ID: PMRREP23458| 291 Pages | 27 Jun 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

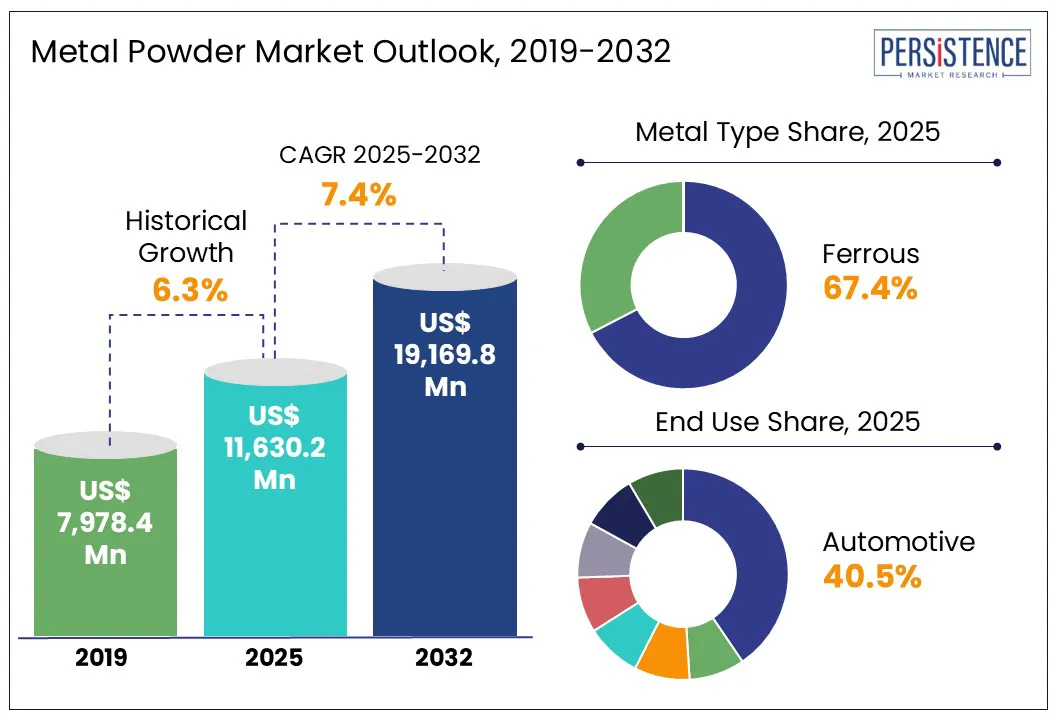

According to the Persistence Market Research report, the global metal powder market size is likely to be valued at US$ 11,630.2 million in 2025 and is expected to reach US$ 19,169.8 million by 2032, growing at a CAGR of 7.4% in the forecast period from 2025 - 2032.

The industry’s upward trajectory reflects robust adoption across various sectors, including healthcare, automotive, aerospace, and construction, all of which increasingly rely on advanced materials for precision components, lightweight structures, and enhanced performance. The dental implant industry plays a significant role in this expansion. Originally dominated by North America and Europe through major companies such as Straumann, Zimmer, and Dentsply, the segment is now experiencing a sharp rise in the Asia Pacific due to the rise in healthcare spending.

In 2020 alone, the global dental implant market grew by 5%, and projections indicate that the market in Asia Pacific is poised to grow 1.6 times faster than other regions by 2027. With titanium-based components accounting for over 90% of implant technologies, demand finely processed material inputs continues to grow, pushing forward the need for high-purity, structurally stable raw materials.

The automotive sector also contributes significantly to this momentum. In 2024, global car sales hit 74.6 million units, led by China with nearly 23 million units sold, making up 31% of global sales. The automotive industry's focus on lightweight and durable components has increased the consumption of powdered forms of metals, particularly in electric vehicle platforms. These advanced materials allow automakers to improve efficiency and structural strength while reducing weight, aligning with stringent environmental standards and evolving consumer preferences.

Key Industry Highlights:

|

Global Market Attribute |

Details |

|

Market Size (2024A) |

US$ 10,828.9 Million |

|

Estimated Market Size (2025E) |

US$ 11,630.2Million |

|

Projected Market Value (2032F) |

US$ 19,169.8 Million |

|

Value CAGR (2025 to 2032) |

7.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.3% |

A clear shift is underway in the powder-based materials industry as demand rapidly gravitates toward specialized, performance-driven applications and decentralized production models. Across sectors such as aerospace, medical devices, and maritime, companies are no longer settling for standard compositions; they want tailor-made materials that meet strict design and durability requirements. The market growth is on a positive trajectory. Titanium and nickel powders, for example, are seeing heightened interest following new facility builds in Sweden and the U.S., as manufacturers race to ensure local, certified supply for regulated industries.

Global players are aligning their production networks closer to end-use markets to overcome logistics bottlenecks and support time-sensitive innovation. Sandvik’s acquisition of Buffalo Tungsten and ATI’s launch of a fully integrated additive manufacturing facility in Florida show how the race for regional dominance is gaining urgency. This is not just about shortening lead times it’s about creating robust ecosystems that can support rapid prototyping, alloy development, and on-demand part production using advanced powder-based methods.

The growing influx of low-priced products, especially from China, continues to disrupt the global landscape for advanced powder materials. Many small and medium enterprises across Asia-Pacific, Latin America, and the Middle East lean toward budget-friendly options that prioritize affordability over long-term performance or quality. These economies, driven largely by SMEs, often operate under cost-sensitive models and avoid investing in premium raw materials. Chinese producers benefit from lower input costs, government-backed subsidies, and lenient regulations, giving them an unmatched pricing edge that global suppliers struggle to counter.

These dynamic forces premium manufacturers in Europe, Japan, and North America to compete under squeezed profit margins. Despite offering superior safety standards and tighter material specifications, these players find it hard to maintain a viable business model in price-sensitive regions. Importers overwhelmingly favor inexpensive options from China, weakening the demand for higher-grade alloy powders and reshaping the pricing structure globally. This dominance of subpar products not only dilutes quality expectations but also undermines innovation by penalizing companies committed to delivering precision and compliance.

The rapid evolution of electric mobility and additive manufacturing technologies is opening new avenues for innovation and investment in the powder metallurgy landscape. GKN Powder Metallurgy is committed to entering the permanent magnet segment tailored for electric vehicles, directly addressing the supply bottlenecks affecting EV production. Backed by solid expertise in engineered materials and well-established plants across North America and Europe, GKN has shifted its focus from development to industrialisation through a dedicated Magnets team. This move positions the company at the intersection of sustainable transport and critical materials supply.

Other global players are also capitalising on the momentum. Sandvik announced a 200 million SEK investment to build a new site in Sandviken, Sweden, to scale up its production of titanium and nickel-based fine powders, essential inputs for additive manufacturing in aerospace and medical fields.

Höganäs boosted its U.S. presence with expanded capabilities at its Pennsylvania plant, producing refined stainless-steel grades ideal for binder jetting and MIM processes. MolyWorks has reinforced this momentum by setting up a foundry in Singapore, focused on recycling-based alloy development for Asia-Pacific markets. These combined efforts reflect a strong opportunity for material providers to cater to industries prioritising lightweight, high-performance components and sustainable production practices.

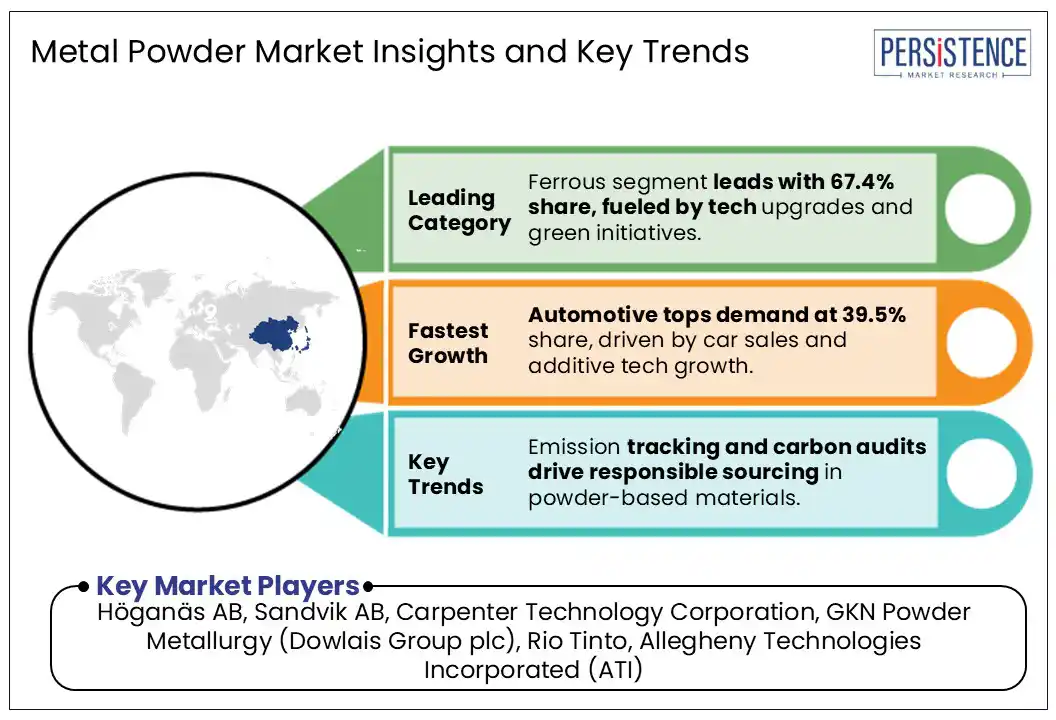

Ferrous type holds the market share of 67.4%, driven by its extensive application in automotive components, industrial tools, and additive manufacturing. Companies such as Höganäs AB and Rio Tinto have intensified their focus on sustainable innovation, with Höganäs introducing biochar to replace fossil coal in sponge iron production and Rio Tinto rolling out advanced water atomized steel grades for 3D printing. These developments reflect a clear industry shift toward high-strength, low-emission ferrous materials tailored for next-generation manufacturing.

Manufacturers are increasingly choosing ferrous-based feedstocks for their superior strength-to-weight ratio and versatility in forming complex parts. Strategic collaborations, such as the one between Höganäs and Porite TAIWAN Co., Ltd., aim to cut emissions while expanding access to near-zero-emission sponge iron alternatives.

Innovations such as Rio Tinto’s atomised steel powder also position ferrous materials at the forefront of industrial-scale 3D printing. The consistent investment in cleaner and more efficient production methods keeps this segment in a dominant position across key end-use sectors.

The automotive industry holds the largest market share of 39.5%, driven by the consistent rise in global car production and increasing integration of advanced manufacturing techniques. In 2024, global car sales reached 74.6 million units, signaling renewed strength across key regions like China, India, and North America.

This steady growth in vehicle production directly fuels the need for high-performance materials used in transmission parts, engine components, and brake systems, where precision and durability remain critical. Collaborations such as Conflux Technology and GKN Additive highlight how manufacturers now rely on 3D printed thermal solutions to meet design flexibility and efficiency goals.

These innovations increase the demand for atomized feedstocks optimized for automotive applications. As electrification and lightweighting trends accelerate, manufacturers continue to seek cost-effective, high-strength options, placing automotive at the forefront of the consumption curve in this segment.

North America holds a market share of 27.9% in 2025, driven by strong industrial momentum and high-value investments that reinforce localized manufacturing. Sandvik’s acquisition of Buffalo Tungsten has expanded domestic access to tungsten-based materials, enhancing supply stability across industries like automotive and aerospace. This move ensures that manufacturers benefit from shorter lead times and secure access to critical inputs as demand continues to grow.

The region’s aerospace and defense (A&D) sector further amplifies market potential. In 2023, the U.S. A&D industry generated over $955 billion in sales, creating a deep ripple effect across the supply chain. With nearly 60% of jobs tied directly to supply-related functions, this industrial backbone plays a critical role in sustaining demand for advanced materials, including atomized feedstocks. As labor income in the sector climbs, along with rising output and job creation, the need for high-performance input materials continues to rise in tandem.

East Asia holds the market share of 31.4%, driven by strong industrial manufacturing and rising demand from the rapidly expanding automotive sector. In China, consistent growth in vehicle production and sales has created substantial momentum. April 2025 alone recorded vehicle production of 2.619 million units and sales of 2.59 million units, reflecting year-over-year increases of 8.9% and 9.8%, respectively.

With the production of New Energy Vehicles (NEVs) reaching 1.251 million units in April, a 43.8% jump, automotive parts manufacturing, which heavily depends on fine powdered metals, has surged accordingly.

The shift toward electrification continues to reshape industrial supply chains in China, Japan, and South Korea. In China, 2023 marked a major turning point as NEV sales soared by 35% despite the withdrawal of national EV subsidies. Japan is also showing signs of consistent automotive recovery, with vehicle sales in May 2025 rising by 3.7% to over 324,000 units.

These developments increased the demand for high-performance powders used in lightweight automotive components, EV battery systems, and additive manufacturing processes. As East Asian nations push technological advancements and scale up exports, demand for such materials is poised to grow steadily.

The global metal powder market is moderately consolidated, with a few dominant companies controlling a significant share while several others operate regionally. Major players such as GKN PLC (Dowlais Group plc), Sandvik AB, Höganäs AB, and Carpenter Technology Corporation drive innovation and industrial adoption across diverse sectors, including automotive, medical, aerospace, and energy. These manufacturers are not only strengthening their technological base but are also expanding production capacities, focusing on advanced materials, and aligning with emerging sustainability standards to retain competitive advantage.

Competition is increasingly shaped by companies investing in next-generation additive manufacturing and sustainable processing technologies. The focus has shifted towards developing advanced alloy compositions, diversifying application segments, and integrating end-to-end production systems.

The global market is projected to be valued at US$ 11,630.2 million in 2025.

Ferrous type dominates the market with a 67.4% share due to its widespread use in automotive components, industrial tools, and additive manufacturing.

The market is poised to witness a CAGR of 7.4% from 2025 to 2032.

Verified emission reductions and lifecycle carbon tracking are driving demand for sustainable, responsibly sourced powder-based materials.

Strategic expansion into advanced alloys and additive technologies is creating new growth avenues in electric mobility, aerospace, and medical applications.

Key market players include GKN PLC, Sandvik AB, Höganäs AB, Carpenter Technology Corporation, and Rio Tinto.

|

Report Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value, Tons for Volume |

|

Key Regions Covered |

|

|

Key Companies Covered |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available on Report |

By Metal Type

By Production Method

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author