ID: PMRREP32484| 191 Pages | 7 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

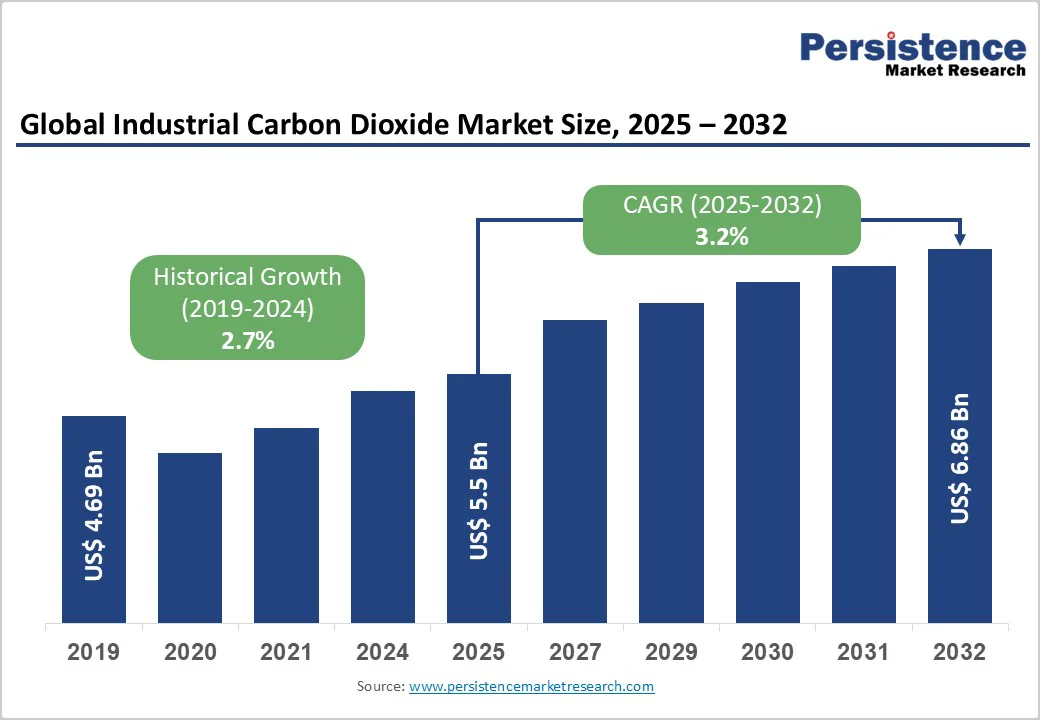

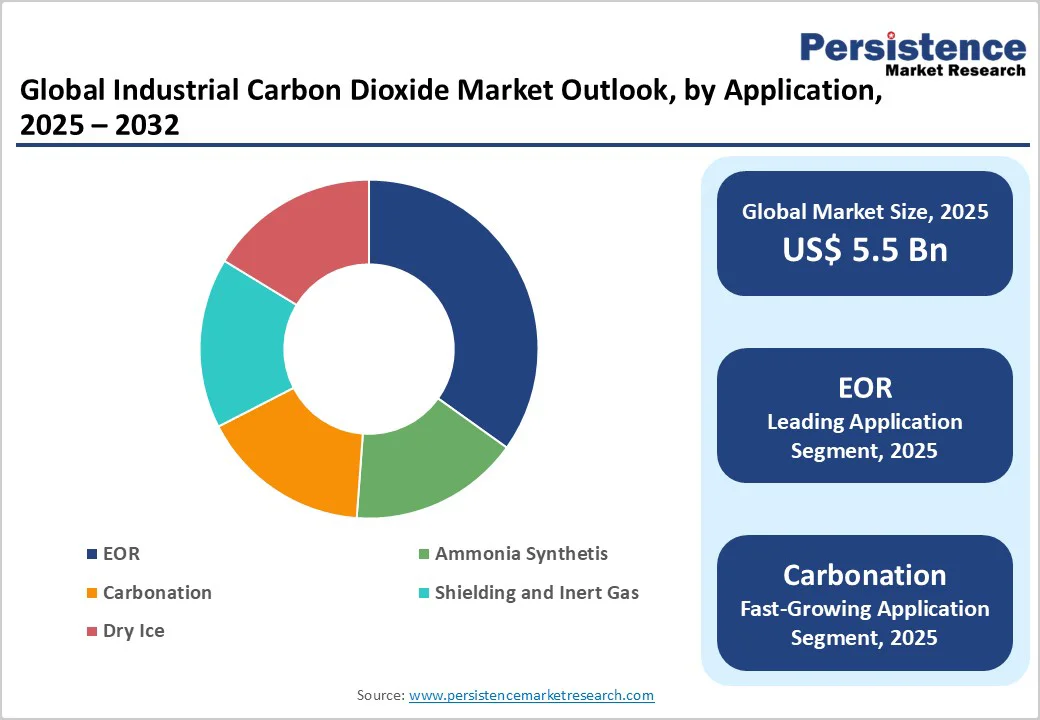

The global industrial carbon dioxide market size is likely to value at US$ 5.5 billion in 2025 and is projected to reach US$ 6.9 billion by 2032, growing at a CAGR of 3.2% between 2025 and 2032. The market is expanding due to rising demand across key sectors such as food and beverage for carbonation and oil and gas for enhanced oil recovery (EOR), supported by advancements in carbon capture and utilization (CCU) technologies that transform CO2 into valuable products. This growth is underpinned by industrial processes generating CO2 as a byproduct from natural gas processing and ammonia production, which supply reliable volumes for purification and distribution.

| Key Insights | Details |

|---|---|

|

Industrial Carbon Dioxide Market Size (2025E) |

US$ 5.5 Bn |

|

Market Value Forecast (2032F) |

US$ 6.9 Bn |

|

Projected Growth CAGR (2025-2032) |

3.2% |

|

Historical Market Growth (2019-2024) |

2.7% |

The food and beverage industry's expansion primarily drives growth, as CO2 is primary ingredient for carbonation in soft drinks and beer production, preserving freshness in packaging, and freezing in food processing. The sector accounts for over 40% of domestic CO2 use in regions like the U.S., driven by population growth and urbanization that boost processed food sales. Global urbanization and consumer preference for convenient, packaged foods have increased this demand, with the sector accounting for a significant portion of CO2 consumption due to its reliance on high-purity CO2 for safety and quality standards.

Furthermore, CO2's role in quick-freezing applications reduces spoilage losses by up to 30%, enhancing supply chain efficiency and supporting export markets, which collectively propel market expansion by ensuring reliable revenue streams for suppliers. According to industry associations, the beverage sector's growth in emerging markets has led to higher CO2 utilization, enhancing market stability. This driver positively impacts the market by ensuring steady volumes from byproduct sources such as ethanol plants, supporting purification investments, and distribution networks.

EOR techniques using CO2 injection are driving market growth by improving oil extraction from mature reservoirs, particularly in regions with abundant natural gas supplies. The EOR process improves extraction rates by reducing oil viscosity and mobilizing reserves, potentially recovering an additional 10-20% of original oil in place, as evidenced by U.S. Department of Energy reports on successful projects.

This technique is widely adopted in the oil and gas sector, with global CO2-EOR projects consuming around 50 Mtpa of CO2, supported by energy security needs and technological advancements in injection systems that enhance recovery efficiency. With global oil demand persisting amid energy transitions, CO2-EOR provides economic incentives for operators to source and transport industrial CO2, fostering infrastructure development. Integration with the Oil and Gas Pipes Market facilitates seamless CO2 transport to reservoirs, minimizing infrastructure costs

Stringent regulations on CO2 emissions and handling pose significant barriers, as governments impose limits on industrial releases to combat climate change, increasing compliance costs for producers by up to 20-30% through mandatory capture and reporting requirements. Strict regulations on greenhouse gas emissions, such as those from the EPA and EU ETS, impose compliance costs on CO2 production and handling.

In the U.S., the Environmental Protection Agency (EPA) enforces standards under the Clean Air Act, which restrict CO2 venting during production and transport. Such rules, including emission caps and carbon pricing, increase operational expenses for producers, with penalties up to €100 per excess tonne in Europe, deterring small-scale operations. As a result, the market faces barriers in regions with aggressive decarbonization targets, potentially shifting focus from utilization to sequestration and raising supply chain complexities.

The expense of capturing and purifying CO2 from industrial sources like ammonia plants creates a restraint, with costs ranging from $30-60 per tonne depending on technology, as per NETL assessments. Fluctuations in feedstock availability, such as seasonal ethanol production dips, can reduce CO2 output by 15-25% during peak demand periods.

Natural disasters or energy price volatility further exacerbate this, with historical events like the 2021 Texas freeze halting CO2 supplies from natural gas processing, impacting downstream industries like food processing. Such events negatively affect market accessibility, particularly for emerging CCU projects, and slow adoption in developing regions despite growing demand.

The integration of carbon capture and utilization (CCU) technologies presents a substantial opportunity, enabling industries to repurpose the captured CO2 into valuable products like chemicals and fuels, with the potential to abate up to 90% of emissions from sources such as power plants and cement production. Emerging technologies, including direct air capture (DAC) and sorption-enhanced processes, are scaling up, with pilots demonstrating over 80% conversion efficiency, as reported by the World Economic Forum.

Recent advancements, including the EU's Carbon Management Strategy adopted in May 2024, incentivize CCU deployment through funding for pilot projects, projected to create demand for 50 Mtpa of captured CO2 by 2030 in building materials and synthetic fuels. This aligns with the Carbon Credit/Carbon Offset Market, where monetizing captured CO2 via credits enhances profitability.

The shift toward green ammonia production offers key opportunities, as CO2 is a critical feedstock in synthesis processes powered by renewables, supporting the global transition to low-carbon fertilizers and fuels with an expected demand surge of 20-30% by 2030 driven by agricultural needs. Policy support, such as the U.S. 45Q tax credit providing up to US$ 50 per ton for CO2 utilization, encourages investments in CO2-intensive ammonia plants, particularly in regions with abundant renewables like the Middle East and Asia Pacific. This opportunity targets the fastest-growing end-uses in agriculture and energy storage, where the integration of the Green Ammonia market with CO2 from industrial sources can reduce production costs by 15%, positioning market participants to capture significant shares in the expanding sustainable chemicals landscape.

Among sources, natural gas processing leads the industrial carbon dioxide market with approximately 31% share, attributed to its abundant availability as a by-product from hydrocarbon extraction and refining processes, which generate high-purity CO2 suitable for industrial applications. This dominance is supported by global natural gas production exceeding 4 trillion cubic meters annually, ensuring a steady supply chain integrated with energy infrastructure, as seen in major fields in the U.S. and the Middle East where recovery rates reach 95%. The segment's leadership is further justified by cost efficiencies, with CO2 from natural gas costing 20-30% less than alternatives, driving adoption in high-volume uses like EOR and aligning with the Oil and Gas Pipes Market for efficient transport.

In applications, EOR commands the leading position with around 30% market share in the industrial carbon dioxide market, driven by its effectiveness in revitalizing aging reservoirs and extending field life in oil-producing regions. Statistical data from the U.S. Department of Energy indicates that CO2-EOR projects have recovered over 400 billion barrels of additional oil globally, with injection volumes surpassing 50 Mtpa annually, underscoring its economic viability through improved recovery rates of up to 60%. This segment's prominence is bolstered by technological refinements in CO2 flooding, reducing injection pressures and enhancing sweep efficiency, making it indispensable for energy security in mature markets such as North America.

Food & beverage holds the leading position in end-use industries at about 34% market share, owing to CO2's critical role in carbonation, chilling, and modified atmosphere packaging to extend shelf life. According to industry associations, this sector consumes over 70% of CO2 from ethanol by-products in the U.S., with beverage carbonation alone accounting for 25 Mtpa worldwide, supported by consumer trends toward sparkling waters and ready meals. This leadership is justified by stringent purity requirements (over 99.9%) and regulatory compliance under FDA and EFSA standards, outpacing sectors like oil & gas due to consistent, year-round consumption worldwide.

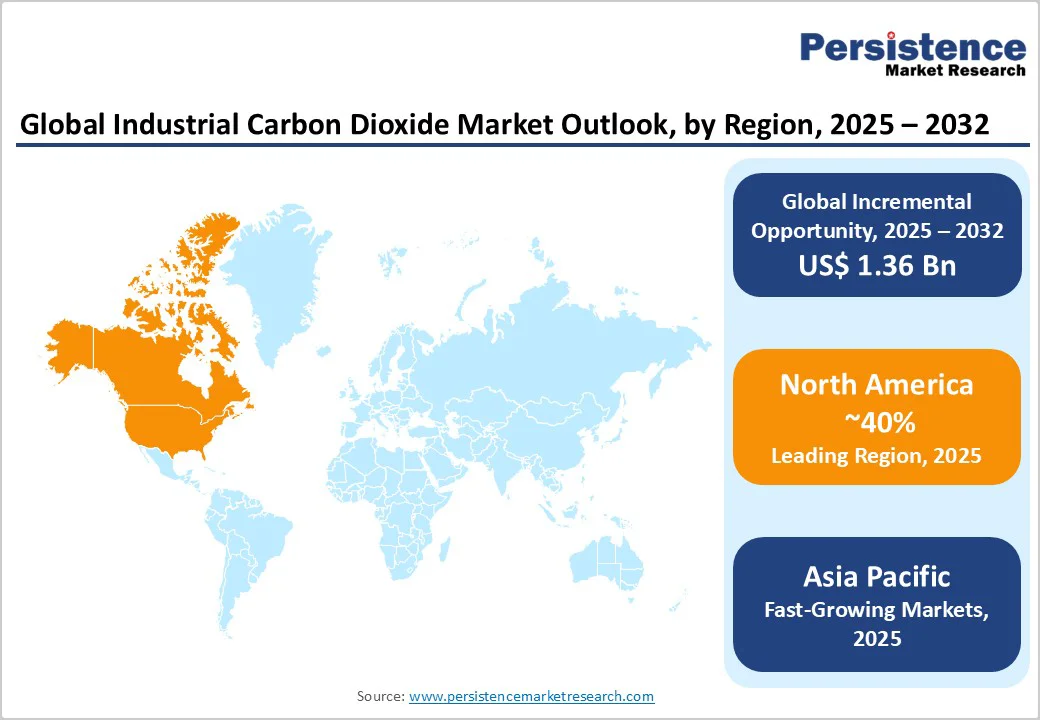

North America leads the industrial CO2 market, with the U.S. driving dynamics through robust oil & gas infrastructure and EOR applications in the Permian Basin. EPA regulations, including 2024 carbon standards for power plants mandating 90% CO2 capture for new gas turbines, promote CCU integration, reducing emissions while boosting supply from natural sources. Innovation ecosystems, supported by DOE investments in DAC technologies, enhance purification efficiency, positioning the region for sustainable growth amid energy transitions. Recent developments like Linde's 2024 supply of captured CO2 to Celanese exemplify partnerships advancing low-carbon chemical production.

The regulatory framework emphasizes compliance, with the Clean Air Act amendments incentivizing sequestration, fostering a mature market for industrial CO2 in food processing and medical uses.

Europe's industrial CO2 market is shaped by harmonized regulations under the EU ETS, which reduced emissions by 47% since 2005, driving demand for captured CO2 in chemicals and construction. In Germany, Air Liquide's 2024 investment of €40 million in site modernization cut emissions by 15,000 tonnes annually, highlighting innovation in recycling CO2 for circular use. The U.K. and France focus on ETS linkage announced in 2025, exempting mutual CBAM to streamline trade, while Spain advances bio-based sources. This regulatory alignment supports steady growth in ammonia synthesis and metal industries.

Asia Pacific exhibits rapid growth in industrial CO2, with China contributing over 50% of regional emissions at 21 billion tonnes in 2023, fueling demand from manufacturing hubs. India's 2025 GEI targets and Japan's renewable integration drive CCU adoption, with ASEAN nations leveraging low-cost production for exports. Statistics from UNESCAP indicate a 9.3% rise in renewables, yet fossil dependence sustains byproduct CO2 from ammonia plants. Manufacturing advantages in China and India support EOR and food sectors, with NDCs needing strengthening for 1.5°C alignment.

The global industrial CO2 market is moderately consolidated, with a few global giants such as Linde Plc and Air Liquide controlling over 50% share through vertical integration from capture to distribution. Expansion strategies include long-term supply agreements and investments in CCU, such as DAC facilities, to meet decarbonization demands. R&D trends emphasize energy-efficient purification, with leaders differentiating via high-purity standards for medical and food applications. Emerging models focus on circular economy partnerships, like CO2 recycling in ports, amid fragmented regional players in Asia.

Linde Plc (Guildford, UK) leads with extensive global infrastructure, supplying over 10 million tonnes of CO2 annually via integrated networks, focusing on CCU for electronics and energy sectors to drive sustainable growth.

Air Liquide (Paris, France) excels in innovation, with 2024 PPAs adding 2,500 GWh of low-carbon power, enhancing CO2 recycling and positioning it strongly in Europe's regulatory landscape.

Air Products and Chemicals Inc. (Allentown, US) dominates North America through EOR supplies and hydrogen synergies, leveraging NETL-backed projects for reliable, high-volume delivery to oil and food industries.

The industrial carbon dioxide market is expected to reach US$ 6.9 billion by 2032, growing from US$ 5.5 billion in 2025 at a CAGR of 3.2%, driven by CCU adoption.

Rising food and beverage sector expansion fuels demand for CO2 in carbonation and packaging, supported by global urbanization trends.

Food & Beverage leads with 32% share, due to essential use in processing and compliance with purity standards like the FDA.

North America dominates, led by U.S. EOR and EPA regulations promoting CO2 utilization in energy sectors.

CCU technologies offer growth via synthetic fuels and links to the Green Ammonia Market, backed by tax credits up to $85 per tonne.

Major players include Linde Plc, Air Liquide, and Air Products, focusing on global supply and CCU innovations.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Source

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author