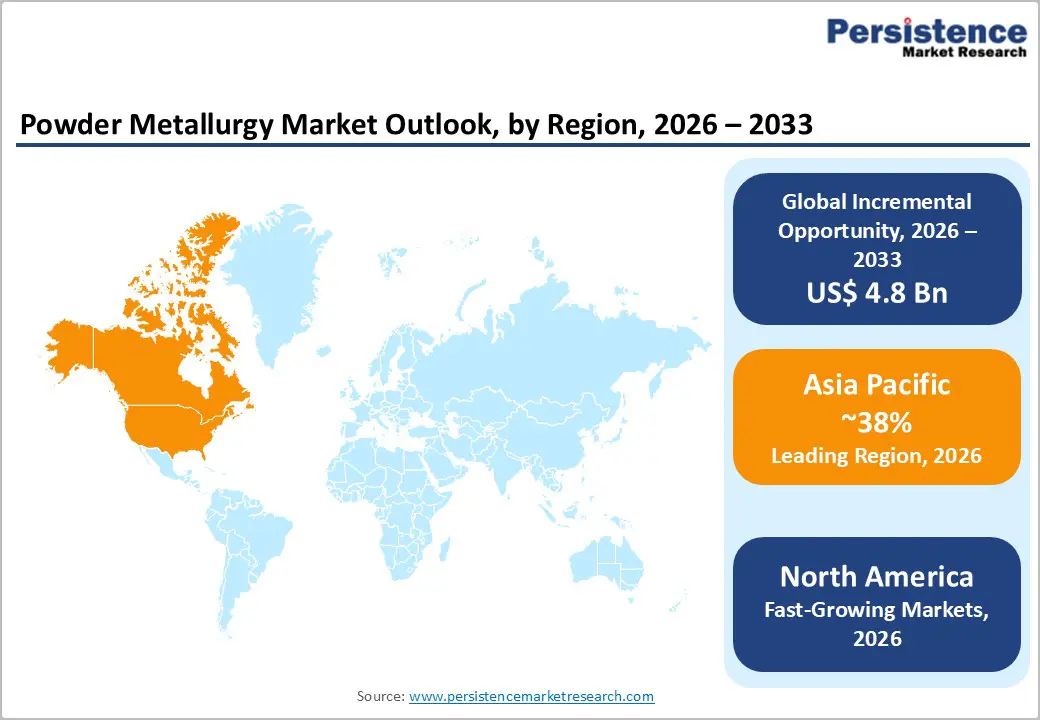

North America maintains a leading position in the global powder metallurgy market, accounting for approximately 38% of global market share in 2026, supported by a highly advanced manufacturing ecosystem and strong end-use demand from aerospace, defense, and high-value industrial sectors. Substantial public funding for advanced and sustainable manufacturing, channeled through federal research programs, continues to strengthen innovation infrastructure, material science development, and process optimization. The region’s aerospace and defense dominance, anchored by major aircraft OEMs, defense contractors, and tier-one component suppliers, generates consistent, high-volume demand for precision-engineered powder metallurgy components that meet stringent performance, reliability, and traceability requirements.

North America’s leadership in powder metallurgy is further reinforced by its strong focus on technology innovation, digital manufacturing, and early adoption of additive manufacturing and Industry 4.0 practices. Leading research institutions and private-sector R&D investments drive continuous improvements in powder production, compaction, sintering, and quality control technologies. The region has well-established metal powder supply chains, ensuring reliable access to high-quality iron, aluminum, titanium, and specialty alloy powders, which support cost optimization and production scalability.

Europe represents a mature and technologically sophisticated powder metallurgy market, characterized by high specialization in precision industrial manufacturing, automotive components, and aerospace systems. Germany is a core regional leader, leveraging its globally recognized industrial engineering capabilities, strong automotive supplier network, and advanced aerospace manufacturing expertise to sustain demand for high-performance PM components. The United Kingdom complements this strength through its innovation-driven approach, emphasizing research-intensive manufacturing, advanced materials development, and aerospace and defense applications.

Europe’s powder metallurgy market is strongly shaped by a harmonized regulatory framework that prioritizes environmental sustainability, emissions reduction, and circular-economy integration. Stringent environmental regulations and material traceability requirements are accelerating the adoption of resource-efficient PM processes, recycled metal powders, and low-waste manufacturing practices. These regulatory pressures, combined with strict quality and safety standards, encourage continuous process innovation and support the production of premium-grade components with consistent performance and long service life.

The Asia-Pacific region is the fastest-growing market for powder metallurgy, projected to expand at a CAGR of 14.4% between 2026 and 2033, driven primarily by China’s manufacturing dominance and large-scale industrial base. China accounts for nearly 35% of the regional market and is expected to grow at a CAGR of approximately 13.1%, supported by rapid industrialization, robust automotive and consumer electronics production, and expanding electric-vehicle manufacturing. Government-led initiatives focused on infrastructure development, domestic manufacturing self-sufficiency, and advanced materials innovation confer high cost and scale advantages.

India is emerging as one of the fastest-growing powder metallurgy markets globally, with an estimated CAGR of 18.0%, driven by the rapid expansion of the healthcare and pharmaceutical industries, the growth of medical device manufacturing, and the increasing adoption of additive manufacturing technologies. Government-led digital transformation and manufacturing initiatives, combined with rising private-sector investment, are accelerating the development of modern manufacturing infrastructure and the localization of component production. The increasing demand for cost-effective, precision-engineered components across the healthcare, automotive, and industrial sectors supports sustained growth momentum.

The powder metallurgy market exhibits moderate consolidation dominated by Tier 1 global manufacturers, including Höganäs AB, GKN Powder Metallurgy, and Sandvik AB, commanding substantial market share through comprehensive product portfolios, advanced manufacturing capabilities, and innovation leadership. GKN's strategic emphasis on advanced metal additive manufacturing, combined with its sustainability positioning establishing competitive differentiation.

Specialized manufacturers, including Advanced Technology & Materials, Rio Tinto, and Rusal establish competitive positions through material specialization and regional distribution networks. R&D-driven competition emphasizes powder quality improvement, advanced alloy development, and process innovation, creating continuous market dynamism. Supply chain integration and strategic partnerships (GKN-First Phosphate LFP battery collaboration) demonstrate value-chain positioning supporting sustained competitive intensity.

The global powder metallurgy market is projected to reach US$ 8.4 billion by 2033, expanding from US$ 3.6 billion in 2026 at a CAGR of 12.8%, driven by electric vehicle production surge requiring lightweight components, aerospace and defense demand for high-performance materials.

Market demand growth is driven by multiple converging factors including automotive electrification and lightweight component necessity, aerospace turbine blade and engine component demand, powder bed fusion and additive manufacturing capability advancement.

Ferrous metals command market leadership with 79% market share in 2026, particularly steel powder capturing 45% share, driven by cost-effectiveness, easy availability, extensive automotive engine component applications.

North America maintains market leadership position with 38% of global market share driven by advanced manufacturing ecosystem, strong aerospace and defense sectors, substantial DOE and NSF research investment, and well-established metal powder supply chains.

Major market opportunities include additive manufacturing process expansion with powder bed fusion enabling complex geometries and 80% material waste reduction advantage: Asia-Pacific manufacturing scale expansion with China reducing import dependency and India demonstrating 18.0% CAGR growth.

Leading market players include Höganäs AB commanding world-leading position with 250,000 tonnes annual capacity and Science Based Targets initiative validation; GKN Powder Metallurgy establishing global leadership with 10 million pieces daily production; Sandvik AB maintaining aerospace and medical specialization and emerging specialists including Advanced Technology & Materials, Rio Tinto, Rusal, CRS Holdings, and INDO-MIM capturing specialty applications and regional market segments.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Process

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author