ID: PMRREP35511| 193 Pages | 24 Jul 2025 | Format: PDF, Excel, PPT* | Industrial Automation

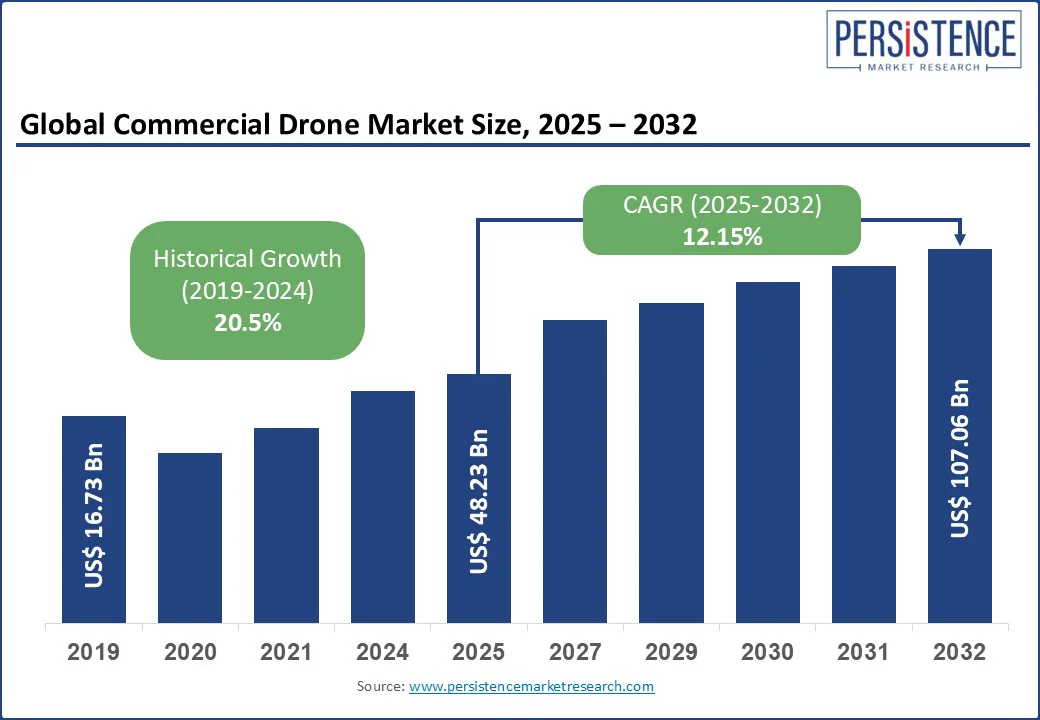

The global commercial drone market size is likely to be valued at US$ 48.23 Bn in 2025, and is estimated to reach US$ 107.06 Bn by 2032, growing at a CAGR of 12.15% during the forecast period 2025−2032. Commercial drones, also known as unmanned aerial vehicles (UAVs), have become increasingly integral to several industries ranging from infrastructure and agriculture to logistics and public safety. These systems enable data capture, remote monitoring, and delivery operations without direct human intervention, often reducing costs and improving operational efficiency.

The commercial drone market growth is driven by an upsurge in the requirement for autonomous inspection solutions, last-mile delivery optimization, and precision farming applications. The market trajectory is currently shaped by the rapid expansion of Beyond Visual Line-of-Sight (BVLOS) operations across industries, integration of AI-powered imaging and navigation systems, and the growing deployment of drone-in-a-box solutions for continuous industrial monitoring.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

| Commercial Drone Market Size (2025E) | US$ 48.23 Bn |

| Market Value Forecast (2032F) | US$ 107.06 Bn |

| Projected Growth (CAGR 2025 to 2032) | 12.15% |

| Historical Market Growth (CAGR 2019 to 2024) | 20.5% |

The rapid expansion of drone usage in industrial and public infrastructure inspection is emerging as a pivotal factor driving the commercial drone market growth. Major companies have already started leveraging their capabilities to meet this increasing demand. For example, Nokia and Swisscom deployed 300 drones across Switzerland in 2024 to support on-demand inspections of critical assets while reducing human risk and downtime. This shift toward drones-as-a-service (DaaS) models allows operators to scale deployment without large upfront capital investments, driving rapid buyer adoption across energy, utilities, and infrastructure sectors.

What sets this trend apart in the commercial drone space is its bringing together of high-value applications and operational efficiency. Infrastructure inspection drones equipped with LiDAR, thermal imaging, and AI-enabled analytics can identify faults with extremely high accuracy, comfortably surpassing traditional methods. As a result, companies are actively replacing conventional inspection methods with remotely operated drone solutions. SA Power Networks in Australia, for instance, is turning to long-range VTOL drones, completing fully automated BVLOS flights over 150 km of power lines to replace costly helicopter surveys. With cost savings upwards of 40%, reduced risks to human operators, and real-time fault detection, infrastructure inspection is now the most lucrative entry point for commercial drone vendors, and a high-margin gateway into wider industrial deployment.

The slow pace and fragmentation of regulatory frameworks around BVLOS operations is weakening the prospects of the commercial drone market. While the FAA has granted over 200 BVLOS waivers in 2024 alone, the reliance on individual exemptions rather than clear, streamlined rules is creating operational uncertainties and driving up compliance costs for drone operators. Similarly, although the U.S. and European authorities are advancing unified BVLOS rulemaking, the anticipated Notice of Proposed Rulemaking (NPRM) has been repeatedly delayed, pushing the expected final rule to early 2026 or later. This regulatory ambiguity restricts long-range BVLOS missions, which are vital to scaling commercial drone applications such as delivery, infrastructure inspection, and agricultural monitoring, restricting market growth and discouraging investments in advanced systems.

Without dependable and consistent BVLOS regulations, commercial drone providers have to stay shackled to short-range, line-of-sight operations, unable to fully deploy high-impact use cases at scale. The need for case-by-case waivers not only lengthens deployment timelines, often taking months, but also drives up operating costs.

The expanding use of drones for medical logistics, such as delivery of vaccines, blood, and emergency medicines, is emerging as an impactful opportunity in the commercial drone market. Companies such as Zipline and Swoop Aero are at the frontier of this trend. For example, Zipline’s delivery of blood products in Rwanda has reduced delivery times by 61% and blood wastage by 67%, while in Australia, Swoop Aero has deployed fifth-generation drones capable of carrying up to 4 kg of cargo over 170 km to deliver vaccines and medical supplies in remote regions, slashing transport times and costs. These deployments herald a compelling value proposition by presenting drones as essential vehicles that enable rapid, reliable delivery to underserved or hard-to-reach areas, addressing critical public health needs directly, especially during crises.

Innovations such as temperature-controlled payload systems and autonomous corridor management are further elevating the potential of commercial drones in the medical logistics space. Urban and rural healthcare networks in India, Africa, and Latin America are deploying drone-based systems to maintain cold-chain integrity for vaccines and pharmaceuticals, with pilot initiatives such as Drone-Enhanced Emergency Medical Services (DEMS) showing success in rapid deliveries of automated external defibrillators (AEDs). With government support, telehealth integration, and improved airspace regulations, drone medical logistics is transitioning from experimental status into an economically viable and scalable commercial service.

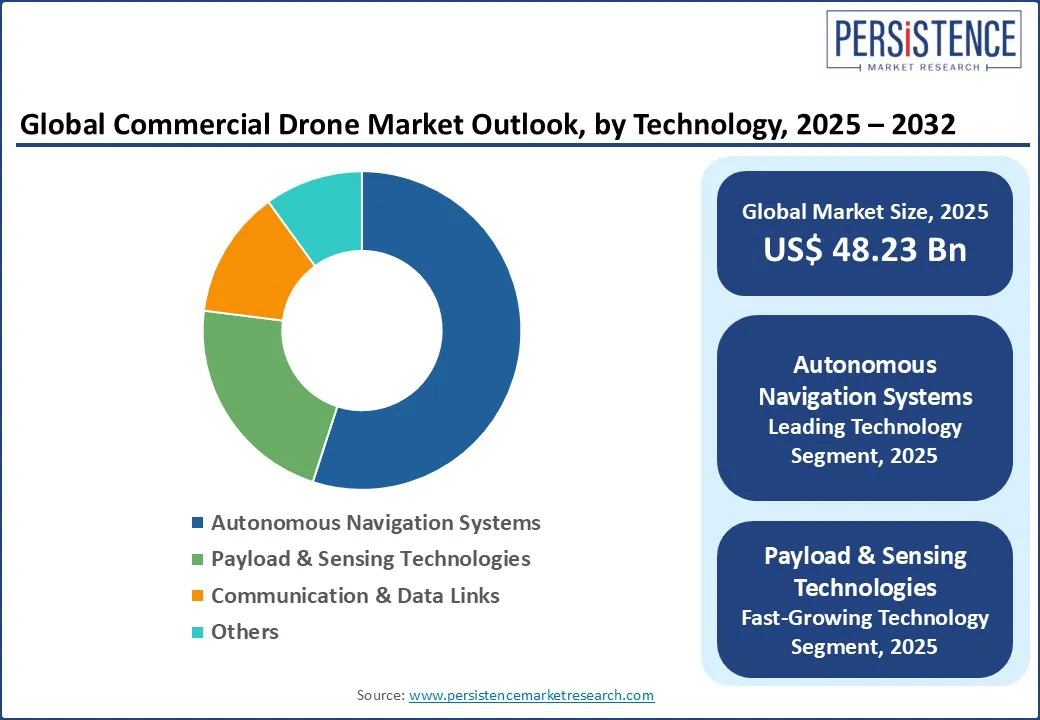

The autonomous navigation systems segment, which includes AI-based path planning, real-time obstacle avoidance, and adaptive flight control, is expected to claim the largest revenue share of around 55% in the technology category. The incorporation of AI-powered navigation systems in commercial drone applications, such as infrastructure inspection, logistics, and surveying, has led to vast improvements in data accuracy and has also enhanced the battery life due to flight path optimization. Their dominance is attributable to their capacity for enabling drones to operate beyond line-of-sight, navigate dynamic environments, and comply with emerging airspace rules. These properties are also proving advantageous for scaling Drone-as-a-Service models and unlocking high-value industrial use cases.

On the other hand, the payload & sensing technologies is projected to grow at an estimated a positive CAGR, driven by a massive demand for autonomous data-collection missions and minimal human intervention in remote or complex sites. These systems promise a near 100% accuracy in identifying infrastructure faults, prompting their uptake in power line, solar farm, and bridge inspections.

Visual Line-of-Sight (VLOS) operations are the most preferred commercially, especially in short-range applications such as media capture, construction site surveys, and close-range inspections. They account for nearly 70% of deployments as getting regulatory approvals for these flights is much simpler compared to other operations, along with high reliability and easier airspace integration. VLOS remains the low-obstacle entry point for small and medium enterprises (SMEs) servicing local infrastructure and municipal markets.

At the same time, beyond visual line-of-sight (BVLOS) represents the next growth frontier in the commercial drone market, generating huge possibilities for scalable, long-distance missions and fully realized DaaS business models. This sub-segment is estimated to exhibit a CAGR of over 20% during the forecast period 2025-2032, owing to the wide applicability of BVLOS operations in delivery, pipeline inspection, and agricultural surveying. Once the barriers hindering the expansion of BVLOS start shrinking, the market stands benefit as drone companies will have better incentives to scale autonomous drone operations not just at the local level but also at the national level, elevating service value and enabling high-margin service models.

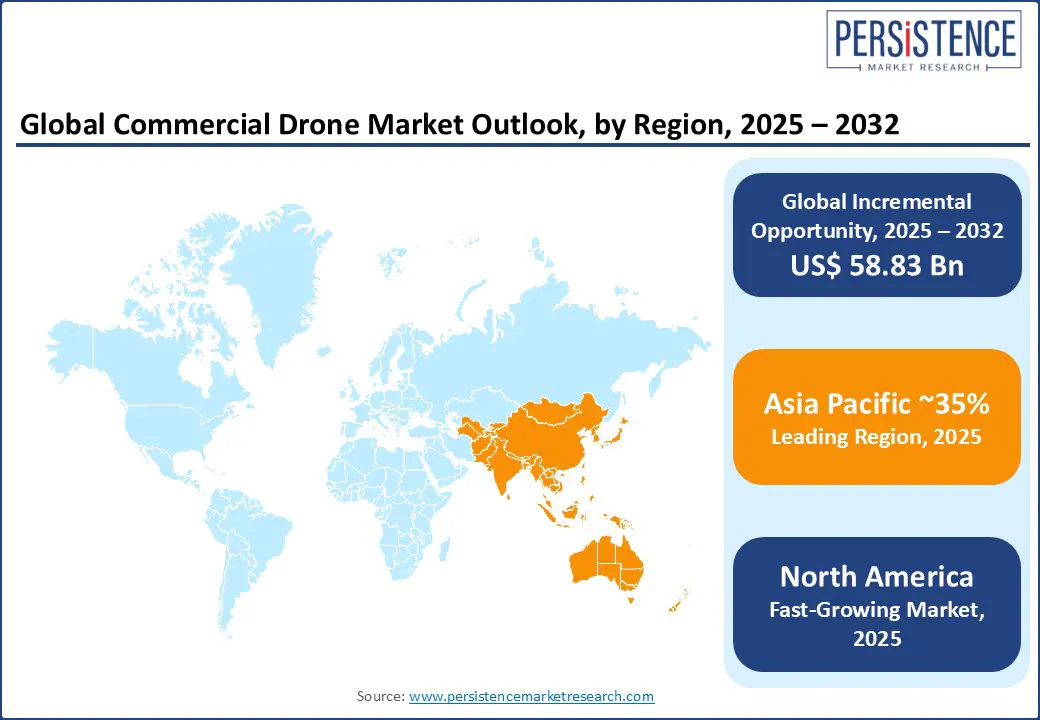

At 35%, Asia Pacific remains the undisputed leader in the commercial drone market share, with China alone responsible for around 75% of global hardware production and government-led investments in low-altitude economies. A major factor for the apex position of China in this market is the low production costs attained through massive component supply chains centered in Shenzhen. Meanwhile, original equipment manufacturers (OEMs) such as DJI and Yuneec dominate domestic and export markets, delivering high-capability multispectral platforms tailored for precision agriculture, mining, and disaster response.

The availability of ultra-competitive drone hardware combined with institutional support, such as India’s drone manufacturing incentives aiming to build a US$ 23 Bn ecosystem by 2030, positions the Asia Pacific for a wide-scale rollout of hybrid-use UAV systems. These platforms support a diverse spectrum of projects and missions, from crop spraying to medical logistics. Bolstering these systems are battery-swap and payload-routing innovations that are expected to unlock highly lucrative opportunities in aftermarket services such as sensor retrofitting and automated maintenance. Digitization of agriculture and a growing focus on resilient infrastructure are also accelerating the employment of commercial drones across different sectors in the burgeoning economies in the region.

The commercial drone landscape in North America is becoming increasingly vibrant, fueled largely by significant regulatory breakthroughs, especially the expansion of BVLOS operations and the FAA’s evolving UAV integration policies. The FAA’s rollout of BVLOS rulemaking and Remote ID standards (for example, Part 135 updates and LAANC expansion) is envisaged to enable enterprise operators to deploy drones for infrastructure inspections, precision agriculture, and logistics at scale. With this backdrop, the drone services sector in North America is slated to register a staggering 20% CAGR.

The biggest opportunity for market players in North America is the integration of edge-AI with 5G-enabled drones that can open up new service lines, such as real-time pipeline health monitoring, disaster-response triage, and large-area crop analytics, ensuring higher per-flight revenues and a tighter return on investment (ROI). Such advancements coincide with the legislative efforts in the U.S. to build and enhance domestic drone manufacturing capacity, offering blue-chip vendors a unique chance to optimize production, gain procurement advantage, and insulate themselves from foreign tariffs or security restrictions.

In Europe, the commercial drone ecosystem has been ushered into a high-growth phase catalyzed by harmonizing regulations under the U-Space framework of the European Union (EU). The Standard Scenarios designed by the EU Aviation Safety Agency (EASA) simplify BVLOS missions across member states, enabling pan-European DaaS contracts and eliminating redundant approval processes. As a result, the commercial drone market in Europe is forecast to achieve a positive CAGR through 2032. The regulatory consistency of the EU is empowering multi-country deployment of drone services, creating novel revenue pathways in pan-regional asset deployment.

A notable development favoring the Europe market is the EU’s strong sustainability push in offshore wind capacity building, CO2 reduction mandates, and digital infrastructure inspection, producing high-margin opportunities for commercial drone manufacturers. For instance, wind-farm operators using drone platforms have realized 80% savings on line scans vis-a-vis helicopter imagery, with fleet expansion underway across North Sea grids. Additionally, emerging swarm-flight UAV systems in industrial zones across Germany, the Netherlands, and the U.K. are pioneering new automated monitoring service packages, mixing photogrammetry, emission sensing, and AI-based anomaly detection.

The global commercial drone market landscape is a highly consolidated one, with DJI being the most dominant market player. Powered by its Shenzhen manufacturing ecosystem and a robust product portfolio, the company capitalizes on its scale and rapid innovation cycles, such as the February 2025 launch of the DJI Dock 3 automated operations unit.

The market also features a basket of specialist commercial drone brands such as Parrot, Skydio, AeroVironment, Yuneec, Autel, and AeroVironment. For instance, Skydio has set a benchmark in flight autonomy and resilience, having secured major U.S. defense contracts, while Parrot is known for its modular platforms for public safety and regulated environments. AeroVironment and Lockheed Martin are broadening their portfolios with tactical hybrid and fixed-wing systems optimized for infrastructure and mission-critical operations. Niche innovators such as Wingcopter for logistics and Delair for long-range surveying are bringing in revenue through specialized edge technologies and BVLOS capabilities.

The market is projected to reach US$ 48.23 Bn in 2025.

The use of drones in industrial and public infrastructure inspection is driving the market.

The commercial drone market is poised to witness a CAGR of 12.15% from 2025 to 2032.

The expanding employment of drones for medical logistics and the steady easing of regulatory barriers in beyond visual line-of-sight (BVLOS) operations are key market opportunities.

DJI Technology Co., Ltd., Parrot Drones SAS, Skydio, Inc., and AeroVironment, Inc. are some of the key players in the market.

| Report Attribute | Details |

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

By Product

By Maximum Takeoff Weight (MTOW)

By Propulsion

By Range

By Technology

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author