ID: PMRREP18259| 195 Pages | 9 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

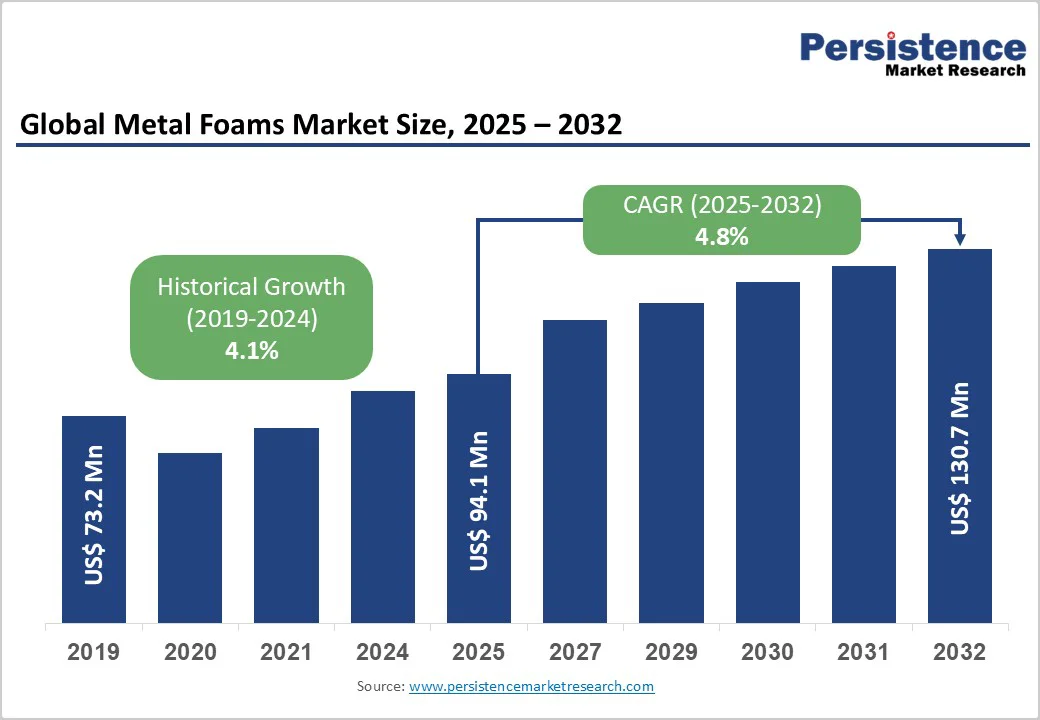

The global metal foams market size is likely to be valued US$94.1 Million in 2025, expected to reach US$130.7 Million by 2032 at a CAGR of 4.8% during the forecast period from 2025 to 2032, driven by increasing demand for lightweight materials in automotive and aerospace, rising focus on energy absorption and vibration damping in construction, and advancements in manufacturing technologies like powder metallurgy.

The market is further propelled by innovations in closed-cell aluminium foams and hybrid composites, catering to preferences for sustainable and high-performance materials. The growing acceptance of metal foams as alternatives to traditional metals, especially in impact-resistant applications, is a key growth factor.

| Key Insights | Details |

|---|---|

|

Metal Foams Market Size (2025E) |

US$94.1 Mn |

|

Market Value Forecast (2032F) |

US$130.7 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

4.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.1% |

Rising Demand for Lightweight and High-Performance Materials in Automotive and Aerospace

Manufacturers are increasingly adopting cellular metal to reduce structural weight, enhance fuel efficiency, and improve overall performance. Aluminum and hybrid metallic sponge are particularly valued for their excellent energy absorption, corrosion resistance, and thermal management properties, making them ideal for crash structures, aerospace components, and structural panels. Their vibration-damping capabilities improve passenger comfort and extend the lifespan of mechanical systems. The shift toward electric and hybrid vehicles is further boosting demand, as reducing vehicle weight directly enhances battery efficiency and driving range.

In aerospace, porous metals are used for lightweight fuselage components, insulation panels, and noise reduction applications. The combination of high strength-to-weight ratios, recyclability, and versatility across multiple applications continues to drive innovation and adoption, positioning metallic sponge as a strategic material in next-generation automotive and aerospace designs. For instance, CYMAT Technologies’ foams have achieved 30% weight reduction in EV battery enclosures, aligning with EPA emission standards and saving 20% in fuel costs. The surge in electric vehicle (EV) production, expected to reach 40 Mn units annually by 2030, has driven investments in advanced materials to US$ 100 Bn in 2025.

High Production Costs and Manufacturing Complexities

Manufacturing processes such as gas injection, powder metallurgy, and additive manufacturing require highly specialized equipment and skilled labor, making production more expensive than conventional metals. Maintaining consistency in foam structure and pore uniformity is challenging, often leading to quality control issues and reduced production efficiency. Additionally, the limited availability of raw materials and the need for precise temperature and pressure conditions during fabrication further add to operational costs.

Stringent performance and safety standards, especially in aerospace and automotive applications, lengthen product development cycles and certification processes. For example, Ultramet’s copper foam projects have faced 30% cost overruns due to stringent testing. Smaller manufacturers struggle against leaders such as Erg Aerospace, limiting penetration in cost-sensitive industrial segments where traditional alloys dominate.

Expansion in Construction and Energy Sectors with Hybrid Foams

Advancements in hybrid foamed metals are creating substantial growth opportunities, particularly in the construction, automotive, and energy sectors. These foams combine the benefits of multiple metals, offering enhanced strength, corrosion resistance, and thermal insulation. Closed-cell foams are increasingly used in building envelopes for improved energy efficiency and acoustic insulation, aligning with the growing demand for sustainable construction materials. In industrial applications, cellular metals help minimize vibrations, enhance safety, and extend equipment lifespan.

The integration of 3D printing enables greater design flexibility and customization for complex structures, while bio-based foaming agents support eco-friendly manufacturing processes. The use of hybrid and composite foams in renewable energy systems such as wind turbines, hydrogen storage, and battery components is expanding rapidly. With governments emphasizing sustainability and infrastructure modernization, the market is witnessing a surge in collaborations between material scientists and manufacturers.

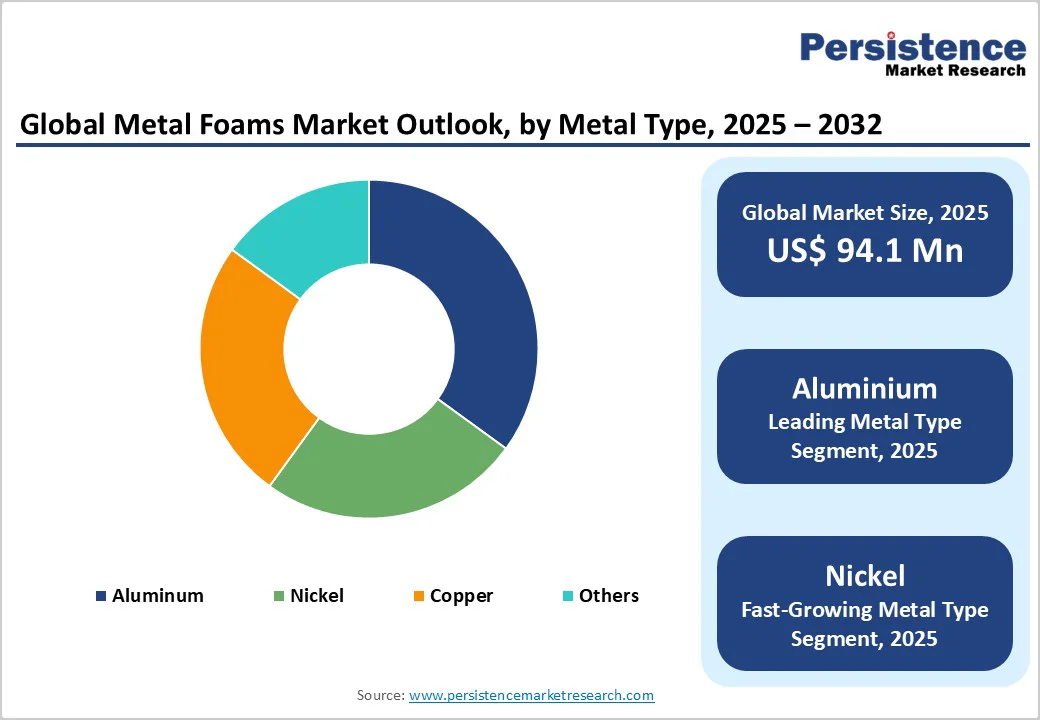

Metal Type Insights

Aluminium dominates the market, account 60% of the share in 2025, owing to its lightweight nature, excellent recyclability, and cost-effectiveness. Its superior strength-to-weight ratio and energy absorption properties make it ideal for automotive, aerospace, and construction applications, where reducing weight and enhancing fuel efficiency are key performance and sustainability priorities.

Nickel is the fastest-growing segment, driven by its exceptional corrosion resistance, strength, and thermal stability. These properties make nickel foams highly suitable for chemical processing, heat exchangers, and thermal management systems. Their durability in harsh environments and superior conductivity further boost adoption across industrial and energy applications.

End-use Insights

Automotive leads with 40% share, driven by stringent lightweighting and safety regulations. Automakers are increasingly adopting porous metals for crash absorption, vibration damping, and thermal management. Their excellent strength-to-weight ratio and recyclability make them ideal for enhancing vehicle efficiency, passenger safety, and compliance with global emission standards.

Construction is the fastest-growing, fueled by sustainable building initiatives and rising demand for eco-friendly, energy-efficient materials. Metallic foams are increasingly used in seismic-resistant panels, soundproofing, and thermal insulation applications, offering superior strength-to-weight ratios and recyclability that align with modern green construction and safety standards.

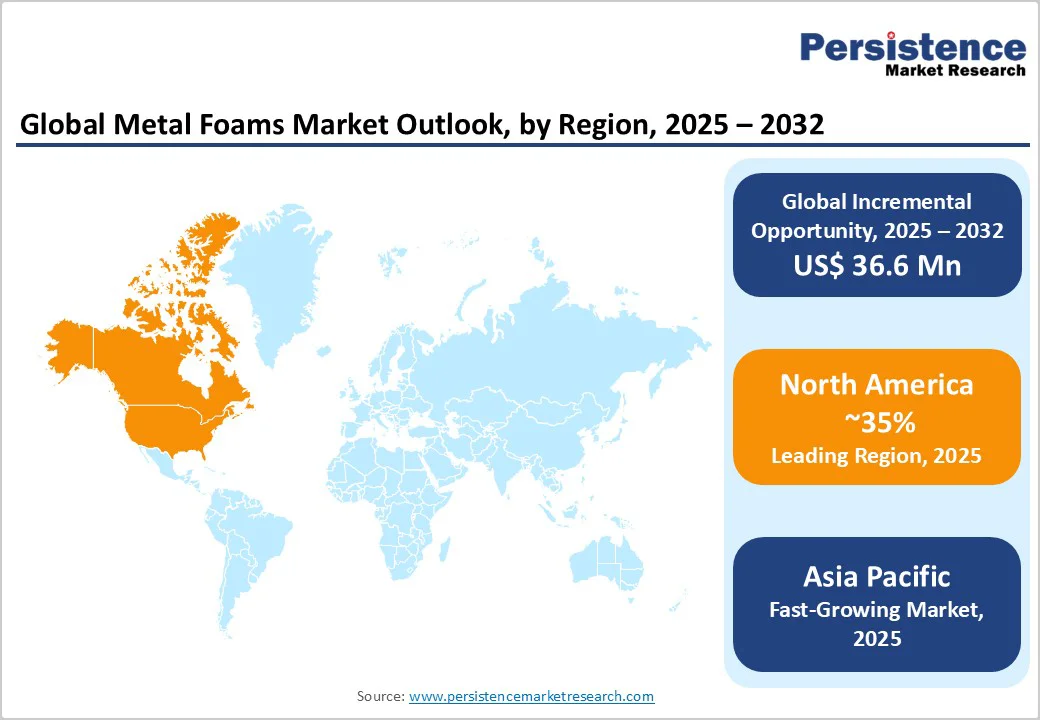

North America Metal Foams Market Trends

North America accounts for 35% in 2025, driven by substantial investments in aerospace, defense, and automotive industries, particularly in the United States and Canada. The increasing focus on fuel efficiency and emissions reduction has led manufacturers to adopt lightweight materials such as metallic foams for structural components, crash protection, and heat dissipation applications. The U.S. aerospace sector, backed by NASA and major players such as Boeing and Lockheed Martin, continues to integrate cellular metals into advanced designs for improved performance and weight optimization.

Canada’s expanding automotive and energy sectors further support market growth through innovations in energy absorption and thermal management. Interestingly, the U.K., though geographically part of Europe, exhibits similar trends, driven by Ministry of Defence (MoD) projects and strong university-led R&D efforts focusing on composite and hybrid metal foams. This growing emphasis on high-performance materials and sustainability positions both North America and the U.K. as important contributors to global technological advancements in the metal foams market.

Europe Metal Foams Market Trends

Europe holds about 25% market share, led by Germany, France, and the United Kingdom emerging as key contributors. The region’s strong industrial base, coupled with stringent environmental regulations, is driving the adoption of lightweight and energy-efficient materials across automotive, aerospace, and construction sectors. Germany leads the market owing to its advanced automotive manufacturing capabilities and continuous innovation in lightweight engineering solutions aimed at reducing carbon emissions.

France is also playing a pivotal role, supported by government-backed research programs and EU Horizon 2020 funding initiatives that encourage material innovation and sustainability. The growing emphasis on circular economy principles and the use of recyclable metals is further strengthening Europe’s position in the market. Extensive collaboration between research institutions, universities, and industry players is fostering advancements in metal foam production technologies, including powder metallurgy and additive manufacturing.

Asia Pacific Metal Foams Market Trends

Asia Pacific commands around 25% share and is the fastest-growing region, driven by rapid industrialization and infrastructure expansion in countries such as China, India, Japan, and South Korea. The region’s robust manufacturing base, particularly in the automotive, aerospace, and construction sectors, is creating significant demand for lightweight, durable, and cost-effective materials. China remains a major contributor, supported by strong government investments in green buildings, electric vehicles, and energy-efficient technologies. Meanwhile, India’s growing focus on sustainable construction and domestic manufacturing initiatives under “Make in India” is further accelerating market growth.

The rising adoption of cellular metal in energy absorption, noise reduction, and thermal management applications is expanding their use across diverse industries. Favourable government policies encouraging local production and technological innovation are also stimulating market development. With increasing R&D investments, expanding industrial infrastructure, and a focus on sustainability, Asia Pacific is expected to remain the most dynamic and influential region in the global metallic sponge market over the coming years.

The global metal foams market is highly competitive, with key players focusing on R&D and strategic partnerships to drive material innovation and expand applications. Companies are increasingly investing in research and development to enhance the mechanical, thermal, and acoustic properties of metal foams, thereby expanding their applicability across sectors such as automotive, aerospace, defense, construction, and energy. Innovation in lightweight and high-strength materials is a key focus area, driven by the rising demand for energy-efficient and sustainable solutions. Strategic partnerships, mergers, and joint ventures are commonly pursued to strengthen market presence and leverage combined expertise in production and product design. Furthermore, advancements in additive manufacturing and powder metallurgy are enabling cost-effective and customized foam structures. Players are also emphasizing eco-friendly production processes and recycling of metals to align with global sustainability trends.

Key Industry Developments

The global metal foams market is projected to reach US$94.1 Million in 2025, driven by demand for lightweight materials in automotive and aerospace.

The market is driven by automotive lightweighting initiatives saving US$ 500 Bn by 2030 and EV growth to 40 Mn units, necessitating metal foams for efficiency.

The market is poised to witness a CAGR of 4.8% from 2025 to 2032, supported by innovations in hybrid foams and construction applications.

Advancements in nickel and copper foams for thermal management offer opportunities for efficient heat dissipation in electronics and batteries.

CYMAT Technologies, Ultramet, Erg Aerospace, Mott, and Liaoning Rontec lead through innovations in aluminum and hybrid metal foams for diverse applications.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Metal Type

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author