ID: PMRREP33258| 199 Pages | 29 Dec 2025 | Format: PDF, Excel, PPT* | Consumer Goods

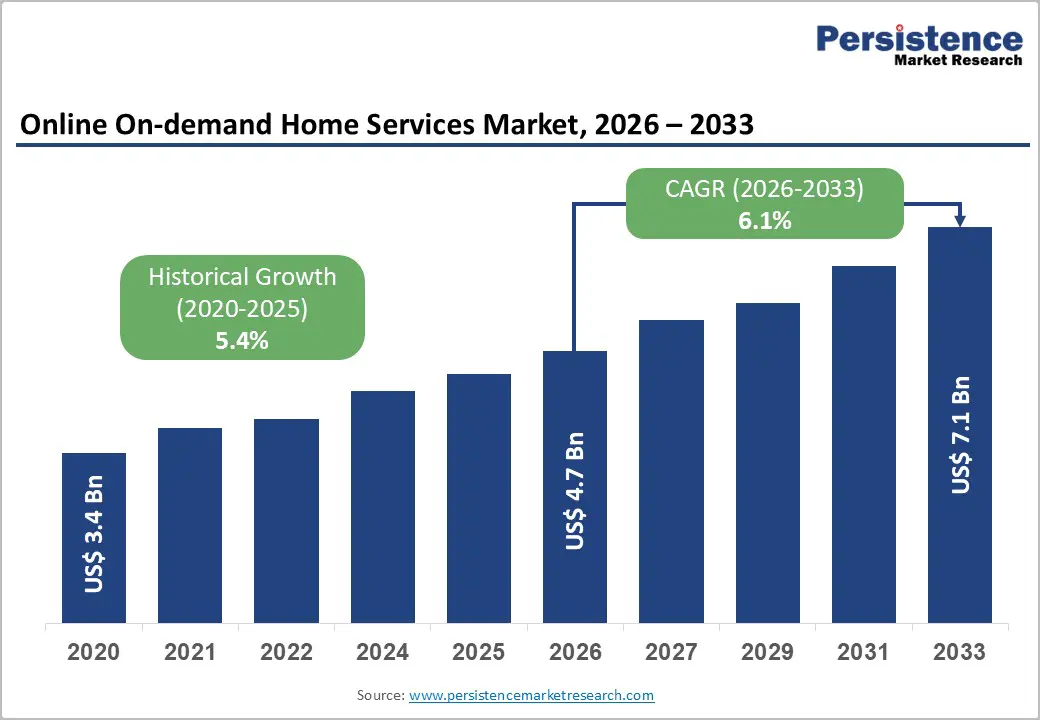

The global online on-demand home services market size is projected to grow from US$ 4.7 billion in 2026 to US$ 7.1 billion by 2033, at a CAGR of 6.1% between the forecast period 2026 and 2033.

This growth is driven by increasing smartphone penetration, rising internet adoption, and consumers’ preference for convenience-driven solutions. Urban lifestyles and dual-income households are fueling demand for outsourced home services, as people prioritize time-saving options. Digital platforms enhance trust through secure payments, background-verified service providers, and transparent rating systems. Together, these factors are accelerating the shift from traditional service booking methods to efficient, technology-enabled on-demand home service platforms.

| Key Insights | Details |

|---|---|

| Online On-Demand Home Services Market Size (2026E) | US$ 4.7 billion |

| Market Value Forecast (2033F) | US$ 7.1 billion |

| Projected Growth CAGR (2026 - 2033) | 6.1% |

| Historical Market Growth (2020 - 2025) | 5.4% |

The rapid proliferation of smartphones and widespread internet connectivity is a key driver for the online on-demand home services market. Globally, there are 5.45 billion internet users, representing 67.1% of the population, while smartphone users reached 4.88 billion and are expected to hit 7.1 billion by 2025. This digital infrastructure enables consumers to access on-demand services easily via mobile applications, facilitating seamless bookings and real-time interactions.

Developing markets, particularly India, have witnessed accelerating smartphone adoption, with internet users increasing from 1.2 billion in 2023 to 1.4 billion by March 2024. Consumers spend an average of 6 hours and 40 minutes online daily, fostering continuous engagement with digital platforms. Mobile-first behaviors across North America, Europe, and the Asia Pacific further reinforce platform accessibility as a competitive advantage.

Rapid urbanization and increasingly busy professional lives have reshaped consumer behaviors, boosting demand for convenient home services. Urban populations exceeded 4.4 billion in 2023, with dual-income households particularly prevalent in developed nations. This has heightened the need for cleaning, home repair, beauty, and wellness services that save time and reduce domestic burdens.

Generational shifts also play a role, as over 47% of millennials and Gen Z prefer digital service channels over traditional booking methods. Rising disposable incomes and the growing acceptance of outsourcing household tasks have transformed home services into a routine expenditure in lifestyle rather than a luxury. These factors collectively sustain demand, encouraging service diversification and platform expansion across regional markets.

On-demand home services platforms face significant cybersecurity and data protection challenges because they collect and store sensitive customer information, including home addresses, payment details, and service schedules. The use of location-tracking technologies and personal data collection raises privacy concerns, especially in regions with strict regulations such as the European Union’s GDPR, which enforces rigorous rules on data processing, storage, and third-party sharing.

Instances of data breaches, weak encryption, and unauthorized access have undermined consumer trust and hindered platform adoption. Beyond financial risks, unauthorized access to home location data can create physical security threats. Ensuring robust cybersecurity and regulatory compliance requires substantial investment, making data protection a critical restraint that platforms must address to maintain user confidence and enable sustainable growth.

The absence of uniform regulatory frameworks across regions poses operational challenges for online on-demand home service platforms. Licensing requirements, labor protections, liability insurance, and worker classification rules differ significantly between North America, Europe, the Asia Pacific, and emerging markets, complicating service expansion and increasing compliance costs.

For example, India’s new labor code mandates that platforms contribute 1-2% of annual turnover to social security funds for gig workers while ensuring proper registration and benefits. Ambiguities over whether service providers are independent contractors or employees create legal uncertainties. Additionally, meeting licensing requirements for beauty, wellness, and maintenance services, including background checks, certifications, and insurance, elevates operational costs and slows market growth.

Substantial opportunities exist for on-demand home service platforms in semi-urban and rural regions where service penetration remains low. Approximately 2.1 billion people in Tier 2 and Tier 3 cities globally currently lack reliable access to organized home service infrastructure, representing a largely untapped market with immense growth potential. Infrastructure improvements, such as India’s BharatNet project, which connects over 250,000 villages to high-speed internet, have enabled hyperlocal service platforms to enter previously inaccessible markets.

These emerging areas offer favorable unit economics, including lower customer acquisition costs and higher retention rates compared to saturated urban markets. Platforms adopting localized strategies, such as regional-language interfaces, cash-on-delivery payments, and culturally relevant services, have achieved up to 45% growth in user registrations in non-urban regions. This expansion diversifies revenue, reduces reliance on mature cities, and establishes first-mover advantages in rapidly digitizing consumer segments.

The integration of artificial intelligence (AI) and machine learning (ML) technologies presents significant opportunities to enhance platform efficiency, service quality, and the overall customer experience. AI-powered smart dispatch systems optimize technician allocation based on skill, location, and availability, reducing service response times and operational costs. Predictive maintenance using ML and IoT sensors allows proactive identification of potential issues, enabling new revenue streams through preventive service offerings.

Advanced solutions such as real-time location tracking, dynamic pricing algorithms, customer sentiment analysis, and voice-enabled AI assistants improve operational efficiency by approximately 32%. Generative AI-driven personalization delivers tailored service recommendations, maintenance reminders, and customized promotions, strengthening customer engagement and lifetime value. These technological innovations create competitive differentiation and establish high.

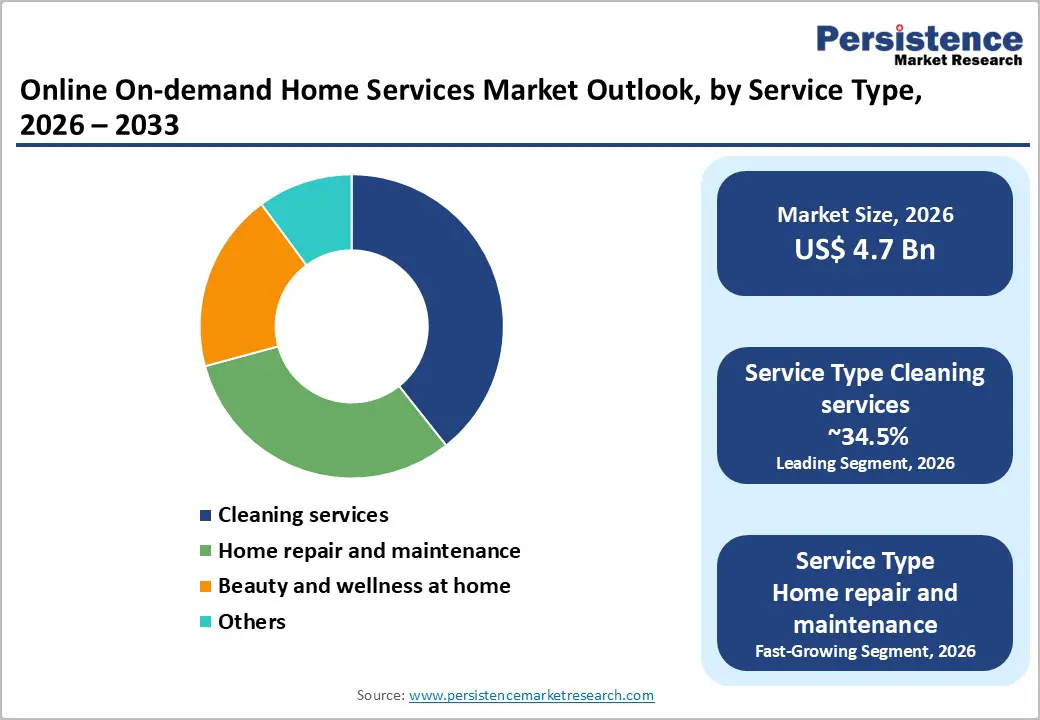

Home cleaning services represent the largest segment in the online on-demand home services market, capturing approximately 34.5% of total market share. This leadership is driven by recurring demand, which generates predictable revenue streams and enhances customer lifetime value for platforms. Cleaning services also require lower skill levels than specialized repair work, allowing platforms to onboard more service providers and ensure widespread service availability.

Consumer preferences increasingly favor professional cleaning over DIY approaches, especially among dual-income households seeking time-efficient solutions. Flexible offerings, such as one-time cleanings, weekly maintenance, and deep-cleaning packages, cater to diverse consumer needs. Additionally, eco-friendly cleaning practices and the use of sustainable products are opening new market segments focused on environmentally responsible service delivery, further supporting growth in this category.

Mobile application platforms dominate the market, capturing approximately 68.7% of global share and outperforming web-based platforms in engagement and conversions. Smartphones enable ubiquitous access, allowing users to book services anytime, anywhere. Mobile apps provide superior experiences through real-time provider tracking, instant notifications, one-tap payments, and integration with device features like GPS and cameras for diagnostics and virtual consultations.

Mobile users view over four times as many services per session as web users and achieve conversion rates up to three times higher, with some platforms recovering 22% of abandoned bookings through targeted notifications. While web platforms remain important for search visibility and desktop users, combining mobile and web strategies ensures maximum customer acquisition, engagement, and retention across digital ecosystems.

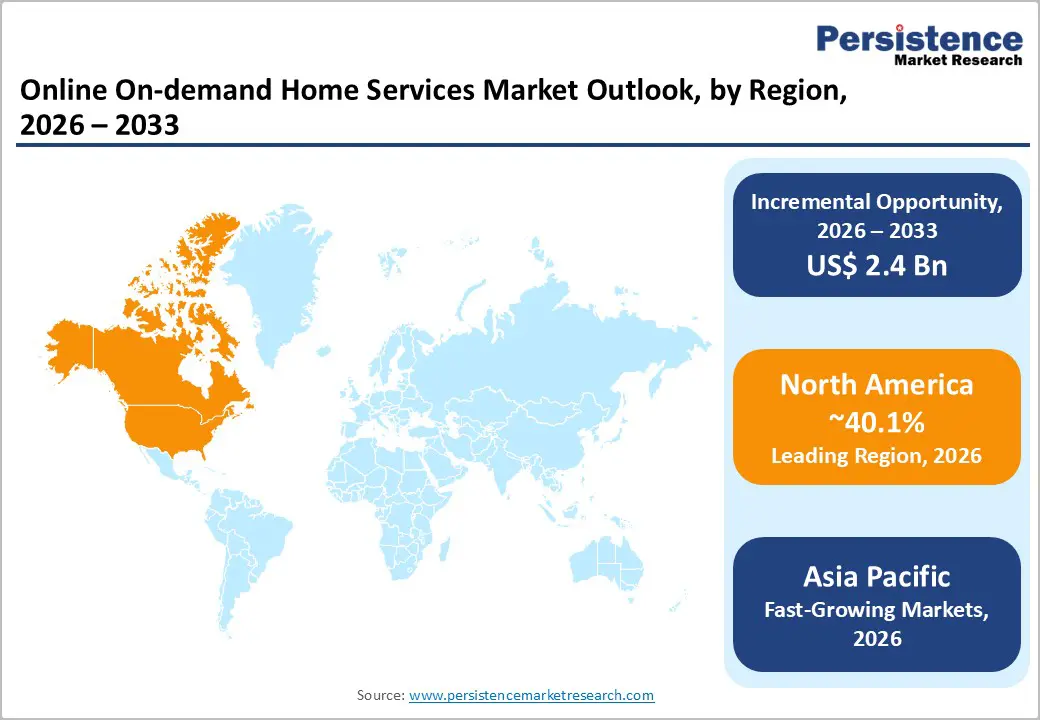

North America leads the global online on-demand home services market, capturing approximately 40.1% of the market, supported by advanced digital infrastructure, mature regulations, and high consumer adoption of platform-based services. The United States dominates regional growth, with over 250 million users engaging with platforms that prioritize quality, safety, and transparency. High disposable incomes, concentrated urban populations, and robust real estate sectors further fuel demand. Platforms such as TaskRabbit, Angi Inc., Thumbtack, and Amazon Home Services dominate, continuously innovating offerings, expanding geographic coverage, and integrating advanced technologies.

Competitive consolidation is evident, with larger platforms acquiring specialized service providers to broaden their service portfolios. Investment in AI-powered matching, virtual consultations, loyalty programs, and eco-friendly offerings enhances differentiation. Strong regulatory frameworks and consumer trust in secure, reliable platforms solidify North America as a global benchmark for service delivery excellence and technological advancement.

Europe’s online on-demand home services market is expanding steadily, with a projected CAGR of 6.9% driven by increasing platform adoption and regulatory harmonization. The United Kingdom, Germany, and France collectively account for over 60% of the regional user base. Germany generated USD 209.3 million in revenue in 2022 and is expected to reach USD 694.3 million by 2030, while France is the fastest-growing market. Mobile platform adoption is high, with Germany at 73.48%, reflecting mobile-first consumer behavior consistent with global trends.

Platforms such as Helpling and other European-focused services have built a strong regional presence, emphasizing subscription models, eco-friendly services, and personalized offerings. EU regulations, including GDPR compliance, enhance consumer trust and create barriers for new entrants. Localized strategies addressing language, culture, and certifications remain critical for competitive advantage, while international platforms must adapt to diverse country-specific requirements to capture growth opportunities.

Asia Pacific is the fastest-growing regional market, accounting for approximately 37.5% of global market share, driven by rapid smartphone adoption, internet penetration, and urbanization. India, China, and Japan serve as the primary growth engines, with India showing exceptional potential due to a large, digitally savvy middle class and rising disposable incomes. Emerging rural internet users, projected to account for 56% of new users in India by 2025, expand the addressable market beyond traditional urban areas. Platforms such as Urban Company leverage localized strategies, offering region-specific beauty, wellness, and household services with flexible payment options.

The market is highly heterogeneous, requiring platforms to balance premium service expectations in developed markets such as Japan and Singapore with price-sensitive segments in India and Southeast Asia. Adoption of smart home technologies and AI-driven solutions, combined with regulatory frameworks like India’s Social Security Code, supports sustainable growth while protecting gig workers and enhancing platform reliability across diverse markets.

The online on-demand home services market is highly fragmented, with numerous local, regional, and international players competing across service categories and geographies. Low barriers to entry, technological accessibility, and diverse consumer preferences support the proliferation of niche platforms targeting specific regional needs or specialized services. Larger platforms maintain a competitive edge through scale, comprehensive service offerings, and integrated technology ecosystems, while pursuing expansion via service diversification, geographic penetration, and strategic acquisitions.

Emerging business models such as subscription-based loyalty programs, AI-powered personalization, and smart home service packages further differentiate platforms beyond price competition. Smaller specialized players compete effectively through niche focus, local expertise, and personalized service quality, particularly in developing markets where localization is critical.

The global online on-demand home services market is projected to reach US$ 7.1 billion by 2033, growing from US$ 4.7 billion in 2026 at a 6.1% CAGR.

Key demand drivers include rising smartphone penetration, urban lifestyles, and 47% of millennials and Gen Z preferring digital service channels.

Home cleaning services dominate, capturing approximately 34.5% market share due to recurring demand, lower complexity, and high customer lifetime value.

North America leads with 40.1% global market share, supported by mature digital infrastructure, high incomes, and established platform adoption.

The largest growth opportunity is expansion into Tier 2 and Tier 3 cities and rural areas where 2.1 billion people lack organized service access.

Urban Company, TaskRabbit, Thumbtack, Handy Technologies, and Helpling are the key market players in the Online On-Demand Home Services Market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Service Type

By Platform Type

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author