ID: PMRREP4528| 190 Pages | 9 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

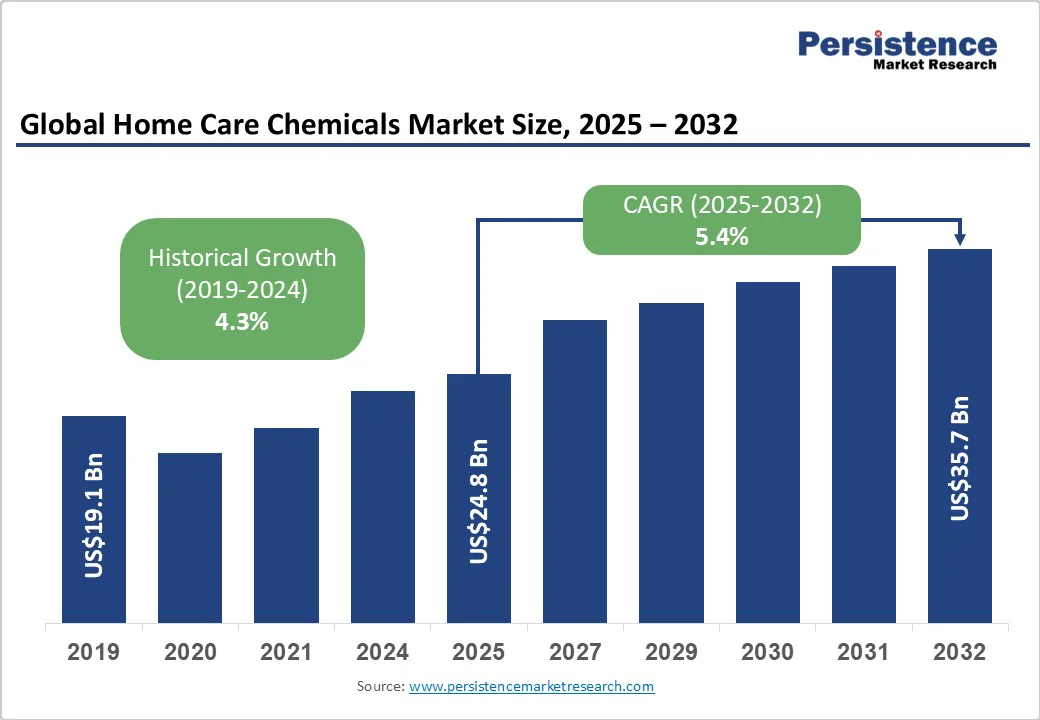

The global home care chemicals market size is likely to be valued at US$24.8 Billion in 2025 and is estimated to reach US$35.7 Billion in 2032, growing at a CAGR of 5.4% during the forecast period 2025-2032, driven by rising consumer awareness of hygiene, health, and environmental sustainability. Surging concerns about germs and viruses are also boosting demand for disinfectants and antibacterial sprays.

| Key Insights | Details |

|---|---|

|

Home Care Chemicals Market Size (2025E) |

US$24.8 Billion |

|

Market Value Forecast (2032F) |

US$35.7 Billion |

|

Projected Growth (CAGR 2025 to 2032) |

5.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.3% |

A key growth driver for home care chemicals is the increased consumer focus on hygiene and disease prevention. Awareness about germs, bacteria, and viruses has surged, especially following the COVID-19 pandemic, prompting households and commercial spaces to adopt effective cleaning and disinfecting solutions. Products such as antibacterial sprays, multi-surface disinfectants, and enzyme-based detergents are in high demand to minimize microbial contamination.

Brands such as Lysol and Dettol have expanded their disinfectant product lines with improved formulations that promise long-lasting protection against pathogens, reinforcing consumer trust and boosting repeat purchases. This rising health consciousness continues to fuel demand for safe and efficient home care chemicals, making disease prevention a sustained growth driver.

Another key growth driver is the demand for products that preserve and protect household surfaces. Consumers today seek cleaning solutions that not only remove dirt and stains but also maintain the longevity of materials such as wood, stone, glass, and metals. Specialty surface cleaners, polishers, and protective sprays provide anti-scratch, anti-stain, and hydrophobic benefits, appealing to those looking to maintain aesthetic value and durability.

For instance, products such as Method’s wood polish and Weiman’s granite cleaner in North America are formulated to clean effectively while protecting surface integrity. This focus on surface care bolsters innovation and allows manufacturers to deliver premium products that justify high price points.

One key restraint for the global market is the potential health risks associated with prolonged exposure to certain cleaning agents. Ingredients in some detergents, disinfectants, and surface cleaners can cause respiratory problems, skin irritation, or allergic reactions in sensitive individuals. This has led consumers to increasingly scrutinize product labels and prefer safe alternatives, putting pressure on manufacturers to reformulate.

For example, studies on ammonia- and bleach-based cleaners have exhibited respiratory irritation among frequent users. As a result, brands such as Seventh Generation and Ecover have developed hypoallergenic and non-toxic formulations. Such health concerns can slow the adoption of conventional products, specifically in households with children or elderly residents.

Environmental considerations also act as a restraint for home care chemicals. Phosphates and other harmful compounds in detergents can enter rivers and lakes, promoting excessive algae growth that disrupts aquatic ecosystems. This eutrophication reduces oxygen levels, threatening fish and other marine life, and can create imbalances in biodiversity.

Regulatory measures in Europe and North America, including phosphate bans in laundry detergents and dishwasher products, are already in effect, compelling manufacturers to reformulate products with eco-friendly alternatives. Companies unable to quickly adapt face reputational and compliance risks, further limiting the market potential for conventional chemical-based formulations.

The home care chemicals market has key growth potential through the adoption of plant-based and biodegradable ingredients. Consumers are now seeking products that are gentle on the environment and safe for household use, such as detergents with naturally derived enzymes, essential oils, and surfactants. These ingredients not only improve cleaning efficiency but also appeal to the surging eco-conscious segment.

Companies investing in sustainable formulations can differentiate themselves, build brand loyalty, and meet strict environmental regulations. For example, Reckitt Benckiser has expanded its eco-friendly Lysol and Finish lines with biodegradable ingredients, while Ecover emphasizes natural formulations, catering to consumers who prioritize sustainability without compromising performance.

Another emerging opportunity lies in the expansion of direct-to-consumer (DTC) and private label home care brands. These small players are challenging traditional industry leaders by delivering cost-effective, high-quality products directly to consumers, bypassing conventional retail channels. The DTC model allows for personalized marketing, subscription services, and superior customer engagement, which improves loyalty and brand recognition.

For instance, brands such as Dropps in the U.S. and Cleancult in Europe have embraced subscription-based deliveries and minimalistic, eco-friendly packaging to attract urban and sustainability-conscious consumers. This trend reflects a shift in purchasing behavior, where convenience, value, and direct connection with the brand are influencing buying decisions.

Surfactants are predicted to occupy approximately 24.6% of the market share in 2025, as they are versatile and effective at breaking down grease, oils, and dirt across multiple applications. Their ability to refine cleaning efficiency while being compatible with other ingredients makes them indispensable in products such as laundry detergents, dishwashing liquids, and surface cleaners. Recent developments in biodegradable and plant-based surfactants, including BASF’s eco-friendly Plantacare range, have further boosted consumer preference for surfactants.

Additives are seeing steady demand as they improve product performance, stability, and shelf-life. They include enzymes, brighteners, fragrances, and preservatives, which allow manufacturers to differentiate products and meet consumer expectations. For example, enzymes in detergents improve stain removal at low temperatures, complying with energy-efficient and environmentally conscious consumer trends. Fragrance microcapsules in surface cleaners provide long-lasting freshness, making additives a key component of premium home care formulations.

Laundry care is the leading application with a share of about 33.9% of the market share in 2025, as clothes are washed frequently, making it a recurring consumer requirement. Consumers now demand products that deliver stain removal, color protection, and fabric care. Innovations such as concentrated detergents, cold-water-effective enzymes, and eco-friendly tablets by brands, including Tide and Persil, have strengthened laundry care’s dominance by delivering convenience and sustainability.

Dishwashing is a prominent application area as it combines hygiene, convenience, and daily necessity. Consumers prefer products that remove grease effectively, are gentle on hands, and are safe for dishes. The rise of premium dishwashing liquids with biodegradable surfactants, anti-bacterial agents, and eco-friendly packaging shows the surging focus on both effectiveness and environmental responsibility.

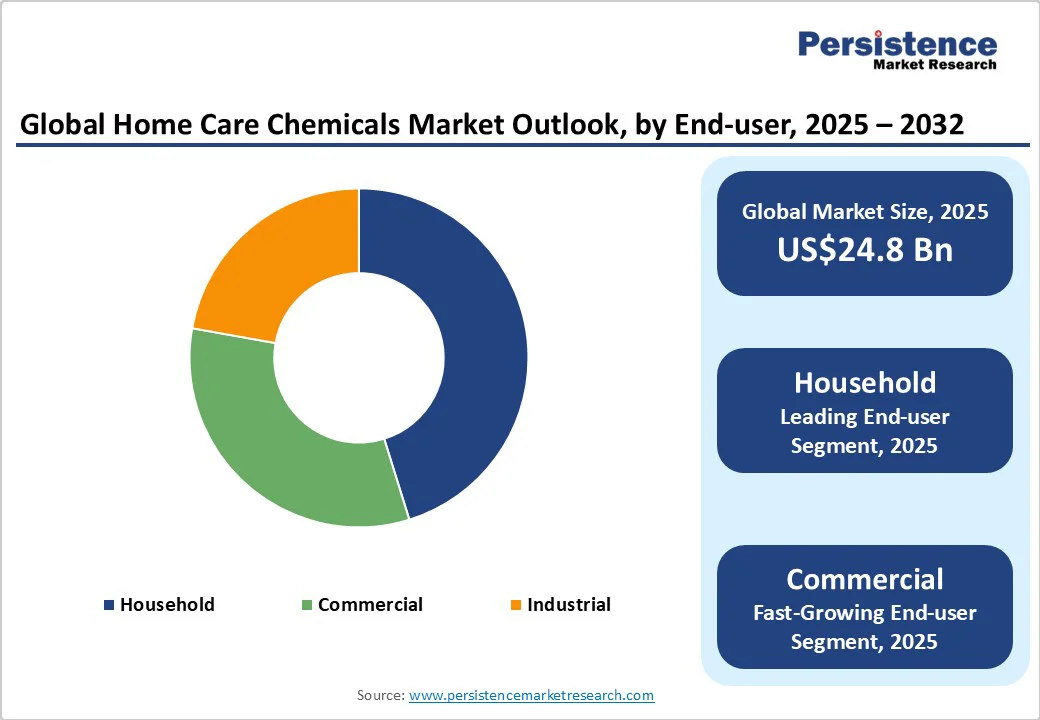

Household is predicted to be the dominant end user with a market share of nearly 45.2% in 2025, owing to the routine nature of cleaning, laundry, and dishwashing. Rising hygiene awareness, busy lifestyles, and the trend of eco-conscious living have increased demand for convenient and effective home care products. For instance, the popularity of concentrated liquid detergents and eco-friendly multi-surface cleaners across homes in Europe and North America highlights this trend.

Commercial establishments are key end-users as they require large volumes of cleaning chemicals for operational efficiency and hygiene compliance. Hotels, restaurants, and healthcare facilities prioritize high-performance products that meet strict sanitation standards. Developments such as industrial-strength disinfectants and enzyme-based laundry detergents for commercial laundries, including Ecolab’s portfolio, showcase how customized formulations address the rigorous demands of commercial cleaning.

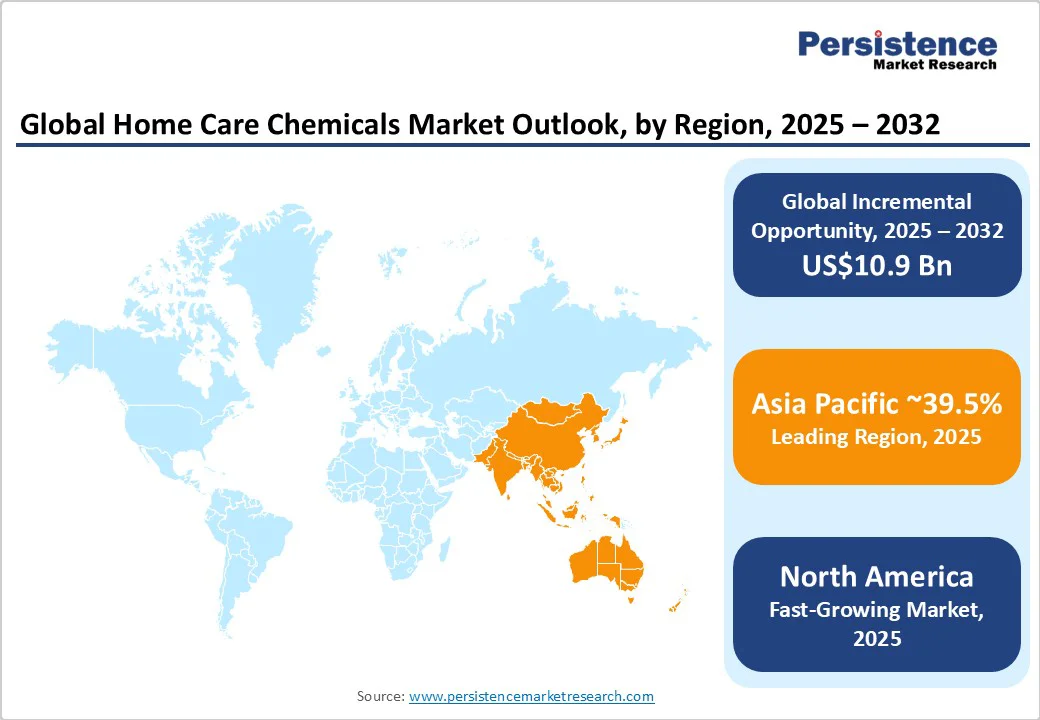

In 2025, Asia Pacific is expected to account for approximately 39.5% of the market share, owing to evolving consumer preferences and rising disposable incomes. Regional dynamics play a significant role in shaping the market. East Asia, particularly China, is a dominant force in the industry. China accounts for nearly 70% of the regional laundry detergent market, while India is witnessing robust growth, especially in the laundry care segment.

Consumer behavior in Asia Pacific is shifting toward natural and sustainable products. A surging middle class and increased health and hygiene consciousness are prompting consumers to seek out organic and phosphate-free products. The hybrid working model has also led to more time spent at home, increasing the demand for home care products. Leading companies in the region, such as Unilever, Reckitt Benckiser, and Kao Corporation, are focusing on product development and sustainability to meet consumer demands.

North America will likely hold a share of around 26.7% in 2025, backed by sustainability and eco-friendly developments. Companies such as Dow are developing biodegradable surfactants, while Colgate-Palmolive focuses on waste reduction and sustainable sourcing, reflecting a shift toward environmentally responsible products. Consumer preferences are also influencing the market.

There is a rising demand for natural and health-focused products, including antimicrobial and surface cleaners. Transparency in ingredients and safe chemical formulations is becoming a key factor in purchase decisions. Regulatory changes are influencing product development and market operations. The Environmental Protection Agency (EPA) has proposed banning trichloroethylene (TCE) due to health risks, and ongoing debates around PFAS restrictions highlight the region’s focus on safe chemicals.

Consumers in Europe are prioritizing eco-friendly and sustainable cleaning products. Companies are responding by developing biodegradable and non-toxic formulations. For instance, BASF's Care 360° initiative focuses on transitioning from fossil to renewable carbon sources and achieving net-zero emissions, reflecting the industry's shift toward sustainability. The demand for natural and health-conscious home care products is rising. Consumers are seeking products with transparent ingredient lists and minimal environmental impact. This trend is influencing product development and marketing strategies across the region.

Europe's regulatory environment is becoming more stringent. The revised Classification, Labelling and Packaging (CLP) Regulation, effective from December 2024, introduces clear labelling requirements and hazard classifications, improving consumer safety and product transparency. European Commission's Chemicals Strategy aims to phase out harmful chemicals in consumer products, promoting the use of safe alternatives.

The global home care chemicals market is influenced by strategic corporate actions. For instance, Reckitt Benckiser Group, known for brands such as Lysol, has announced plans to divest several home-care brands, including Air Wick and Mortein, to focus on core brands such as Lysol, Dettol, and Strepsils. However, market volatility, partly due to U.S. tariff policies, has led to delays in this divestment process.

The market is also witnessing increased competition from non-traditional retailers. For example, Coles has reported a loss of approximately US$500 Million in sales over the past four years to competitors such as Chemist Warehouse, Amazon, and Bunnings, specifically in health and home product categories.

The home care chemicals market is projected to reach US$24.8 Billion in 2025.

Rising hygiene awareness and demand for eco-friendly cleaning solutions are the key market drivers.

The home care chemicals market is poised to witness a CAGR of 5.4% from 2025 to 2032.

Growth in direct-to-consumer sales and a shift toward concentrated products are the key market opportunities.

BASF SE, Ashland Inc., and Solvay S.A. are a few key market players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author