ID: PMRREP32443| 199 Pages | 13 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

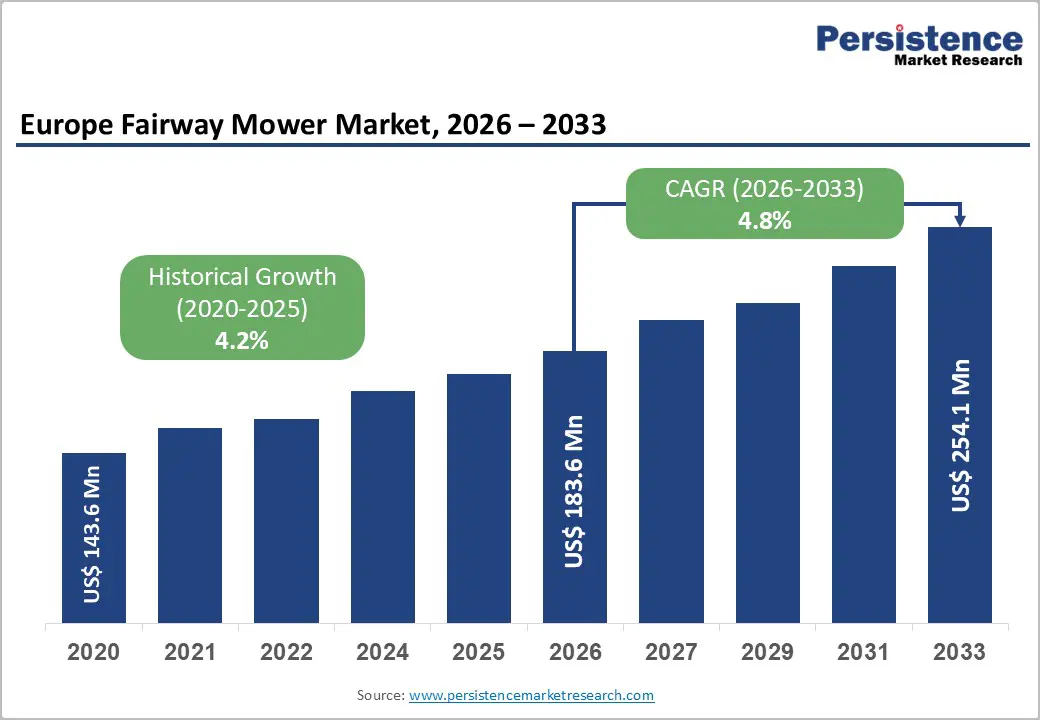

Europe fairway mower market size is likely to be valued at US$ 183.6 million in 2026 and is projected to reach US$ 254.1 million by 2033, growing at a CAGR of 4.8% between 2026 and 2033.

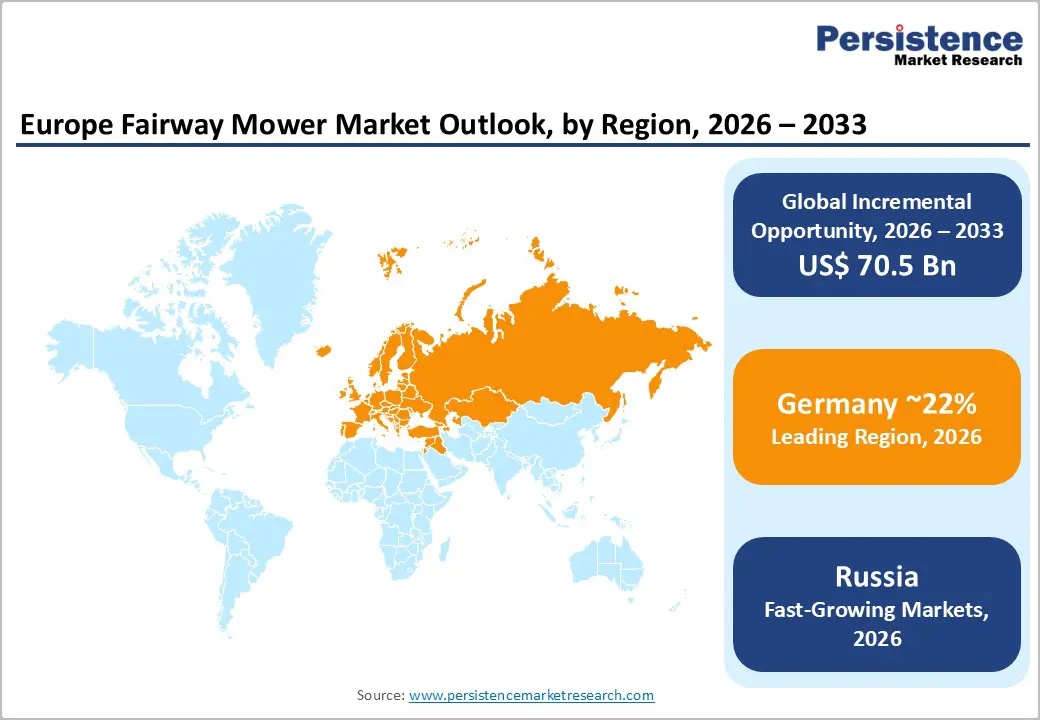

Market expansion is driven by rising golf course infrastructure modernization, accelerating adoption of electric and hybrid mower technologies to support environmental sustainability objectives, and increasing golf tourism across Europe, particularly in Scotland, Spain, and Portugal, which promotes premium course maintenance standards. Germany maintains market leadership with ~22% regional share, leveraging advanced manufacturing capabilities and sophisticated turf management infrastructure, while the United Kingdom and Russia demonstrate strong momentum supported by technological integration and course expansion initiatives throughout the continent.

| Key Insights | Details |

|---|---|

| Europe Fairway Mower Market Size (2026E) | US$ 183.6 million |

| Market Value Forecast (2033F) | US$ 254.1 million |

| Projected Growth CAGR (2026 - 2033) | 4.8% |

| Historical Market Growth (2020 - 2025) | 4.2% |

Rising Golf Course Modernization and Infrastructure Development

Golf course infrastructure modernization and equipment replacement cycles represent the primary market growth catalyst, with European golf courses prioritizing facility upgrades, course redesigns, and maintenance optimization, creating sustained demand for fairway mower solutions supporting turf management standards. European golf tourism has surged, with regions including Scotland, Spain, and Portugal witnessing increased visitor volumes driven by championship courses and destination resort development attracting international players and corporate events. Course operators are investing in facility modernization to attract tournaments, enhance player experiences, and maintain competitive positioning within the golf market.

Major European championship courses are upgrading equipment infrastructure to support consistent playing conditions essential for hosting competitions. Government sports tourism initiatives and private sector course development pipelines extend fairway mower demand across markets. Professional golf organizations require turf equipment supporting year-round conditioning and international visitor expectations, driving demand for fairway mower technologies.

Advanced Technology Integration and Precision Turf Management Requirements

Modern fairway mower technology integration, including GPS-guided systems, telematics platforms, autonomous operation capabilities, and precision performance monitoring, is enabling golf course operators to optimize turf management efficiency, reduce labor requirements, and achieve unprecedented maintenance standards supporting professional tournament operations and premium player experiences. Toro's GeoLink autonomous fairway mower field testing, which commenced in 2022, represents a technology advancement addressing labor shortage concerns and operational cost pressures confronting golf industry. John Deere's TechControl display systems enable password-protected precision speed configuration, operator performance standardization, and real-time operational alerting, supporting consistent cut quality across diverse operator capabilities. Autonomous technology development by multiple manufacturers, including Toro and Gravely, represents an emerging market opportunity that addresses labor availability constraints and supports long-term optimization of operational efficiency. Telematics systems enabling remote monitoring, predictive maintenance, and operational analytics are creating value-added service opportunities supporting equipment supplier positioning and customer relationship development.

Fairway mower acquisition and deployment involve substantial capital requirements, with premium equipment commanding high prices reflecting advanced engineering, precision manufacturing, and specialized features, limiting adoption among cost-constrained golf operations and smaller facilities. Electric fairway mower technologies carry pricing premiums over conventional hydraulic alternatives, creating affordability barriers that delay adoption despite superior operating performance and long-term cost advantages. Additional infrastructure investments for charging networks further restrict uptake, particularly at remote courses or regions with limited electrical readiness. Financing constraints facing independent and family-owned golf courses slow modernization cycles. Supply chain disruptions and manufacturing capacity limitations periodically restrict equipment availability, delaying purchases.

European fairway mower operations must comply with multiple regulatory frameworks, including emissions standards, noise pollution rules, worker safety protocols, and golf-specific operational guidelines, creating compliance burdens and limiting manufacturing flexibility across diverse markets. EU noise regulations and local sound limits restrict diesel and gasoline-powered equipment use during sensitive periods, requiring investment in emission controls or transitions toward electric alternatives. Equipment certification and homologation across jurisdictions increase compliance costs and extend product development timelines from design to commercialization. Regional environmental compliance obligations and sustainability reporting mandates impose ongoing administrative and verification costs throughout product lifecycles, directly influencing manufacturing economics and profitability.

Autonomous fairway mower platforms represent a significant market opportunity that addresses systemic labor shortages in golf course operations, with technological feasibility demonstrated through field testing programs and commercial deployment roadmaps that establish viable commercialization pathways. Gravely's autonomous zero-turn mower prototype, utilizing Greenzie autonomous technology, demonstrates commercial viability through field testing with landscapers and municipal operators, generating positive feedback. Toro's autonomous fairway mower development signals a major equipment manufacturer's commitment to market commercialization, with an estimated market opportunity supporting multiple competing platforms across regional and global markets. Smart city and municipal green space management initiatives are creating adjacent market opportunities for autonomous turf management solutions supporting cost reduction and operational efficiency objectives. Early-mover advantages and brand positioning as technology leaders could enable specialized fairway mower suppliers to capture premium market positioning and pricing, sustaining attractive profit margins throughout product lifecycles.

Russia and Eastern European markets represent emerging growth opportunities for fairway mower suppliers, with regional golf course development, government sports initiatives, and expanding affluent demographics supporting market expansion potential. Russian golf infrastructure development programs and private sector course investments are creating greenfield opportunities for equipment suppliers, establishing early regional presence and service networks. Eastern European expansion supports geographic diversification strategies, reducing reliance on mature Western European markets while capturing higher-growth demand dynamics. Developing golf tourism, resort projects, and premium residential communities is increasing the requirements for professional turf maintenance standards. Local authorities and private developers are investing in modern course design and maintenance capabilities to attract international visitors and tournaments. These factors collectively improve long-term sales visibility, encourage distributor partnerships, and strengthen the commercial rationale for targeted market entry across Russia and Eastern Europe over the medium- to long-term outlook.

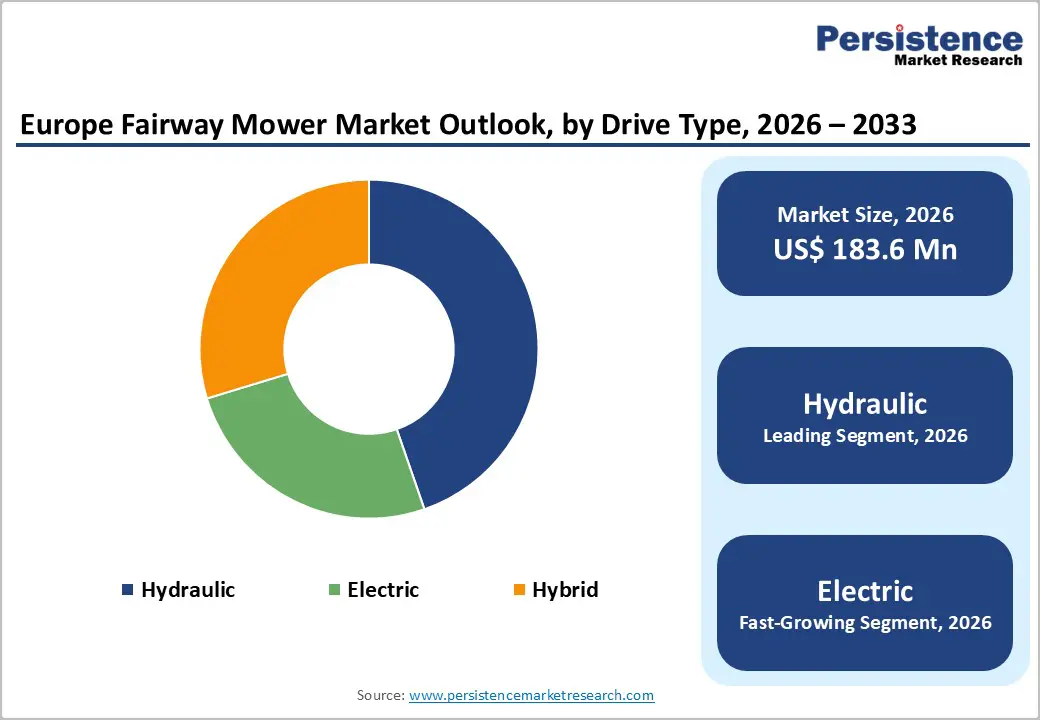

Hydraulic-powered fairway mowers command approximately 45% share, representing the established dominant technology preferred for robust performance, precise control, and reliable operation under demanding golf course operating conditions across diverse turf types and terrain variations. Hydraulic systems deliver powerful control mechanisms enabling sophisticated cutting unit management, variable turning speed optimization, and terrain adaptation supporting professional turf maintenance standards. Established service infrastructure and operator familiarity with hydraulic systems across European golf courses support continued market dominance despite emerging electric alternative competition.

Electric fairway mower systems represent the fastest-growing category, expanding at 9.3% CAGR, driven by sustainability priorities, low noise, reduced maintenance, and improving battery technology, removing range constraints. Models such as Gravely’s Pro-Stance EV demonstrate commercial viability, reinforcing confidence. Eliminated fuel costs and lower servicing offset premium pricing over equipment lifetimes, strengthening adoption economics for course operators across European golf facilities.

Fairway mowers exceeding 100 inch cutting width command approximately 35% share, driven by large-course applications requiring efficient area coverage and enhanced productivity supporting professional turf maintenance standards across premium golf facilities. Major championship courses and resort-style facilities utilizing large fairway areas prioritize wider cutting systems maximizing operational efficiency and reducing mowing time requirements supporting maintenance cost optimization.

Mid-range cutting width fairway mowers (80.1 to 100 inches) represent the fastest-growing segment, expanding at 4.9% CAGR, driven by application versatility supporting diverse course sizes and layouts, terrain complexity management, and balanced productivity-to-maneuverability optimization. European golf courses exhibit diverse terrain characteristics and layout complexity requiring balanced cutting width supporting efficient area coverage while maintaining precise maneuvering capability around hazards and obstacles.

Fairway mowers rated up to 25 horsepower command approximately 30% of European market share, representing cost-effective solutions for smaller courses and maintenance-focused operations prioritizing affordability and operational simplicity over maximum performance capability. Smaller golf facilities and maintenance-intensive courses favor lower-horsepower equipment, supporting operational cost optimization and reduced fuel consumption.

Mid-range power rating fairway mowers (41-55 horsepower) represent the fastest-growing segment, expanding at 6.8% CAGR, driven by enhanced performance requirements supporting larger fairway areas, challenging terrain conditions, and premium maintenance standards characteristic of championship courses and resort facilities. Professional golf operations and complex terrain courses prioritize higher-horsepower equipment, enabling superior performance and operational reliability under demanding conditions.

Germany maintains market leadership, commanding a significant 22% share of Europe's fairway mower market, driven by sophisticated manufacturing infrastructure, advanced technology adoption, premium golf course maintenance standards, and established relationships between equipment manufacturers and golf course operators. German automotive and precision machinery manufacturing traditions support advanced fairway mower development and high-quality production. The German golf course industry emphasizes operational excellence and environmental sustainability, creating favorable conditions for premium equipment adoption. Government environmental policies and sustainability initiatives support electrification and low-emission equipment deployment across German golf operations.

German equipment manufacturers, including regional specialists, maintain competitive positions through precision engineering and premium product positioning. Regulatory framework emphasizing equipment safety, environmental compliance, and performance standards supports premium product differentiation for suppliers meeting stringent German quality expectations. Investment in electrification technology development and sustainable manufacturing positions Germany as an innovation leader supporting emerging zero-emission golf course maintenance solutions.

The United Kingdom holds a considerable 15% share within Europe's fairway mower market, expanding at a 5.4% CAGR, driven by established golfing culture, sophisticated course infrastructure, sustainability commitment, and technology integration supporting premium turf maintenance standards. UK golf course industry emphasizes historical heritage, championship events, and environmental responsibility, creating favorable conditions for technology-intensive equipment adoption. Government environmental initiatives and strict emissions regulations support electrification momentum and sustainable equipment deployment across UK golf operations.

Scottish and English championship courses prioritize maintenance excellence and environmental stewardship, creating flagship facilities for technology demonstration and advanced equipment deployment. UK golf tourism supports course modernization and premium equipment investment supporting international visitor attractions and competitive tournament hosting. The British golf industry emphasis on environmental sustainability and noise reduction supports electric fairway mower adoption across premium and operational course segments.

Russia demonstrates prominent growth momentum, expanding at a 6.0% CAGR, supported by emerging golf infrastructure development, rising affluent demographics, government sports initiatives, and regional course modernization programs extending market opportunities throughout the forecast period. Russian golf market development represents a frontier opportunity for equipment manufacturers establishing regional market positions and support infrastructure. Private sector course investment and emerging wealthy demographics support equipment modernization cycles and technology adoption. Government sports development initiatives and international event hosting aspirations support golf infrastructure investment and equipment modernization.

Europe fairway mower market shows moderate consolidation, dominated by multinational manufacturers with broad portfolios, strong distribution, and technical expertise. Key players, including John Deere, Toro, Jacobsen, Husqvarna, Kubota, and Gravely/Ariens lead through innovation and service reach. High entry barriers persist, while regional specialists compete via niche expertise, customization, and customer-focused support.

Europe fairway mower market is valued at US$ 183.6 million in 2026 and is projected to reach US$ 254.1 million by 2033.

Market growth is driven by golf course infrastructure modernization, rapid adoption of electric and sustainable equipment, and increasing integration of autonomous, GPS, and telematics technologies addressing labor shortages and precision turf management needs.

The market is expected to grow at a 4.8% CAGR from 2026 to 2033.

Key opportunities include autonomous fairway mower commercialization, premium equipment customization for professional turf applications, and geographic expansion into Russia and Eastern Europe, driven by new golf infrastructure development.

Leading players include John Deere, Toro, Jacobsen (Textron), Husqvarna, Kubota, and Gravely/Ariens, leveraging electrification, autonomous technology, and strong distribution networks to maintain market leadership.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Drive Type

By Cutting Width

By Power Rating Type

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author