ID: PMRREP27385| 191 Pages | 10 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

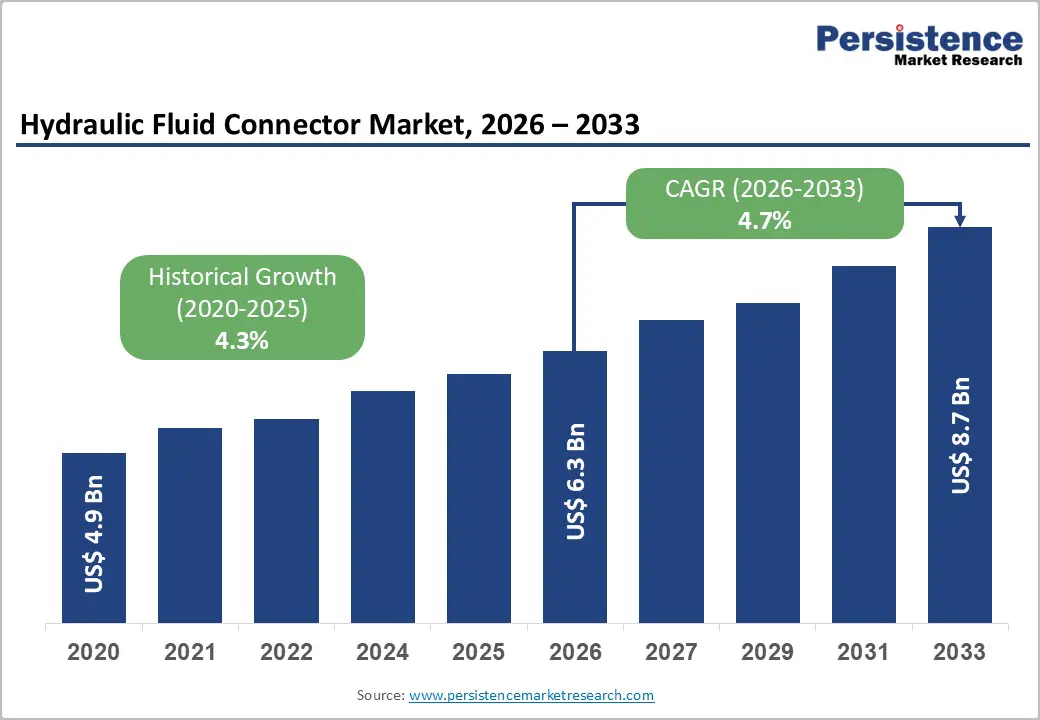

The global hydraulic fluid connector market size is likely to be valued at US$6.3 billion in 2026 and is expected to reach US$8.7 billion by 2033, growing at a CAGR of 4.7% during the forecast period from 2026 to 2033, driven by the rising adoption of hydraulic systems across construction, agriculture, industrial manufacturing, and material handling, where connectors play a critical role in ensuring efficient, high-pressure fluid transfer. Growing infrastructure development and mechanization in emerging economies are driving demand for durable, high-performance hydraulic connectors, especially for earthmoving equipment, tractors, and industrial machinery. Ongoing technological advancements, such as enhanced sealing technologies, corrosion-resistant materials, and quick-connect solutions, are improving system reliability, minimizing leakage, and reducing maintenance downtime.

| Key Insights | Details |

|---|---|

| Hydraulic Fluid Connector Market Size (2026E) | US$6.3 Bn |

| Market Value Forecast (2033F) | US$8.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.7% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.3% |

Hydraulic systems are central to the operation of modern construction machinery. Equipment such as excavators, bulldozers, cranes, loaders, and road-building machines depends on high-pressure hydraulic connectors for efficient and safe fluid transmission. Increasing investments in highways, railways, airports, ports, and urban infrastructure are driving greater deployment of such machinery, boosting demand for hoses, couplings, fittings, and adapters. The growing shift toward mechanized and automated construction methods to improve productivity and shorten project timelines is further increasing the need for reliable hydraulic connectors. Large-scale public-private infrastructure initiatives are accelerating equipment procurement across regions.

In both emerging and developed markets, infrastructure expansion and renewal programs are sustaining heavy equipment usage, leading to frequent maintenance and replacement of hydraulic components. This is generating recurring demand for durable connectors with superior leak prevention, corrosion resistance, and high load-bearing capabilities. Stricter safety and performance regulations are pushing manufacturers to develop advanced connector designs that enhance system reliability and reduce operational risks. The emphasis on minimizing downtime is encouraging contractors to adopt high-quality, standardized connectors.

Hydraulic connectors rely on raw materials such as steel, brass, aluminum, polymers, and elastomers, whose costs are affected by global demand, energy prices, and trade policies. Supply chain disruptions, limited availability of specialty alloys, and extended lead times for critical components can raise procurement costs and delay production. To maintain a steady supply for construction, industrial, and energy applications, manufacturers are optimizing sourcing strategies, diversifying suppliers, increasing inventory levels, and strengthening partnerships with regional providers.

Volatility in material costs is also driving innovation and strategic adaptation. Companies are exploring alternative materials, lightweight composites, and cost-effective alloys to manage price fluctuations while maintaining performance standards. Strategies such as long-term supplier agreements, localized production, and vertical integration are increasingly being implemented to reduce exposure to global supply risks. Rising material costs are encouraging end users to select durable, high-quality connectors with longer service life and lower maintenance requirements, while supply chain challenges are prompting efficiency improvements, material innovation, and more resilient manufacturing practices throughout the hydraulic connector industry.

Manufacturers are increasingly designing hydraulic connectors with environmental sustainability and operational efficiency in mind. The rising adoption of eco-friendly hydraulic systems is driving demand for connectors that are compatible with biodegradable and low-toxicity fluids, feature advanced sealing technologies, and minimize leakage. Innovations in materials, such as corrosion-resistant alloys, lightweight composites, and recyclable polymers, enable connectors to maintain high performance while reducing environmental impact. These developments help end users comply with stricter environmental regulations and achieve sustainability targets across construction, agriculture, and industrial sectors.

The integration of digital and smart technologies into hydraulic systems is creating additional opportunities for connectors optimized for sensor-enabled monitoring and predictive maintenance platforms. Improved durability and extended service life reduce material consumption and maintenance frequency, supporting circular economy objectives. By aligning advanced connector technology with sustainability and efficiency requirements, manufacturers can differentiate their products, expand into new applications, and strengthen long-term competitiveness in the hydraulic fluid connector market.

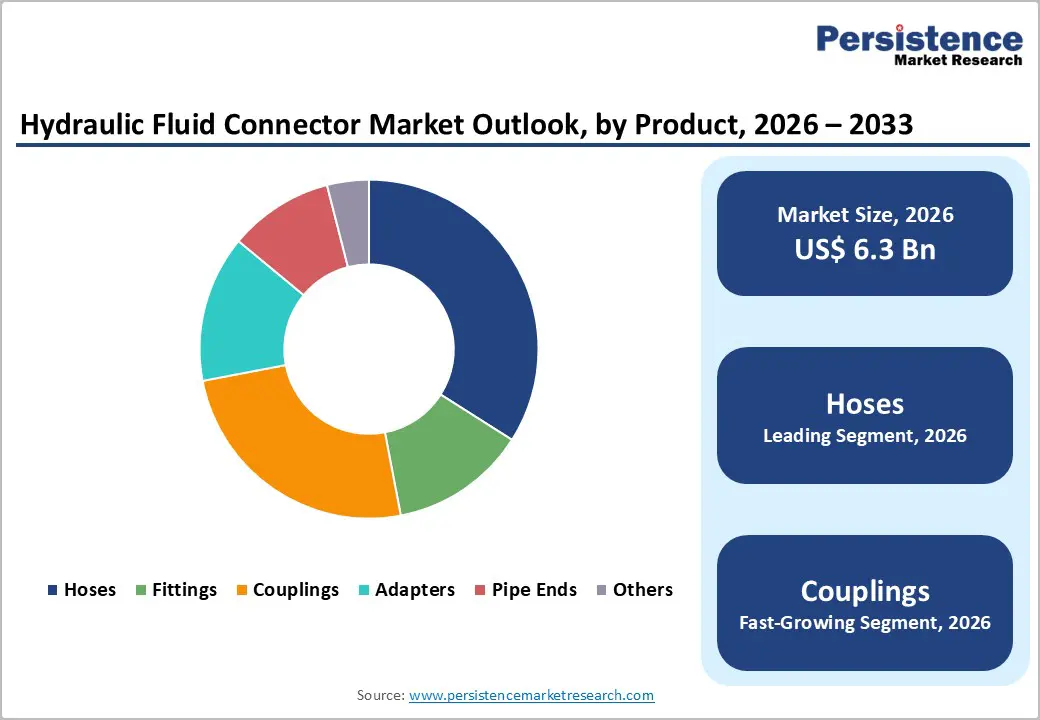

The hoses segment is expected to lead the market, accounting for approximately 40% of total revenue in 2026, owing to their critical role in flexible fluid transmission across both mobile and stationary hydraulic systems. Hoses are essential in construction, agricultural, and industrial equipment, ensuring smooth and safe hydraulic fluid flow under high pressure and dynamic movement. In large-scale infrastructure projects, such as those involving excavators and loaders, hydraulic hoses enable precise operation of boom and bucket mechanisms while withstanding repeated bending and extreme environmental conditions. Their widespread adoption is further supported by compatibility with various hydraulic fluids, the ability to handle a range of pressures, and durability in harsh operational settings.

The couplings segment is anticipated to be the fastest-growing in 2026, driven by the demand for rapid, reliable connections in high-cycle industrial and mobile hydraulic applications. Couplings facilitate quick assembly and disassembly of hydraulic circuits without leakage, enhancing operational efficiency and reducing downtime during maintenance. Growth in this segment is further fueled by automation trends in construction, manufacturing, and material handling equipment, where frequent reconnections and system flexibility are required. For instance, RYCO Hydraulics offers quick couplings for mining and agricultural machinery, providing leak-proof performance under high pressure while enabling rapid equipment changes in the field.

Metal connectors are projected to lead the market, accounting for approximately 60% of revenue in 2026, due to their superior strength, high-pressure tolerance, and durability required in heavy-duty applications such as oil & gas, mining, and industrial machinery. These connectors can withstand extreme temperatures, pressures, and corrosive fluids, making them essential for reliable hydraulic systems. For example, Eaton supplies stainless steel hydraulic fittings for high-pressure drilling equipment, ensuring system integrity and long-term operational safety. The robustness of metal connectors also allows repeated assembly and disassembly without performance loss, which is critical for maintenance-intensive operations. They are widely used in mobile equipment such as tractors and excavators, where consistent reliability is key to minimizing downtime in field operations.

Plastic connectors are expected to be the fastest-growing material segment in 2026, driven by increasing use in applications prioritizing weight reduction, corrosion resistance, chemical compatibility, and cost efficiency over high-pressure performance. These connectors are particularly suited to low- and medium-pressure systems in industries such as chemical processing, food & beverage, and light industrial machinery, where plastics offer superior resistance to corrosive fluids and environments compared with metals. For instance, high-strength nylon and polyamide hydraulic fittings from manufacturers such as PNR are designed for durability, chemical resistance, and lighter weight, making them ideal for agricultural sprayers, low-pressure fluid handling, and customized fluid circuits.

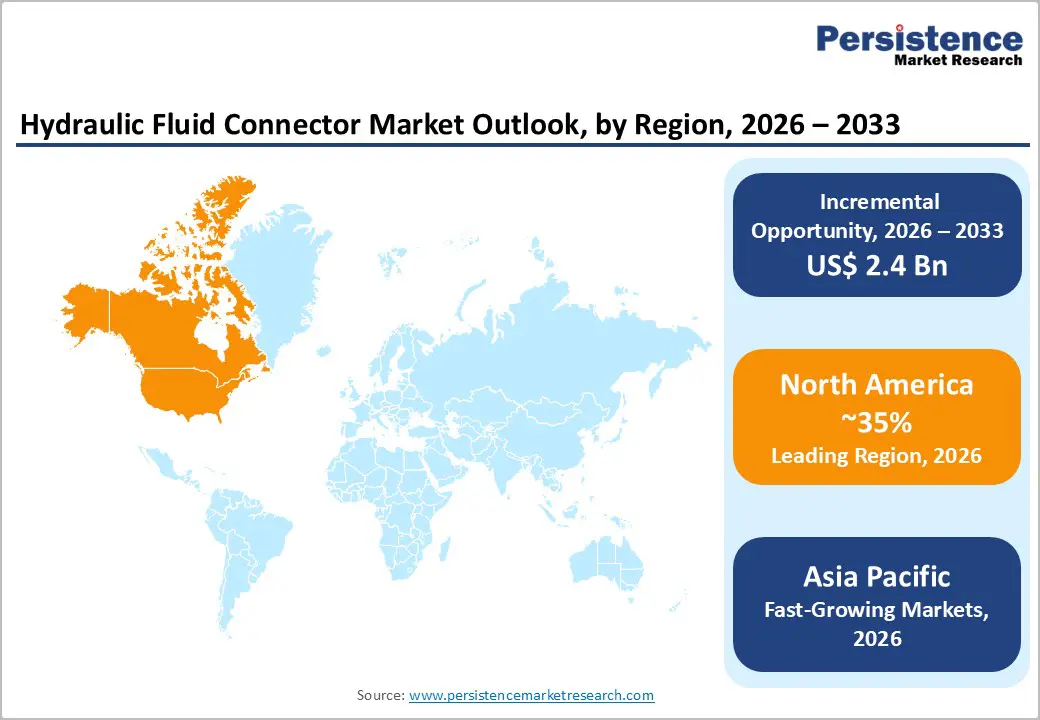

North America is expected to be the leading region, capturing approximately 35% of the market share in 2026, driven by continued industrial investments and evolving demand across key end-user sectors, including construction, energy, agriculture, and manufacturing. Growth in infrastructure and construction projects, supported by federal initiatives such as the U.S. Infrastructure Investment and Jobs Act, is boosting demand for high-performance hydraulic systems that rely on reliable, leak-free connectors for heavy machinery and mobile equipment. Increasing mechanization in mining and material handling is further fueling the need for advanced hoses, quick couplings, and fittings capable of withstanding high pressures and harsh operating conditions.

Regional manufacturers are focusing on advanced materials and smart connector technologies that offer real-time diagnostics, enhanced corrosion resistance, and lighter weight to improve operational efficiency. For example, Parker Hannifin Corporation launched low-spill quick-disconnect couplers with integrated sensors for industrial applications and data center liquid cooling, highlighting the growing role of digital fluid systems and leak prevention in North America. This trend aligns with broader shifts toward predictive maintenance, IoT integration, and environmentally sustainable design, positioning the market for continued innovation beyond traditional hydraulic applications.

Europe is expected to be a significant market for hydraulic fluid connectors in 2026, driven by a strong industrial base and increasing automation across manufacturing, automotive, and material handling sectors. EU regulatory frameworks, including the Pressure Equipment Directive (PED 2014/68/EU) and stringent safety and environmental standards, ensure that hydraulic connectors meet high requirements for performance, leak prevention, and durability. These regulations are encouraging manufacturers to innovate and certify products in compliance with these norms. The growing adoption of automation and digital manufacturing is further boosting demand for advanced hydraulic systems that rely on precise and reliable connectors, particularly in logistics, robotics, and heavy machinery applications.

Sustainability and eco-efficient technologies are a key focus in the European market. Equipment manufacturers increasingly favor hydraulic connectors that support energy-efficient systems and lower environmental impact, including components compatible with biodegradable fluids and recyclable materials. For example, Hydroscand, a Sweden-based supplier of hydraulic hoses and connectors with extensive European operations, offers corrosion-resistant and service-oriented solutions that enhance lifecycle performance and reduce waste. The emphasis on predictive maintenance, IoT integration, and sensor-enabled hydraulic components is reshaping product development, as European end users prioritize connectors that maximize uptime and reduce operational costs.

The Asia Pacific region is expected to be the fastest-growing market for hydraulic fluid connectors in 2026, driven by rapid industrialization, large-scale infrastructure development, and increasing mechanization in key economies such as China, India, Japan, and Southeast Asian countries. Investments in highways, rail networks, ports, and urban development projects are boosting equipment utilization and driving demand for reliable connectors, including hoses, couplings, and fittings. The move toward standardized safety regulations is also enhancing product quality and adoption across the region. For example, Manuli Hydraulics expanded its manufacturing presence in India and China, supplying a comprehensive range of hoses, fittings, and quick-connect couplings designed for demanding construction and industrial applications.

The region is also witnessing growing adoption of advanced and smart hydraulic solutions, including connectors compatible with digital monitoring and predictive maintenance systems. To improve operational efficiency, minimize downtime, and meet sustainability goals, manufacturers are introducing lightweight, corrosion-resistant, and high-performance connector variants tailored to regional requirements. Increased focus on material innovation and localized production is helping reduce reliance on imported components while addressing raw material volatility and lead-time challenges.

The global hydraulic fluid connector market is moderately fragmented, characterized by the presence of numerous global and regional manufacturers competing on product quality, innovation, distribution networks, and service capabilities. While a few multinational companies hold a significant share of the market, a diverse group of mid-sized and local players contributes to competitiveness by catering to niche segments and aftermarket demand. Market growth is supported by ongoing advancements in materials, sealing technologies, and leak-proof designs, which enhance performance standards and expand options for end users in construction, agriculture, energy, and industrial sectors.

Key market leaders include Parker Hannifin, Eaton Corporation, Gates Corporation, Bosch Rexroth, and Manuli Hydraulics. The competitive landscape is shaped by their extensive product portfolios, global distribution networks, and substantial investments in innovation and customer support. These companies differentiate themselves through product innovation, strategic partnerships, geographic expansion, and targeted acquisitions to strengthen market presence and technological capabilities.

In April 2025, Parker introduced the SensoControl Converter Box, an enhancement to its Service Master Connect platform, aimed at improving monitoring and control of complex hydraulic systems. The device allows seamless integration of multiple hydraulic sensor technologies, enabling real-time measurement of pressure, flow rates, and fluid conditions. The Converter Box connects via Plug & Play to the CAN input, supporting up to 20 external current/voltage sensors or 34 digital inputs across four boxes, providing scalability for large and complex systems

The global hydraulic fluid connector market is projected to reach US$6.3 billion in 2026.

Rising demand from construction, agriculture, industrial machinery, and infrastructure development requires reliable hydraulic systems.

The hydraulic fluid connector market is expected to grow at a CAGR of 4.7% from 2026 to 2033.

Key market opportunities include the adoption of advanced and smart hydraulic connectors, the use of lightweight and corrosion-resistant materials, and growth in emerging markets driven by expanding industrialization and infrastructure development.

Parker Hannifin, Eaton, Kurt Hydraulics, RYCO Hydraulics, and Manuli Hydraulics are the leading players.

| Report Attribute | Details |

|---|---|

| Historical Data | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author