ID: PMRREP35262| 180 Pages | 29 Aug 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

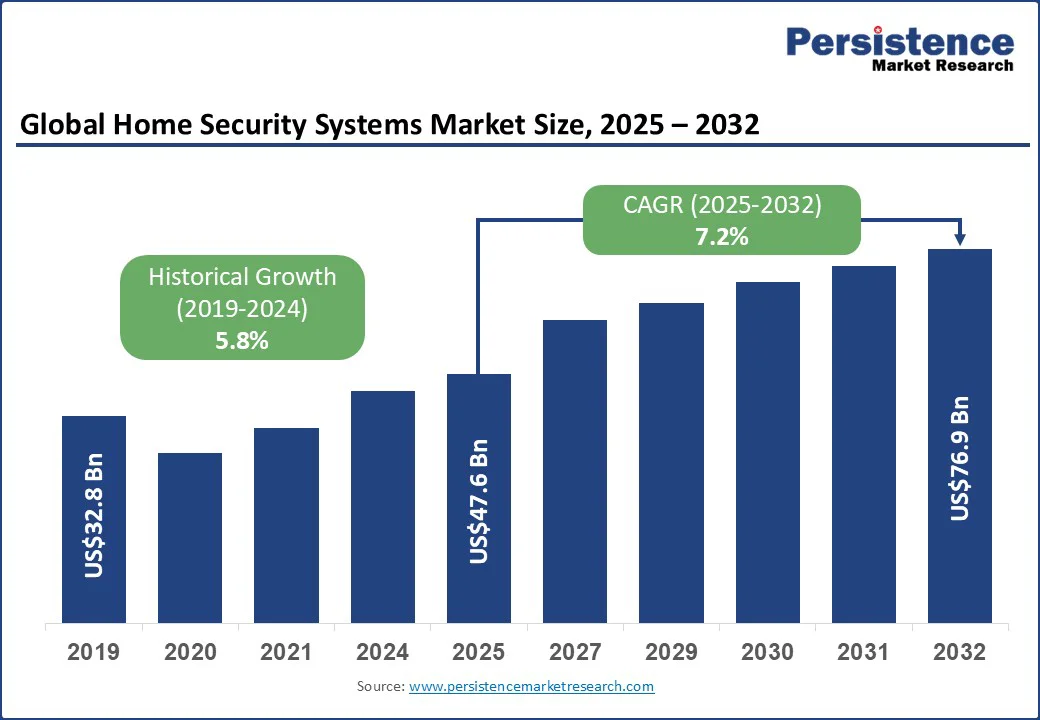

The global home security systems market size is likely to value at US$47.6 Bn in 2025 to US$76.9 Bn by 2032 growing at a CAGR of 7.2% during the forecast period from 2025 to 2032. Rising crime rates and a growing demand for smarter, safer living environments drive the home security systems market growth.

As concerns property crimes increase alongside rapid urbanization, both homeowners and businesses are increasingly adopting advanced security solutions. Modern systems provide real-time monitoring, greater control, and peace of mind, making them essential for securing both residential and commercial properties.

Key Industry Highlights

Rising security risks, such as burglary, property damage, and unauthorized access, are fueling the home security systems market growth. With increasing reports of domestic break-ins and the psychological stress associated with such incidents, both urban and suburban homeowners are investing in advanced home security technologies. Real-time monitoring, video surveillance systems, and rapid alert features are becoming critical for safeguarding residential and commercial properties.

According to the latest Crime Survey for England and Wales, an estimated 9.5 million incidents of theft, robbery, criminal damage, fraud, computer misuse, and violence occurred in the year ending September 2024, highlighting the urgent need for effective home security solutions.

The shift toward smart living and connected homes is driving the adoption of integrated security systems that connect seamlessly with smart devices, offering convenience, automation, and remote control through mobile apps. Industry leaders are also leveraging AI to enhance security.

For example, in October 2024, SimpliSafe launched Active Guard Outdoor Protection, a proactive smart home security service combining AI-powered monitoring with live agents to deter intruders. The launch of its AI-enabled outdoor security camera series further strengthens the demand for intelligent, next-generation home security solutions.

The market growth is restrained by compatibility issues between devices from different brands. Many homeowners combine DIY home security systems with professionally installed setups, but a lack of interoperability often results in integration challenges. Proprietary software platforms and closed technologies limit seamless connectivity among smart security cameras, wireless door sensors, motion detectors, alarms, and IoT-based control panels, leading to security gaps and system inefficiencies.

This lack of standardization in smart home security systems discourages adoption, particularly among cost-conscious buyers seeking customizable home security solutions. Consumers searching for the best home security systems with multi-brand compatibility often face limitations, which slow down market penetration and growth of AI-powered and IoT-enabled home security solutions.

Consumers today want the convenience of controlling their smart home devices, whether it is lights, locks, cameras, alarms, or thermostats, through a single connected platform. By linking security systems with popular ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit, homeowners get a smoother experience with voice commands, automation, and better cross-device connectivity. Companies are already moving in this direction.

ADT remains a leader in professional monitoring by offering Alexa-compatible systems that enable users to manage alarms and smart locks with simple voice prompts. Its SMART Monitoring feature also improves emergency response by sending instant group text alerts to family members. Vivint has expanded its home automation capabilities with deeper Alexa integration, allowing users to adjust lights, locks, and thermostats seamlessly for a more personalized smart home experience.

This growing shift toward voice-enabled and interconnected systems goes beyond convenience. It also creates new opportunities for manufacturers through bundled home security and automation packages, subscription-based services, and stronger customer engagement. As demand for AI-powered, voice-controlled security systems rises, companies that focus on interoperability and cross-platform integration are likely to gain a competitive advantage in the smart home market.

Artificial Intelligence (AI) is transforming the home security systems market by making surveillance smarter and more reliable. AI-powered home security cameras can analyze video feeds in real time, recognize faces, detect unusual activities, and distinguish between people, pets, and vehicles. This reduces false alarms while enabling proactive monitoring with instant alerts for potential threats. Over time, AI systems learn from data, becoming more accurate and efficient, which gives homeowners better protection and peace of mind.

Leading brands are integrating AI to stay competitive. Honeywell’s Smart AI Supervision Camera is a strong example, offering real-time alerts for suspicious activity and customizable security settings through the Impact by Honeywell mobile app. As demand for AI-driven home security solutions grows, integrating intelligent features such as video analytics, voice control, and personalized monitoring will be key to attracting modern homeowners seeking both convenience and enhanced safety.

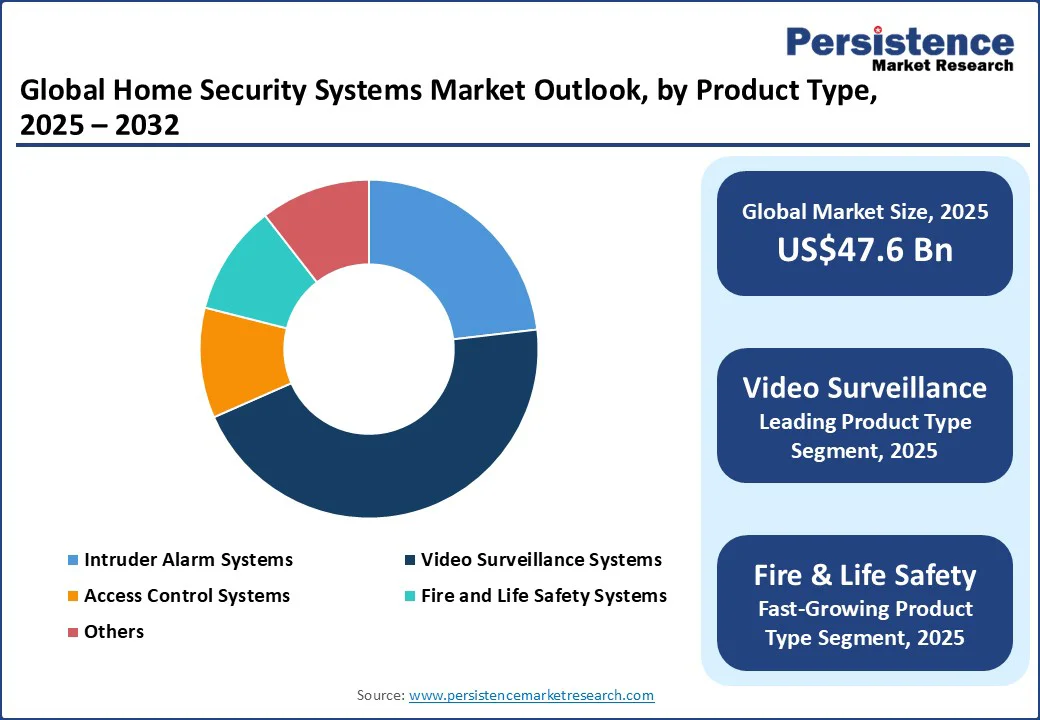

By product type, video surveillance is anticipated to dominate, accounting for nearly 43% of the total market share in 2025, due to its critical role in both deterrence and incident verification. Rising concerns over burglary, theft, and property crimes have accelerated the adoption of CCTV and IP-based surveillance systems, which are increasingly favored for their high-definition video quality, remote accessibility, and real-time monitoring.

In developing countries, including India, the India CCTV camera market is projected to grow at a 19.1% CAGR, increasing from US$2 Bn in 2025 to approximately US$7 Bn by 2032. The integration of AI-driven analytics, facial recognition, and cloud storage has further strengthened demand by reducing false alarms and enabling proactive threat detection. With both businesses and residential complexes investing in advanced surveillance, this segment remains the backbone of the market, driving both revenue and technological innovation.

By end-user, apartments are expected to lead the market, driven by urban growth and security concerns in high-density areas, as residents increasingly seek peace of mind through enhanced security systems. According to the Scottish Sun, Police Scotland recorded nearly 1,416 housebreakings in Edinburgh in 2024, showing that even urban centers with strong policing face significant burglary threats. A U.S. survey by Deep Sentinel found that 71% of renters felt property management should improve safety, 28% of apartments lack any security system, and 60% of tenants feel unsafe at their complexes.

These figures highlight the rising need for compact, affordable, and easy-to-install security solutions such as video doorbells, window sensors, and smart locks. Users increasingly prefer systems that offer remote monitoring, integrate with devices such as lights and thermostats, and deliver real-time protection. With urban living on the rise, this segment is set to dominate the market.

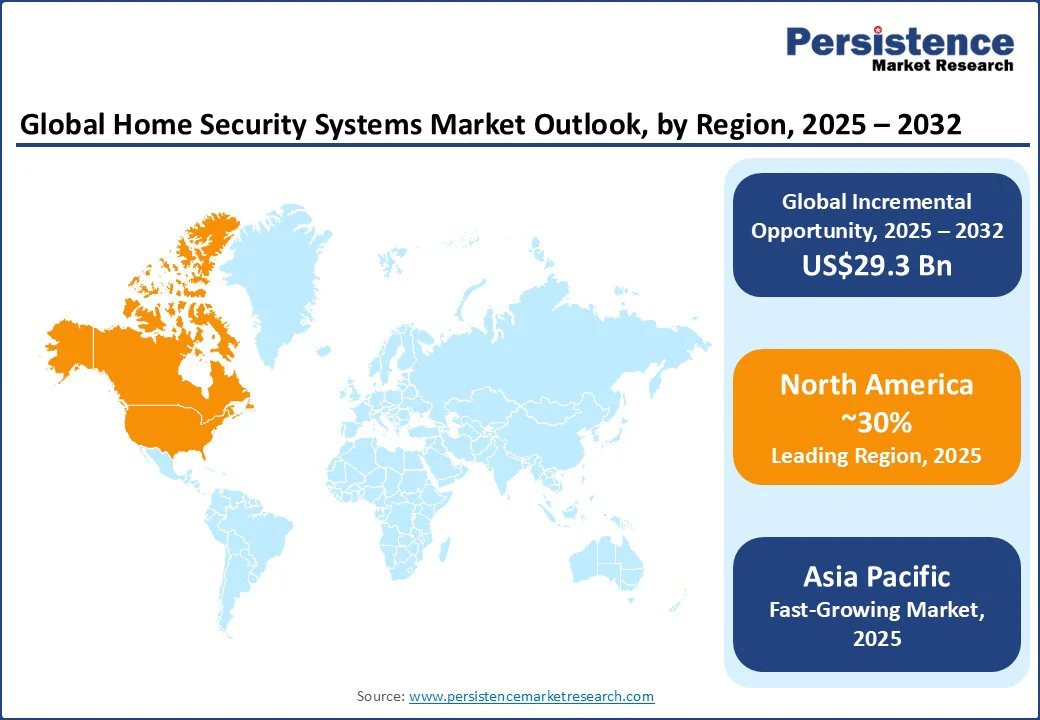

North America is projected to dominate, accounting for a market share of 30% in 2025, driven by high burglary rates and strong adoption of smart technologies. According to the FBI, the U.S. reported over 900,000 burglaries in 2022, with most involving residential properties. Increasing awareness of safety, coupled with a surge in smart home adoption, has boosted demand for video surveillance, smart locks, and alarm systems.

Data from the U.S. Census Bureau also indicates that more than 39 million people live in apartments, intensifying the need for compact, easy-to-install security solutions. With rising consumer spending on IoT-enabled devices and insurance incentives for secured homes, North America continues to dominate the market.

Europe is experiencing steady growth in the market, supported by rising property crimes and rapid urbanization. According to Eurostat, over 3,500 burglaries per 100,000 households were reported across the EU in 2022, with higher risks observed in urban centers. Growing concerns over residential safety have led to increased adoption of smart security devices such as CCTV cameras, motion sensors, and digital locks.

Germany, the U.K., and France are the leading markets, benefiting from technological integration and government initiatives promoting smart housing. With nearly 75% of Europe’s population living in urban areas, the demand for accessible and reliable home protection solutions is expected to expand further, particularly among apartment residents.

Asia Pacific is projected to record the fastest growth in the market due to rapid urban expansion and rising middle-class income levels. The United Nations reports that over 2.3 billion people in Asia lived in urban areas in 2023, a figure expected to grow significantly by 2030. This urban concentration increases the need for reliable security solutions, especially in high-density apartment complexes.

In India, the National Crime Records Bureau recorded more than 110,000 burglary cases in 2022, underscoring the growing security risks nationwide. Additionally, China’s push toward smart city development has accelerated the adoption of AI-powered surveillance and smart locks. The affordability of connected devices and smartphone penetration further drives demand, making Asia Pacific a key growth region.

The global home security systems market is witnessing intense competition as established players and emerging startups race to capture demand for smart, connected security solutions. Leading companies such as ADT Home Security, Honeywell International, Hikvision, Bosch Security Systems, and Johnson Controls are heavily investing in AI-powered surveillance, IoT-enabled devices, and mobile-based monitoring platforms to stay ahead.

Increasing adoption of subscription-based professional monitoring, coupled with integration of wireless technologies, cloud storage, and voice-controlled smart assistants, is reshaping customer preferences. Partnerships with telecom operators and real estate developers are further strengthening market presence, particularly in smart home and urban housing projects. Continuous R&D, product differentiation, and mergers & acquisitions remain central strategies as companies seek to expand their footprint in both developed economies and fast-growing emerging markets.

The home security systems market is projected to be valued at US$47.6 Bn in 2025.

The home security systems market is fueled by increasing security concerns and the growing adoption of smart living solutions.

The home security systems market is expected to grow at a CAGR of 7.2% from 2025 to 2032.

Integration with smart home ecosystems is the key market opportunity.

Major players include ADT Home Security, SimpliSafe, Vivint Smart Home, Cove Security, and Alder Security.

|

Report Attribute |

Details |

|

Home Security Systems Market Size (2025E) |

US$47.6 Bn |

|

Market Value Forecast (2032F) |

US$76.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.8% |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Type of System

By Distribution Channel

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author