ID: PMRREP34911| 194 Pages | 29 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

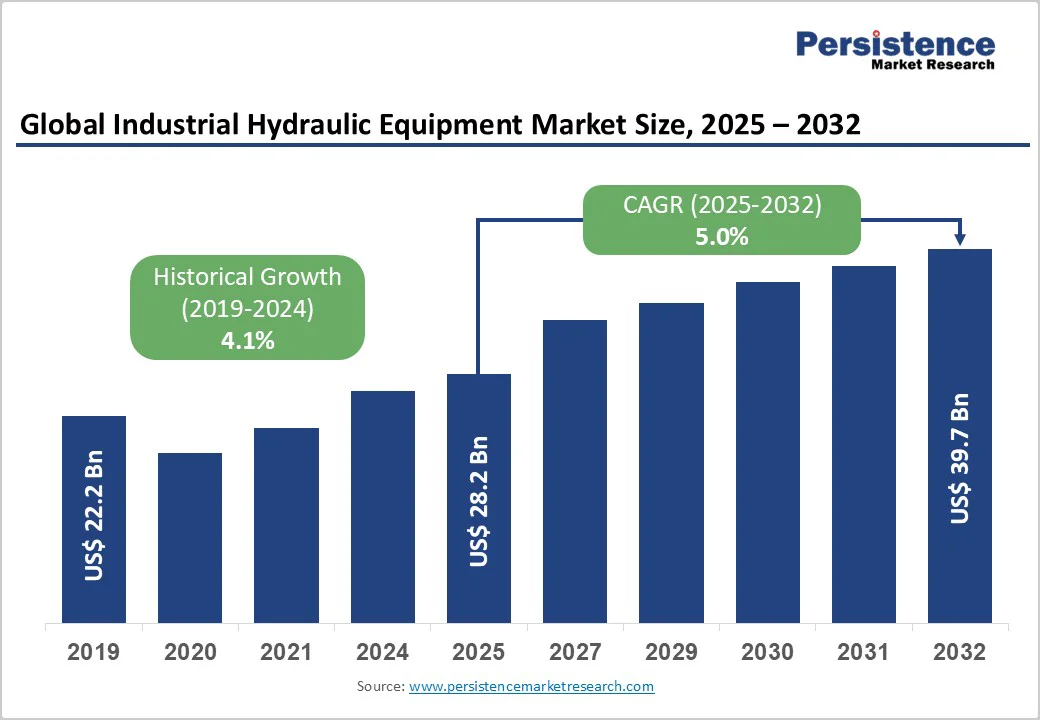

The global Industrial Hydraulic Equipment Market size was valued at US$28.2 billion in 2025 and is projected to reach US$39.7 billion by 2032, growing at a CAGR of 5.0% between 2025 and 2032. The increasing automation in manufacturing and the worldwide development of robust infrastructure demand reliable hydraulic systems for precision and power. These factors are supported by rising investments in construction and industrial sectors, where hydraulic equipment enhances efficiency and productivity.

| Key Insights | Details |

|---|---|

|

Industrial Hydraulic Equipment Market Size (2025E) |

US$28.2 Bn |

|

Market Value Forecast (2032F) |

US$39.7 Bn |

|

Projected Growth CAGR (2025-2032) |

5.0% |

|

Historical Market Growth (2019-2024) |

4.1% |

The surge in industrial automation is a key driver of the Industrial Hydraulic Equipment Market, as hydraulic systems provide the precise control and high force required for automated machinery across sectors such as manufacturing and automotive. With industries adopting automation to enhance productivity, hydraulic pumps, valves, and cylinders are integral to robotic arms and assembly lines, reducing labor costs and improving output consistency.

According to the U.S. Bureau of Labor Statistics, sectors integrating smart hydraulic technologies have seen a 15% increase in productivity over the past five years, underscoring their efficiency gains. This trend is evident in the growing Hydraulic Pumps Market, where automation demands efficient fluid power solutions. As factories transition to Industry 4.0, the need for durable, integrated hydraulic equipment continues to rise, supporting sustained market growth.

Global infrastructure development is driving the Industrial Hydraulic Equipment Market, as hydraulic equipment powers essential machinery such as excavators and cranes for lifting and excavation tasks. Rapid urbanization in emerging economies has driven increased construction activity, necessitating robust hydraulic systems for heavy-duty applications. The Asian Development Bank reports that infrastructure needs in the Asia-Pacific alone will require investments of USD 184 billion to USD 210 billion annually, directly boosting demand for hydraulic motors and cylinders. This growth is further supported by government initiatives, such as China's USD 270 billion investment in roads and waterways over the past few years, which enhance project timelines and efficiency by enabling reliable hydraulics.

High maintenance costs pose a significant restraint on the industrial hydraulic equipment market, as hydraulic systems require regular servicing of fluids, seals, and filters, straining operational budgets across industries such as manufacturing and mining. These costs arise from the complexity of hydraulic components, often necessitating specialized technicians and downtime for repairs, which can disrupt production and reduce profitability. For example, frequent fluid checks and part replacements due to wear in high-pressure environments add to expenses, and some reports indicate that maintenance can account for 20-30% of total ownership costs in heavy machinery. This financial burden discourages adoption among small-scale operators, limiting market penetration and innovation in cost-sensitive regions.

Stringent environmental regulations are hindering the Industrial Hydraulic Equipment Market by imposing restrictions on fluid use and hydraulic system emissions, particularly in the construction and oil & gas sectors. Compliance with standards such as those from the Environmental Protection Agency requires eco-friendly fluids and leak-proof designs, which increase development costs and slow adoption. For instance, bans on certain hydraulic fluids due to pollution risks have led to higher transition expenses, with non-compliance fines impacting profitability. These regulations, aimed at reducing contamination, create compliance challenges that delay projects and restrain overall market growth in regulated markets.

The integration of IoT and smart technologies presents a major opportunity for industrial hydraulic equipment participants, enabling predictive maintenance and energy-efficient operations in automated factories. By embedding sensors in pumps and valves, companies can monitor real-time pressure and temperature data, reducing failures by up to 30% and optimizing performance across sectors such as automotive and aerospace.

Recent developments highlight this potential, with the U.S. market leading in IoT adoption for hydraulics, according to industry insights that show a 15% productivity boost from smart systems. This opportunity aligns with the expanding Industrial Robot Arm Market, where smart hydraulics enhance precision in assembly lines. As digital transformation accelerates, manufacturers investing in electro-hydraulic solutions can capture significant market share from end users seeking sustainable, connected equipment.

The rise of renewable energy projects offers substantial opportunities in the Industrial Hydraulic Equipment Market, particularly for hydraulic systems in wind turbine installation and solar panel tracking mechanisms. With global investments in renewables projected to reach USD 1.3 trillion annually by 2030, hydraulic cylinders and motors are crucial for precise positioning and heavy lifting in offshore wind farms and solar fields.

For example, hydraulic equipment supports the erection of turbine towers, where reliability under harsh conditions drives demand. This segment's growth is bolstered by policies such as the European Green Deal, which promotes sustainable hydraulics with biodegradable fluids. Companies focusing on energy-efficient designs can tap into this high-potential area, especially as the sector's expansion outpaces traditional applications.

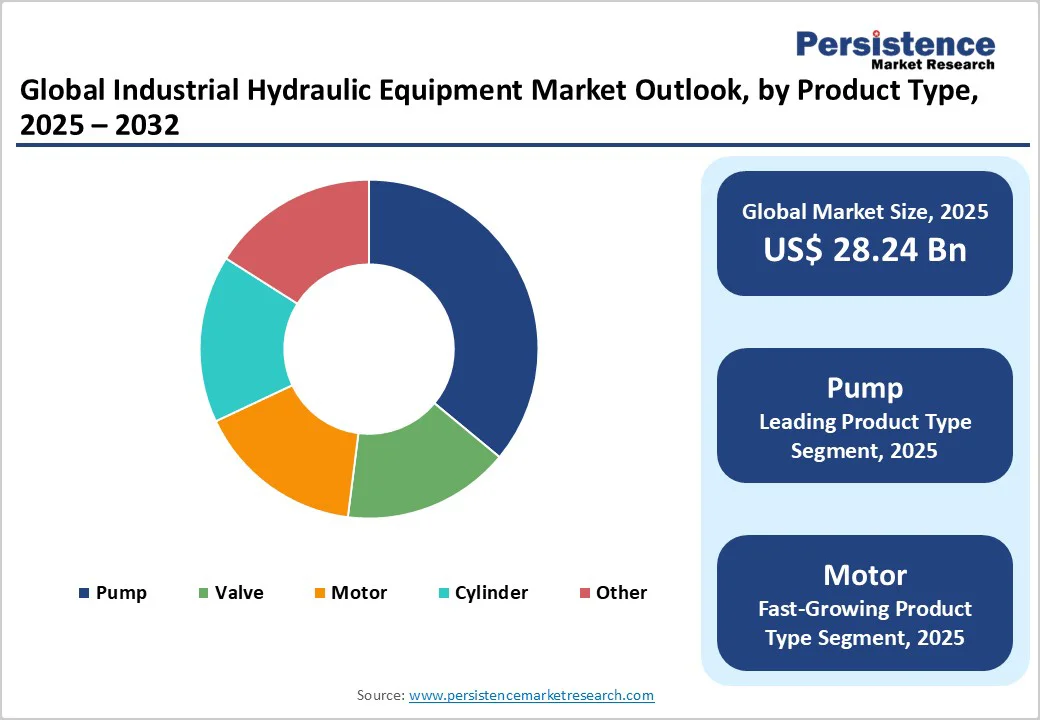

Pumps dominate the Product Type category in the industrial hydraulic equipment Market, holding approximately 35% market share, as they serve as the primary power source in hydraulic systems across manufacturing and construction. Gear, vane, and piston pumps generate fluid flow essential to machinery such as presses and loaders, thanks to their versatility and efficiency in high-pressure environments. Data from industry associations indicates that pumps account for the majority of hydraulic component sales, driven by automation trends that require precise fluid control. Their widespread use in mobile and industrial applications, including integration with IoT for monitoring, justifies their leadership.

Construction leads the Application category in the Industrial Hydraulic Equipment Market, with about a 30% share, owing to the sector's reliance on hydraulic-powered equipment for excavation and material movement. Excavators, cranes, and bulldozers depend on hydraulic valves and cylinders for heavy lifting, fueled by global infrastructure booms. Statistics from the International Energy Agency show that the adoption of energy-efficient hydraulics in construction could cut consumption by 40% by 2040, highlighting their dominance. This segment's growth is tied to urbanization projects, making it pivotal for market expansion.

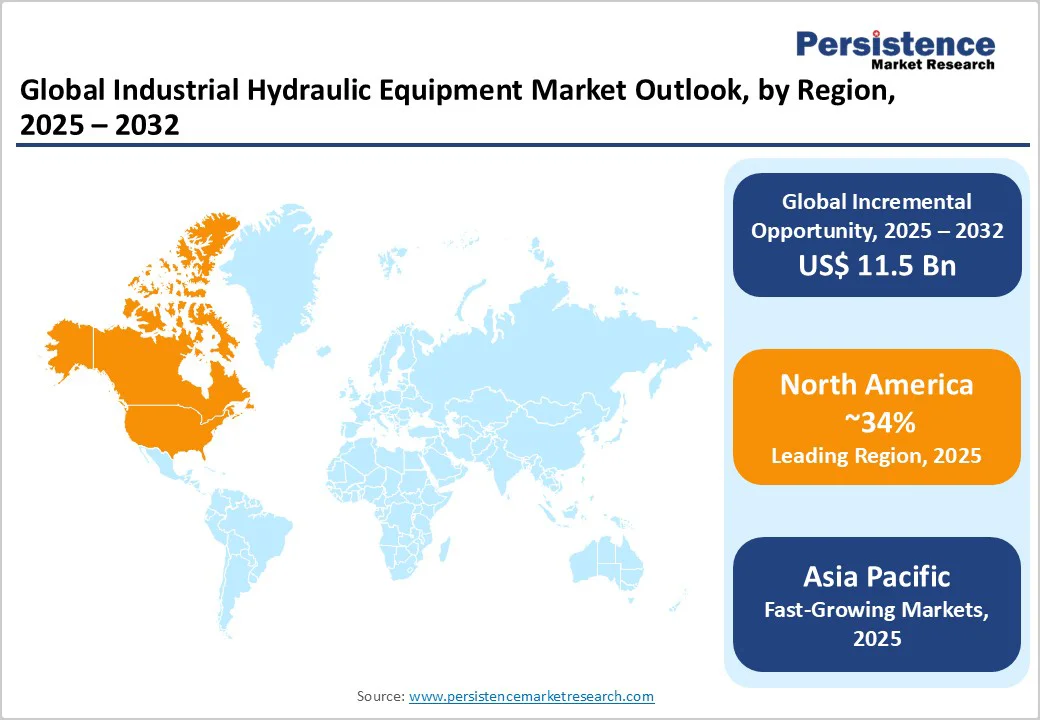

North America, led by the U.S., dominates the industrial hydraulic equipment market due to its advanced manufacturing base and stringent safety regulations from bodies like the Occupational Safety and Health Administration. The region's innovation ecosystem fosters electro-hydraulic advancements, with hydraulic systems integral to aerospace and automotive sectors for precision control. Recent developments, such as the launch of smart hydraulic power units by U.S. firms in 2023, enhance material-handling efficiency by reducing downtime through IoT integration.

Regulatory frameworks emphasize energy conservation, promoting biodegradable fluids and leak prevention, which align with sustainability goals. The U.S. Bureau of Labor Statistics projects a 13% growth in machinery maintenance jobs by 2034, reflecting sustained demand for reliable hydraulics in industrial applications.

Europe's industrial hydraulic equipment market is characterized by strong performance in Germany, the U.K., France, and Spain, driven by harmonized regulations under the European Union Machinery Directive that ensure safety and interoperability. Germany's manufacturing prowess, particularly in automotive, relies on hydraulic motors for assembly lines, with recent EU investments in green infrastructure boosting demand. For instance, the European Green Deal has spurred the adoption of low-emission hydraulics, as seen in France's construction projects.

Regulatory harmonization facilitates cross-border trade, while innovations such as energy-efficient valves support the region's sustainability focus. In the U.K., post-Brexit policies emphasize domestic production, with hydraulic equipment key to mining and agriculture.

Asia Pacific's Industrial Hydraulic Equipment Market is experiencing rapid growth, led by China, Japan, India, and ASEAN countries, driven by manufacturing advantages and infrastructure development. China's dominance stems from its vast production capabilities, with hydraulic pumps essential for electronics and heavy machinery exports. The Asia Development Bank forecasts USD 3.1 trillion in climate-adjusted infrastructure needs, driving hydraulic adoption in construction.

In India, government initiatives such as investing USD 1.4 trillion in ports and highways drive demand, while Japan's precision engineering integrates hydraulics into robotics. ASEAN's growth dynamics, including mining expansions, benefit from cost-effective manufacturing, with the Hydraulic Hoses Market supporting fluid transfer in these applications.

The Industrial Hydraulic Equipment Market exhibits a consolidated structure, with major players like Bosch Rexroth AG and Parker Hannifin Corporation controlling significant shares through extensive portfolios and global reach. Companies pursue expansion via acquisitions and R&D in smart hydraulics, focusing on IoT integration for predictive maintenance. Key differentiators include energy-efficient designs and customization for end-users, while emerging models emphasize sustainable, modular systems to meet regulatory demands. This concentration fosters innovation but allows niche players to compete in specialized segments.

Bosch Rexroth AG (Germany) leads with a strong focus on innovative hydraulic solutions for automation, boasting extensive R&D and a global presence that drives revenue through integrated systems in manufacturing. Its portfolio strength in valves and pumps positions it as a market influencer.

Parker Hannifin Corporation (United States) excels in diversified hydraulic components, generating high revenue from aerospace and industrial applications via acquisitions and technology leadership, ensuring maturity and reliability.

Eaton Corporation (Ireland) dominates with robust motors and cylinders for construction, leveraging strategic partnerships and a mature portfolio to maintain influence and steady revenue growth in heavy machinery.

The market is expected to reach US$ 39.7 Bn by 2032, growing from US$ 28.2 Bn in 2025 at a CAGR of 5.0%.

Rising industrial automation and global construction activities drive demand, with automation enhancing precision and infrastructure investments, boosting equipment needs.

Pumps lead with 35% market share, essential for fluid power in manufacturing and construction applications.

North America leads, supported by U.S. innovation and regulatory frameworks in manufacturing sectors.

IoT integration for smart hydraulics offers opportunities in predictive maintenance, improving efficiency in automated industries.

Major players include Bosch Rexroth AG, Parker Hannifin Corporation, and Eaton Corporation, leading through innovation and global portfolios.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author