ID: PMRREP33671| 200 Pages | 21 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

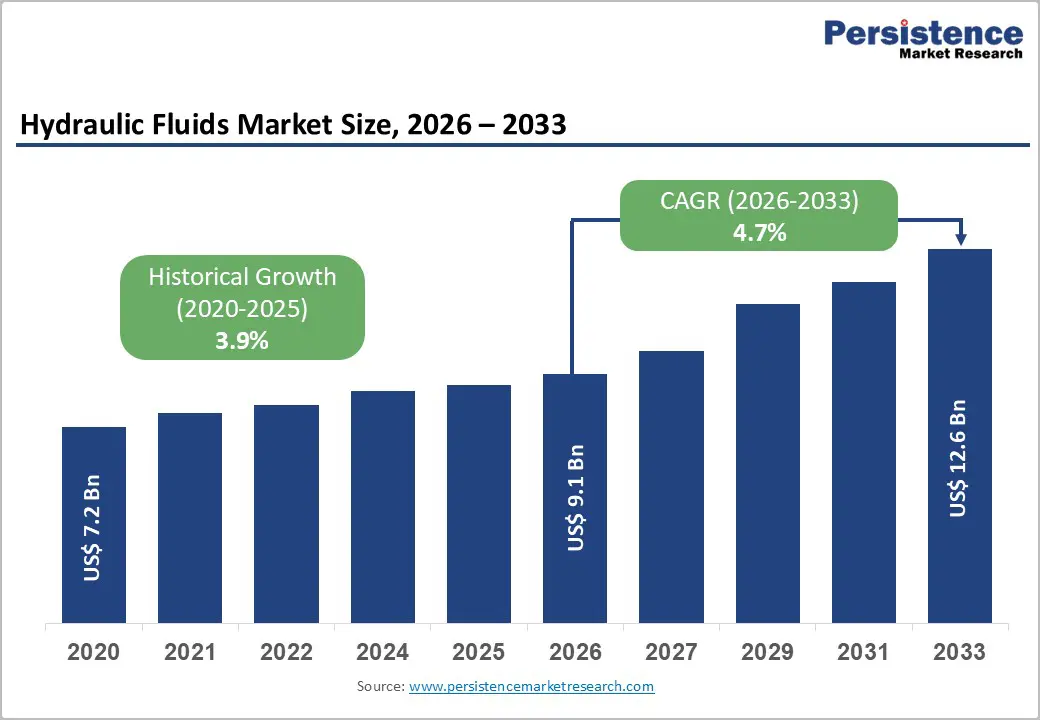

The global hydraulic fluids market size is expected to be valued at US$ 9.1 billion in 2026 and projected to reach US$ 12.6 billion by 2033, growing at a CAGR of 4.7% between 2026 and 2033.

The market’s steady expansion is fundamentally driven by three converging imperatives: sustained demand from construction, mining, and agricultural sectors requiring heavy equipment and machinery that depend on high-performance hydraulic systems, increasing adoption of energy-efficient hydraulic technologies reducing operational costs and fuel consumption, and regulatory pressures mandating environmental sustainability, driving transition toward bio-based and synthetic hydraulic fluids with improved biodegradability and reduced toxicity.

| Key Insights | Details |

|---|---|

| Hydraulic Fluids Market Size (2026E) | US$ 9.1 billion |

| Market Value Forecast (2033F) | US$ 12.6 billion |

| Projected Growth CAGR(2026 - 2033) | 4.7% |

| Historical Market Growth (2020 - 2025) | 3.9% |

Global infrastructure development projects represent the primary growth driver for the hydraulic fluids market, with governments worldwide allocating substantial capital for modernization initiatives. The United States government allocated over USD 55 billion for water infrastructure modernization, while China’s credit package exceeds USD 1.4 trillion supporting massive construction and manufacturing expansion.

The construction machinery segment, encompassing excavators, loaders, and drilling equipment, generates demand for 40-60 million gallons of hydraulic fluid annually in the United States alone, with replacement cycles typically spanning 5-8 years for heavy equipment requiring compatible fluid specifications. Mining and construction segments are expected to grow at 3.4% CAGR, driven by infrastructure project expansion in developing economies. Government infrastructure mandates across India and Southeast Asia create sustained institutional demand for hydraulic systems and compatible fluids, directly translating into market expansion for suppliers and OEMs.

Shift Toward Energy-Efficient and Eco-Friendly Hydraulic Fluids

The global hydraulic fluids market is experiencing a rapid transition toward energy-efficient and environmentally sustainable formulations, driven by rising operational cost pressures and regulatory mandates. Advanced friction-optimized blends can reduce torque losses by up to 30%, lowering fuel consumption and improving equipment efficiency. The U.S. Department of Energy efficiency standards for pumps and compressors encourage adoption of low-viscosity, shear-stable hydraulic fluids compatible with variable-speed drives.

The global lubricants market reached US$ 149.2 billion in 2025 and is projected to hit US$ 174.9 billion by 2032 at 2.3% CAGR, with hydraulic fluids registering the fastest expansion. Environmental regulations such as EU Ecolabel and ISO 15380 HETG standards push manufacturers to develop biodegradable, bio-based fluids achieving >90% biodegradation in 21 days, versus <30% for mineral oils. Additionally, rising insurance premiums of 30-60% for mineral-oil-based systems in sensitive areas accelerate demand for sustainable hydraulic solutions.

Environmental concerns surrounding hydraulic fluid contamination represent a significant market restraint, with conventional mineral oils demonstrating poor biodegradability. Documented evidence indicates 40-60 million liters of petroleum oil enter ecosystems annually through equipment leakage and disposal, persisting in soil and water systems for 10-30 years, causing continuous environmental contamination. PFAS restrictions implemented across European Union territories are accelerating transition requirements, mandating investment in alternative chemistries with uncertain long-term performance profiles.

Compliance with ISO 15380 standards, EU Ecolabel requirements, and increasingly stringent regional environmental regulations increase product development costs and extend commercialization timelines. The complexity of transitioning manufacturing infrastructure from mineral oil to bio-based synthetic esters requires significant capital investment and technical expertise, creating barriers particularly for smaller manufacturers lacking resources to implement necessary process modifications and certification procedures.

Raw Material Price Volatility and Supply Chain Disruptions

Mineral oil pricing volatility, driven by OPEC+ production adjustments and geopolitical tensions, creates significant cost pressures on hydraulic fluid manufacturers. Base-oil feedstock costs directly impact final product pricing, with mineral oil price spikes potentially triggering 10-15% cost increases across the industry within short timeframes. Supply disruptions caused by refinery outages or geopolitical incidents create immediate margin compression for manufacturers operating under fixed-price supply contracts, particularly impacting smaller regional producers lacking long-term supply agreements.

The manufacturing transition from Group I mineral oils toward Group II and Group III base stocks requires facility upgrades and process modifications costing millions of dollars, creating barriers to participation in emerging market segments requiring advanced formulations. Rare-earth material scarcity affecting additive packages compounds supply-chain vulnerabilities, particularly impacting manufacturers sourcing specialized performance additives from geographically concentrated suppliers.

Bio-based hydraulic fluids represent exceptional growth opportunities, with bio-based products forecast to register 5.19% CAGR as environmental compliance accelerates. Matrol B, developed through collaboration between Hydronit and Novamont, exemplifies high-performance bio-based solutions achieving ISO 15380 HETG, EPA EAL, and EU Ecolabel certifications with demonstrated 800% ROI over 5 years and 6-7 month payback periods. These fluids demonstrate 92% biodegradability in 21 days and aquatic toxicity LC50 exceeding 1,000 mg/L, compared to 10-50 mg/L for mineral oils, meeting increasingly stringent environmental standards.

Chevron’s introduction of Clarity Bio EliteSyn AW targeted for marine and construction sectors, and TotalEnergies Lubrifiants acquisition of fire-resistant hydraulic fluid product lines from Fluid Competence, illustrate major oil company commitment to sustainable product development. Institutional investor emphasis on environmental performance as investment criteria, combined with supply chain requirements from major corporations demanding certified sustainability from suppliers, creates expanding market opportunities for manufacturers offering certified bio-based solutions.

Agricultural Mechanization Expansion in Developing Economies

The agricultural sector represents rapid-growth opportunity segment, with agricultural mechanization surge contributing +0.9% CAGR impact across developing economies, particularly in Asia-Pacific. India’s agricultural sector is experiencing accelerated mechanization, with tractor sales increasing at double-digit growth rates annually, each requiring 15-25 liters of hydraulic fluid per annum for pump, cylinder, and transmission applications. Kawasaki Heavy Industries doubled hydraulic component manufacturing capacity in India to service surging domestic agricultural equipment demand and reduce import reliance.

China’s agricultural modernization initiatives and Southeast Asian farming equipment adoption create substantial additional fluid requirements. Precision agriculture applications including GPS-guided spraying systems, automated irrigation controls, and variable-rate fertilizer application require specialized hydraulic fluids with enhanced stability and performance characteristics at premium price points. The combination of population growth driving agricultural productivity requirements and government subsidies supporting farmer equipment adoption creates expanding market opportunities for manufacturers with regional distribution infrastructure and agricultural fluid specialization.

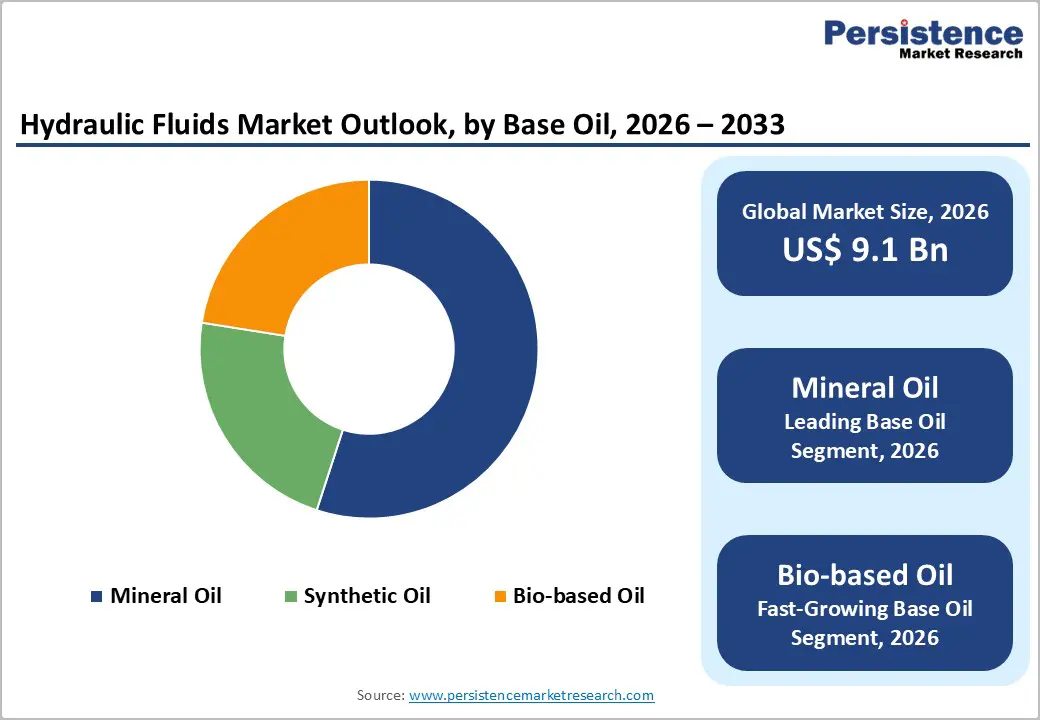

Mineral Oil Maintaining Dominant Market Position Despite Environmental Transition

Mineral oil remains the dominant base oil in hydraulic fluids, maintaining roughly 55% market share in 2024, supported by favorable cost-performance economics and strong OEM approval legacy. Its advantages stem from decades of installed system compatibility and established refining and distribution infrastructure, making it the preferred option in cost-sensitive markets.

Although sustainability regulations and efficiency standards, including U.S. DOE guidelines and ISO 4413 compliance requirements, are accelerating interest in higher-performance alternatives, mineral oils continue to serve millions of installed hydraulic systems worldwide with proven reliability. Their longevity and retrofit suitability provide a structural demand floor, even as gradual share erosion occurs due to shifts toward Group II and III formulations offering improved oxidation stability and viscosity index performance.

OEM Channel Commanding Market Leadership Through Equipment Manufacturing Integration

The OEM channel retains leadership in hydraulic fluid supply, accounting for 65% market share in automotive applications and comparable dominance across industrial machinery. OEMs integrate hydraulic fluid specifications during equipment design, enabling long-term supply contracts and locked-in supplier relationships throughout product lifecycles. This integration supports exclusive supplier arrangements due to performance validation testing and high switching costs for end users.

OEM alignment allows manufacturers to influence formulation requirements, ensure compatibility with proprietary hydraulic systems, and secure predictable volumes that enhance production efficiency. While the aftermarket captures remaining share, OEM leadership persists due to embedded engineering standards, sustained equipment production rates, and increasing complexity of hydraulic systems that prioritize certified fluid use to safeguard warranty compliance and system reliability.

Construction Segment Leading Market Revenue Through Heavy Equipment Concentration

The construction industry remains the leading consumer of hydraulic fluids, generating approximately 28% of global revenue due to heavy reliance on high-capacity hydraulic equipment such as excavators, crawler cranes, and drilling rigs. Individual units may require 150-300 liters of hydraulic fluid with replacement cycles every 3-5 years, establishing stable aftermarket demand.

Growth aligns directly with the expanding global construction equipment market, valued at USD 142.7 billion in 2025 and projected to reach USD 232.2 billion by 2032 at a 7.2% CAGR. Large-scale public infrastructure programs-including metro rail projects and rail network expansion across Europe and Asia-ensure multi-year demand visibility for OEM suppliers and distributors. Construction activity’s relatively inelastic maintenance requirements support recurring fluid consumption despite economic fluctuations, sustaining the segment’s dominant share.

North America exhibits sustained hydraulic fluid demand supported by infrastructure renewal, industrial modernization, and a large installed equipment base across construction, manufacturing, warehousing, and agriculture. Significant public funding for water systems, transportation upgrades, and logistics infrastructure continues to stimulate deployment of hydraulic-powered machinery and lift systems. The region remains a technological hub for advanced hydraulic formulations, including renewable base oils and smart fluids embedded with sensor-monitoring capabilities to support predictive maintenance and fluid-life optimization.

Reshoring initiatives aimed at supply-chain resilience are stimulating investment in machine tools and automation, expanding fluid replacement and aftermarket opportunities. Agricultural equipment utilization remains a structural demand pillar, particularly in the United States, where large farm mechanization fleets require routine hydraulic servicing. However, electrification of braking, steering, and industrial actuation systems is gradually eroding hydraulic penetration in select light-duty applications. Increasing sustainability expectations and regulatory focus on emissions, leak management, and biodegradability are shaping future product development priorities.

Europe presents a mixed demand outlook characterized by mature hydraulic applications and transition pressures from electrification, while selective high-performance fluid demand persists in regulated applications. Regional sustainability policies including PFAS restrictions and EU ecolabel requirements accelerate the shift toward synthetic esters, biodegradable fluids, and fire-resistant blends. Pan-European renewable energy initiatives such as REPowerEU’s EUR 300 billion budget support hydraulic deployment in offshore wind installation, lifting systems, tunneling, and port equipment. Industrial softness persists, evidenced by Germany’s 8% decline in fluid-power orders in 2024, contributing to near-term demand moderation in traditional industrial hydraulics.

However, precision manufacturing, aerospace, marine, and high-pressure heavy equipment applications sustain premium fluid demand characterized by strict oxidation-resistance, cleanliness, and extended drain interval requirements. Regional manufacturers increasingly differentiate through R&D investment in energy-efficient additives, enhanced shear stability, and leak-management innovations aligned with regulatory compliance. Automation upgrades across European manufacturing ecosystems help maintain baseline fluid demand despite electrification pressures.

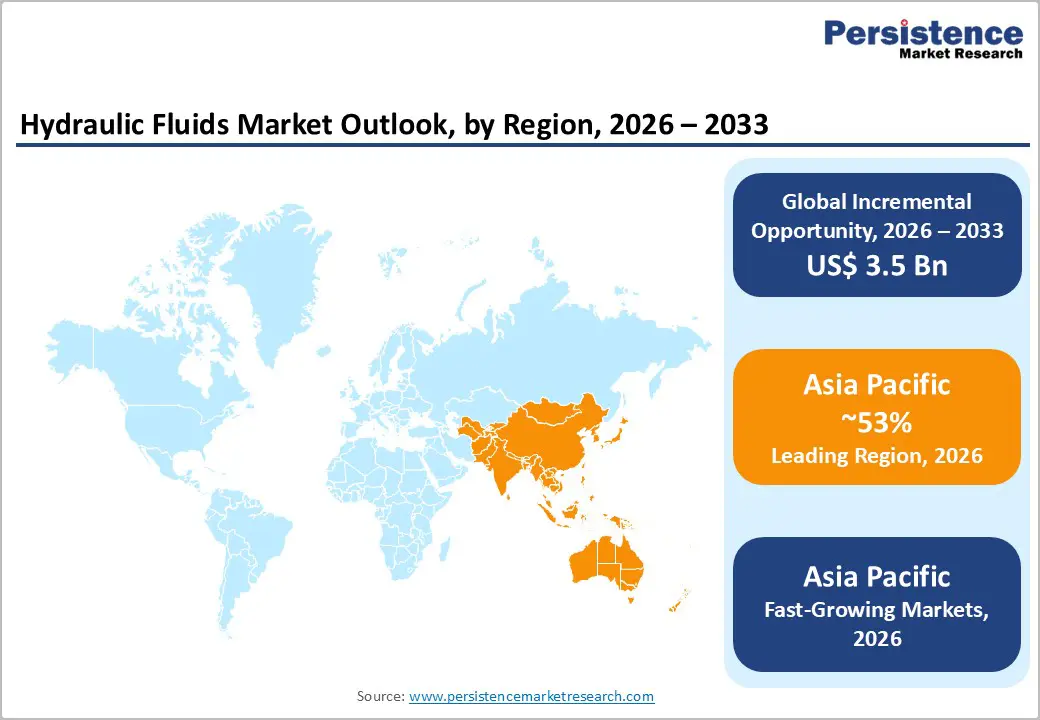

Asia Pacific dominates global hydraulic fluids consumption, accounting for 53% regional market share supported by extraordinary construction, industrialization, and agricultural mechanization momentum. China remains the largest consumer with 16.4% global market share in 2024, reinforced by a USD 1.4 trillion government credit package prioritizing infrastructure expansion and equipment procurement. Fluid supply resilience improves with refinery and basestock capacity investment, including projects that add more than 20,000 barrels per day of high-performance basestock output for regional manufacturers.

India represents the fastest-growing demand center, where tractor sales expand at double-digit annual growth rates, each requiring 15-25 liters of hydraulic fluid annually for maintenance and replacement cycles. Manufacturing output in India increased by over 5% annually in 2023, driving hydraulic use in automotive, packaging, and food processing machinery. Precision manufacturing clusters in Japan and South Korea continue to adopt micro-hydraulics and contamination-resistant valves that require premium formulations, supporting a projected 5.5% CAGR through 2033 across the region.

The global hydraulic fluids market features a moderately fragmented structure, with technological and scale advantages concentrated among a limited group of vertically integrated producers. These leading suppliers leverage end-to-end control of base-oil refining, additive formulation, and distribution to secure OEM approvals and long-term supply contracts, strengthening switching barriers for industrial and mobile equipment users. Specialized regional fluid formulators compete by targeting niche performance requirements, such as fire resistance, biodegradable compositions, and extreme-temperature stability, which demand proprietary additive packages and application engineering expertise.

Competitive strategies increasingly emphasize value-added services, including fluid-monitoring analytics, predictive maintenance support, and performance-based supply agreements bundled with system optimization. Investment flows are shifting toward sustainable chemistries and low-viscosity formulations that enhance energy efficiency while meeting tightening environmental standards. Ongoing consolidation and capacity upgrades indicate an industry pivot toward advanced formulation capability, stronger distribution presence in growth markets, and greater alignment with equipment electrification and industrial digitalization trends.

The global hydraulic fluids market is expected to reach about US$ 9.1 billion in 2026.

Growth is driven by rising construction, mining, and agricultural equipment use, adoption of energy-efficient hydraulic systems, and tightening environmental regulations.

Asia Pacific holds the largest share of the hydraulic fluids market in 2025.

Expanding agricultural mechanization and growing demand for bio-based hydraulic fluids present major opportunities.

Leading market participants include Shell plc, Exxon Mobil Corporation, Chevron Corporation, BP plc., and TotalEnergies, among others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn/Bn, Volume: Million Liters |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Base Oil

By Sales Channel

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author