ID: PMRREP33647| 214 Pages | 29 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

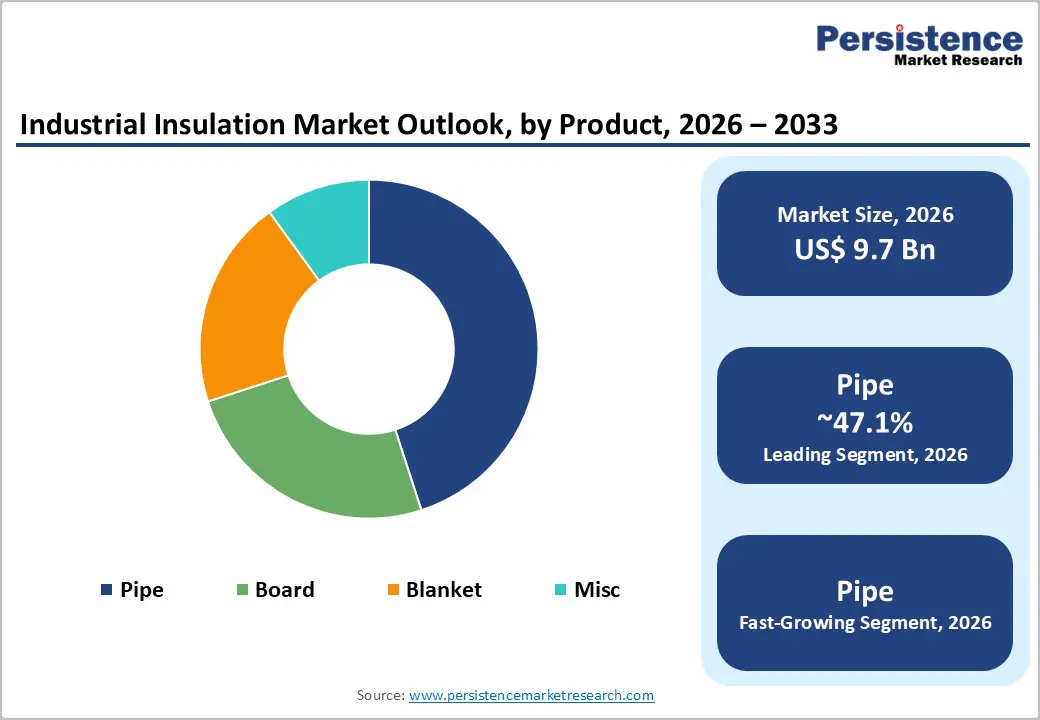

The global industrial insulation market size is likely to be valued at approximately US$ 9.7 billion in 2026 and is projected to reach US$ 13.4 billion by 2033, growing at a CAGR of approximately 4.1% during the forecast period (2026 - 2033).

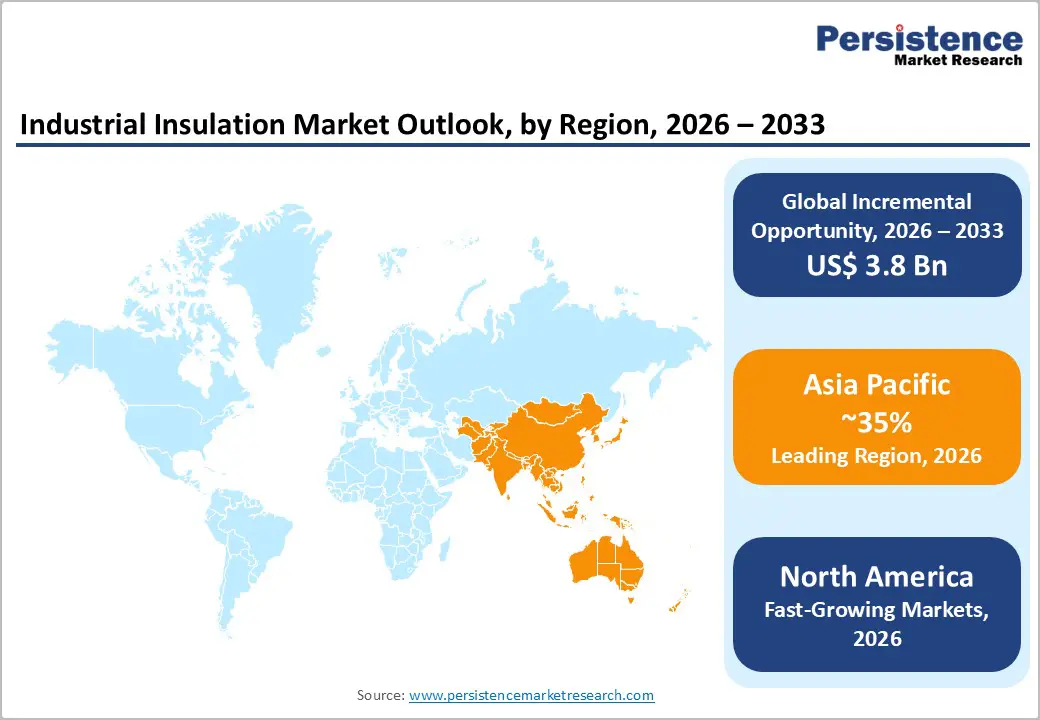

The market growth is primarily driven by escalating energy efficiency regulations across major industrial economies, significant capital investments in oil & gas infrastructure and LNG terminal development and accelerating industrial capacity expansion in emerging markets, particularly across the Asia Pacific.

| Key Insights | Details |

|---|---|

| Industrial Insulation Market Size (2026E) | US$ 9.7 Bn |

| Market Value Forecast (2033F) | US$ 13.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.8% |

| Historical Market Growth (CAGR 2020 to 2024) | 4.1% |

Regulatory frameworks are fundamentally reshaping demand for industrial insulation. The European Union's new EN 17956 standards, which took effect on December 1, 2024, mandate the insulation of industrial equipment and pipelines, establishing a binding technical floor for insulation specifications across member states. In India, the Energy Conservation Building Code (ECBC) establishes minimum energy performance requirements for commercial buildings with connected loads exceeding 100 kW, thereby directly stimulating the adoption of insulation materials. The United States implements Department of Energy (DOE) appliance standards and ENERGY STAR specifications that create compliance-driven demand for high-performance insulation across HVAC and industrial equipment. These regulations create a structural floor for market demand, with non-compliance resulting in financial penalties and operational liability. Industrial facilities modernizing to meet these standards present a significant recurring-revenue opportunity for manufacturers, with compliance costs typically accounting for 3-5% of capital expenditure budgets for new industrial construction.

The global industrial insulation market is experiencing substantial stimulus from LNG terminal construction, petrochemical plant development, and power generation facility expansion. China and India are undertaking aggressive industrial capacity additions to service growing domestic and export demand, with China's petrochemical sector expanding by 8-12% annually. Offshore oil & gas exploration in regions such as the North Sea and West Africa, and in deepwater fields, requires specialized insulation solutions rated for extreme conditions, including cryogenic temperatures and corrosive subsea environments. Global LNG infrastructure investment exceeds $150 billion across the forecast period, with each terminal requiring substantial volumes of high-temperature and cryogenic insulation materials. The expansion of the power generation sector, particularly in renewable energy infrastructure (solar, wind, geothermal), creates incremental insulation demand for thermal management and equipment protection.

The industrial insulation sector remains vulnerable to fluctuations in petrochemical prices, mineral availability constraints, and logistics bottlenecks. Fiberglass shortages during 2021-2022 caused 15-20% price premiums and construction project delays. China's domestic demand for fiberglass and foam products has limited exports available to global markets despite historical net exporter status. Transportation constraints-including port congestion, shipping container scarcity, and logistics network disruptions-continue elevating delivered costs for bulky insulation materials. The interconnected nature of global supply chains means that regional disruptions (geopolitical events, natural disasters, trade disputes) immediately cascade into production delays and margin compression for manufacturers and end-users. Many facilities operating below capacity utilization post-COVID provide limited pricing power and require substantial volume increases to recover fixed costs.

High initial installation costs for advanced insulation systems create adoption friction, particularly in price-sensitive emerging markets. Aerogel insulation, while offering superior thermal performance (thermal conductivity 2-2.5 times lower than conventional mineral insulation), commands premium pricing around $10-80/m² depending on specifications, limiting addressable market penetration to high-value applications. Traditional insulation retrofits require significant operational disruption, extended project timelines, and skilled labor availability, creating opportunity costs that defer investment decisions. Smaller industrial facilities and regional manufacturers operating on constrained capital budgets frequently select lower-cost alternatives despite inferior long-term energy economics, reducing demand for premium-tier solutions.

Next-generation insulation materials, including aerogels, vacuum insulation panels (VIPs), and ceramic fiber systems, are capturing market share at growth rates exceeding 20% annually compared to 4-5% baseline market growth. Aerogel composites with optimized fiber content deliver thermal conductivity performance that enables a 50+ year service life (versus 5-25 years for conventional VIPs), opening applications in building retrofits and industrial equipment where space constraints demand ultra-thin insulation. Ceramic fiber materials rated for temperatures exceeding 1000°C are used in specialized applications across high-temperature process industries, power generation, and aerospace manufacturing. Research into phase-change materials (PCMs) and bio-based insulation alternatives (cellulose, mycelium, hemp) aligns with corporate sustainability commitments, creating premium pricing opportunities for eco-certified products.

India's building insulation material market is projected to grow from $2.4 billion (2024) to $3.95 billion by 2035, driven by "Housing for All" initiatives, Smart Cities Mission, and Energy Conservation Building Code compliance requirements. Asia-Pacific industrial insulation market expanded to 35% of global share in 2024, with China and India representing incremental capacity representing 300+ gigawatts of power generation and 50+ petrochemical plants under construction or planned through 2032. Retrofitting aging industrial infrastructure across North America and Europe creates immediate opportunities, with many facilities operating with 20-30-year-old insulation systems that fail modern efficiency standards and create corrosion-under-insulation (CUI) vulnerabilities. Conservative estimates suggest 40-50% of industrial facilities across developed economies require insulation upgrades or replacement, representing cycle opportunities with a total addressable market exceeding $8-10 billion.

The shift toward natural gas and renewable energy infrastructure creates substantial insulation demand for LNG storage/transportation systems, wind turbine nacelles, solar thermal facilities, and hydrogen pipeline networks. LNG industry investments alone will generate an estimated $30-40 billion in insulation material demand through 2035 as new terminal capacity ramps across Asia-Pacific, the Middle East, and emerging markets. Hydrogen economy infrastructure development, currently in early commercialization phases, will require specialized cryogenic and high-temperature insulation systems. Electric-vehicle thermal management is driving innovation in phase-change materials and compact insulation systems for battery-pack integration, creating new end-use segments with premium pricing.

The product type segment comprises pipe, board, blanket, and miscellaneous. Pipe insulation accounts for the largest share of the industrial insulation market. The prevalence of pipe insulation across sectors such as energy, petrochemicals, and manufacturing to prevent heat loss and maintain optimal pipeline temperatures, thereby conserving energy and ensuring operational efficiency, is the driving force behind this dominance.

The fastest-growing market segment is blanket insulation, driven by its adaptability and ease of installation. The increasing demand for blanket insulation is attributable to its ability to insulate complex geometries and irregular surfaces, providing a cost-effective solution for industries seeking improved thermal efficiency across a wide range of applications.

The material segment is divided into mineral wool, fiberglass, foamed plastics, calcium silicate, and miscellaneous materials. The predominant market share in the industrial insulation sector is attributable to the extensive use of fiberglass across various industries. Outstanding thermal insulation properties, fire resistance, and adaptability across a wide range of applications, including equipment and conduit insulation, contribute to its widespread use.

Conversely, foamed plastics are experiencing the most rapid expansion, primarily due to their low weight and exceptional insulating properties. The market for foamed polymers is experiencing significant growth, driven by the versatility of these materials in meeting a wide range of industrial insulation requirements and by the rising demand for energy-efficient solutions.

The segment is sub-categorized into automotive, chemical and petrochemical, construction, electrical and electronics, oil and gas, power generation, and miscellaneous. The oil and gas sector dominates the industrial insulation market due to the essential need for temperature control in equipment, containers, and pipelines. The ongoing expansion of oil and gas exploration, rigorous safety standards, and energy-efficiency objectives collectively contribute to sustained demand for industrial insulation solutions.

On the contrary, power generation is emerging as the sector experiencing the most rapid growth, driven by the escalating worldwide need for electricity and the focus on improving energy efficiency in power plants. The exponential expansion of this sector is driven by the implementation of insulation solutions in power generation facilities to reduce heat leakage and enhance overall efficiency.

The North American industrial insulation market maintains a substantial global market share at approximately 30% of worldwide demand, valued at roughly $3.8 billion annually. Market leadership reflects a mature industrial base, including world-class oil & gas infrastructure, a diversified power generation sector, and advanced manufacturing. The United States represents the region's primary market driver, leveraging established refinery capacity (representing 13-15% of global refining), LNG export terminals (contributing 15-20% of global LNG exports), and an extensive petrochemical production base.

Aging infrastructure replacement creating systematic retrofit opportunities across refineries, power plants, and industrial facilities with 20-30-year-old insulation systems; Stringent DOE and EPA energy efficiency standards driving insulation upgrades for compliance with appliance efficiency mandates and building envelope requirements.

Europe represents approximately 22% of global industrial insulation market value, though regional market dynamics emphasize sustainability and regulatory compliance over volume growth. Market size approximates $2.1 billion annually, with Germany, the UK, France, and Spain accounting for approximately 65% of total regional demand. The European market demonstrates structural maturity, with limited new industrial facility construction but substantial retrofit and modernization activity driven by stringent environmental and energy-efficiency mandates.

European regulatory framework represents the world's most stringent and comprehensive insulation standards. EN 17956 establishes binding technical specifications for the insulation of industrial equipment, superseding national standards with a unified technical floor. EU's Ecodesign Directive and Energy Performance of Buildings Directive create cascading compliance requirements affecting manufacturing, refining, and utility sectors. Fire safety regulations (particularly EN 13823) mandate the use of non-combustible or limited-flame-spread materials for industrial applications, thereby supporting the adoption of mineral wool and specialty ceramics.

Asia Pacific has emerged as a dominant regional market, commanding 35% of global industrial insulation market share as of 2026, valued at approximately $2.9 billion annually and growing at 7.8% CAGR compared to 4-5% global average. Region's market dominance reflects a rapid industrialization trajectory, massive infrastructure investment, and manufacturing expansion, creating substantial insulation demand. China and India represent approximately 70-75% of the regional market value, with emerging ASEAN economies (Vietnam, Thailand, Indonesia) contributing to accelerating growth.

Regulatory frameworks remain less stringent than those in developed markets but are progressively tightening. India's ECBC requirements (effective 2017, updated 2020) establish minimum thermal performance standards for commercial buildings, creating compliance-driven insulation demand among institutional and corporate real estate developers. China implements energy-efficiency standards through mandatory equipment labeling and factory energy-consumption regulations, though enforcement mechanisms vary by region.

The industrial insulation market is distinguished by the existence of major actors who implement diverse strategies to attain a competitive advantage in this ever-changing sector. Well-established corporations frequently prioritize the expansion of their product lines, providing an extensive variety of insulation materials that are specifically designed for various industrial purposes. Companies invest heavily in research and development to introduce advanced insulation solutions that offer superior performance, durability, and environmental sustainability; thus, innovation in materials and technologies is a critical battleground.

The Industrial Insulation market is estimated to be valued at US$ 9.7 Bn in 2026.

The key demand driver for the Industrial Insulation market is the growing emphasis on energy efficiency and regulatory compliance, which compels industries to adopt insulation solutions that reduce energy consumption, lower operational costs, and cut carbon emissions.

In 2026, the Asia Pacific region will dominate the market with an exceeding 35% revenue share in the global Industrial Insulation market.

Among the Product Type, Pipe holds the highest preference, capturing beyond 47.1% of the market revenue share in 2026, surpassing other Product Type.

The key players in Industrial Insulation are Owens Corning, Johns Manville, Saint-Gobain and Knauf Insulation.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysi | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author