ID: PMRREP33022| 166 Pages | 3 Jul 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

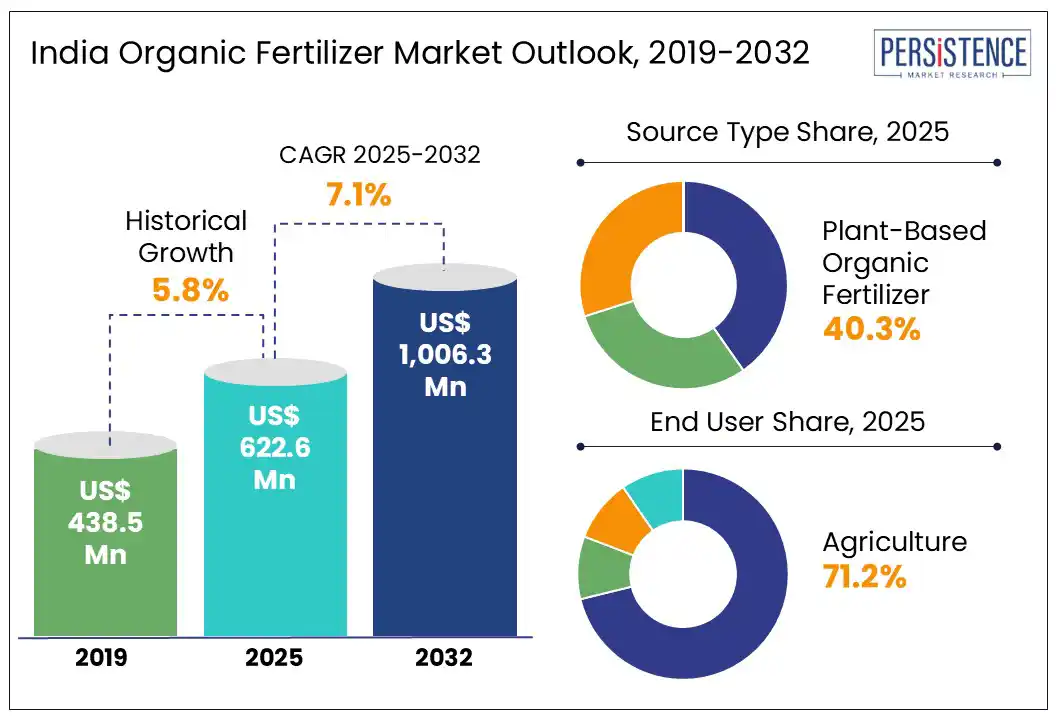

India organic fertilizer market is estimated to increase from US$ 622.6 Mn in 2025 to US$ 1,006.3 Mn by 2032. The market is projected to record a CAGR of 7.1% during the forecast period from 2025 to 2032. The market is primarily driven by government support and increasing consumer demand for organic products. Notably, North India is expected to dominate the market, accounting for around 29% of the share, due to the expansion of organic farming initiatives.

Key Highlights of the Market

|

Global Market Attribute |

Details |

|

Market Size (2024A) |

US$ 581.3 Million |

|

Estimated Market Size (2025E) |

US$ 622.6 Million |

|

Projected Market Value (2032F) |

US$ 1,006.3 Million |

|

Value CAGR (2025 to 2032) |

7.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.8% |

Organic food has become increasingly popular in recent years particularly during the COVID-19 epidemic, as people consider it healthy and better for immunity. Organic food such as fruits and vegetables is expected to be in high demand. Due to their high nutritional content, organic fruits and vegetables are in high demand in domestic and international markets.

Vitamins, minerals, fibre, carbs, and calcium are abundant in fruits and vegetables. As a result, to develop organic food and maintain its nutrients, farmers are turning to organic fertilizers, which increase the food's richness while maintaining the authenticity of the product.

Significant shifts to organic food, around 62% have been reported in metropolitan cities, especially in fruits and vegetables. This has increased 95% in the last five years in some cities such as Delhi-MCR, Mumbai, Cochin, Indore, Chandigarh, and Dehradun.

Consumers are becoming more health conscious. They prefer to invest more in organic items as awareness of the health benefits of organic food grows.

Consumers choose naturally developed items for healthy living to reduce the use of chemicals. The entire lifestyle pattern is shifting, and demand for natural and plant-based products has become fashionable in recent years.

Customers are migrating to organic food goods due to toxic chemicals and diseases, and the government is actively marketing these products. As a result, organic fertilizers are required to cultivate natural and organic foods, significantly raising the demand for organic fertilizers across India.

Natural fertilizers are often more expensive than chemical fertilizers because chemical fertilizers have a high concentration of nutrients per the product's weight. Several pounds of organic fertilizers are required to achieve the same soil nutrient level as a single pound of chemical fertilizer. Thus, the high expense of organic fertilizers is one of the main reasons why organic products are more expensive than non-organic produce. Another primary reason is that typical organic yields are lower.

Organic fertilizers are lower in nutritional content (N-P-K) value, so they must be applied at higher application rates. In some cases, where the soil nutrient content could be higher, more than organic fertilizers are required. Although it is possible to create many organic fertilizers at home, homemade organic fertilizers are usually more expensive than store-bought chemical fertilizers after labour, time, and other resources are factored in, which makes organic fertilizer products relatively expensive.

The growing awareness of health and environmental issues among consumers has significantly increased the demand for organic food products in India. With consumers becoming more conscious about what they eat, there is a clear shift towards organic produce perceived as safe and more nutritious. This trend reflects changing consumer preferences and indicates a broader societal shift towards sustainability.

Farmers will increasingly seek organic fertilizers to meet the demands of health-conscious consumers as organic food consumption rises. Organic fertilizer manufacturers can seize this opportunity by enhancing their product portfolios, focusing on quality, and establishing solid relationships with farmers.

Brands can leverage marketing strategies highlighting the benefits of organic farming and its positive impact on health and the environment. This growing demand for organic food creates a promising avenue for growth in the organic fertilizer market.

The Indian government has recognized the importance of organic farming for sustainable development and food security, leading to various policy initiatives promoting organic agriculture. These include subsidies for organic fertilizers, financial assistance for farmers transitioning to organic practices, and initiatives like the Soil Health Card Scheme to monitor soil health and promote organic inputs.

Supportive measures can significantly boost the organic fertilizer market by making these inputs more affordable and accessible to farmers. Government programs that educate farmers about the benefits of organic fertilizers and practices can enhance market penetration.

Companies that align their strategies with government initiatives can capitalize on these opportunities by providing innovative products and solutions tailored to farmers' needs. This government backing creates a favourable environment for growth, making it an essential opportunity for stakeholders in the organic fertilizer sector.

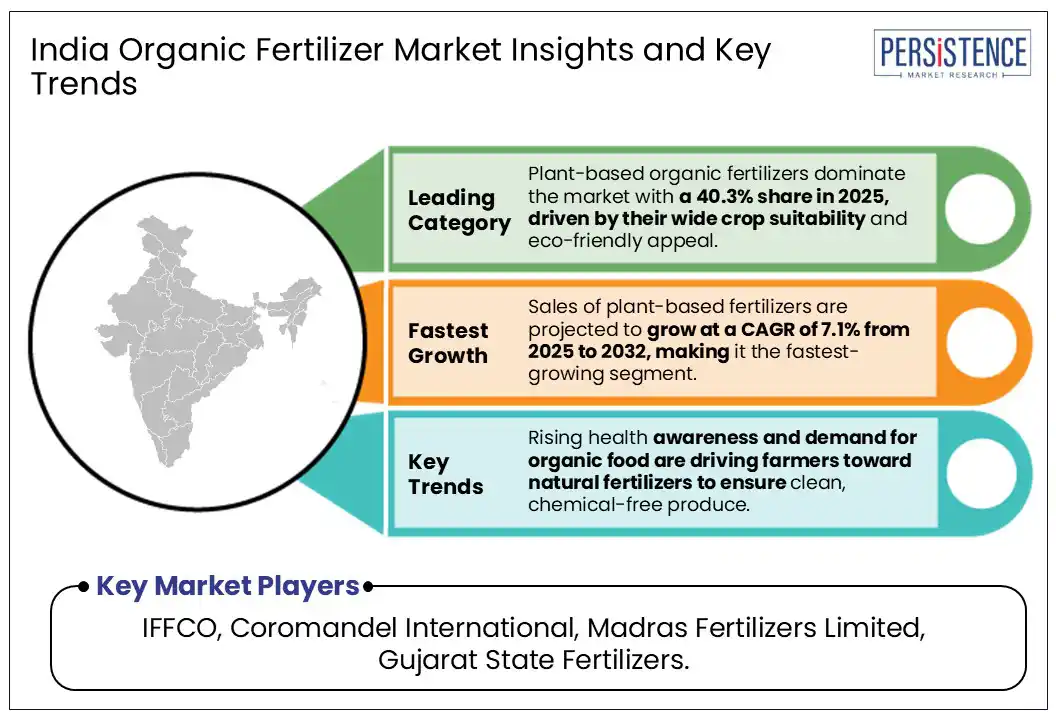

Plant-based organic fertilizers hold a market share of 40.3% in India’s organic fertilizer market in 2025, driven by rising demand for sustainable and crop-specific inputs. Fertilizers like cotton seed meal and green manure are widely preferred by farmers growing flowers, fruits, and leafy vegetables. These inputs improve soil structure, boost microbial activity, and suit a wide range of crops, making them a favored choice across organic farms.

With organic farming expanding in states like Madhya Pradesh, Maharashtra, and Gujarat, the need for natural, plant-sourced nutrients continues to grow. The market is witnessing strong interest from horticulturists and vegetable growers who prioritize chemical-free cultivation. Sales of plant-based fertilizers are rising steadily at a projected CAGR of 7.1% from 2025 to 2032, reflecting their critical role in India’s shift toward regenerative agriculture.

The agriculture segment holds around 71.2% of the Indian organic fertilizer market in 2025, driven by the rapid growth of organic farming across key states. As of March 2024, India has over 1.76 million hectares under organic farming and 3.62 million hectares under conversion, making it the 4th largest certified organic area globally.

Farmers in Madhya Pradesh, Maharashtra, Rajasthan, Gujarat, and Karnataka continue to adopt organic practices to improve soil health and meet rising consumer demand for chemical-free food. The focus on sustainability and crop resilience is also fueling this shift.

Strong government support through schemes like PKVY, along with health-conscious consumers and export potential, pushes farmers to use organic fertilizers more widely. Despite facing hurdles like certification complexity and high input costs, farmers are transitioning faster due to climate challenges and growing domestic demand. With India ranking first globally in the number of organic farmers, the agriculture segment will remain the backbone of the organic fertilizer market.

North India holds the market share of 28.9% in the India organic fertilizer market in 2025, driven by increasing demand for organic food, government-supported schemes, and large-scale cultivation in states like Punjab, Haryana, Uttar Pradesh, and Uttarakhand. Despite only a small fraction of farmland under organic cultivation in these states, the demand is growing fast. Punjab and Haryana, traditionally known for intensive farming, are gradually shifting toward sustainable practices due to rising concerns around soil health and chemical residue in food. Uttarakhand, with over 10% of its net sown area under organic farming, adds further weight to the region’s contribution.

The region benefits from multiple government initiatives, including the Paramparagat Krishi Vikas Yojana (PKVY) and Jaivik Kheti portal, which help farmers with financial support and direct market access. States like Uttar Pradesh have also made progress under schemes like NPOP and PM-PRANAAM, pushing adoption of bio and organic inputs. With growing consumer interest in clean-label foods and export-oriented crops like oilseeds, pulses, and dry fruits, North India continues to strengthen its position in the organic fertilizer ecosystem.

West India holds a market share of around 22.3% in the India organic fertilizer market in 2025, driven by the strong presence of organic farming and fertilizer production in Maharashtra and Gujarat.

Maharashtra ranks among the top three states in India for organic cultivation, contributing significantly to national coverage. It also produced over 131,000 metric tonnes of organic fertilizers, with City Compost and PROM leading the output. This strong demand and supply cycle makes Maharashtra a key pillar for market growth in the region.

Gujarat adds further strength to the western region by producing nearly 294,000 metric tonnes of organic fertilizers. The state shows a well-distributed mix of inputs like organic manure, farmyard manure, and PROM.

While Goa remains at an early stage in this sector with limited production, the overall momentum in the region remains upbeat. With increasing awareness, policy push, and diverse fertilizer production, West India continues to shape itself as a robust organic fertilizer market.

The Indian organic fertilizer market features an increasingly dynamic and innovation-driven landscape, led by key players such as IFFCO, Coromandel International, ICL, Syngenta, and Khetiwalo (Dharti Shakti). These companies are investing heavily in next-generation formulations such as nano fertilizers, bio-based inputs, and crop-specific soil health enhancers.

With advanced manufacturing units, proprietary blends, and region-specific product launches, these players are actively expanding their distribution networks and product footprints to meet rising demand for eco-conscious farming solutions.

Manufacturers in this space are not just scaling up capacities but are also leveraging public-private partnerships, field research data, and government-led schemes to drive adoption. The strong involvement of ICAR-backed innovations and central subsidies has led to a more balanced competitive environment.

Based on these trends, the market leans toward a fragmented nature, with a mix of large-scale cooperatives and private companies offering diverse formulations rather than a few dominant entities controlling the majority share.

Key Developments

By Source

By Crop Type

By Form

By End User

By Region

The Indian market is projected to be valued at US$ 622.6 million in 2025.

The plant-based source is expected to hold a 48.3 % share in the organic fertilizer market.

The market is poised to witness a CAGR of 7.1% from 2025 to 2032.

Rising health awareness, increasing organic food consumption, and strong government support are driving the organic fertilizer market growth in India.

Surging demand for organic food products and policy-driven promotion of sustainable farming practices offer major growth opportunities for organic fertilizer manufacturers.

Key players include IFFCO, Coromandel International, Madras Fertilizers Limited, Gujarat State Fertilizers.

|

Report Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value |

|

Key Regions Covered |

|

|

Key Companies Covered |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available on Report |

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author