ID: PMRREP33657| 210 Pages | 14 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

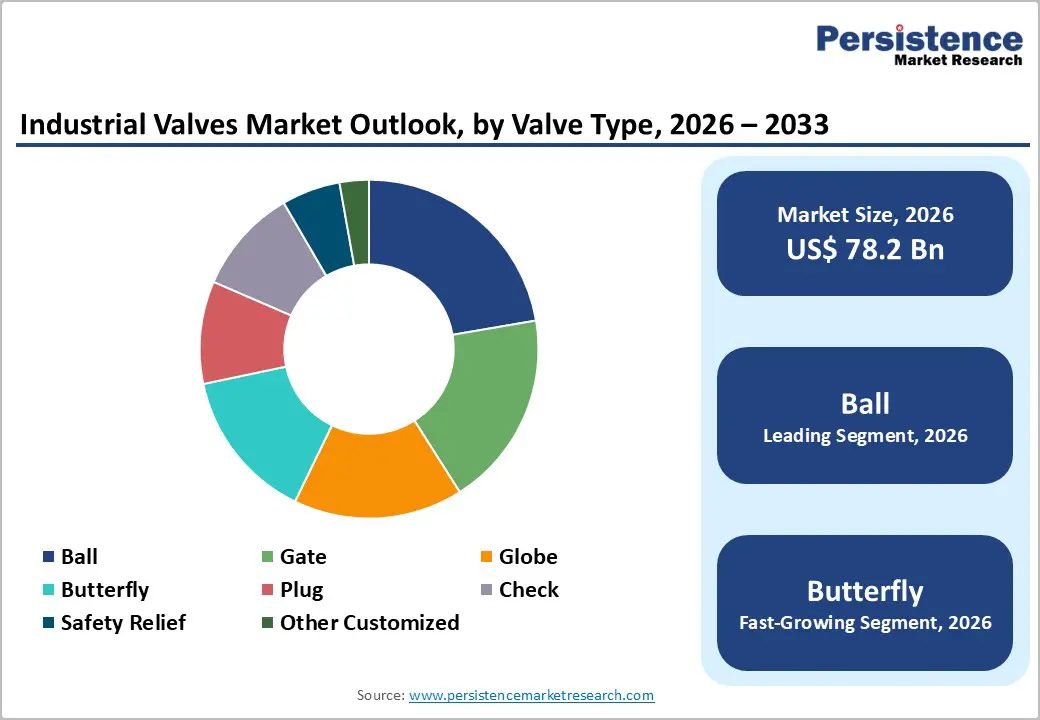

The global industrial valve market size is likely to be valued at US$ 78.2 billion in 2026 and is projected to reach US$ 107.3 billion by 2033, growing at a CAGR of 4.6% between 2026 and 2033.

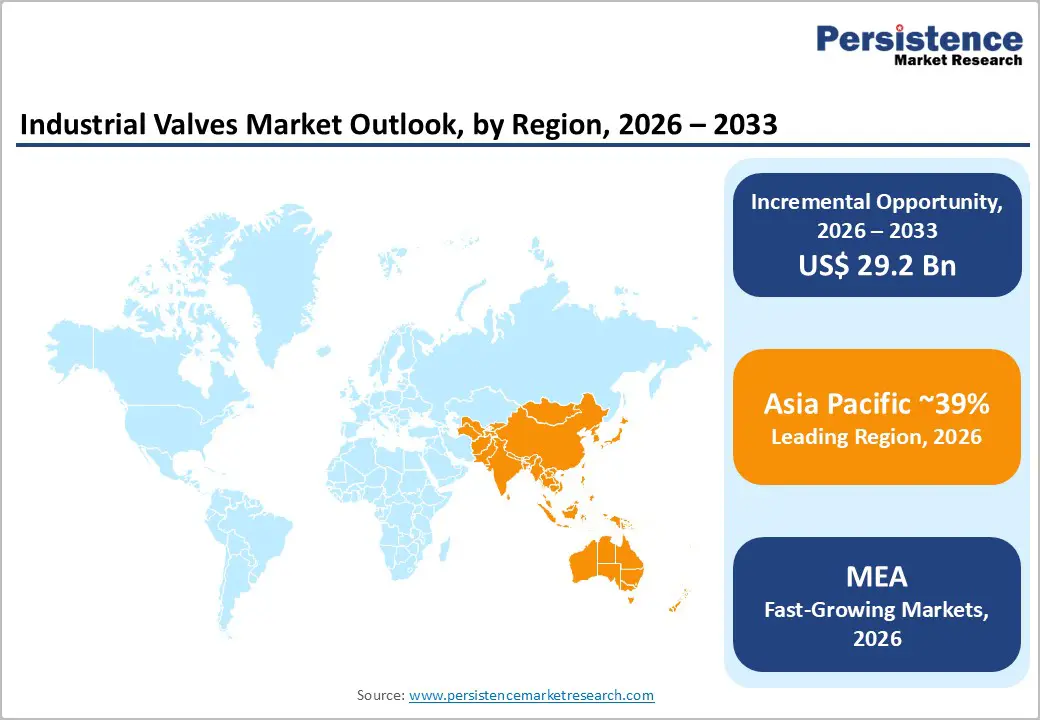

Market expansion is driven by sustained oil and gas infrastructure investment supporting energy security and LNG production expansion, systematic water and wastewater treatment facility development addressing global environmental requirements, and accelerating automation adoption, including IoT integration enabling predictive maintenance and operational optimization. Asia-Pacific dominates global markets with ~39% regional share, driven by rapid industrialization in China, India, and Southeast Asia, while Americas Industrial Valve Market maintains ~30% of global market share with sophisticated regulatory frameworks and advanced technology adoption supporting premium equipment deployment.

| Key Insights | Details |

|---|---|

| Industrial Valves Market Size (2026E) | US$ 78.2 Billion |

| Market Value Forecast (2033F) | US$ 107.3 Billion |

| Projected Growth CAGR (2026 - 2033) | 4.6% |

| Historical Market Growth (2020 - 2025) | 4.0% |

Global oil and gas sector capital expenditure continues systematic expansion, supporting upstream exploration, midstream pipeline infrastructure development, and downstream processing facility modernization. Rising energy demand and geopolitical diversification requirements are creating sustained industrial valve deployment across critical operational phases. Global LNG production expansion is forecast at 12-16 billion cubic feet per day through 2026, according to the U.S. Energy Information Administration, highlighting accelerating energy infrastructure needs supporting cryogenic valve deployment and extreme-duty applications. Asia-Pacific infrastructure investments are estimated at USD 1.7 trillion annually through 2030, per the Asian Development Bank, supporting refinery expansion, pipeline networks, and upstream extraction infrastructure development. The shale gas revolution in North America and unconventional resource development globally continue driving exploration and production activity requiring specialized high-pressure valve solutions. LNG terminal construction, liquefaction facility development, and offshore deepwater exploration further drive demand for premium valve technologies.

Industrial automation advancement including IoT connectivity, artificial intelligence analytics, and cloud-based management platforms are systematically transforming valve deployment strategies, enabling operational efficiency optimization, predictive maintenance deployment, and sophisticated real-time process control supporting next-generation manufacturing competitiveness. Smart valve technology integration, enabling remote monitoring, automated performance adjustment, and predictive failure analysis, represents an emerging market standard supported by organizational adoption across process industries. IoT platform development supporting real-time performance monitoring across geographically distributed facilities enables centralized operational intelligence and optimized maintenance strategies. Predictive maintenance algorithms analyzing sensor data enable proactive intervention prior to failure occurrence, reducing catastrophic equipment damage and extending asset lifecycle. Automation integration, supporting labor cost reduction and operational complexity minimization, drives adoption particularly across developed economy markets. Industry 4.0 manufacturing transformation initiatives drive systematic adoption of connected valve solutions, enabling comprehensive equipment communication and integrated process control supporting digital manufacturing competitiveness.

Industrial valve system deployment exhibits substantial capital requirements and complex integration processes, with sophisticated equipment, specialized installation services, and technical training creating significant adoption barriers, particularly for cost-constrained organizations in developing economies. Premium valve technology pricing relative to conventional alternatives limits adoption among budget-conscious organizations despite superior operational performance and lifecycle value. Supply chain disruptions and manufacturing capacity constraints limit equipment availability during demand surge periods, constraining market growth and delaying customer acquisition. Skilled labor scarcity in emerging markets for installation, integration, and ongoing maintenance creates operational challenges limiting market penetration. Raw material price volatility affecting steel, bronze, and specialty alloys influences manufacturing costs and pricing strategies, affecting market competitiveness.

Global energy transition momentum and decarbonization mandates create uncertainty regarding long-term fossil fuel industry capital expenditure patterns, with potential investment delays affecting oil and gas sector equipment procurement and growth trajectories. Climate-related regulatory initiatives and renewable energy transition policies threaten traditional fossil fuel industry expansion and equipment procurement strategies. Financial sector constraints on fossil fuel industry lending create capital availability challenges, limiting industry expansion and infrastructure investment. Policy uncertainty regarding long-term regulatory framework direction creates organizational hesitation regarding substantial capital commitments in traditional energy sectors, affecting equipment procurement timing and investment prioritization.

Emerging market infrastructure development and mining industry expansion create growth opportunities for industrial valve suppliers, with India planning natural gas pipeline network expansion from 16,000 km to 35,000 km by 2025, with investments reaching USD 55 billion, demonstrating substantial infrastructure modernization supporting valve technology deployment. Chinese industrial automation investments totaling RMB 238 billion (USD 36.8 billion) in 2023 demonstrate a sustained commitment to manufacturing modernization, supporting smart valve adoption. Mining and mineral extraction expansion across emerging markets creates process control valve deployment opportunities supporting operational efficiency and worker safety. Light rare earth element extraction supporting renewable energy and technology manufacturing creates specialized valve demand for chemical processing applications.

Smart valve technology platform development, integrating advanced sensors, cloud connectivity, and AI-driven analytics, represents a significant market opportunity, with Flowserve’s USD 290 million MOGAS acquisition in August 2024 highlighting strategic focus on installed base expansion and aftermarket revenue growth supporting sustainable profitability models. Predictive maintenance capabilities enable transition from reactive to proactive maintenance strategies, delivering cost reduction and operational efficiency improvements. Connected valve solutions enabling real-time performance monitoring support environmental compliance and energy efficiency optimization across industrial facilities. Ongoing digital transformation initiatives are accelerating the adoption of integrated valve platforms, enhancing asset visibility and long-term reliability across critical process industries worldwide.

Cast steel valve construction commands approximately 49% of the global industrial valve market share, representing the predominant material selection for high-pressure applications, extreme temperature environments, and demanding applications requiring robust material properties and superior stress tolerance across diverse industrial sectors. Cast steel delivers cost-effective premium performance across oil and gas, chemical processing, power generation, and water treatment sectors. Manufacturing flexibility enables customized valve geometries and pressure ratings, while established infrastructure and supplier networks ensure competitive pricing and reliable supply availability.

Bronze valve construction represents fastest-growing material segment, expanding at 5.5% CAGR, driven by superior corrosion resistance characteristics, marine environment applicability, and specialized chemical compatibility requirements supporting emerging application domains including coastal industrial facilities and advanced chemical processing systems. Bronze material properties supporting extended service life in corrosive environments justify premium pricing for specialized applications.

Manual valve operation maintains market dominance with ~57% of market share, reflecting established preferences for operator control, cost efficiency, and reliability across process industries where manual intervention provides operational flexibility and safety assurance. Manual valve operation eliminates energy requirements and complex automation infrastructure supporting cost optimization. Operator control capabilities supporting adaptive response to changing process conditions drive sustained preference. Established maintenance infrastructure and operator familiarity support operational reliability and reduced training requirements.

Automatic valve operation systems expand at 5.3% CAGR, driven by labor cost reduction, operational consistency improvement, and integration with digital control systems supporting advanced process automation and Industry 4.0 adoption. Automatic systems eliminate manual labor requirements supporting operational cost reduction. Integration with electronic control systems and remote monitoring platforms drive adoption supporting advanced facility management capabilities.

Ball valve technology holds around 22% share of the global industrial valve market, reflecting its versatility as a flow control solution across wide pressure ranges, temperature conditions, and diverse fluid characteristics. Widespread deployment is supported by proven reliability and operational simplicity across multiple industrial sectors. Full-bore geometry eliminates internal flow restrictions, enabling minimal pressure drop and improved system efficiency. Bidirectional flow control capability, along with floating and trunnion-mounted design variants, supports diverse application requirements in oil and gas, chemicals, power generation, water management, and general industrial processing environments.

Butterfly valve technology represents the fastest-growing valve type segment, expanding at 5.4% CAGR, driven by compact design advantages, lightweight construction, and cost-effective positioning across power generation, water treatment, and industrial processing. The High Performance Butterfly Valve Market accounts for approximately USD 5.5 billion in 2025 comes under this category, supported by superior sealing capability and durability. Compact installation characteristics drive adoption in space-constrained applications, while advanced configurations, including triple-offset designs, enhance performance under high-pressure and high-temperature operating conditions.

Oil and gas industry applications command approximately 33% of global industrial valve market share, driven by upstream extraction, midstream transportation, and downstream refining requirements supporting critical operational functions including pressure management, flow isolation, and safety protection. Upstream exploration and production operations require sophisticated valve infrastructure supporting high-pressure extraction and gas processing. Midstream pipeline infrastructure supporting energy distribution across continental networks represents substantial valve deployment opportunity. Downstream refining facilities require diverse valve types supporting processing operations and environmental compliance.

Power generation represents the fastest-growing end-use segment, expanding at 5% CAGR, driven by thermal capacity additions, renewable energy development, and modernization initiatives across emerging markets. Thermal plants require extensive valve systems for steam and cooling management, while renewable and nuclear projects drive demand for specialized, high-reliability, and premium valve technologies.

North America maintains substantial market position as 30% of global market, with the United States commanding 76% of North American market share, driven by extensive oil and gas infrastructure, sophisticated water treatment systems, mature industrial base, and advanced technology adoption supporting premium equipment deployment. U.S. natural gas production represents 78% of domestic energy supply, creating sustained infrastructure demand supporting upstream, midstream, and downstream operations.

Refinery infrastructure supporting domestic fuel supply and petrochemical production requires continuous equipment modernization. Water infrastructure supporting municipal supply and wastewater treatment across diverse geographic regions creates baseline valve demand. EPA environmental regulations and safety standards establish framework supporting technology advancement and market development. Major industrial clusters including Gulf Coast petrochemical complex and diverse manufacturing centers sustain regional market leadership. Technology innovation ecosystem and premium equipment deployment support advanced valve development and market growth.

Europe demonstrates significant market presence with 4.6% CAGR expansion, supported by a stringent regulatory environment, advanced technology infrastructure, and a diverse industrial base enabling sophisticated valve technology adoption across chemical processing, power generation, and water treatment sectors. Germany, France, the United Kingdom, and Spain represent primary deployment centers supporting premium solution adoption and advanced feature development. The European environmental regulatory framework, emphasizing emissions reduction and energy efficiency, accelerates technology advancement and product innovation.

Industrial modernization initiatives and a strong sustainability focus reinforce the adoption of advanced valve technologies. Established manufacturing infrastructure, skilled engineering talent, and deep technical expertise support competitive positioning, export strength, and regional market leadership. A strong industrial footprint across chemical, pharmaceutical, oil and gas, utilities, and renewable energy sectors sustains long-term demand for high-performance, compliant, and digitally enabled industrial valve solutions across mature and emerging European end-use industries.

Asia Pacific dominates global markets, commanding a 39% regional market share, driven by rapid industrialization, substantial infrastructure investment, cost-competitive manufacturing, and accelerating technology adoption supporting expansion across diverse industrial verticals. China represents the largest market, where extensive commercial development, transportation infrastructure, and government-led industrial initiatives drive significant valve demand. Industrial automation investments in China, totaling RMB 238 billion in 2023, demonstrate a sustained commitment to manufacturing modernization. Japan exhibits advanced technology adoption, enabling sophisticated valve integration. India’s natural gas pipeline expansion from 16,000 km to 35,000 km by 2025 creates substantial deployment opportunities. Southeast Asian economies show sustained growth potential, while manufacturing cost advantages enhance regional competitiveness and global export positioning. Continued urbanization, energy transition projects, and water infrastructure investments reinforce long-term demand for industrial valves across power, chemicals, utilities, and manufacturing sectors throughout the Asia Pacific.

The global industrial valve market is highly consolidated, dominated by multinational manufacturers with broad portfolios, deep customer relationships, and strong technical expertise across oil and gas, chemicals, water treatment, and power generation. Leaders, including Emerson, Flowserve, Crane, SLB Cameron, KSB, and IMI, benefit from scale barriers. Flowserve’s Velan and MOGAS acquisitions reinforce ongoing consolidation trends reshaping competitive industry structure globally.

The global Industrial Valve Market is valued at US$ 78.2 billion in 2026 and is projected to reach US$ 107.3 billion by 2033, supported by oil and gas infrastructure expansion, water and wastewater development, and automation adoption. Asia-Pacific leads with 39% share, while North America holds nearly 30%.

Market growth is driven by oil and gas infrastructure expansion, accelerating automation and Industry 4.0 adoption, and tightening environmental and regulatory compliance requirements across industrial operations.

The market is projected to grow at a 4.64% CAGR between 2026 and 2033.

Key opportunities include water and wastewater infrastructure expansion, emerging market pipeline and energy projects, mining sector growth, and smart valve adoption, enabling aftermarket monetization and predictive maintenance.

Key players include Emerson Electric, Flowserve, Crane Co., SLB (Cameron), KSB, and IMI, supported by regional specialists, with ongoing consolidation driven by strategic acquisitions and digital platform expansion.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Valve Type

By Material Type

By Function

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author