ID: PMRREP3211| 191 Pages | 4 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

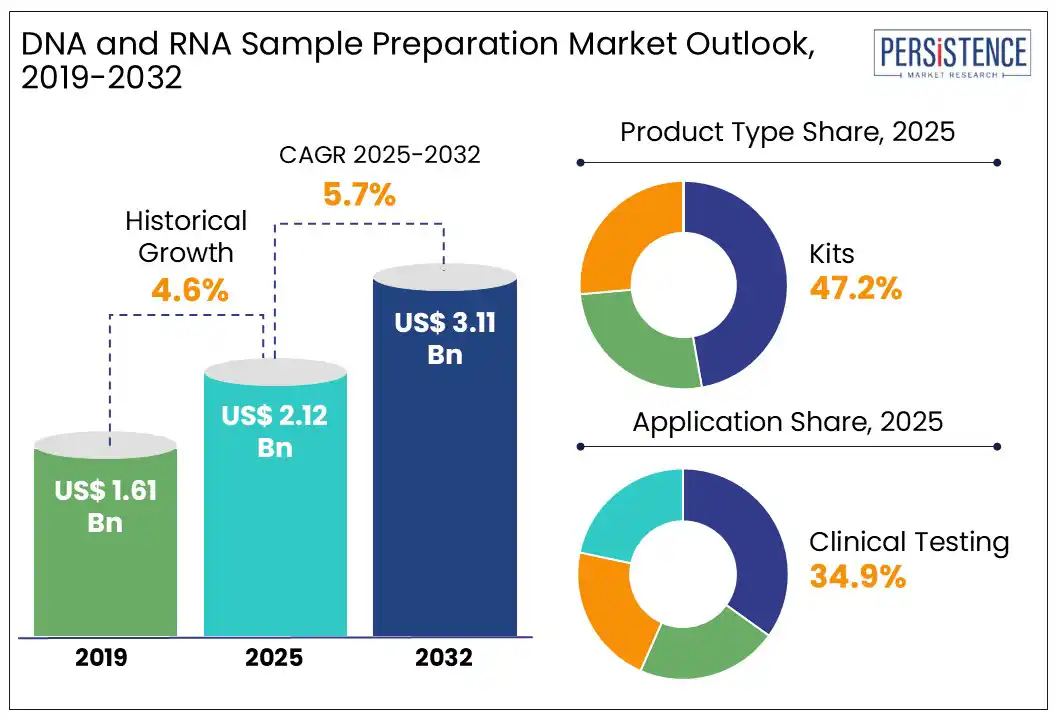

The global DNA and RNA sample preparation market size is likely to be valued at US$ 2.12 Bn in 2025 and is estimated to reach US$ 3.11 Bn by 2032, growing at a CAGR of 5.7% during the forecast period 2025 - 2032. The DNA and RNA sample preparation market growth is driven by a rise in infectious diseases, increased investments in molecular diagnostics, and expanding cancer research. Sample preparation is necessary for the accurate diagnosis of illnesses such as hepatitis, pneumonia, and AIDS, thereby fueling demand for reliable and high-throughput nucleic acid extraction and purification systems.

Advancements in automation, AI-driven workflows, and innovations in next-generation sequencing (NGS) are transforming the landscape by improving sample quality and throughput in clinical, academic, and industrial labs. Moreover, the growing integration of DNA/RNA sample prep in personalized medicine and cancer diagnostics is creating new revenue pockets for market players.

Key Industry Highlights

| Global Market Attribute |

Key Insights |

|

DNA and RNA Sample Preparation Market Size (2025E) |

US$ 2.12 Bn |

|

Market Value Forecast (2032F) |

US$ 3.11 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.6% |

DNA and RNA sample preparation has advanced with the use of lower sample volumes, complicated sample types, and faster preparation. The adoption of automated nucleic acid extraction platforms has further improved throughput, reproducibility, and reduced error rates. Vacuum purification and single-use centrifuge methods are used with multi-well plate systems, such as GE Healthcare's illustraTM RNAspin 96 RNA Isolation Kit, to enhance sample throughput and reduce extraction times. High PCR efficiency, sensitivity, reproducibility, and durability are provided by a proprietary solution from InnoGenomics Technologies that addresses multiplexing difficulties with restriction enzymes (REs).

Leading manufacturers such as QIAGEN, Thermo Fisher Scientific, and Beckman Coulter launched compact and fully integrated systems that support walk-away functionality, reducing human intervention and increasing reproducibility. These systems are particularly beneficial in large-scale clinical diagnostics and oncology research, where the volume of patient samples is high and turnaround times are critical. Advanced reagent chemistries and magnetic bead-based purification protocols are improving yield, sensitivity, and inhibitor removal, which are essential factors for accurate diagnostics. As healthcare providers expand their molecular testing capabilities, automated sample prep platforms are becoming foundational tools for ensuring efficiency, consistency, and clinical relevance.

The DNA and RNA sample preparation market faces a significant bottleneck due to operational complexity and the need for technical expertise. The extraction and purification of nucleic acids are highly sensitive procedures that demand precision, contamination control, and a clear understanding of biochemical interactions. This sensitivity restricts the usage of these technologies to skilled personnel and well-equipped laboratories, particularly in lower-tier clinical settings or developing economies.

Lack of standardized training and variability in sample types (blood, tissue, and biopsies) further complicate procedural consistency, increasing the chances of errors and compromised outputs. These limitations are especially prominent in academic or diagnostic laboratories that are transitioning from manual to semi-automated or fully automated workflows. The proliferation of vendors offering diverse protocols, kit chemistries, and platform-specific consumables often leads to end-user confusion and inefficiencies. Inexperienced end-users struggle to choose compatible systems, which may lead to inefficiencies, requiring repeated validation cycles.

As investments grow in molecular diagnostics and personalized medicine, the growing field of cancer research is driving the demand for high-quality nucleic acid sample processing. Researchers need precise and contamination-free samples for genetic and biomarker investigations. Diagnostic centers are predicted to dominate, holding a 34.2% share in 2025, driven by increasing number of patient visits. Companies are investing in automation, AI-driven sample processing, and NGS technologies owing to the expected 47% rise in the prevalence of cancer worldwide by 2040, which would require a surge in high-quality DNA and RNA separation techniques.

The evolution of precision medicine, driven by genomic profiling, personalized therapies, and biomarker-based diagnostics, is creating immense demand for high-integrity nucleic acid sample preparation solutions. As clinicians and researchers aim to stratify patients based on genetic and transcriptomic markers, the need for ultra-pure, contamination-free DNA and RNA has become paramount. This demand is amplified by the global rise in oncology-focused research, where early detection of mutations, tumor-specific gene expression, and longitudinal monitoring are central to therapeutic decisions. Sample preparation tools that process complex samples such as FFPE tissue, liquid biopsies, and bone marrow are particularly in high demand.

In 2025, the kits segment is projected to hold approximately 47.2% market share, driven by high demand for genetic testing, diagnostics, and research applications. Kits are widely used for DNA and RNA isolation, purification, and quantification, offering convenience, accuracy, and scalability for laboratories and healthcare facilities. For example, in October 2023, Qiagen launched a high-throughput nucleic acid extraction kit, improving sample processing efficiency. Pre-packaged nucleic acid extraction kits dominate the market due to increasing genomics and personalized medicine research and development activities, ensuring consistent results and ease of use in diagnostic and research settings.

In 2025, the clinical testing segment is likely to account for 34.9% market share, driven by rising demand for genetic testing, infectious disease diagnosis, and personalized medicine. The increasing prevalence of cancer and rare genetic disorders has boosted the need for high-precision nucleic acid sample preparation in clinical settings. For example, in October 2023, Roche Diagnostics introduced an automated DNA extraction system to enhance clinical genomics workflows. As clinical applications continue expanding, developments in molecular diagnostics and next-generation sequencing (NGS) are driving market growth.

North America is projected to hold a 35.1% share in 2025. The region’s leadership is underpinned by an established biotechnology sector, advanced research infrastructure, and consistent government and private funding toward molecular diagnostics and precision medicine. The U.S. accounts for the largest share, driven by widespread adoption of genomic technologies and the presence of industry giants such as Thermo Fisher Scientific, Agilent Technologies, and Bio-Rad Laboratories.

In 2023, Agilent launched an automated DNA extraction platform specifically aimed at increasing the efficiency of diagnostic labs, supporting the growing need for scalable, high-throughput workflows. Bio-Rad Laboratories also expanded its RNA sequencing prep kit portfolio to address research in oncology and virology, enhancing its footprint across clinical and academic segments.

Academic institutions in the U.S. and Canada continue to lead in genomics research, supported by consistent NIH, CDC, and Genome Canada grants. These institutions are at the forefront of biomarker discovery, personalized therapy validation, and next-generation sequencing (NGS) innovation, all of which rely heavily on high-quality nucleic acid preparation protocols. Furthermore, the U.S. FDA’s proactive stance on precision diagnostics and NGS-based testing is fostering a regulatory environment conducive to innovation. North America’s healthcare providers are also increasingly adopting sample prep automation in clinical labs to reduce turnaround times and ensure diagnostic accuracy.

Asia Pacific is anticipated to be the fastest-growing region in 2025. Rapid healthcare infrastructure development, a surge in chronic and hematologic disorders, and a booming biotechnology sector are propelling market expansion across this region. Countries such as China, Japan, South Korea, and India are actively investing in precision healthcare and expanding their molecular diagnostics capabilities. China’s BGI Genomics, for instance, launched a high-throughput DNA sequencing platform in 2023 to enhance genetic disease diagnosis, reinforcing the country’s strategic focus on becoming a global genomics hub. In Japan, Takara Bio scaled its RNA extraction kit production to meet the growing demands of precision medicine research.

National genomics initiatives, such as China’s Genomics Blue Book and India’s GenomeIndia project, are significantly increasing sample testing volumes, necessitating standardized and efficient sample preparation workflows. These developments are supported by improved reimbursement policies, rising awareness of personalized medicine, and a surge in local manufacturing capabilities. As Asia Pacific continues to evolve into a global hub for molecular biology and diagnostic innovation, manufacturers offering cost-effective, scalable, and automation-ready solutions are well-positioned to tap into a rapidly expanding user base.

Europe is anticipated to witness steady growth, benefiting from a robust academic research ecosystem, supportive public health policies, and growing public-private collaborations. The region’s top markets, Germany, the U.K., France, and the Netherlands, are increasing investments in genomics, biopharmaceuticals, and molecular diagnostics. In October 2023, Qiagen partnered with the University of Oxford to advance RNA sequencing techniques, with applications in gene expression profiling and biomarker identification.

Harmonized EU regulations and funding programs such as Horizon Europe are enabling streamlined research collaborations across borders, supporting infrastructure modernization and innovation. Furthermore, the rise of genomics-based personalized medicine programs in the U.K. and the Nordic countries is accelerating the adoption of DNA and RNA extraction tools in hospitals and biobanks. Europe is also seeing growth in translational research, where DNA/RNA sample preparation plays a critical role in linking laboratory discoveries to clinical applications. This trend is particularly strong in cancer and rare disease research, with national health systems increasingly adopting molecular diagnostics as a standard of care.

The global DNA and RNA sample preparation market is changing quickly, and businesses are continually looking for ways to improve and enhance their goods and services. In light of the growing need for sophisticated sample preparation solutions, they are concentrating on growing their clientele and gaining a competitive edge.

The growing interest has led to market expansion and heightened competition among key participants. These have spurred innovation and compelled companies to keep improving their products to satisfy the shifting demands of labs and researchers worldwide.

The DNA and RNA sample preparation market is set to reach US$ 2.12 Bn in 2025.

By forecast period 2032, the DNA and RNA sample preparation market is projected to grow to US$ 3.11 Bn, reflecting steady expansion.

The key trends include improved efficiency and accuracy in sample preparation and increased demand for diagnostic testing for diseases such as HIV, TB, and COVID-19.

Kits and Reagents dominate due to their widespread use in clinical and research applications.

The DNA and RNA sample preparation market is estimated to rise at a CAGR of 5.7% through 2032.

Thermo Fisher Scientific Inc., Isogen Lifescience B.V., MP Biomedicals, and Minerva Biolabs GmbH are a few of the leading players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author