ID: PMRREP20698| 199 Pages | 28 Nov 2025 | Format: PDF, Excel, PPT* | Consumer Goods

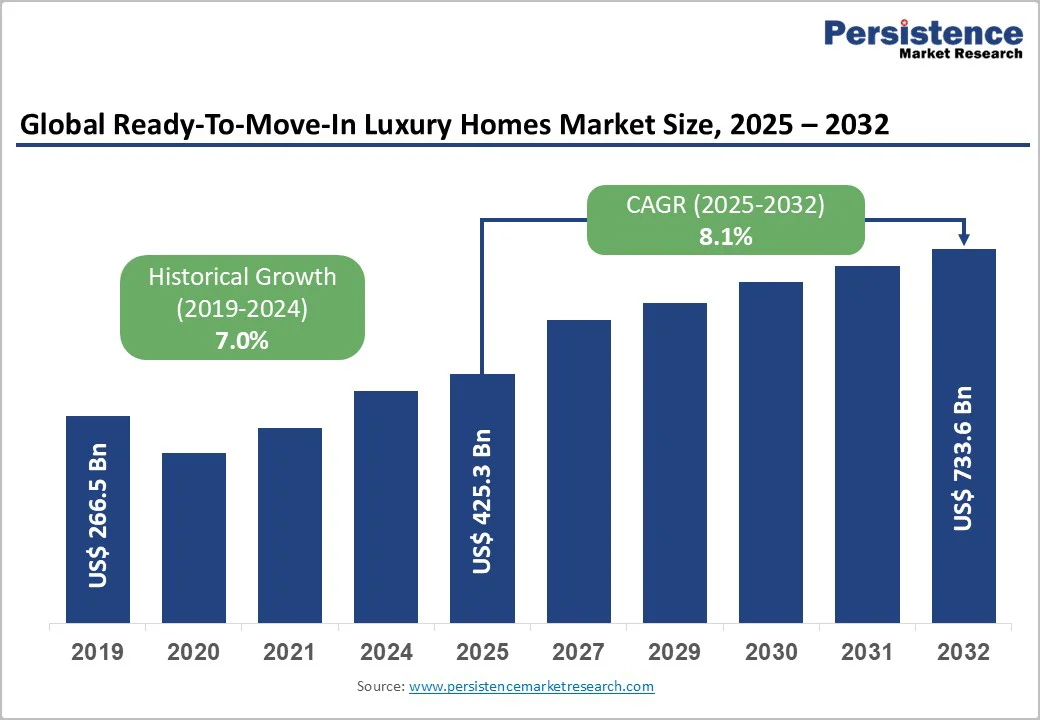

The global ready-to-move-in luxury homes market size is valued at US$425.3 billion in 2025 and is projected to reach US$733.6 billion, growing at a CAGR of 8.1% during the forecast period from 2025 to 2032.

Growth is fueled by a rising population of High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) and a strong preference for instant-occupancy properties that eliminate construction risks. Knight Frank’s Wealth Report 2024 shows India’s UHNI population grew 6.1% in 2023 to 13,263 and is expected to reach 19,908 by 2028. Luxury single-family homes in North America are selling at 98.6% of list price, highlighting sustained demand for premium, move-in-ready residences.

| Key Insights | Details |

|---|---|

|

Ready-To-Move-In Luxury Homes Market Size (2025E) |

US$425.3 Bn |

|

Market Value Forecast (2032F) |

US$733.6 Bn |

|

Projected Growth CAGR (2025-2032) |

8.1% |

|

Historical Market Growth (2019-2024) |

7.0% |

The expansion of the global affluent population is a core force driving the ready-to-move-in luxury homes market. According to the World Wealth Report 2024 (Capgemini), the global HNWI population grew by 5.1%, while their overall wealth increased by 4.7%, reinforcing their capacity and intent to invest in high-value real estate assets. This wealth expansion is translating into stronger interest in premium, move-in-ready homes as affluent buyers increasingly seek assets that combine lifestyle value and long-term investment security.

Demand is particularly visible in India. CBRE India reported that luxury homes priced above INR 4 crore witnessed a 37.8% year-on-year surge in sales from January to September 2024, with Delhi-NCR, Mumbai, and Hyderabad accounting for nearly 90% of transactions. This strong performance reflects the rising appetite for high-quality, ready-to-occupy luxury residences among India’s expanding affluent class.

The accelerating pace of urban living is pushing affluent buyers toward ready-to-move-in luxury homes that eliminate the uncertainty and delays associated with long construction cycles. Buyers prefer completed residences that offer immediate possession, superior craftsmanship, and a curated luxury experience from day one. This shift is reinforced by growing demand for premium amenities such as wellness-integrated layouts, enhanced privacy features, and advanced home automation systems.

Market research and industry trends indicate that reputed developers offering move-in-ready luxury properties are witnessing stronger and more consistent demand than mid-income and under-construction segments. Buyers continue to prioritize convenience, speed, and certainty, making RTMI luxury homes the preferred choice, particularly in metro markets where time value, location advantage, and lifestyle expectations are significantly higher.

Regulatory complexity remains a significant barrier for ready-to-move-in luxury homes, especially in emerging economies. For example, in Mumbai, the average time to obtain a construction permit was recorded at 162 days under the earlier regime. Even though reforms have aimed to reduce approval times, the complexity of multiple clearances and large procedural burdens continues to slow new development.

Approval bottlenecks, land-use conversion delays, heritage preservation regulations and environment clearances all further constrain the supply of new luxury inventory. In India, regulatory directives have set a maximum of 45 days for permits to be cleared in some jurisdictions. These elongated timelines increase costs and risks for developers and discourage new launches in the luxury segment.

High pricing in the ready-to-move-in luxury segment creates a narrow buyer pool and makes the market more vulnerable to macroeconomic shifts. While specific premium-price differential data is not consistently published, US housing market indicators show that inventory rose by 6.7% year-on-year as of May 2024, reflecting growing supply pressure in a high-priced environment. With elevated mortgage rates and inflationary pressures, affordability and demand for very high-ticket homes become constrained.

Rising construction and land costs further amplify these pressures. For instance, obtaining permits and completing luxury projects in major metros can take 3 to 4 years, thereby inflating costs and impacting margins. When economic conditions shift, luxury homeowners become more sensitive to price drops and alternative investment options, limiting market penetration beyond the ultra-affluent buyer segment.

Sustainability is becoming a central value driver in luxury real estate. According to Trident Realty, green-certified premium properties routinely command 10–15% higher sale prices than non-certified buildings. Meanwhile, energy-efficient operations help lower costs: certified buildings achieve 20–30% savings in energy use and similar reductions in water and maintenance costs.

On the technology front, modern luxury homes are increasingly integrating smart automation, AI-driven security, and wellness systems. These features, combined with sustainability credentials, make ready-to-move luxury homes more attractive to affluent buyers willing to pay a premium. Green-certified residences also transact more quickly; some close 20–30% faster than non-certified ones, boosting liquidity for developers.

Luxury developers have strong growth potential in emerging Asia-Pacific markets and secondary luxury destinations. According to Knight Frank, Southeast Asia, including Vietnam, Thailand, and the Philippines, is seeing rapid growth in branded residences, fueled by economic expansion and a projected 45.2% increase in UHNWI population by 2028. Branded residences in the region are forecasted to nearly double, with 43,100 new units across 180 projects being added in the coming years.

The surge is underpinned by rising affluence, strong tourism, and increasing interest from global investors seeking second homes. Branded luxury real estate in the Asia Pacific, worth around US$26.6 billion, now accounts for tens of thousands of units, according to C9 Hotelworks. These trends open up major opportunities for ready-to-move-in luxury homes in markets with both high-growth potential and increasing investor confidence.

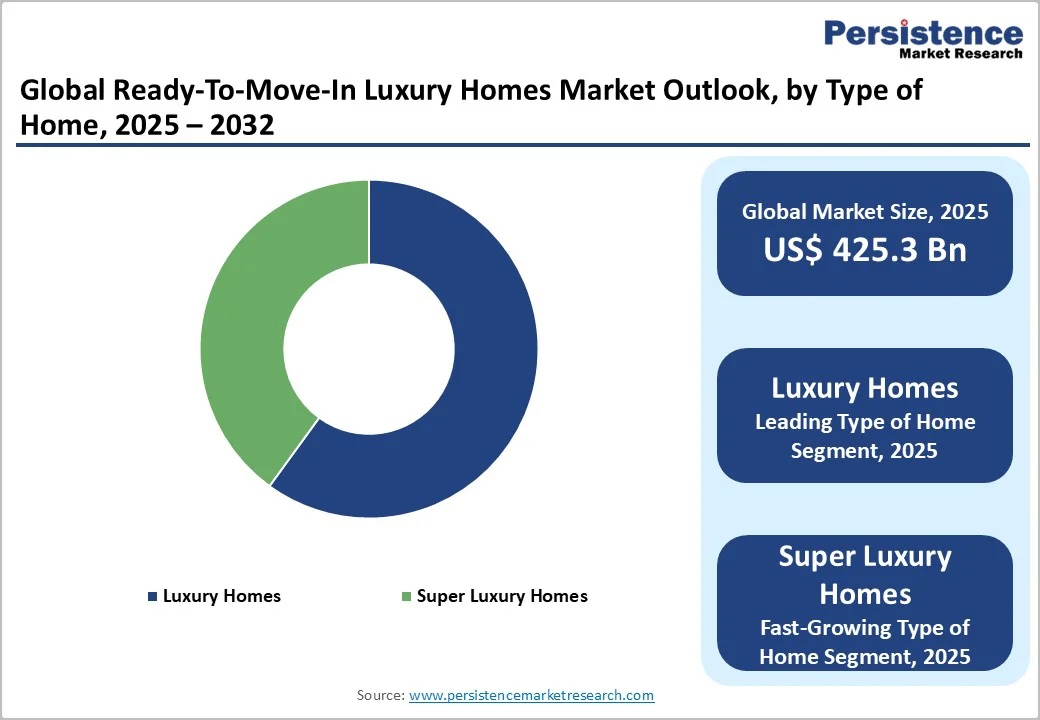

The super-luxury/ultra-luxury homes segment continues to demonstrate exceptional strength, driven by concentrated demand from UHNWIs seeking premium, move-in-ready assets. Verified ANAROCK data confirms that 59 ultra-luxury homes priced above INR 40 crore were sold across India’s top seven cities in 2024, achieving a total transaction value of INR 4,754 crore, reflecting a 17% annual increase. Mumbai remained the epicenter of India’s luxury housing market, recording 52 of the 59 transactions an 88% share highlighting its enduring dominance in high-value residential investments.

Of the 59 units sold, 53 were luxury apartments and 6 were bungalows, underlining the strong buyer inclination toward premium, ready-to-occupy residential towers. Market traction in this segment continues to rise, supported by resilient demand from business owners, senior professionals, NRIs, and wealthy investors prioritizing exclusivity, privacy, and immediate possession in prime urban micro-markets.

Demand for spacious ready-to-move-in luxury homes remains elevated, with affluent buyers seeking larger layouts that deliver privacy, multifunctional spaces, and integrated high-end amenities. Verified data from the Institute for Luxury Home Marketing (ILHM) shows that luxury single-family homes in North America are selling at 98.86% of the list price, underscoring a competitive, high-absorption market for premium, move-in-ready inventory. The average luxury home size of ~3,163 sq ft reflects buyer preferences for expansive layouts that support contemporary lifestyle needs.

These larger units offer enhanced livability with space for home offices, wellness corners, entertainment zones, and private outdoor extensions. Market traction remains strong across major luxury markets where buyers increasingly prioritize immediate availability combined with features like elevators, premium finishes, and advanced home automation. Spacious units continue to outperform mid-sized formats due to their superior lifestyle value and long-term investment appeal.

Individual residential buyers remain the dominant demand drivers in the ready-to-move-in luxury homes segment, supported by strong participation from HNWIs and a rising preference for premium primary residences. ANAROCK’s verified ultra-luxury market data indicates that most high-value purchases, particularly homes above INR 40 crore, are led by wealthy individuals seeking long-term residential assets with immediate possession. Demand is further reinforced by NRIs, whose luxury housing investments continue to rise due to favorable currency movements and a growing preference for fully finished, risk-free properties.

These buyers prioritize asset security, lifestyle enhancement, and capital appreciation, making ready-to-move-in luxury homes a preferred investment avenue. With increasing emphasis on convenience, design quality, premium amenities, and zero construction delays, individual end-users significantly outpace corporate buyers. The segment’s resilience is also supported by sustained interest from business owners, senior executives, and global professionals valuing exclusivity and turnkey readiness.

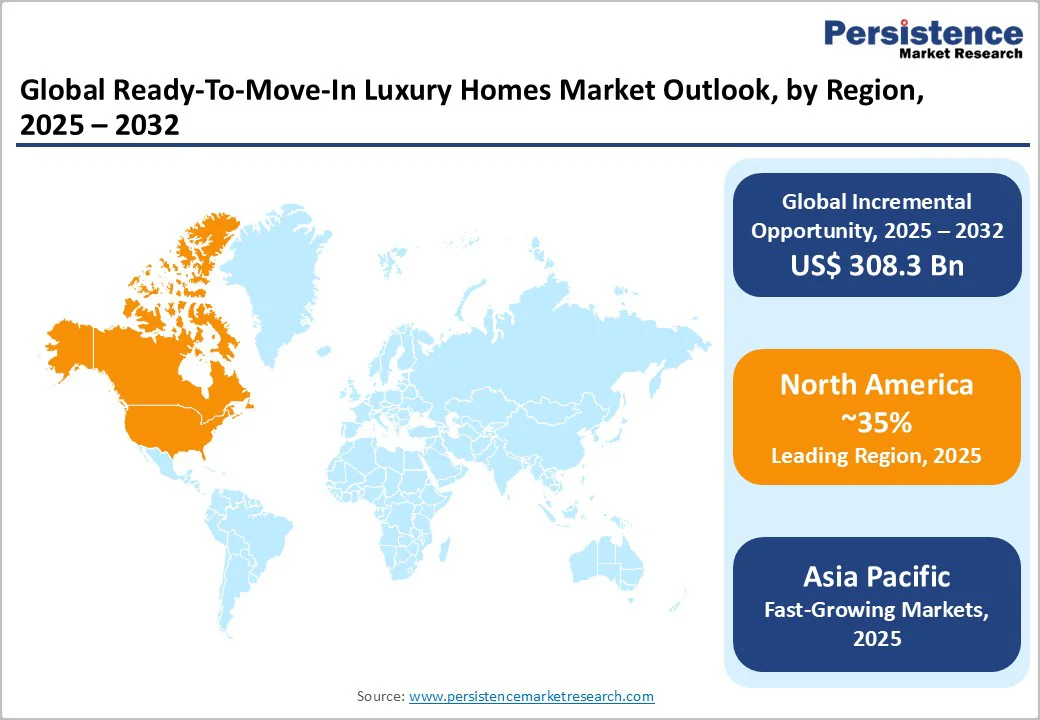

North America remains a mature and resilient market for ready-to-move-in luxury homes, supported by strong housing demand, established regulatory systems, and affluent buyer preference for immediate-occupancy properties. Verified U.S. Census data confirms steady momentum in new residential construction during 2024 as easing mortgage conditions improved builder sentiment. Luxury single-family homes continue to perform strongly, with the Institute for Luxury Home Marketing (ILHM) noting that luxury homes sell close to list price, reflecting healthy absorption and sustained confidence among high-net-worth buyers.

Adoption of smart-home features is rising, with the U.S. Census Bureau reporting significant increases in energy-management systems and integrated home-automation installations in newly built residences. Sustainability also plays a growing role, with the U.S. Green Building Council documenting widespread expansion of LEED-certified residential construction. Despite inventory adjustments and cautious buyer sentiment in certain metros, the segment remains fundamentally stable, driven by cash-led purchases and investor preference for turnkey, risk-free luxury assets.

Europe’s luxury real estate market is shaped by heritage properties, international investor inflows, and the enduring appeal of culturally rich urban and coastal destinations. Major hubs such as London, Paris, Milan, and Berlin continue to attract affluent buyers seeking immediate-occupancy premium residences that combine architectural pedigree with modern amenities. Strong demand also persists in iconic leisure markets such as the French Riviera, Tuscany, and the Alps, where limited supply and global desirability support long-term value for ready-to-move luxury units.

Buying preferences have evolved, with demand rising for large layouts, private outdoor areas, and wellness-oriented features as remote work reshapes lifestyle priorities. Smart-home technology, flexible floor plans, and upgraded energy-efficient features have become essential in high-end properties. While certain countries face regulatory complexities, including preservation laws and varying property taxes, the overall European luxury housing market remains resilient due to constrained supply in prestige locations, high international interest, and sustained demand for branded residences offering concierge, wellness, and hospitality-grade services.

Asia Pacific emerges as the fastest-expanding luxury housing region, supported by rapid economic growth, rising HNWI populations, and a strong appetite for premium ready-to-move residences across major cities such as Tokyo, Singapore, Shanghai, Beijing, Mumbai, and Bangkok. Knight Frank’s Prime Global Cities Index confirms that most tracked Asian markets recorded stable or positive luxury price growth in 2024, highlighting the region’s sustained demand despite global headwinds. Large urban centers continue to attract affluent domestic and foreign investors due to strong economic fundamentals and improving infrastructure.

Select cities such as Manila and Tokyo have witnessed notable price momentum driven by foreign investment interest, favorable currency dynamics, and lifestyle-driven demand for premium, fully finished homes. India’s luxury segment is bolstered by an expanding affluent class and rising numbers of UHNWIs, sustaining the appetite for turnkey high-end projects. Southeast Asia continues evolving as a hotspot for branded residences, with Vietnam, Thailand, and the Philippines seeing strong development pipelines as buyers prioritize wellness amenities, sustainability integration, and globally aligned luxury standards.

The ready-to-move-in luxury homes market is moderately fragmented, with competition shaped by developers’ brand equity, execution capability, design quality, and amenity depth. Market leaders typically differentiate through large-format gated communities, branded collaborations, and strong project delivery records. Vertical integration across design, construction, and property management further strengthens competitiveness by ensuring consistent quality and faster go-to-market timelines.

Digital adoption is increasingly widening the gap between top performers and smaller players. Advanced tools such as virtual walkthroughs, behavioral analytics, blockchain-based title validation, and full smart-home integration are becoming core competitive levers. Sustainability-driven luxury supported by green certifications adds another layer of differentiation, enabling higher price realization and long-term operational savings.

The market is projected to reach US$ 733.6 Bn by 2032 driven by rising HNWI demand and preference for immediate-occupancy luxury homes.

Growth is driven by rising affluent buyers, increasing cash purchases, and strong demand for energy-efficient and smart-home-enabled luxury properties.

Homes above 3,000 sq ft lead the market due to high demand for spacious, flexible, and wellness-oriented layouts.

North America dominates the market owing to strong purchasing power, mature frameworks, and high adoption of smart-home infrastructure.

Smart-home integration and green-certified sustainability features offer major value through higher premiums, faster sales, and long-term cost savings.

Key market players include leading developers across global regions such as DLF Ltd, Godrej Properties, Lodha Group , Emaar Properties, DAMAC Properties, and Nakheel.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Type of Home

By Unit Size

By End-user

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author