ID: PMRREP33435| 190 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

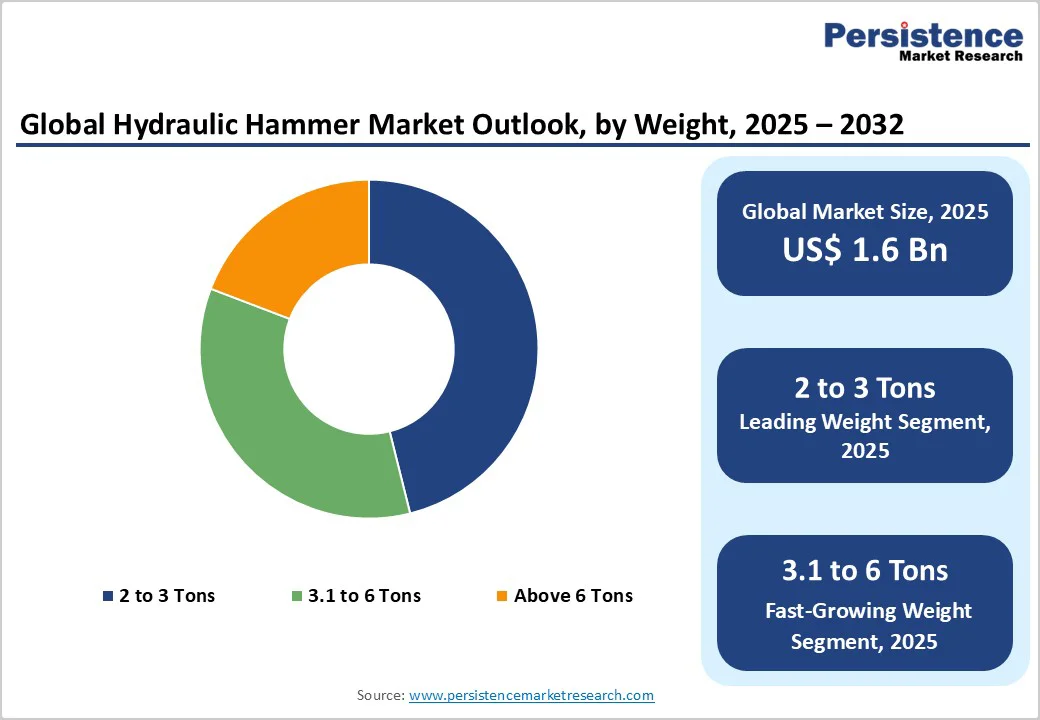

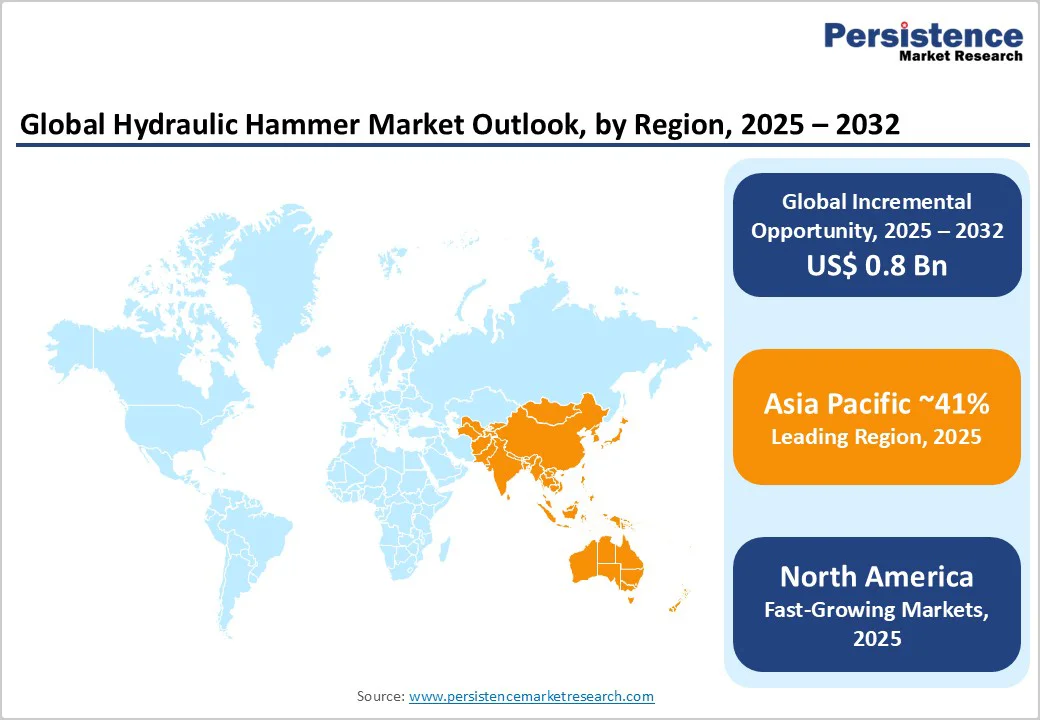

The global hydraulic hammer market size is likely to value at US$ 1.6 billion in 2025 and is projected to reach US$ 2.4 billion by 2032, growing at a CAGR of 6.0 % between 2025 and 2032. The market demonstrates sustained momentum driven by accelerating infrastructure development across emerging economies, rise in mining activities, and technological innovations enhancing operational efficiency. The equipment, commonly referred to as hydraulic hammers in North America and hydraulic breakers across Europe and Asia, reflects regional terminology preferences shaped by industry practice and manufacturer usage. Rapid urbanization in Asia Pacific countries, coupled with government-backed construction initiatives such as China’s Belt and Road Initiative and India’s Smart Cities Mission, is generating substantial demand for demolition and excavation equipment.

| Key Insights | Details |

|---|---|

| Hydraulic Hammer Market Size (2025E) | US$ 1.6 billion |

| Market Value Forecast (2032F) | US$ 2.4 billion |

| Projected Growth CAGR (2025-2032) | 6.0% |

| Historical Market Growth (2019-2024) | 5.1% |

Market Drivers

Global infrastructure investment represents the most significant growth driver for hydraulic hammer demand, with governments worldwide allocating unprecedented capital toward construction projects. The United States Infrastructure Investment and Jobs Act channels approximately US$ 1.2 trillion into infrastructure modernization, while Europe's NextGeneration recovery plan commits €800 billion toward sustainable infrastructure. According to the World Bank, global construction output is expected to reach US$ 15 trillion by 2030, with major contributors being China, India, and the United States.

The United Nations projects that approximately 68% of the world's population will live in urban areas by 2050, necessitating extensive construction of buildings, transportation systems, and utilities, all requiring robust demolition and excavation equipment. India's Union Budget for 2023-24 committed INR 10 lakh crore (approximately US$ 120 billion) to infrastructure, more than triple its 2019 allocation, spurring demand for excavators, hydraulic hammers (breakers), and related attachments. China's construction industry output exceeded 31 trillion Yuan (approximately US$ 4.5 trillion) in 2023, significantly influenced by the Belt and Road Initiative, creating sustained demand for advanced demolition equipment.

The mining equipment experiencing prominent growth in the global Construction & Mining Equipment Market directly influences hydraulic hammer demand as these tools remain essential for rock breaking and material processing operations. Rising demand for critical minerals, including lithium, cobalt, nickel, and copper, fundamental components in electric vehicle batteries and renewable energy infrastructure, has intensified mining activities globally. Investment in copper mining alone is expected to surpass around US$60 billion in 2025, reflecting the strategic importance of mineral extraction to support the energy transition. According to the US Geological Survey, global mining machinery demand has been increasing steadily, with the mining sector contributing billions annually to the global economy. India's mining sector, contributing approximately 2% to GDP, witnessed prominent growth in coal production in 2024 compared to 2023, with the government approving the National Critical Mineral Mission in January 2025. Mining operations in resource-rich regions including Latin America, Africa, and Australia are ramping up production to meet surging commodity demand, requiring hydraulic hammers for efficient ore extraction, overburden removal, and secondary breaking operations.

Restraints

The substantial upfront investment required for purchasing heavy-duty hydraulic hammers poses a significant barrier, particularly for small and medium-sized enterprises operating on constrained budgets. High-quality hydraulic breakers from established manufacturers command premium prices reflecting their advanced engineering, durable materials, and superior performance capabilities. Beyond acquisition costs, ownership entails ongoing expenses including maintenance, replacement parts, storage, and depreciation, creating financial strain for contractors with irregular project pipelines.

According to industry analysis, maintenance costs and the necessity for skilled operators to handle these machines can deter smaller businesses from market entry. The hydraulic breakers rental market, projected to reach around US$698.2 million by 2032, demonstrates how cost pressures are reshaping procurement strategies, as contractors increasingly favor rental models offering operational flexibility without substantial capital commitment.

The construction industry faces a critical skilled labor shortage, with approximately 650,000 positions unfilled in the United States alone, directly impacting effective utilization of hydraulic hammers and related heavy equipment. Proper operation of hydraulic breakers requires specialized training, technical expertise, and certification to ensure safe, efficient performance, yet 85 to 90% of construction firms report difficulty finding workers possessing the necessary skills. The aging workforce compounds this challenge, with over 20% of construction workers aged 55 or older approaching retirement, while less than 3% of young people consider construction careers. This demographic imbalance threatens to exacerbate the skills gap, as experienced operators who understand hydraulic hammer maintenance protocols, proper usage techniques, and troubleshooting retire without adequate successor training. Operator incompetence increases equipment damage risk, reduces productivity, and elevates safety hazards, as improper techniques such as using breakers as pry bars or running equipment continuously beyond recommended intervals cause premature wear and catastrophic failures. The shortage of qualified heavy equipment operators leads to project delays, increased labor costs, and compromised quality control as remaining workers face excessive workloads and burnout.

The aftermarket segment, growing at a CAGR of 6.3% through 2032, presents substantial revenue opportunities as hydraulic hammers operating in demanding construction and mining environments require regular maintenance, component replacement, and service interventions. Hydraulic breakers experience continuous wear from high-impact operations, generating sustained demand for consumables, including chisels, bushings, seals, pistons, and nitrogen charging services. The global consumables hydraulic breaker market is projected to expand at a CAGR of 6.3% from 2025 to 2032. Manufacturers offering comprehensive repair kits, predictive maintenance programs, and genuine OEM replacement parts capture recurring revenue streams while building customer loyalty through superior after-sales support. Epiroc's hydraulic breaker repair kits, which include all crucial wear parts needed for factory-specification service, exemplify value-added aftermarket offerings that simplify order handling and ensure optimal equipment performance. The integration of telematics and remote diagnostics enables proactive maintenance scheduling, creating opportunities for service providers to offer monitoring contracts, preventive maintenance packages, and performance optimization services that extend equipment lifespan and maximize uptime.

The development of electric and hybrid hydraulic breakers addresses environmental regulations and sustainability demands, creating differentiation opportunities for manufacturers pioneering zero-emission demolition solutions. Stringent emission standards, including Euro 7 regulations, which mandate substantial reductions in nitrogen oxides, particulate matter, and other pollutants from construction machinery, are driving innovation in cleaner hydraulic hammer technologies. Epiroc's 2021 launch of electric breakers and Sandvik's 2022 introduction of models with improved noise reduction technology exemplify industry responses to environmental pressures.

The integration of artificial intelligence, machine learning, and autonomous operation capabilities offers opportunities to develop smart hydraulic hammers featuring adaptive control systems, predictive failure algorithms, and remote operation interfaces that enhance safety in hazardous environments. Manufacturers investing in lightweight, high-strength materials that improve power-to-weight ratios while maintaining durability can capture market share among contractors seeking maximum productivity from compact equipment. The growing emphasis on circular economy principles and equipment recyclability creates opportunities for companies developing modular designs with easily replaceable components and closed-loop material recovery systems.

The 2 to 3 Tons segment dominates the hydraulic hammer market with a commanding 46% market share, driven by its optimal balance of power, maneuverability, and versatility for standard construction and demolition applications. These medium-weight breakers align with the most popular excavator classes used in residential construction, road maintenance, and urban infrastructure projects, providing sufficient impact force for concrete breaking and asphalt removal while maintaining compatibility with widely deployed carrier equipment. Their widespread adoption reflects contractor preferences for multipurpose attachments capable of handling diverse job site requirements without necessitating specialized heavy machinery.

The 3.1 to 6 Tons segment emerges as the fastest-growing category, expanding at a robust 6.5% CAGR through 2032, propelled by increasing large-scale infrastructure development and mining operations requiring enhanced breaking power for tougher materials. This segment's accelerated growth correlates with the proliferation of mid-to-large excavators in major construction markets and the intensification of quarrying activities extracting harder rock formations. Contractors undertaking highway construction, bridge demolition, and mining overburden removal increasingly specify these heavier breakers to achieve superior productivity in challenging applications, while technological improvements have reduced weight penalties and improved energy efficiency, making them attractive alternatives to even larger models.

The construction segment maintains market leadership with 41% share, reflecting the sector's fundamental reliance on hydraulic hammers for demolition, excavation, roadwork, and foundation preparation activities. Global construction spending exceeding US$2 trillion annually and projected to reach US$15.7 trillion in 2025 underscores the scale of industry demand for breaking equipment. Urbanization trends driving residential and commercial building construction, combined with government infrastructure programs focusing on transportation networks, utilities, and public facilities, sustain consistent hydraulic hammer consumption. The construction industry's broad geographic footprint and diverse project types—from small residential renovations to mega-infrastructure developments—create stable, high-volume demand across all hydraulic hammer weight categories.

The quarries segment registers the highest growth rate, fueled by surging demand for aggregates, crushed stone, and industrial minerals supporting infrastructure expansion. The stone crushing equipment market is growing at a significant pace, with an expected CAGR of around 8.1%, reflecting intensifying quarry operations globally. Increased consumption of construction aggregates for road base materials, concrete production, and rail ballast, coupled with mining of dimension stone for architectural applications, drives hydraulic hammer demand in primary and secondary breaking operations. Quarries increasingly adopt hydraulic breakers over traditional drilling and blasting methods in urban-adjacent sites where explosives face regulatory restrictions, noise limitations, and vibration concerns, with breakers offering controlled, precise material fragmentation without environmental disruptions.

The OEM segment commands 68% market share, reflecting direct equipment manufacturer sales dominating procurement channels, particularly for large construction firms and mining operations requiring new machines with full warranties, factory support, and financing options. Major manufacturers including Caterpillar, Epiroc, Komatsu, Atlas Copco, and Volvo leverage extensive dealer networks, integrated product ecosystems, and comprehensive service capabilities to maintain dominant OEM channel positions. Construction equipment buyers prioritize OEM purchases for capital investments involving excavators with matched hydraulic breakers, ensuring optimal compatibility, performance validation, and unified service support. The OEM channel's strength derives from manufacturers' ability to bundle financing packages, extended warranties, telematics integration, and operator training, creating value propositions that justify premium pricing over aftermarket alternatives.

The aftermarket segment exhibits the strongest growth momentum at 6.3% CAGR, driven by replacement demand, retrofit installations, and cost-conscious contractors seeking value alternatives to OEM pricing. The aftermarket encompasses replacement parts, refurbished equipment, third-party attachments, and independent service providers offering competitive pricing and specialized expertise. Growing equipment rental penetration stimulates aftermarket demand, as rental companies require continuous parts supply and maintenance services to keep diverse fleets operational.

The emergence of quality-certified aftermarket suppliers offering OEM-equivalent components at 20-40% cost savings attracts price-sensitive buyers, while extending equipment lifecycles through professional rebuilding services provides economic alternatives to new equipment purchases. Digital marketplaces and e-commerce platforms enhance aftermarket accessibility, enabling contractors to source parts globally, compare specifications, and access technical support through online channels, democratizing availability beyond traditional dealer networks.

The North American hydraulic hammer market demonstrates steady expansion at a prominent CAGR of 5.8% through 2032, driven by substantial public infrastructure investment, aging infrastructure replacement needs, and robust mining sector activity. The United States Infrastructure Investment and Jobs Act allocates US$ 1.2 trillion toward modernizing transportation networks, water systems, and broadband infrastructure, creating sustained demand for demolition and excavation equipment. Total US construction spending, reaching US$ 2.23 trillion in 2025 with a 3.3% year-over-year increase, encompasses institutional projects including healthcare facilities, educational institutions, and public buildings, all requiring hydraulic hammers for site preparation and renovation. Nonresidential construction is projected to grow 1.7 to 2% in 2025-2026, with institutional sectors experiencing prominent spending growth in 2025.

Canada's mining sector investments, particularly in critical minerals extraction supporting electric vehicle battery supply chains, generate equipment demand. North America's market leadership stems from advanced technology adoption, with contractors increasingly specifying hydraulic hammers featuring telematics, automated control systems, and emission-compliant engines meeting stringent EPA standards. The region's well-established equipment rental industry, exemplified by United Rentals' and Herc Holdings' extensive fleets, facilitates hydraulic hammer accessibility for contractors across project scales. Regulatory emphasis on worker safety, noise reduction, and environmental protection drives adoption of advanced hydraulic hammers with vibration dampening, sound attenuation, and dust suppression features. Established distribution infrastructure, comprehensive dealer support networks, and readily available skilled technicians support market maturity, while ongoing infrastructure modernization requirements ensure sustained long-term demand.

The European hydraulic hammer market, holding approximately 23.6% of global market share, maintains steady growth. The region's market dynamics are shaped by stringent environmental regulations, infrastructure modernization imperatives, and mining sector expansion in Eastern Europe. Germany dominates the regional market, driven by its robust construction equipment manufacturing base, extensive infrastructure renewal projects, and advanced demolition technology adoption. The UK market exhibits a 3.9% CAGR, supported by the government's £650 billion infrastructure spending commitment over ten years, targeting transportation, energy, and housing sectors. France demonstrates the fastest growth, propelled by urban redevelopment initiatives, circular construction economy mandates requiring efficient demolition waste management, and railway infrastructure expansion. Spain's construction sector recovery and Italy's infrastructure investment programs contribute to regional demand momentum.

Europe's green building market is projected to grow at an 11% CAGR, influencing hydraulic hammer specifications as sustainability directives necessitate lower emissions, reduced noise, and improved fuel efficiency. The Euro 7 emission standard implementation, establishing stringent limits for nitrogen oxides, particulate matter, and other pollutants from construction equipment, compels manufacturers to develop cleaner hydraulic breaker technologies. European hydraulic breaker manufacturers such as Montabert, Rammer, Indeco, and Atlas Copco strengthen their position through energy-efficient systems and smart technologies. Rising mining activities and infrastructure investments across Scandinavia, Poland, and the Balkans drive demand for safe, ergonomic, and sustainable hydraulic hammer solutions.

Asia Pacific dominates the global hydraulic hammer market with a commanding 41% share, establishing itself as the highest-growth market driven by rapid urbanization, massive infrastructure investments, and expanding mining operations. The region's construction equipment market is growing at a 9.13% CAGR, propelled by China and India's infrastructure mega-programs. China's Belt and Road Initiative, spanning infrastructure development across Asia, Africa, and Europe, generates unprecedented demand for construction machinery, including hydraulic breakers. China's construction industry output exceeding 31 trillion Yuan (US$ 4.5 trillion) in 2023 reflects the scale of building activity, sustaining equipment demand. India's infrastructure sector, receiving INR 10 lakh crore (US$ 120 billion) government commitment in the 2023-24 budget, triple the 2019 allocation, drives accelerated hydraulic hammer adoption across highway construction, metro rail projects, and Smart Cities development.

Southeast Asian markets, including Indonesia, Malaysia, the Philippines, Thailand, and Vietnam, experience rapid construction growth supporting residential, commercial, and industrial expansion in emerging economies. Japan focuses on infrastructure renewal, disaster resilience enhancement, and technology integration, leading the development of smart construction solutions incorporating IoT, AI, and automation in hydraulic equipment. Australia's infrastructure modernization programs and extensive mining sector, particularly iron ore, coal, and precious metals extraction, sustain robust hydraulic breaker demand.

South Korea's hydraulic breaker manufacturers, including Soosan Heavy Industries, Hyundai, and Daemo, compete with global brands, offering cost-competitive products tailored to regional market requirements. The Asia Pacific market's price sensitivity favors manufacturers offering durable, performance-reliable equipment at competitive price points, with growing sophistication in quality expectations and after-sales service demands.

The global hydraulic hammer market remains moderately concentrated, led by Epiroc, Sandvik, Caterpillar, and Atlas Copco, jointly holding around 15–20% share through advanced technologies and global service networks. Second-tier players such as Furukawa, Montabert, NPK, Soosan, Indeco, and Rammer strengthen regional footholds, while Asian manufacturers like Nuosen, Daemo, and Toku Pneumatic compete with cost-efficient, localized offerings.

Innovation-driven growth defines the hydraulic breaker market, with leaders allocating around 4–6% of revenues to R&D for smart, energy-efficient, and IoT-enabled systems. Vertical integration ensures quality and supply chain control, while OEM partnerships enhance market reach. Service-focused models, offering lifecycle contracts and predictive maintenance, build customer loyalty, and rental market expansion strengthens accessibility. Sustainability leadership through electric and emission-compliant designs increasingly drives competitive advantage.

The hydraulic hammer market was valued at US$ 1.6 billion in 2025 and is projected to reach US$ 2.4 billion by 2032.

The market is primarily driven by accelerating infrastructure investment across emerging economies including China and India's mega-projects, expanding mining operations to extract critical minerals for electric vehicles and renewable energy, and technological advancements enhancing equipment efficiency, durability, and environmental compliance.

The hydraulic hammer market is expected to grow at a CAGR of 6.0%.

Key opportunities include aftermarket services expansion, emerging market penetration in Southeast Asia, Africa, and Latin America, experiencing rapid infrastructure development, and technological innovation in electric and hybrid breakers addressing environmental regulations.

Leading manufacturers include Epiroc, Sandvik, Caterpillar, Atlas Copco, Komatsu, Furukawa, Soosan Heavy Industries, NPK, Indeco, Montabert, Volvo Construction Equipment, and other players commanding significant market share through technological innovation, global distribution networks, and comprehensive product portfolios.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Weight

By Industry

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author