ID: PMRREP29140| 196 Pages | 17 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

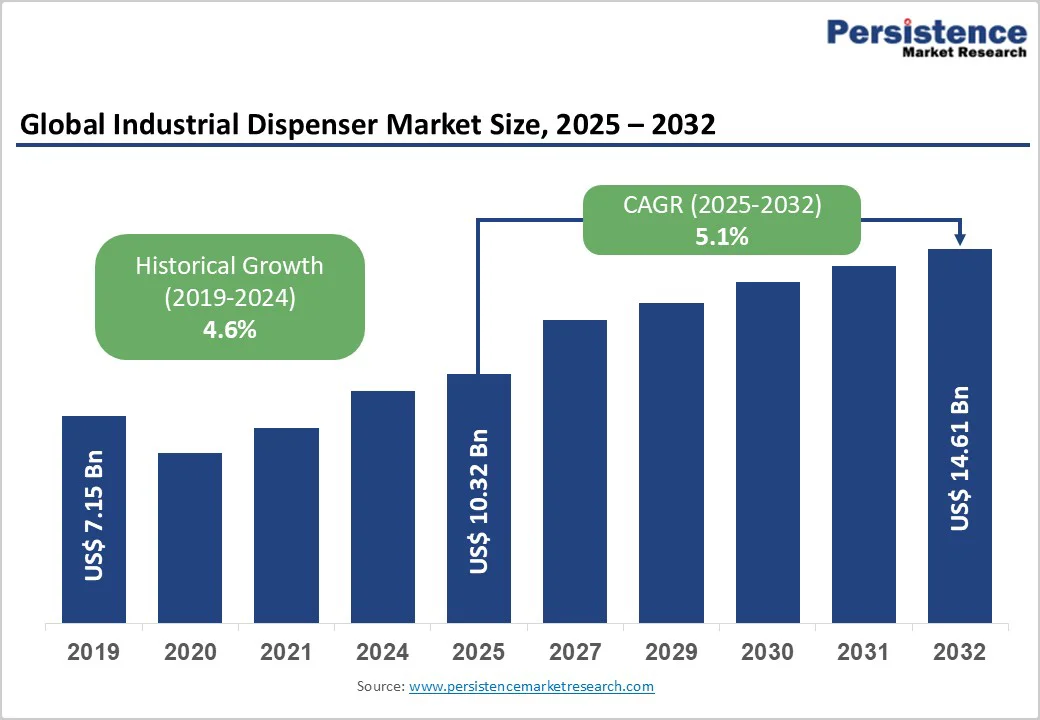

The global industrial dispenser market size was valued at US$10.32 Billion in 2025 and is projected to reach US$14.61 Billion by 2032, growing at a CAGR of 5.1% between 2025 and 2032, driven by accelerating industrial automation, rising demand for precision dispensing in pharmaceuticals and electronics, and investments in smart manufacturing infrastructure. The adoption of automatic dispensing systems, coupled with Industry 4.0 initiatives, strengthens operational efficiency and reduces material waste.

| Key Insights | Details |

|---|---|

|

Industrial Dispenser Market Size (2025E) |

US$10.32 Bn |

|

Projected Industrial Dispenser Market Value (2032F) |

US$14.61 Bn |

|

Value CAGR (2025-2032) |

5.1% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

4.6% |

Global manufacturing is transitioning to smart factories integrated with IoT, AI, and robotics, making automated dispensers essential for process control and precision. According to industry studies, approximately 72% of manufacturing facilities in North America and Europe will have adopted automation technologies by 2024, facilitating demand for fully automated dispensing systems. Industry 4.0 frameworks enable real-time monitoring, predictive maintenance, and digital twin simulations, which improve throughput and reduce downtime. Governments worldwide, including China's "Made in China 2025" initiative and Germany's Industry 4.0 strategy, provide tax incentives and funding for smart manufacturing deployment, directly boosting industrial dispenser adoption.

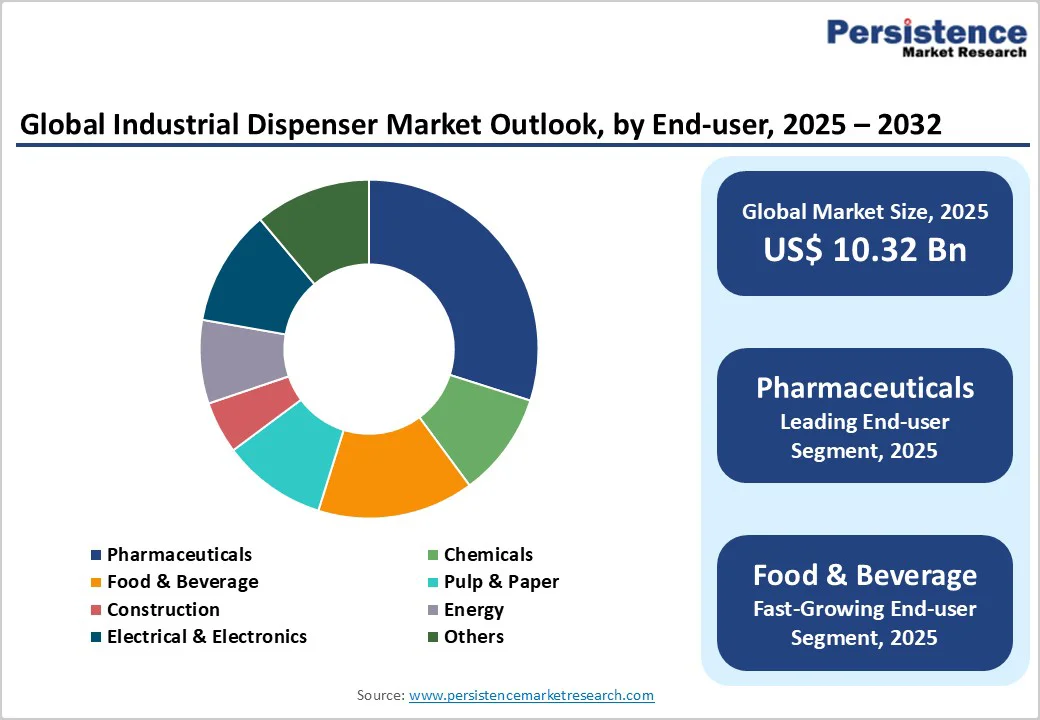

Pharmaceutical manufacturing requires accurate, sterile, and repeatable fluid dispensing for drug formulation, vaccine production, and medical device assembly. The healthcare dispensing systems market reached US$4.36 Billion in 2024, with automatic dispensers capturing a dominant market share. Regulatory agencies such as the FDA and EMA mandate precision dosing and contamination control, making advanced dispensing systems mandatory for compliance. Expansion in biosimilars, personalized medicine, and point-of-care testing further accelerates pharmaceutical dispenser demand.

Food processing and beverage manufacturing depend on automated dispensing for precise ingredient metering, packaging, and sanitation. The food & beverage sector accounts for 18-22% of global industrial dispenser installations, driven by hygiene standards and consumer demand for consistency. Chemical industries also utilize dispensers for the accurate handling of corrosive, viscous, and hazardous materials. Dispensing technologies reduce waste, ensure operator safety, and maintain quality compliance, translating to sustained market growth in these critical end-use segments.

Advanced automatic dispensing systems, particularly those integrated with IoT and robotics, require substantial capital investment. Small and medium-sized enterprises (SMEs) face financial barriers, with systems costing between US$50,000 and US$500,000 depending on complexity. Maintenance and skilled labor requirements further elevate the total cost of ownership, slowing adoption in price-sensitive emerging markets and restricting penetration in industries with tight margins.

Integrating dispensing systems into legacy production lines poses technical and operational challenges. Retrofitting existing equipment requires specialized expertise, downtime for installation, and compatibility testing. Additionally, varying viscosities, abrasive materials (such as thermal interface materials), and multi-component formulations complicate dispenser design, increasing maintenance frequency and operational complexity.

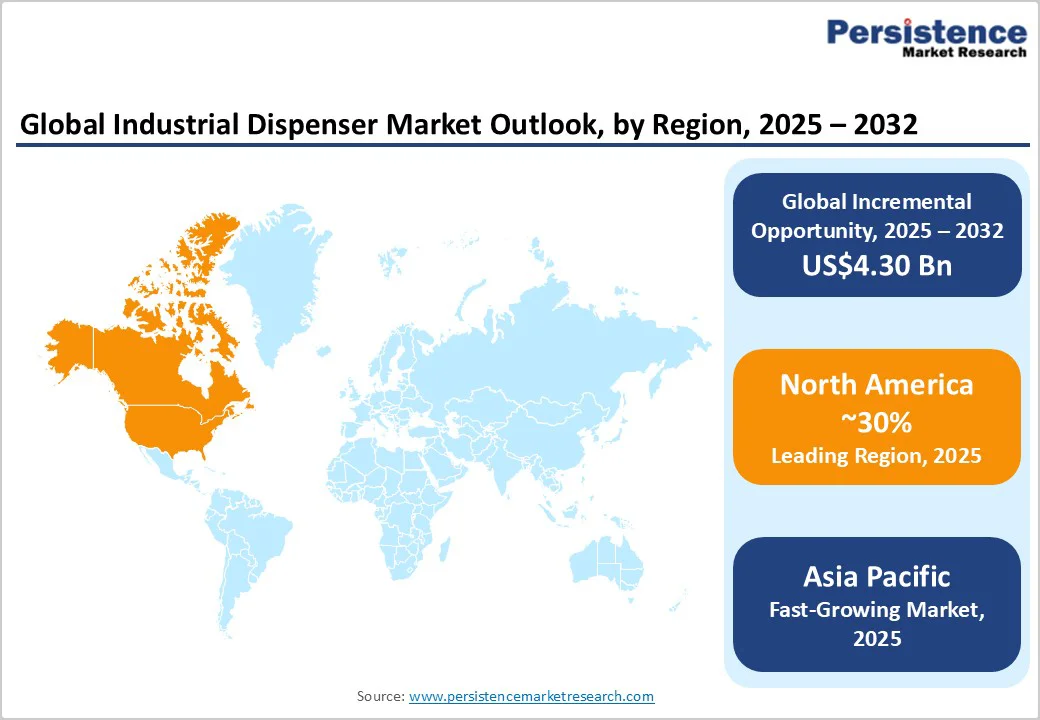

Asia Pacific, accounting for 36-39% of global production capacity, presents significant opportunities for dispenser manufacturers. China, India, and ASEAN economies are investing in greenfield manufacturing plants, industrial clusters, and smart city projects, which require advanced dispensing solutions. Government incentives, including China's New Infrastructure Plan and India's Production-Linked Incentive (PLI) scheme, accelerate adoption, with market projections indicating a high CAGR in the region through 2033.

Semi-automatic dispensers, offering a balance between precision and affordability, represent the fastest-growing segment. These systems appeal to SMEs, contract manufacturers, and industries transitioning from manual to automated processes. Product innovation in modular, user-friendly designs expands addressable markets, particularly in construction, pulp & paper, and regional manufacturing operations.

Integration of sensors, connectivity, and data analytics into dispensers enables predictive maintenance, real-time process optimization, and remote monitoring. Smart dispensing systems reduce unplanned downtime by 30-40% and enhance traceability for regulatory compliance. These capabilities are particularly valuable in the pharmaceutical, electronics, and automotive sectors, where quality control and operational transparency are paramount.

Automatic dispensers dominate the market, holding a 58% share in 2025. Their precision, consistency, and integration capability make them indispensable in high-volume, regulated industries such as pharmaceuticals, electronics, and automotive. Automated systems reduce human error, improve production efficiency, and enable seamless integration with Industry 4.0 ecosystems.

Semi-automatic dispensers are the fastest-growing segment, driven by their cost-effectiveness and versatility. Offering operator-assisted control with programmable dispensing modes, they bridge the gap between manual and fully automatic systems. This segment serves industries requiring moderate throughput, customization flexibility, and lower capital expenditure, making it ideal for SMEs and specialized applications.

Liquid dispensers command an 80% market share, reflecting their extensive use across automotive, food & beverage, chemical, and pharmaceutical sectors. Applications include adhesive bonding, coating, lubricating, and ingredient metering. Technological advances in pump design, valve accuracy, and material compatibility sustain robust demand in this segment.

Solid dispensers, handling powders, granules, and tablets, are gaining traction in the pharmaceutical and food industries. The solid industrial dispensers market, valued at US$2.5 billion in 2025, is projected to reach US$4.2 Billion by 2033. Growth is fueled by precision dosing requirements, automated packaging lines, and quality control mandates in regulated industries.

Pharmaceuticals represent the dominant end-user segment with a 28.4% market share in 2025. Demand is propelled by sterile manufacturing requirements, high-precision drug formulation, and biosimilar production. Automatic dispensing systems ensure contamination-free, repeatable dosing, critical for regulatory compliance and patient safety.

Food & beverage is the fastest-growing end-user segment, benefiting from rising demand for processed foods, hygiene standards, and automation in packaging. Dispensers enable precise ingredient metering, reduce waste, and ensure consistency, key factors for brand reputation and profitability. Growth accelerates as food manufacturers adopt digital traceability and IoT-based quality control.

North America holds a leading position, accounting for approximately 30% of the global market share in 2025, with the U.S. representing over 75% of regional revenue. The market benefits from advanced manufacturing infrastructure, stringent regulatory frameworks (FDA, OSHA), and the early adoption of Industry 4.0 technologies. Pharmaceutical and healthcare sectors drive demand, supported by investments in biologics, personalized medicine, and medical device manufacturing.

The presence of key market players, Nordson, Graco, Honeywell, and a strong innovation ecosystem ensures continuous product development and competitive advantage. Investments in smart factories, sustainability initiatives, and automation retrofits position North America as a mature yet growth-sustaining market.

Europe commands a 23-25% of the global market share, led by Germany, the U.K., France, and Spain. The region's emphasis on precision engineering, automotive manufacturing, and pharmaceutical production fuels dispenser adoption. Germany's Industry 4.0 leadership and France's pharmaceutical sector provide substantial demand, while EU-wide regulatory harmonization (REACH, CE marking) facilitates market entry and standardization.

European manufacturers prioritize sustainability, energy efficiency, and advanced sensor integration, driving innovation in smart dispensing systems. Investment in electric vehicle (EV) production and renewable energy infrastructure further expands opportunities for specialized dispensing solutions in adhesive bonding, thermal management, and battery assembly.

Asia Pacific is the fastest-growing region, holding 25% of global installations through 2033. China, India, Japan, and ASEAN nations lead expansion, driven by manufacturing capacity growth, government incentives, and urbanization. China's "Made in China 2025" and India's PLI schemes accelerate automation and smart manufacturing deployment.

The region benefits from cost-competitive production, expanding pharmaceutical and electronics industries, and increasing FDI in manufacturing sectors. Regional players focus on affordability and modular designs, while global leaders establish local partnerships and production facilities to capture market share. Investments in infrastructure, industrial clusters, and technology transfer programs ensure sustained growth momentum.

The global industrial dispenser market is fragmented in nature, with the presence of a large number of players in the unorganized space, such as regional or local players.

Manufacturers with expertise in creating custom-built dispensing systems, such as GS Manufacturing and DOPAG, have provided a few devices up to this point. These players collaborate closely with their clients to create products that are specifically designed to meet their needs. Collaborations with clients to create customized dispensing systems are anticipated to be a dominant trend in the market as dispensing system manufacturers seek to strengthen current client relationships and increase their clientele.

The industrial dispenser market size is estimated to be valued at US$10.32 Billion in 2025.

The key demand driver for the industrial dispenser market is the growing adoption of automated dispensing solutions to enhance manufacturing precision, productivity, and material efficiency across various industries.

In 2025, the North America region will dominate the market with an exceeding 30% revenue share in the industrial dispenser market.

Automatic dispenser holds the highest preference, capturing beyond 58% of the market revenue share in 2025, surpassing other operation segments.

The key players in the industrial dispenser market are Nordson Corporation, Henkel AG & Co KGaA, Atlas Copco AB, and Graco Inc.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Operation

By Product type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author