ID: PMRREP11002| 180 Pages | 5 May 2025 | Format: PDF, Excel, PPT* | Healthcare

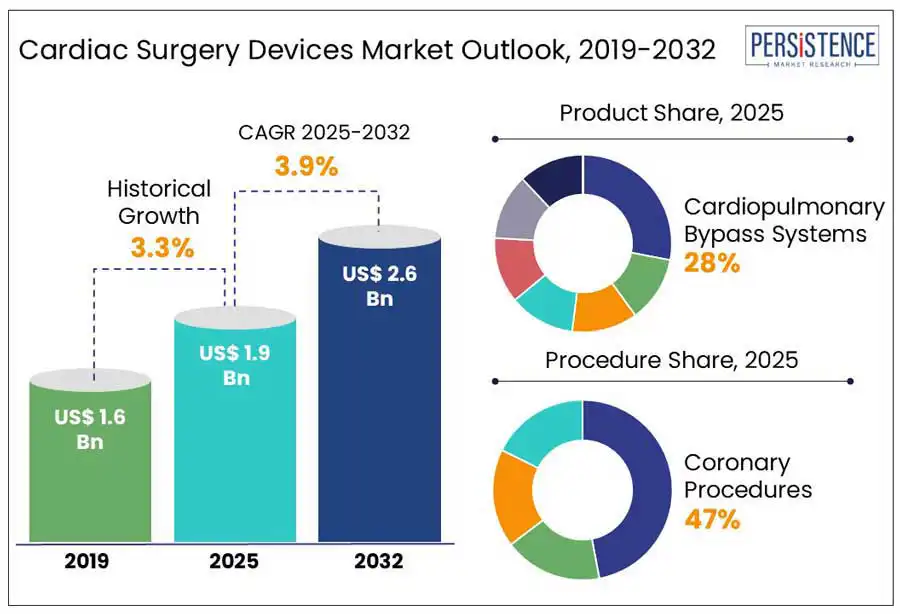

The global cardiac surgery devices market is projected to increase from US$ 2.0 Bn in 2025 to a staggering US$ 2.6 Bn to witness a CAGR of 3.9% by 2032.

According to Persistence Market Research, the cardiac surgery device market continues to expand as global heart disease rates climb, especially in aging and urban populations. Technological breakthroughs are surgical precision and patient outcomes, leading to wider adoption of minimally invasive techniques. Demand for devices such as heart valves, cardiopulmonary bypass machines, and ventricular assist devices is growing. The integration of AI and robotics is enhancing surgical efficiency and safety. With, the rising awareness and innovation, the market is competitive, prompting the key players to prioritize quality, affordability, and accessibility.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Cardiac Surgery Devices Market Size (2025E) |

US$ 2.0 Bn |

|

Market Value Forecast (2032F) |

US$ 2.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.3% |

The rising global prevalence of cardiovascular disease (CVD) is a significant driver for the cardiac surgery device market. With heart-related conditions such as coronary artery disease, heart failure, and valvular disorders increasing due to sedentary lifestyles, poor dietary habits, smoking, and stress, the demand for effective surgical interventions is surging.

According to the World Health Organization, CVD remains the leading cause of death worldwide, contributing to over 17 million deaths annually. This alarming trend is particularly observed in low-and middle-income countries (LMIC), where urbanization and an aging population are widely evident.

As more patients require surgical treatment, hospitals and cardiac centers invest in advanced devices like artificial valves, bypass machines, and minimally invasive tools to improve outcomes and reduce recovery times. This steady influx of patients ensures a sustained market need, encouraging manufacturers to innovate and expand their offerings to meet the growing global demand for life-saving cardiac procedures.

Device recalls pose a significant restraint in the cardiac surgery device market, stemming from concerns over product safety, malfunctions, or design flaws. Past incidents involving faulty heart valves, pacemakers, or cardiopulmonary bypass machines have not only compromised patient safety but also triggered large-scale recalls and class-action lawsuits. Moreover, such recalls invite increased scrutiny from regulatory authorities like the FDA and EMA, often leading to stricter approval processes, post-market surveillance, and compliance costs. For instance, in March 2025, the U.S. Food and Drug Administration (FDA) announced that Medtronic recalled multiple aortic root cannula devices due to ongoing safety risks. All unused devices were to be removed from the market and promptly returned to the manufacturer.

In some cases, recalls also result in temporary bans, product redesigns, or complete market withdrawal. This legal and financial uncertainty makes investors cautious and slows down the pace of new product introductions, especially in highly regulated cardiac surgery segments.

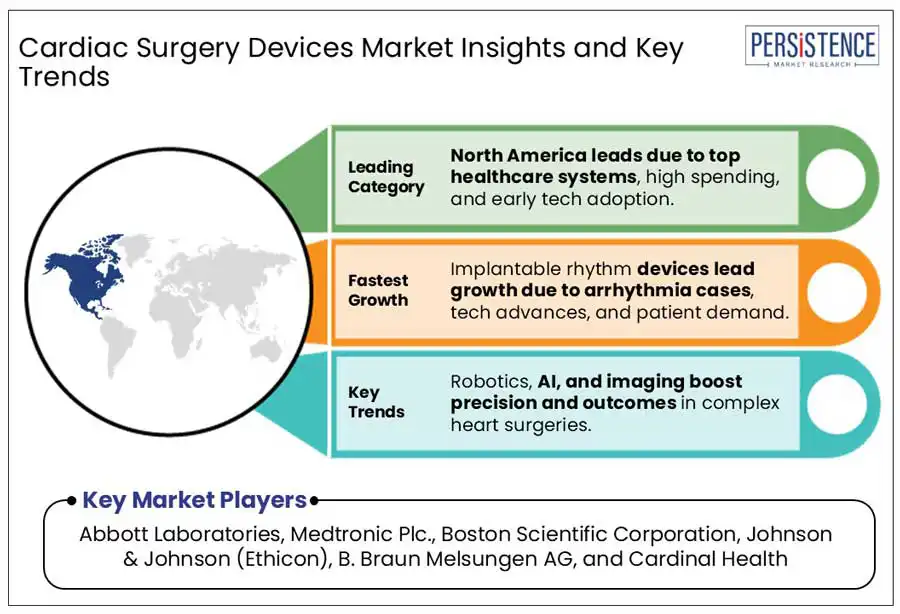

Artificial Intelligence (AI) for predictive surgery is revolutionizing the cardiac surgery device market by enabling smarter, data-driven decision-making. By analyzing vast amounts of patient data such as imaging scans, genetic markers, medical history, and real-time vitals, AI algorithms can accurately forecast surgical risks, potential complications, and likely recovery outcomes. This predictive capability allows surgeons to tailor surgical plans to individual patients, reducing intraoperative surprises and enhancing procedural safety.

Furthermore, AI-powered decision support systems can assist less experienced surgeons by providing real-time recommendations during procedures. As machine learning models grow more sophisticated, integrating AI into cardiac surgery tools promises to elevate precision, reduce mortality rates, and usher in a new era of personalized cardiac care.

Cardiopulmonary Bypass (CPB) Systems are a leading product segment in the cardiac surgery devices market due to their critical role in open-heart procedures. These systems temporarily take over the function of the heart and lungs, allowing surgeons to operate on a still, bloodless heart, a necessity for complex surgeries such as coronary artery bypass grafting (CABG), valve repair or replacement, and congenital defect corrections. CPB systems are used in a high volume of procedures and generate consistent demand through reusable equipment and single-use consumables such as oxygenators and tubing sets. Their indispensability across a broad range of cardiac surgeries ensures steady market growth.

Coronary procedures, particularly CABG, lead the cardiac surgery devices market due to the high global prevalence of coronary artery disease (CAD). CAD remains a primary cause of heart-related deaths, driving demand for surgical interventions. These procedures require essential devices such as cardiopulmonary bypass systems, grafts, and other specialized surgical instruments, ensuring consistent and high-volume usage of cardiac surgery devices.

The frequency of CABG surgeries, coupled with well-established reimbursement models and advancements in surgical technology, ensures that coronary procedures dominate the market, even with the rise of alternative treatments.

Hospitals lead the cardiac surgery devices market owing to their central role in treating complex heart conditions. As primary healthcare institutions, hospitals are equipped with advanced technology and skilled professionals, making them the ideal setting for high-stakes procedures like heart surgeries. They also have access to a wide range of cardiac surgery devices, including bypass equipment, heart valves, and monitoring systems.

Additionally, hospitals cater to a large volume of patients requiring immediate and specialized cardiac care, thus driving demand for innovative devices. With increasing cardiovascular diseases globally, hospitals remain at the forefront, offering essential services that drive both market growth and the development of advanced surgical solutions.

North America, particularly the United States, leads the cardiac surgery devices market due to its advanced healthcare system, high spending on medical research, and technological innovation. The region is home to world-class hospitals and cardiovascular centers equipped with state-of-the-art devices.

Additionally, the U.S. boasts a strong regulatory framework and a large number of prominent medical device manufacturers, fostering continuous advancements in cardiac surgery technology. These factors, along with high healthcare expenditure, position North America as the dominant region in the market.

Europe is a hub for medical innovation, with several key cardiac device manufacturers and research institutions based in the region. The adoption of minimally invasive and robot-assisted cardiac procedures is growing, supported by favorable reimbursement policies. Moreover, cross-border healthcare collaborations, launches, and EU-funded cardiovascular research programs continue to drive technological progress and regional market growth.

For instance, in October 2024, Medtronic launched its Avalus Ultra bioprosthesis valve in Western Europe during the European Association for Cardio-Thoracic Surgery (EACTS) Congress held in Lisbon, Portugal.

The Asia Pacific region is quickly becoming a major hub for cardiac surgery devices manufacturers, due to increasing health awareness, better access to advanced medical care, and a rising number of people living with heart conditions. Countries like China, India, and Japan have witnessed a sharp rise in cardiovascular disease, creating an urgent need for more effective and innovative surgical treatments. According to a recent study, around 330 million people were affected by heart disease, including 13 million who suffered strokes in 2023, underscoring the critical need for effective treatment options across the region.

Furthermore, economic growth has also led to more private healthcare investments, improved infrastructure, and access to sophisticated medical technologies. For instance, in April 2025, a 7-year-old Chinese boy with end-stage heart failure became the world’s youngest patient to receive a magnetically levitated biventricular assist device, the smallest and lightest artificial heart available at the time. This life-saving procedure wasn’t just a medical breakthrough; it also symbolized the region’s deepening investment in advanced healthcare and its dedication to offering cutting-edge solutions, even for its youngest and most vulnerable patients.

Companies are focusing on innovation, with advancements in minimally invasive surgery and robotic-assisted procedures. Strategic collaborations, partnerships, and acquisitions are common as firms seek to expand their market reach and enhance technological capabilities. Additionally, there is a rising emphasis on affordability, leading to the development of cost-effective devices, especially in emerging markets. Regulatory approvals, strong distribution networks, and after-sales services play a crucial role in maintaining a competitive edge.

The global cardiac surgery devices market is estimated to increase from US$ 2.0 Bn in 2025 to US$ 2.6 Bn in 2032.

The rising prevalence of cardiovascular diseases due to aging populations, sedentary lifestyles, and unhealthy diets is a major driver for market growth.

The market is projected to record a CAGR of 3.9% during the forecast period from 2025 to 2032.

Growing demand for minimally invasive and robot-assisted cardiac procedures offers significant potential for innovation and expansion. Emerging markets, particularly in Asia Pacific and Latin America, provide untapped opportunities due to rising healthcare investments, increasing patient awareness, and improving surgical infrastructure.

North America is expected to dominate the global market.

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn/Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Indication

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author