ID: PMRREP32485| 195 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | Industrial Automation

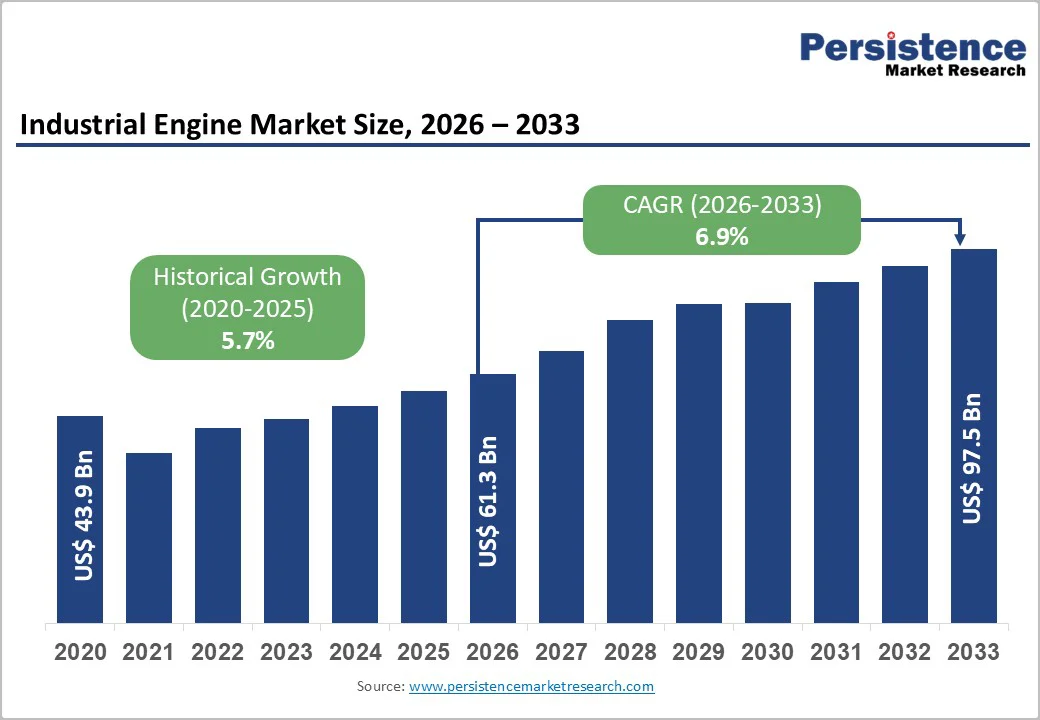

The global industrial engine market size is likely to be valued at US$ 61.3 billion in 2026, subsequently expanding to US$ 97.5 billion by 2033, growing at a CAGR of 6.9% between 2026 and 2033.

Accelerated infrastructure development, rising demand for reliable power generation systems, and increasing mechanization across construction, mining, and agricultural sectors attract robust growth. The market is experiencing sustained growth momentum from stringent emission regulations pushing technological innovation, expanding industrial activities in emerging economies, and the critical need for backup power solutions across manufacturing facilities and data centers globally.

| Key Insights | Details |

|---|---|

| Industrial Engine Market Size (2026E) | US$ 61.3 Bn |

| Market Value Forecast (2033F) | US$ 97.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.9% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.7% |

The power generation segment accounted for over 25% revenue share in the industrial engine market, driven by escalating energy demands and grid reliability challenges across developing regions. The power generation industrial engine reflects critical requirements for backup power in manufacturing plants, data centers, hospitals, and telecommunications infrastructure. India's power generation engines market is fueled by the country's position as the third-largest global energy consumer, with projected energy demand doubling by 2040. Over 70% of global manufacturing facilities rely on backup power systems to prevent operational disruptions, equipment damage, and safety risks during grid failures. The integration of industrial engines with renewable energy systems for grid stabilization during intermittent solar and wind generation creates complementary demand, positioning these engines as essential components in distributed energy infrastructure.

The transition to emission-compliant industrial engines involves substantial capital expenditure for both manufacturers and end users, creating adoption barriers particularly in price-sensitive markets. Compliance with stringent emission standards requires integration of expensive after-treatment technologies including SCR systems, DPF units, and advanced electronic control systems, significantly increasing per-unit costs compared to legacy engines. Small and medium-sized construction contractors, agricultural operators, and industrial users face financial constraints when upgrading equipment fleets to meet regulatory requirements, often extending replacement cycles or opting for refurbished equipment. The complexity of modern emission control systems also elevates maintenance requirements and operational costs, with specialized diagnostic equipment, trained technicians, and premium diesel exhaust fluid (DEF) consumption adding to total cost of ownership. In developing economies where labor costs are low and regulatory enforcement may be less stringent, the value proposition for investing in advanced industrial engines becomes less compelling, potentially slowing market penetration rates.

The development of dual-fuel, bi-fuel, and hybrid industrial engines capable of operating on multiple fuel sources creates new market opportunities while addressing emission concerns. Manufacturers are investing in engines compatible with natural gas, biogas, hydrogen blends, and synthetic fuels, providing operational flexibility and reduced carbon footprints. Cummins' launch of HELM (higher efficiency, lower emissions, multiple fuels) platforms including B6.7N natural gas engines and advanced hydrogen fuel delivery systems demonstrates market evolution toward fuel flexibility while maintaining diesel-equivalent performance. Hybrid powertrain integration combining industrial engines with electric motors and battery systems is gaining momentum in construction equipment, offering enhanced fuel efficiency, reduced emissions, and improved power management. These technological convergences enable manufacturers to serve customers requiring transitional solutions that balance performance requirements with sustainability objectives, potentially expanding addressable market segments.

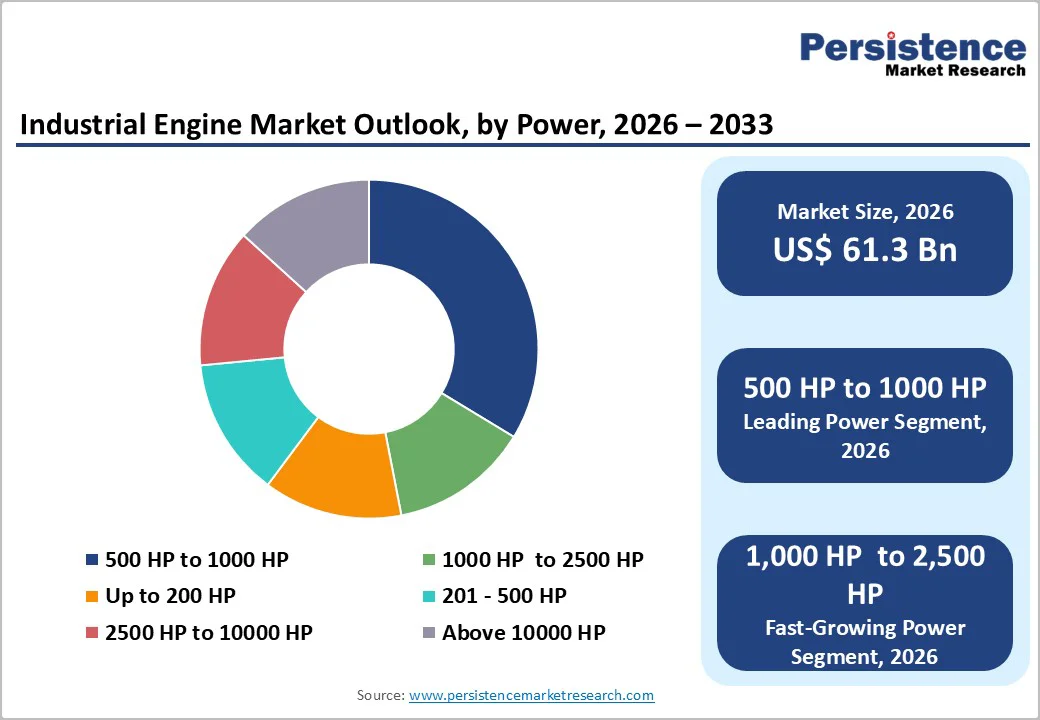

The industrial engine market shows a clear power-based segmentation, with the 500-1,000 HP category emerging as the dominant segment, accounting for over 37% of total revenue. This range delivers the ideal balance of power, durability, and fuel efficiency, making it the preferred choice for mainstream construction, manufacturing, and power generation applications. Engines in this class effectively power medium excavators, wheel loaders, industrial machinery, and generator sets, benefiting from mature technologies, strong supply chains, and wide applicability across industries.

In contrast, the 1,000-2,500 HP segment is witnessing the fastest growth, driven by rising global demand for high-performance engines in heavy-duty construction equipment, large mining vehicles, and high-capacity power systems. Mega infrastructure projects and expanding mining operations increasingly require powerful haul trucks, shovels, drilling rigs, and draglines capable of sustained performance in extreme environments. This segment’s rapid expansion is further reinforced by advancements in turbocharging, electronic fuel injection, and thermal management technologies, which enhance power density while ensuring compliance with modern emission regulations, positioning it as a critical growth engine for the industry’s future.

Power generation remains the leading end-use segment, accounting for over 25% of revenue in 2026, as industries increasingly depend on reliable backup systems to ensure uninterrupted operations across manufacturing, data centers, healthcare facilities, and telecommunications networks. Demand is further supported by rising energy security concerns, frequent grid instability in developing economies, and the growing need to integrate industrial engines with renewable energy systems for effective load balancing. At the same time, industrial facilities in sectors such as chemical processing, food and beverage, and pharmaceuticals are widely adopting engines for combined heat and power (CHP) applications, enabling improved energy efficiency and lower environmental impact.

In parallel, Oil & Gas has emerged as the fastest-growing segment, driven by expanding offshore exploration, remote drilling operations, and the rising use of high-horsepower engines for mechanical drive applications powering compressors, pumps, and critical extraction infrastructure. The segment’s momentum also reflects increasing global energy demand, which continues to drive hydrocarbon investments despite energy-transition pressures. Industrial engines deliver the reliability and durability required for offshore support vessels, drilling rigs, and FPSO units operating in harsh maritime environments, reinforcing the strong growth outlook for this segment.

Diesel continues to dominate the fuel type landscape, accounting for over 60% of total revenue in 2026, primarily due to its unmatched energy density, high torque output, broad fuel availability, and mature global infrastructure. Its exceptional durability, robustness, and ability to deliver consistent high-load performance make diesel the preferred choice across construction, mining, marine, and agricultural sectors. This dominance is further reinforced by continuous improvements in cleaner, more fuel-efficient diesel technologies featuring advanced emission control systems, which help maintain diesel’s relevance in heavy-duty industrial environments. In contrast, gasoline represents the fastest-growing fuel type segment, supported by its advantages in lightweight applications, higher RPM capabilities, and lower upfront costs ualities that suit compact construction equipment, portable generators, and small agricultural machinery. Gasoline engines also benefit from lower particulate emissions and simpler emission control requirements compared to diesel. However, despite its growth potential, gasoline’s overall market share remains constrained by lower fuel efficiency and reduced torque performance, limiting its suitability for demanding industrial operations that require sustained, high-power output.

Four-stroke engines dominate the market with over 65% revenue share, driven by their superior fuel efficiency, lower emissions, durability, and quieter performance compared to 2-stroke counterparts. Valued at USD 24.7 billion in 2024, the 4-stroke segment is projected to reach USD 36.1 billion by 2033, registering a 4.3% CAGR. This growth is strongly supported by tightening global emission regulations, which are accelerating the shift toward cleaner and more efficient combustion technologies. Their widespread use across automotive, marine, agriculture, and power generation sectors further reinforces demand, as industries prioritize environmental compliance, operating cost reduction, and longer maintenance intervals.

In contrast, 2-stroke engines, despite holding a smaller share, represent the fastest-growing stroke category with an estimated 7.3% CAGR through 2033. Their expansion is driven by high power-to-weight ratios, simpler mechanical designs, and lower production costs, making them ideal for applications such as marine outboard motors, handheld and portable equipment, and select agricultural machinery. Moreover, continuous innovations in fuel injection, lubrication, and emission-control systems are enabling modern 2-stroke engines to align with emerging environmental standards while preserving their core performance benefits, thereby maintaining their relevance in niche yet expanding market segments.

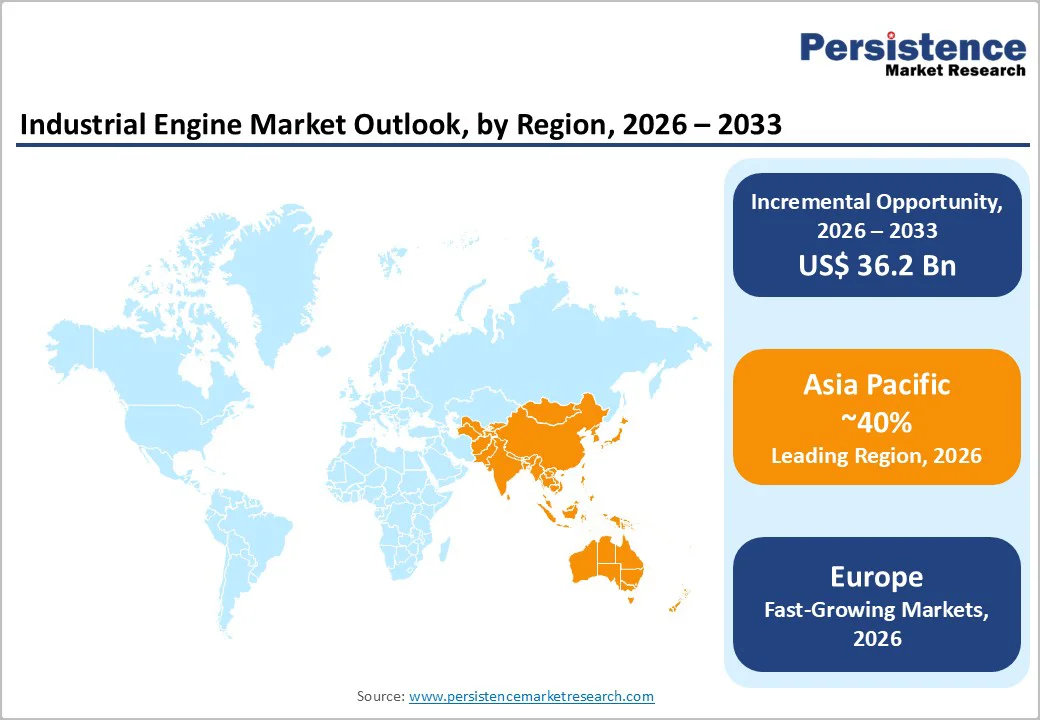

Asia Pacific remains the undisputed leader in the global industrial engine market, commanding over 40% revenue share in 2025 with robust 6.5% CAGR the fastest worldwide. This dominance is rooted in rapid industrialization, large-scale infrastructure projects, accelerated manufacturing expansion, and growing mechanization across agriculture and construction sectors in China, India, Japan, Southeast Asia, and Australia. China continues to anchor regional performance with a 7.4% CAGR, supported by Belt and Road infrastructure initiatives, domestic urbanization policies, and its role as a global manufacturing hub for industrial engines and machinery. India, meanwhile, is emerging as a high-growth market, projected to grow at 7.8% CAGR through 2035, fueled by record-breaking infrastructure spending, smart city developments, extensive road construction, and strong manufacturing incentives under PLI schemes.

Complementing these macroeconomic drivers, Asia Pacific benefits from supportive government policies promoting domestic engine production, streamlined industrial regulations, and major capital allocations toward infrastructure. Abundant natural gas and biogas resources, combined with clean-energy initiatives, are accelerating adoption of dual-fuel and alternative-fuel engines. Additionally, regional manufacturers are strengthening production and service networks to support rising demand from construction, mining, and agricultural equipment users. With urban populations driving an estimated 8% rise in energy consumption in 2024 and ongoing fleet modernization across industries, Asia Pacific is positioned for sustained industrial engine market growth through 2033.

Europe’s industrial engine market generated USD 12,589.8 million in 2024, representing 22.1% of global revenue, and is projected to reach USD 16,458.0 million by 2030 at a 4.7% CAGR. The region’s growth is strongly shaped by its stringent focus on energy efficiency, low emissions, and strict adherence to Euro VI and Stage V standards among the world’s toughest regulations governing nonroad mobile machinery. As the European Union pushes aggressive climate commitments, industries are rapidly adopting hybrid and alternative fuel-powered engines to reduce carbon footprints and align with corporate sustainability goals. Major economies such as Germany, the United Kingdom, France, Spain, and Italy continue to drive demand through infrastructure modernization, a resurgence in manufacturing particularly across Central and Eastern Europe and rising investments in decentralized energy systems.

Within the region, France is expected to record the highest CAGR from 2025 to 2030, supported by naval modernization, retrofitting aligned with emission control area (ECA) rules, and offshore wind vessel development. Germany remains the regional leader with its strong manufacturing base, advanced technological ecosystem, and emphasis on automation and hybrid solutions, while the UK market benefits from infrastructure upgrades and stricter environmental rules encouraging low-emission, digitally integrated engines. Overall, Europe reflects a mature demand pattern driven by replacement cycles, technology upgrades, and regulatory compliance, creating strong opportunities for premium, high-efficiency engine platforms.

The industrial engine market exhibits moderately consolidated structure with leading players including Caterpillar Inc, Cummins Inc, Volvo Penta, Deutz AG, MAN Energy Solutions, Yanmar, Perkins Engines, Mitsubishi Heavy Industries, Wärtsilä Corporation, and Kubota Corp collectively commanding substantial market share through established brand recognition, global distribution networks, and comprehensive product portfolios. Caterpillar and Cummins maintain market leadership positions with estimated combined share exceeding 25%, leveraging vertical integration, extensive service networks spanning over 190 countries, and continuous R&D investments in fuel efficiency and emission reduction technologies. Regional manufacturers including Weichai Power (China), Doosan (South Korea), and domestic players in India are gaining share through competitive pricing, local manufacturing capabilities, and government procurement preferences favoring indigenous producers.

Market concentration reflects competitive dynamics where scale advantages in manufacturing, R&D capabilities, and service infrastructure create barriers to entry for smaller players. However, specialization opportunities exist in niche segments including ultra-high horsepower engines (above 10,000 HP), alternative fuel platforms, and application-specific engine designs for marine, rail, or specialized industrial equipment. The competitive landscape is characterized by ongoing consolidation through mergers and acquisitions as manufacturers seek to expand geographic reach, acquire technology capabilities, and achieve cost synergies in increasingly regulated and technologically complex market environment

The Industrial Engine market is estimated to be valued at US$ 61.3 Bn in 2026.

The key demand driver for the industrial engine market is rising adoption of advanced, fuel-efficient engines across construction, agriculture, mining, and manufacturing sectors, driven by automation, infrastructure expansion, and stricter emission compliance.

In 2026, the Asia Pacific region will dominate the market with an exceeding 40% revenue share in the global Industrial Engine market.

Among end use, Power Generation has the highest preference, capturing beyond 45% of the market revenue share in 2026, surpassing other end uses.

Honda Motor Co.Ltd, Kawasaki Heavy Industries, Ltd., JEEMAR POWER CO., LTD, Chongqing Fuchai Industry Group, Changchai Co., Ltd., Kohler Co., Motorenfabrik Hatz GmbH & Co. KG are a few leading players in the Industrial Engine market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Power

By End-user

By Fuel Type

By Stroke

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author