ID: PMRREP2997| 220 Pages | 8 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

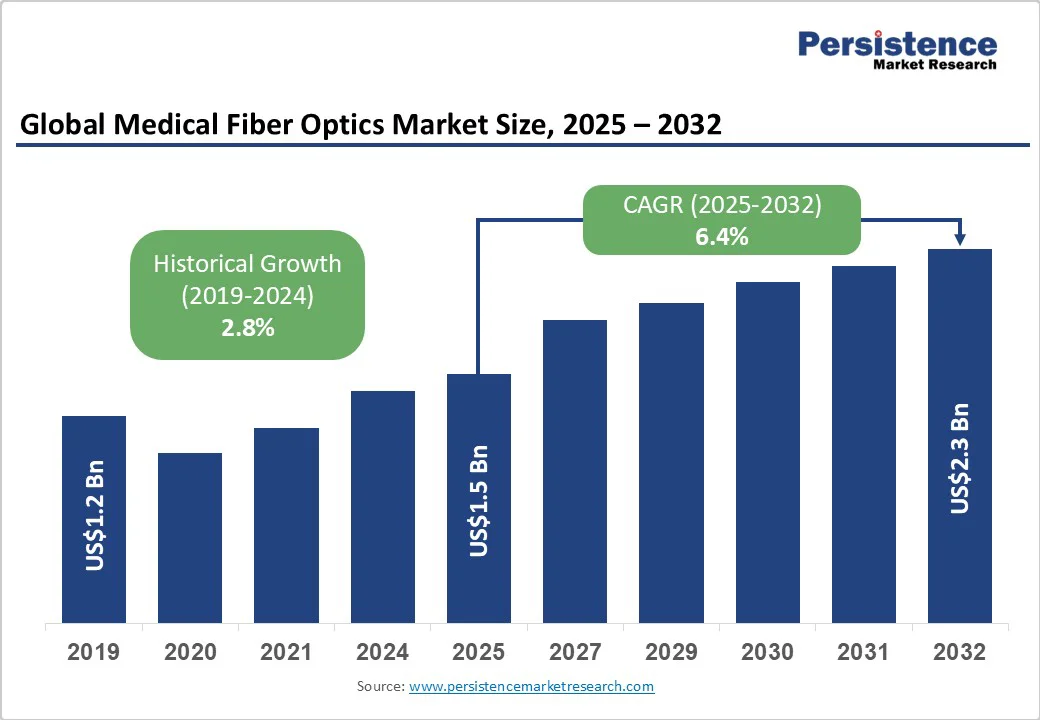

The global medical fiber optics market size is likely to be valued at US$1.5 Billion in 2025 and is estimated to reach US$2.3 Billion by 2032, growing at a CAGR of 6.4% during the forecast period 2025 - 2032, underpinned by a steady demand amid healthcare infrastructure developments, technological integrations, and rising chronic disease prevalence.

Supporting evidence includes over 40% share of fiber optics in endoscopic procedures in 2024 and growing investments in biomedical sensing, driving real-time precision and cost efficiency in healthcare.

| Key Insights | Details |

|---|---|

| Medical Fiber Optics Market Size (2025E) | US$1.5 Bn |

| Market Value Forecast (2032F) | US$2.3 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 2.8% |

The medical fiber optics market is experiencing robust growth driven by advancements in minimally invasive surgical technologies. Fiber optics enables precise light transmission and high-resolution imaging in procedures such as endoscopy and laparoscopy, reducing recovery times and hospital stays.

Regulatory support is also accelerating innovation, with the FDA approving over 150 fiber-optic-integrated devices in 2024 alone. These advancements are fostering growth in photodynamic therapy, where targeted laser delivery minimizes damage to healthy tissue.

Emerging economies, projected by the IMF to see 5.8% annual healthcare spending growth through 2030, are increasingly investing in fiber-based tools integrated with robotic systems to boost efficiency and reduce costs. Additionally, the rising global burden of chronic diseases, expected to affect over 60% of the population by 2030 according to the CDC, is intensifying demand for advanced diagnostics.

Fiber optics offers real-time, high-fidelity imaging far superior to traditional methods. Demographic shifts are further fueling the adoption of fiber-optic sensors in biomedical applications, with SPIE reporting over 95% accuracy in monitoring vital signs, enhancing patient care and outcomes.

Manufacturers and healthcare providers face significant barriers to adopting medical fiber optics due to high initial costs, often exceeding US$1,500 per unit, according to the U.S. Department of Health and Human Services (HHS).

Regulatory hurdles, such as extended validation processes by the European Medicines Agency (EMA), can delay market entry by 6-12 months, increasing development costs. Supply chain challenges, including shortages of specialty glass preforms reported by the International Trade Centre (ITC), have led to production losses of up to 15% during global disruptions such as the COVID-19 pandemic.

Regulatory delays also persist, with FDA review times for Class II fiber-optic devices averaging 18 months. Furthermore, the International Labour Organization (ILO) highlights a 20% shortage of skilled endoscopic technologists in developing regions, contributing to the underutilization of advanced fiber systems. To address these issues, companies are encouraged to diversify suppliers and invest in workforce training, especially for high-volume segments, including disposable endoscopes, to ensure long-term viability.

Emerging economies, particularly in Asia Pacific, are creating significant opportunities for medical fiber optics as governments increase healthcare infrastructure spending by billions annually. These investments are accelerating the adoption of fiber-based biosensors for real-time monitoring of chronic conditions, with notable accuracy gains.

Integration with AI and support from WHO-backed digital health initiatives are propelling the biosensing sub-market, projected to reach US$500 Million by 2032. Investors can capitalize on this growth by forming partnerships with local manufacturers to develop customized single-use fibers. This strategy could capture up to 25% of the US$300 Million gastrointestinal market, where early detection remains a critical unmet clinical need.

Multimode optical fibers are expected to retain their lead in the market, holding around 55.0% of the share in 2025. Their dominance is driven by high light-carrying capacity, ideal for high-intensity applications such as endoscopy and surgical illumination, especially as 4K imaging systems become standard.

Multimode fibers offer cost-effective short-distance transmission, making them suitable for budget-conscious hospitals while ensuring consistent performance in procedures requiring broad light distribution. Additionally, their ease of manufacturing and alignment reduces installation costs by up to 20.0% in surgical environments.

Meanwhile, single-mode optical fibers are the fastest-growing segment, projected to expand at a CAGR of 7.2% from 2025 to 2032. Known for their precision in long-distance transmission and low attenuation, they are transforming laser signal delivery in minimally invasive therapies. Growth is supported by FDA approvals for advanced cancer treatments and innovations in doping materials that improve signal integrity by 25.0%.

Single-mode fibers are gaining traction in niche areas like ophthalmic diagnostics, reducing procedural errors and advancing personalized medicine, especially in aging populations. Their integration with advanced sensors is also meeting unmet needs in biomedical monitoring, enhancing market potential in wearable medical devices.

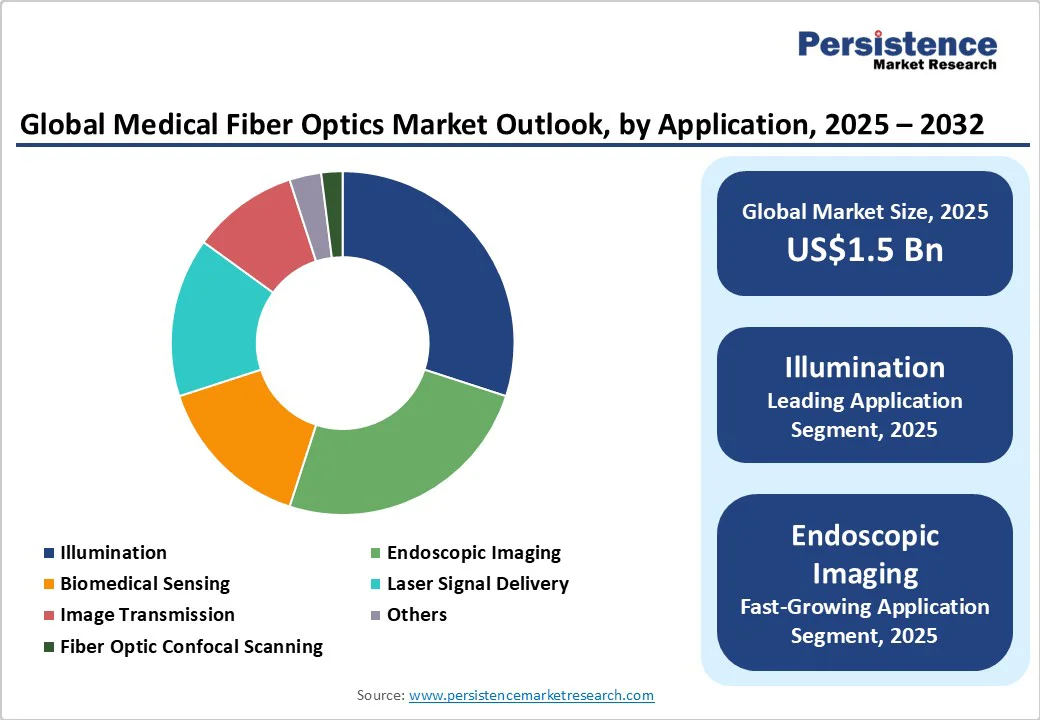

Illumination applications are projected to lead the medical fiber optics market in 2025, accounting for approximately 32.0% of total revenue. Fiber optics plays a vital role in delivering consistent, high-brightness light for surgical and diagnostic procedures, enhancing visibility and reducing operative time-particularly in complex fields like neurosurgery.

This dominance is supported by integration with LED and laser systems, offering energy-efficient, low-heat solutions aligned with WHO sustainability targets. The segment is further expanding due to growing adoption in phototherapy and light-based dermatological treatments, where fiber optics ensures uniform light distribution. Investments in reusable fiber bundles are rising as healthcare providers seek cost-effective solutions for high-frequency procedures.

Endoscopic imaging is emerging as the fastest-growing segment, forecasted to grow at a CAGR of 7.0% between 2025 and 2032. Increasing demand for high-resolution gastrointestinal diagnostics is fueling growth, with fiber optics enabling real-time 3D visualization and driving down diagnostic costs through reusable designs.

Innovations in flexible endoscopes tailored to telemedicine are creating new business opportunities. Additionally, advances in confocal scanning technology are significantly improving image clarity during minimally invasive procedures, enhancing early disease detection. Integrated AI analytics are further optimizing workflow efficiency in ambulatory care, positioning endoscopic imaging as a key frontier in the evolution of precision diagnostics.

Hospitals are anticipated to retain their market dominance, set to capture about 59.0% of the market share in 2025, as these facilities commonly leverage optic technologies for a wide array of inpatient procedures that require robust, scalable systems to handle high patient volumes and integrate with electronic health records for seamless data flow.

This segment's strength lies in its ability to adopt comprehensive fiber solutions that enhance operational efficiency amid increasing regulatory pressures for quality care. In addition, hospitals are benefiting from bulk procurement strategies that lower per-unit costs, facilitating the deployment of advanced illumination and sensing technologies in critical care units, which supports better resource allocation and patient throughput in large-scale facilities.

Specialty clinics are advancing as the fastest-growing end-user segment at a CAGR of 7.3% from 2025 to 2032, fueled by specialized applications in outpatient settings such as dermatology and ophthalmology, where portable fiber devices are addressing unmet needs for quick, accurate diagnostics and enabling cost reductions through targeted investments in ambulatory care models.

The growth is also supported by the trend toward decentralized healthcare, where specialty clinics are adopting disposable fibers to minimize infection risks, offering businesses opportunities to develop customized solutions that improve procedural speed by a sizeable margin and attract partnerships with insurance providers focused on value-based reimbursement structures.

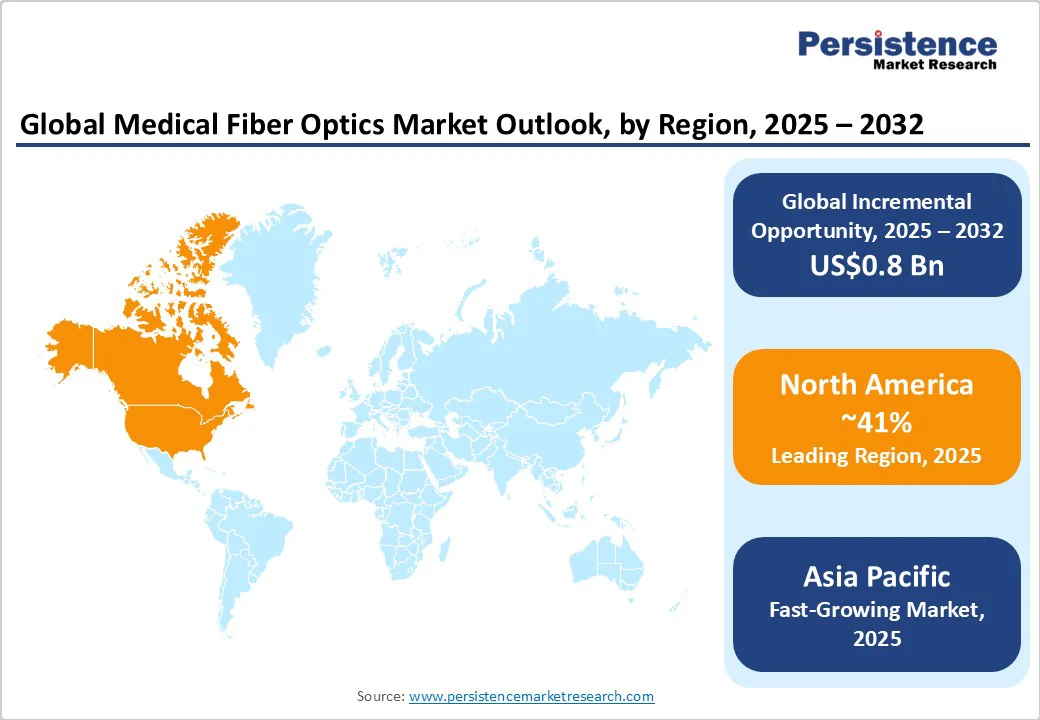

North America is expected to secure a leading market share of approximately 41.0% in 2025, benefiting from the robust U.S. market for cutting-edge medical technologies. Primary growth drivers include technological advancements in laser therapies, supported by FDA initiatives that have approved over 200 fiber-integrated devices since 2024, and demographic shifts toward an aging population projected by the U.S. Census Bureau to rise 20.0% by 2030, amplifying the demand for diagnostic imaging.

The regulatory environment, characterized by stringent yet innovation-friendly frameworks from HHS, is facilitating faster market entry while balancing safety, with competitive landscape features consolidated by major players such as Coherent Inc. through R&D investments exceeding US$500 Million annually.

Investment trends are leaning toward venture capital in biosensing startups, with opportunities in expanding telemedicine networks that could yield 18.0% ROI in underserved rural areas, advising businesses to prioritize FDA-compliant partnerships for sustained dominance.

Additionally, Canada's contributions through healthcare digitization efforts are enhancing regional synergies, where cross-border collaborations are reducing supply chain dependencies and fostering innovation in high-precision fibers for oncology applications.

Europe is anticipated to achieve a 28.0% market share in 2025 at a CAGR of 6.8% through 2032, powered by a strong demand for advanced healthcare solutions across Germany and the U.K., where a rise in endoscopic volumes driven by NHS efficiencies is predicted.

Key drivers encompass regulatory harmonization under the EMA, which is streamlining approvals and reducing timelines, alongside technological convergence in France and Spain, where R&D spending from the European Commission totals EUR 300 million for photonics.

The competitive landscape remains fragmented, with players such as Schott AG leading through localized manufacturing, while investment trends favor green tech integrations, offering opportunities in policy-aligned expansions that could boost margins in oncology niches.

Firms can engage in cross-border collaborations to navigate Brexit-related trade dynamics, ensuring resilient growth. Furthermore, Eastern European countries such as Poland are emerging as cost-effective manufacturing hubs, contributing to supply chain diversification and supporting the region's push toward sustainable medical technologies.

Asia Pacific is poised to be the second-largest regional market for medical fiber optics with a 31.0% share in 2025, surging at the highest CAGR of approximately 7.4% during 2025 - 2032, with China and Japan leading through healthcare exports. Manufacturing advantages in India and ASEAN, where low-cost production cuts fiber prices by 20.0%, and policy changes steered by infrastructure through the Asian Development Bank (ADB) are contributing immensely to the market growth here.

Regulatory impacts from bodies such as China's National Medical Products Administration (NMPA) are accelerating approvals, fostering a competitive environment with local innovators, while investments in 5G-enabled diagnostics present opportunities for growth in biosensing.

In addition, South Korea's focus on medical tourism and Thailand's healthcare reforms are amplifying demand for affordable fiber solutions, enabling market entrants to capture share through localized R&D centers that address region-specific needs such as portable diagnostics for rural populations.

The global medical fiber optics market is moderately consolidated, with the top five players-led by Coherent Inc., Schott AG, and Leoni, holding about 45% market share. An HHI of ~1,200 reflects this structure, where large firms leverage economies of scale in fiber drawing and coating.

Key players differentiate through vertical integration, such as securing silica supply chains to lower costs and compete in emerging markets. Strategic acquisitions of mid-tier specialists are enhancing product portfolios, particularly in biosensing and laser delivery systems. These tactics strengthen competitive positioning and broaden market reach in high-value and specialized medical applications.

The medical fiber optics market is projected to reach US$1.5 Billion in 2025.

Rising chronic disease prevalence worldwide and ongoing advancements in minimally invasive surgical technologies, where fiber optics are enabling precise light transmission and high-resolution imaging in procedures such as endoscopy and laparoscopy, are driving the market.

The medical fiber optics market is poised to witness a CAGR of 6.4% from 2025 to 2032.

Higher budgetary allocations to modern healthcare technologies in developing economies and the integration of fiber-based biosensors with artificial intelligence platforms are key market opportunities.

Coherent Inc., Schott AG, and Leoni AG are some of the key players in the medical fiber optics market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Fiber Type

By End-user

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author