ID: PMRREP32231| 172 Pages | 26 Aug 2025 | Format: PDF, Excel, PPT* | Consumer Goods

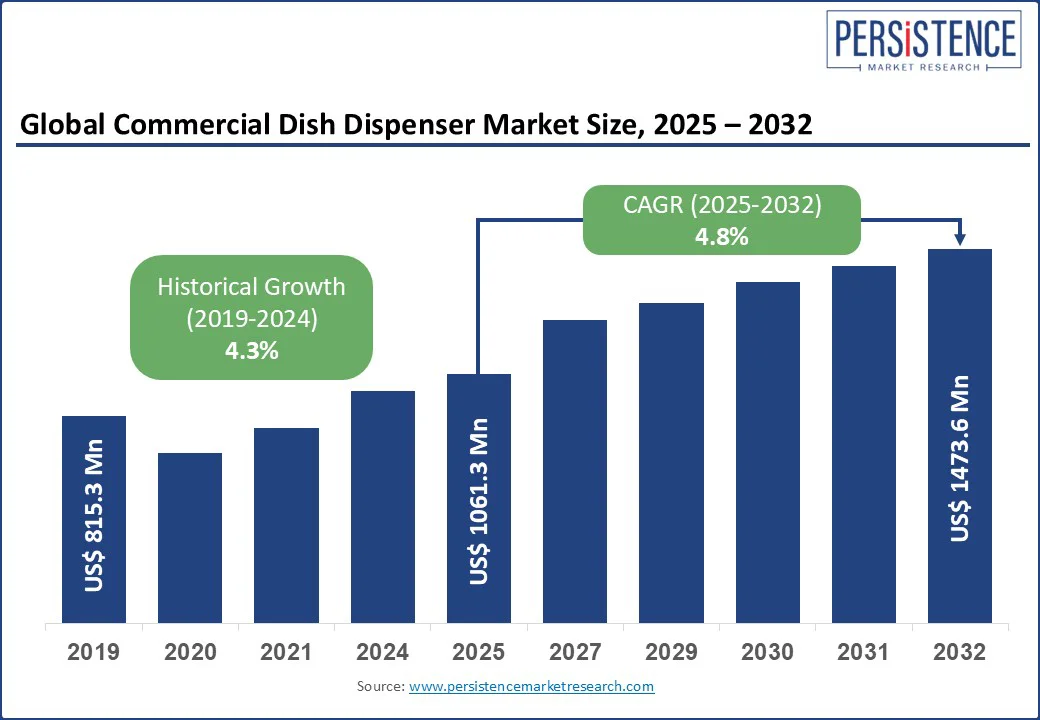

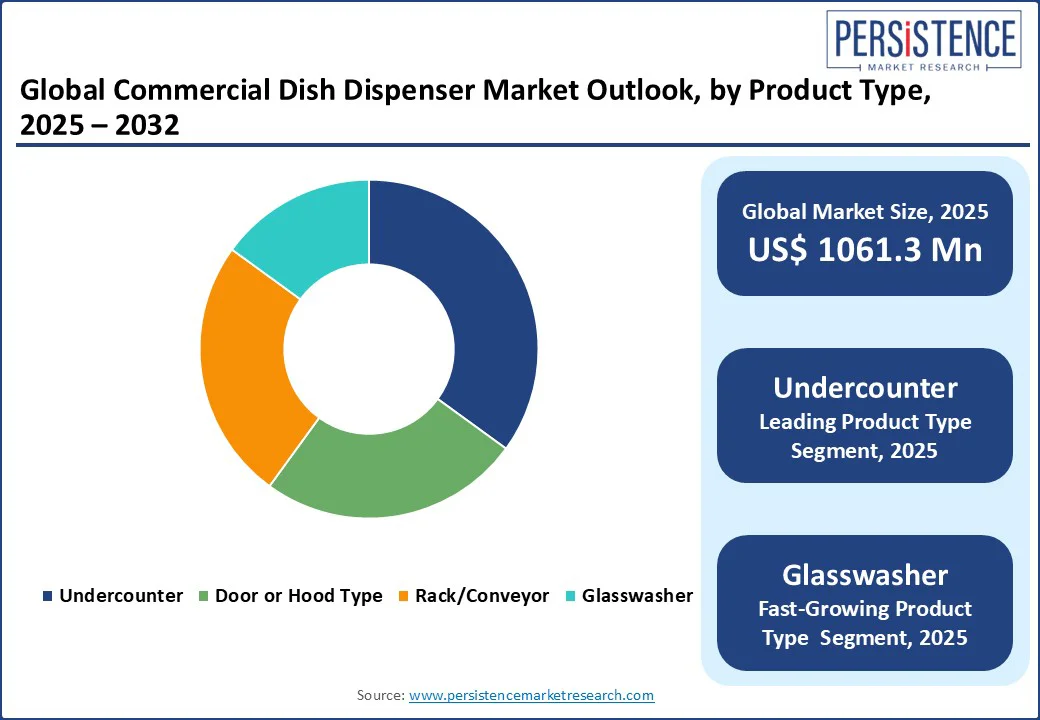

The global commercial dish dispenser market size is poised for steady growth, likely to reach US$1061.3 Mn in 2025, and is expected to reach US$1473.6 Mn by 2032, growing at a CAGR of 4.8% during the forecast period 2025 - 2032.

The commercial dish dispenser industry is growing steadily due to rising demand in the foodservice and hospitality sectors, including restaurants, hotels, cafeterias, and catering services. These dispensers help streamline operations by enabling organized storage, easy access, and efficient handling of plates and dishes, reducing labor costs, and enhancing service speed.

The industry is driven by increasing adoption of automated and spring-loaded dispensing systems, preference for stainless steel and durable materials, and the trend toward energy-efficient and heated units for temperature maintenance.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Commercial Dish Dispenser Market Size (2025E) |

US$1061.3 Mn |

|

Market Value Forecast (2032F) |

US$1473.6 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

4.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.3% |

The commercial dish dispenser market is driven by the increasing demand for efficiency in foodservice operations, significantly boosting the adoption of dish storage units, plate dispensers, and kitchen dispensers. The growth in the hospitality sector, particularly in hotels and restaurants, has heightened the need for adjustable dish dispensers for catering businesses to streamline service processes.

Automatic dish dispensing systems for cafeterias enhance operational efficiency by ensuring consistent dish availability, with 20% reduction in service time reported in high-traffic settings. These systems, integrated with foodservice kitchen automation, support high-volume kitchens in maintaining fast-paced service, boosting demand for plate handling equipment and buffet service accessories.

The durability of stainless-steel dish dispensers for commercial kitchens ensures long-term performance, while heated plate dispensers and insulated dish dispensers cater to temperature-controlled dish storage, enhancing customer satisfaction in commercial catering dish storage solutions. This efficiency-driven demand aligns with the need for organized workflows in foodservice dish storage systems and commercial dishwashing systems, making dispensers essential for modern foodservice operations.

The commercial dish dispenser market faces a significant restraint due to limited adoption in small-scale operations, impacting the uptake of dish storage units and plate dispensers. Small restaurants and cafes, which account for 60% of global foodservice establishments, often lack the space or operational need for advanced automatic dish dispensing systems for cafeterias or stainless-steel dish dispensers for commercial kitchens. This constraint restricts the scalability of spring-loaded dish dispensing units and heated plate dispensers in smaller settings.

The complexity of integrating foodservice kitchen automation into compact kitchens further limits adoption of commercial dishwashing systems. Additionally, small-scale operations prioritize manual processes over buffet service accessories and commercial catering dish storage solutions, particularly in emerging markets with underdeveloped foodservice infrastructure, hindering market penetration for plate handling equipment.

The rise of foodservice kitchen automation presents a significant opportunity for the commercial dish dispenser market. The adoption of automatic dish dispensing systems for cafeterias allows businesses to enhance efficiency and reduce labor costs, with 18% global adoption growth since 2025.

This trend drives demand for kitchen dispensers and serving dish dispensers, particularly in high-volume settings such as hotels and banquet halls. Innovations in durable dish dispensers for high-volume kitchens, such as spring-loaded dish dispensing units, cater to the need for streamlined operations.

The growth of the hospitality sector in emerging economies further supports the expansion of commercial catering dish storage solutions and plate handling equipment, aligning with the increasing focus on automation to meet rising consumer demand for efficient foodservice operations. This opportunity positions the sector for growth, especially in regions embracing automated kitchen solutions.

Undercounter holds a 35% market share in 2025, driven by its compact design, making it ideal for kitchen dispensers in space-constrained environments such as small restaurants and cafes. Its popularity stems from its ability to integrate seamlessly with stainless steel dish dispensers for commercial kitchens, offering efficient plate handling equipment for quick-service restaurants.

With 40% adoption in restaurants in 2025, undercounter units are favored for their ease of installation and compatibility with commercial dishwashing systems, supporting high-turnover operations.

Glasswasher is fueled by demand in bars, cafes, and hotels for specialized plate handling equipment designed for glassware. The segment saw 10% growth in 2025, driven by the rise in beverage-focused establishments and the need for durable dish dispensers for high-volume kitchens.

Glasswashers, often integrated with foodservice dish storage systems, offer precise cleaning and storage solutions, enhancing efficiency in buffet service and commercial catering dish storage.

Free-standing accounts for a 60% market share in 2025, driven by its versatility in stainless steel dish dispensers for commercial kitchens. These units are preferred in restaurants and hotels for their mobility and ease of use in dynamic kitchen layouts, with 65% adoption in 2025. Free-standing dish storage units support buffet service accessories and heated plate dispensers, catering to high-traffic environments like banquet halls and cafeterias.

Built-in is fueled by demand for integrated foodservice dish storage systems in modern kitchen designs. With 8% growth in 2025, built-in units are gaining traction in commercial catering dish storage solutions, particularly in newly constructed hotels and restaurants, where space optimization and aesthetics drive adoption of insulated dish dispensers and spring-loaded dish dispensing units.

Restaurants account for a 40% market share in 2025, driven by the widespread use of plate dispensers and kitchen dispensers in quick-service and fine-dining establishments. With 45% adoption in 2025, restaurants rely on automatic dish dispensing systems for cafeterias and commercial dishwashing systems to maintain fast-paced service, particularly in urban areas with high dining demand.

The global tourism boom and demand for buffet service accessories fuel hotels. The segment saw 12% growth in 2025, driven by the need for heated plate dispensers and serving dish dispensers in large-scale buffet and banquet operations, enhancing guest experiences through efficient commercial catering dish storage solutions.

Offline holds a 70% market share in 2025, driven by direct sales and partnerships in commercial catering dish storage solutions. With 75% adoption in 2025, offline channels dominate due to the need for customized installations and after-sales support for stainless steel dish dispensers for commercial kitchens and durable dish dispensers for high-volume kitchens.

Online is fueled by foodservice kitchen automation and the rise of e-commerce platforms. With 15% growth in 2025, online channels are gaining traction for plate handling equipment and spring-loaded dish dispensing units, driven by convenience and access to a wide range of foodservice dish storage systems.

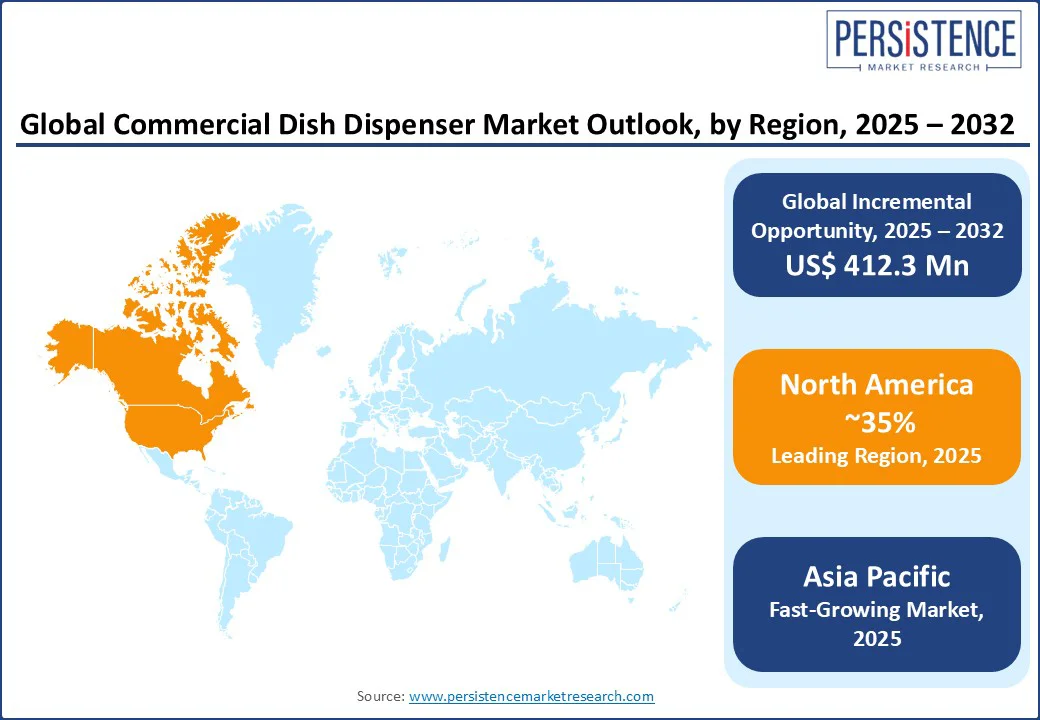

In North America, the commercial dish dispenser market holds a 35% global market share in 2025. The U.S. dominates with US$ 371.8 Mn in sales in 2025, growing at a CAGR of 4.9%, driven by dish storage units and plate dispensers. 70% of U.S. restaurants use stainless steel dish dispensers for commercial kitchens, with automatic dish dispensing systems for cafeterias growing by 10% in 2025.

Heated plate dispensers and buffet service accessories see 8% growth, supported by Champion Industries and Electrolux Professional, which drive 25% of regional revenue. Stringent hygiene regulations, with 90% compliance rates in 2025, boost commercial dishwashing systems. The focuses on quick-service restaurants and corporate dining fuels demand for foodservice kitchen automation and durable dish dispensers for high-volume kitchens.

Europe accounts for a 30% global share, led by Germany, the UK, and France. Germany’s market grows at a CAGR of 4.7%, driven by kitchen dispensers and serving dish dispensers, with 60% of hotels adopting heated plate dispensers in 2025. The UK’s foodservice dish storage systems support a CAGR of 4.6%, with buffet service accessories used by Hilton Hotels.

France’s commercial catering dish storage solutions drive 10% growth in spring-loaded dish dispensing units. EU hygiene regulations, with €50 Mn in funding for foodservice equipment in 2025, enhance durable dish dispensers for high-volume kitchens. Winterhalter Gastronom GmbH holds a 10% market share, leveraging its expertise in commercial dishwashing systems.

Asia Pacific is the fastest-growing region, with a CAGR of 5.5%, led by China, Japan, and India. China holds a 40% regional market share, driven by a 15% increase in restaurant openings in 2025, boosting plate handling equipment and kitchen dispensers.

India’s market is fueled by adjustable dish dispensers for catering businesses, with 80% of urban restaurants using insulated dish dispensers in 2025. Japan’s buffet service accessories drive 12% growth in serving dish dispensers. FAGOR Professional and ASKO Appliances AB lead, supported by US$ 5 Bn in foodservice investments by 2030.

The global commercial dish dispenser market is highly competitive, with foodservice equipment companies focusing on innovation, durability, and automation. Champion Industries and Electrolux Professional lead in stainless steel dish dispensers for commercial kitchens, while Insinger Machine Company excels in automatic dish dispensing systems for cafeterias.

Plate handling equipment, buffet service accessories, and foodservice kitchen automation drive competition. Strategic partnerships and R&D investments in durable dish dispensers for high-volume kitchens are key differentiators, with companies leveraging technology to meet evolving foodservice demands.

The commercial dish dispenser market is projected to reach US$ 1061.3 Mn in 2025, driven by dish storage units and plate dispensers.

Efficiency in foodservice operations, with a 20% reduction in service time, drives demand for foodservice kitchen automation.

The commercial dish dispenser market grows at a CAGR of 4.8% from 2025 to 2032, reaching US$ 1473.6 Mn by 2032.

Foodservice kitchen automation, with 18% global adoption growth, offers opportunities for automatic dish dispensing systems for cafeterias.

Key players include Champion Industries, Insinger Machine Company, FAGOR Professional, Electrolux Professional, and Winterhalter Gastronom GmbH.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Category

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author