ID: PMRREP17704| 267 Pages | 9 Feb 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

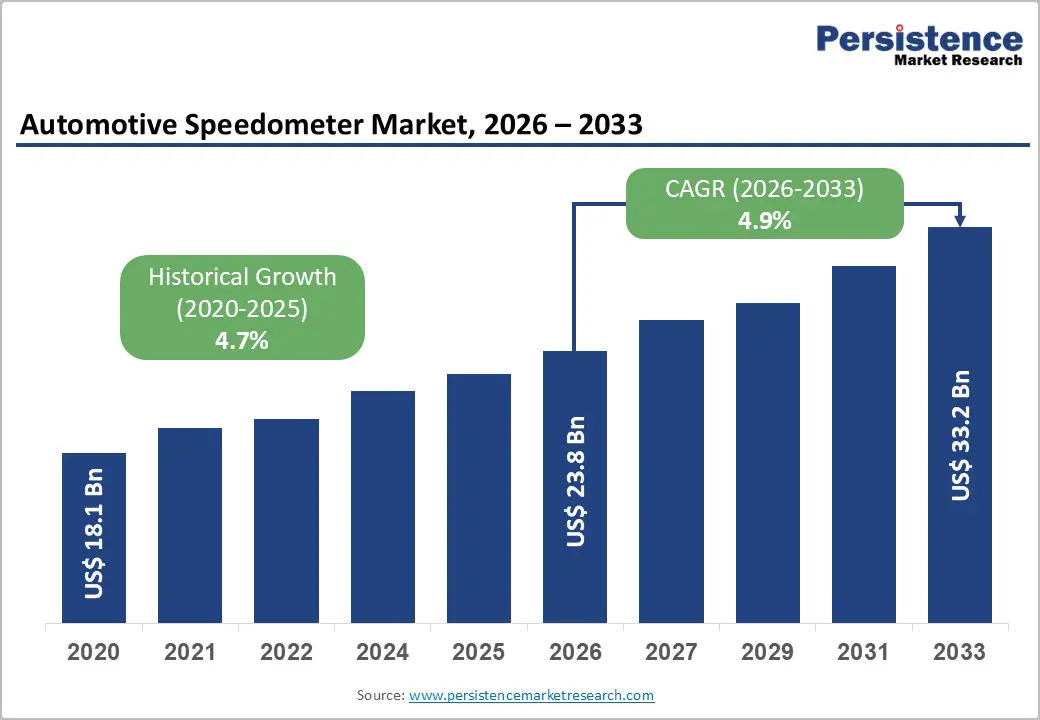

The global automotive speedometer market size is likely to be valued at US$23.8 billion in 2026 and is expected to reach US$33.2 billion by 2033, growing at a CAGR of 4.9% during the forecast period from 2026 to 2033, driven by increasing vehicle production, particularly in emerging economies, alongside the sustained demand for passenger vehicles, two-wheelers, and commercial vehicles.

Regulatory mandates focused on road safety and speed compliance continue to reinforce the need for accurate and reliable speed-monitoring systems across all vehicle categories. The market is benefiting from a gradual shift from traditional mechanical and analog speedometers toward electronic, electromechanical, and digital display systems, which offer improved precision, durability, and integration with broader vehicle electronics. The rising adoption of digital instrument clusters, head-up displays, and connected vehicle platforms is enhancing the functional role of speedometers.

| Key Insights | Details |

|---|---|

| Automotive Speedometer Market Size (2026E) | US$23.8 Bn |

| Market Value Forecast (2033F) | US$33.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.9% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.7% |

Growing population, urban expansion, improving road infrastructure, and rising disposable incomes are fueling demand for passenger vehicles, two-wheelers, and commercial vehicles. Each vehicle manufactured requires a speed-monitoring system, ensuring a direct correlation between automotive output and speedometer demand. Strong vehicle production growth in regions such as Asia Pacific, Latin America, and parts of Eastern Europe supports consistent volume demand for speedometers across OEM installations.

Recovery in automotive manufacturing following supply-chain disruptions has strengthened long-term growth prospects. Automakers are launching new models across multiple price segments, including entry-level and mid-range vehicles, where cost-efficient speedometer solutions remain essential. Commercial vehicle production is also rising due to growth in logistics, infrastructure development, and e-commerce. Fleet expansion increases replacement demand and reinforces the need for durable and accurate speedometers.

Governments worldwide mandate accurate speed measurement systems to reduce road accidents, enforce speed limits, and improve traffic discipline. Regulatory frameworks require all vehicles to be equipped with calibrated and tamper-resistant speedometers that meet defined safety and performance standards. These requirements apply across passenger vehicles, two-wheelers, and commercial vehicles, ensuring steady baseline demand irrespective of economic cycles.

Evolving safety regulations increasingly emphasize precision, digital accuracy, and driver awareness. Authorities are encouraging integration of speed monitoring with warning systems, compliance reporting, and driver assistance features. In commercial vehicles, regulatory focus on driver behavior monitoring has increased the adoption of electronic speedometers. These regulatory pressures maintain steady demand while encouraging manufacturers to adopt more advanced and compliant technologies, thereby reinforcing long-term market stability.

The growing adoption of fully integrated digital instrument clusters acts as a restraint on the standalone automotive speedometer market. Modern vehicles increasingly feature multifunctional digital dashboards that combine speed, navigation, vehicle diagnostics, and infotainment into a single display unit. This integration reduces the demand for individual speedometer components, particularly in mid-range and premium vehicles. Automakers focus on minimalistic and centralized cockpit designs, and standalone speedometer suppliers face reduced differentiation.

Integrated clusters are often sourced as complete systems from large Tier-1 suppliers, limiting opportunities for specialized speedometer manufacturers. This trend is especially strong in electric and connected vehicles, where software-driven architectures dominate. While speed data remains essential, its standalone hardware value is declining. Market growth is constrained by the gradual shift in value from discrete speedometers to integrated digital display ecosystems. This transition increases dependency on long-term OEM contracts, reducing aftermarket opportunities for standalone speedometer providers.

Digital and electronic speedometers rely heavily on software, sensors, and vehicle networks, making them vulnerable to hacking, data manipulation, and system failures. Any compromise in speed data accuracy poses safety and compliance risks, prompting stricter validation and security requirements from automakers and regulators. These challenges increase development timelines and operational risks for manufacturers. Vehicles become more connected, and speedometers are exposed to wider attack surfaces through telematics and infotainment integration. This forces suppliers to invest in secure-by-design architectures and continuous monitoring capabilities.

Ensuring cybersecurity compliance adds to R&D, testing, and maintenance costs. Smaller manufacturers may struggle to meet functional safety and cybersecurity standards, limiting market participation. Frequent software updates, compatibility issues, and long-term support requirements increase complexity. These factors can delay product deployment and raise system costs, acting as a barrier to faster adoption of advanced digital speedometer solutions. Higher compliance costs reduce price competitiveness in cost-sensitive vehicle segments. This can slow digital speedometer penetration in entry-level and emerging-market vehicles.

Electric vehicles rely heavily on digital displays to communicate speed, energy consumption, battery range, and driving modes. This increases demand for advanced electronic speedometers capable of seamless integration with vehicle control systems. As governments promote EV adoption through incentives and emission regulations, production volumes continue to rise, directly supporting market expansion. OEMs are increasingly standardizing digital speedometers across EV models to improve energy efficiency feedback and driving behavior. This trend creates sustained demand for high-precision, software-enabled speedometer solutions.

Connected vehicles enhance this opportunity by enabling real-time data exchange, diagnostics, and remote monitoring. Speedometers in connected vehicles serve as interactive interfaces rather than simple gauges. Integration with telematics, navigation, and driver assistance systems enhances functionality and user experience. This shift positions electronic and digital speedometers as critical components within next-generation vehicle architectures. Connectivity enables over-the-air updates and feature enhancements, extending product lifecycles. It also supports new use cases such as fleet analytics and usage-based services, expanding the value proposition of digital speedometers.

Consumers increasingly demand personalized vehicle experiences, including customizable display layouts, themes, and real-time information preferences. Digital speedometers that support configurable interfaces align with these expectations, particularly in passenger and premium vehicle segments. Automakers use customizable dashboards to differentiate models, driving demand for flexible speedometer solutions. This trend also improves brand identity by allowing OEM-specific design language within instrument clusters. It enhances customer satisfaction by offering intuitive and user-centric driving information displays.

Reconfigurable interfaces allow speedometers to adapt to different driving modes, regional regulations, and driver profiles without hardware changes. This flexibility is valuable for OEMs and fleet operators seeking scalable solutions. As vehicles evolve toward software-defined platforms, speedometers transition into dynamic digital components. This creates long-term opportunities for innovation, upgrades, and value-added services within the market. Software-based customization reduces lifecycle costs by minimizing hardware redesigns. It enables faster feature deployment and monetization through digital upgrades.

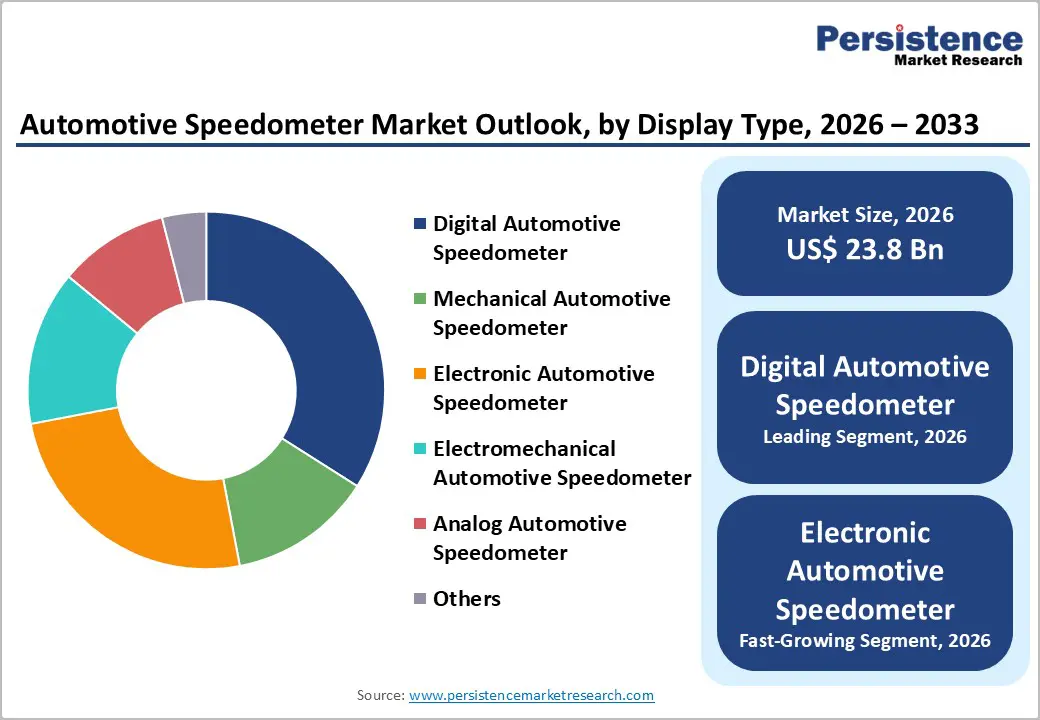

Digital automotive speedometers are expected to lead the automotive speedometer market, accounting for approximately 52% of revenue in 2026, driven by their superior accuracy, real-time data processing, and seamless integration with modern vehicle infotainment and driver assistance systems. Digital speedometers have become the preferred choice in passenger vehicles due to their ability to display multiple parameters such as speed, warnings, navigation cues, and vehicle diagnostics within a single interface. For example, Tesla uses fully digital speed displays integrated into its central touchscreen, demonstrating how digital speedometers function as part of a broader vehicle information ecosystem rather than a standalone gauge.

The electronic automotive speedometer is likely to represent the fastest-growing segment in 2026, supported by its balance between technological advancement and cost efficiency. Electronic speedometers offer higher reliability and accuracy than mechanical systems while remaining more affordable and robust than fully digital clusters, making them attractive for commercial vehicles and mid-range passenger cars. For example, Tata Motors widely deploys electronic speedometers in its commercial vehicle lineup to ensure accurate speed monitoring and compliance with safety norms while maintaining cost control.

Passenger vehicles are projected to lead the market, capturing approximately 56% of revenue in 2026, supported by high production volumes and strong consumer demand for safety, comfort, and advanced features. Passenger cars increasingly incorporate digital and electronic speedometers in modern instrument clusters, aligning with trends such as premiumization and connected mobility. For example, Hyundai integrates advanced digital speedometers across many of its passenger car models to deliver improved readability, safety alerts, and a modern cockpit feel.

Two-wheeler vehicles are likely to be the fastest-growing vehicle type in 2026, driven by rapid urbanization, traffic congestion, and demand for affordable personal mobility, especially in Asia Pacific. Two-wheelers are increasingly equipped with electronic and digital speedometers as manufacturers respond to safety regulations and consumer demand for modern features such as trip data, fuel efficiency indicators, and connectivity. Growth is also supported by the rising adoption of electric two-wheelers, which use digital displays to display speed and battery information effectively. For example, Ola Electric equips its electric scooters with fully digital speedometer displays and smart connectivity, highlighting the shift away from analog systems.

North America is likely to be a significant market for automotive speedometers in 2026, driven by the region’s strong embrace of digital instrument clusters and advanced vehicle electronics. Demand for high-precision, digital speedometers is particularly strong in the U.S. and Canada due to high vehicle ownership, premium vehicle sales, and substantial EV adoption. Automakers and suppliers are prioritizing digital cockpit solutions that integrate speed data with infotainment, ADAS alerts, and telematics information, reinforcing the transition away from traditional analog gauges.

This shift is supported by safety regulations, consumer preference for advanced interfaces, and OEM investments in software-defined vehicle electronics that enhance driver information delivery. For example, Visteon Corporation, a major U.S. automotive electronics supplier, provides advanced digital instrument clusters tailored for North American vehicles, integrating speedometer functions with connected car technologies and customizable displays. This approach aligns with the region's trend toward cockpit electronics convergence, where speedometers form part of larger digital dashboards that offer real-time data, connectivity features, and enhanced driver experience.

Europe is likely to be a significant market for automotive speedometers in 2026, due to the region’s strong automotive manufacturing base, rapid electrification, and high consumer preference for advanced in-vehicle technology. Automakers are focusing on digital cockpit systems that combine speed data with navigation, ADAS alerts, and vehicle performance metrics, aligning with consumer expectations for seamless and intuitive interfaces. Regulatory pressures on emissions, safety, and energy efficiency also reinforce the adoption of electronic and digital solutions over traditional analog systems, accelerating the shift toward fully integrated digital dashboards in passenger cars and EVs across the region.

Emerging trends in the Europe automotive speedometer market highlight opportunities driven by electrification, digitalization, and connected mobility. Connected vehicles amplify this opportunity by enabling real-time data exchange between speedometers, telematics systems, and cloud services. For example, Continental AG, a major automotive technology supplier headquartered in Germany, exemplifies this trend by developing advanced digital cockpit and instrument cluster solutions that incorporate speed monitoring, ADAS visualization, and customizable digital interfaces tailored for European vehicles.

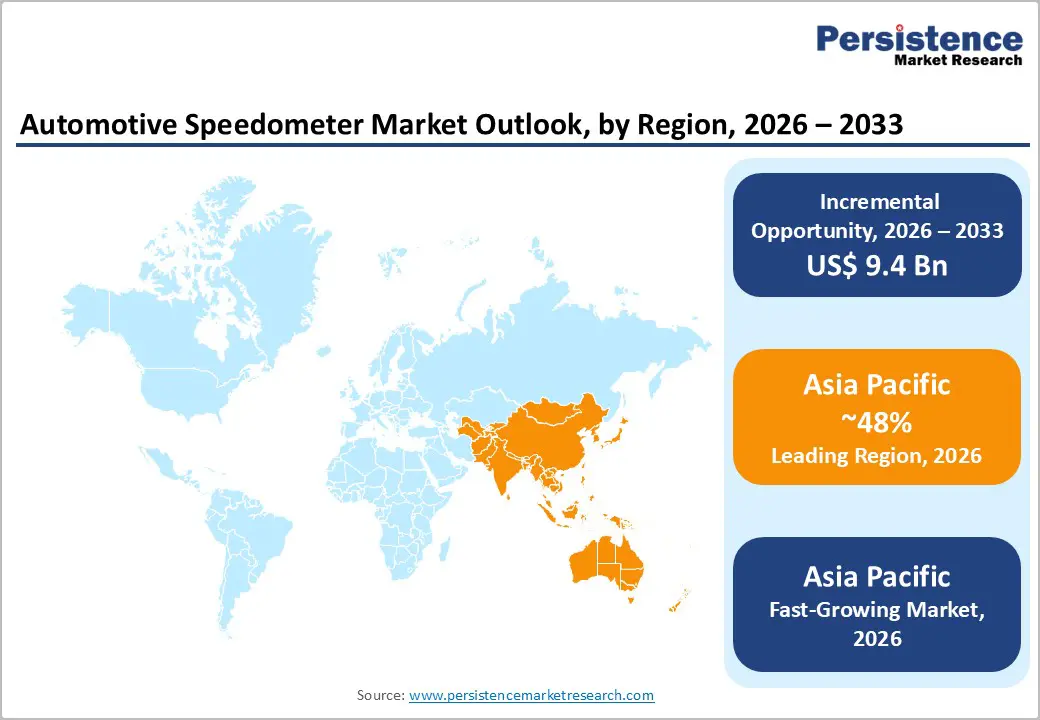

The Asia Pacific region is anticipated to be the leading region, accounting for a market share of 48% in 2026, driven by the region’s dominant automotive manufacturing base and rapid adoption of digital instrument clusters in new vehicles. Digital speedometers are increasingly integrated into vehicle dashboards to meet consumer demands for enhanced safety, connectivity, and real-time performance feedback, aligning with the broader shift toward connected and electrified mobility. Governments in China and India also support localization and advanced vehicle technology adoption, accelerating digital cluster penetration in mid-range and premium vehicles.

The Asia Pacific automotive speedometer market is also characterized by innovation in display technologies and growing opportunities in both OEM and aftermarket segments. Advanced display types such as TFT and OLED are gaining traction due to consumer demand for intuitive, customizable interfaces that combine speed, navigation, and diagnostics into single instrument clusters. For example, Pricol Limited, an Indian automotive components manufacturer, supplies precision dashboard instruments, including speedometers for two-wheelers, passenger cars, and commercial vehicles, supporting regional demand and local content strategies.

The global automotive speedometer market exhibits a moderately fragmented structure, driven by a blend of longstanding automotive electronics leaders and a growing number of regional and niche players competing on innovation, technology, and customization. Established Tier-1 suppliers are focusing on advanced digital display solutions that integrate speed data with navigation, ADAS alerts, and infotainment systems, while smaller firms leverage modular designs and regional expertise to meet cost-sensitive market demand.

With key leaders including Continental AG, Visteon Corporation, Denso Corporation, Robert Bosch GmbH, and Yazaki Corporation commanding significant market share, competition centers on technological superiority, product portfolio expansion, and regional footprint growth. These players compete through continuous innovation in display clarity, software integration, and scalability across vehicle platforms, ensuring their solutions align with evolving consumer expectations and regulatory requirements.

Key Industry Developments:

The global automotive speedometer market is projected to reach US$23.8 billion in 2026.

Rising adoption of digital instrument clusters driven by vehicle electrification, connected technologies, and stricter safety and accuracy regulations is driving the automotive speedometer market.

The automotive speedometer market is expected to grow at a CAGR of 4.9% from 2026 to 2033.

Growing demand for digital and customizable speedometers in electric, connected, and software-defined vehicles presents a key market opportunity.

Caerbont Automotive Limited, Galaxy Indicators India, Pricol Limited, Speedhut, and Bob's Speedometer Service Inc. are the leading players.

| Report Attribute | Details |

|---|---|

| Historical Data | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Display Type

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author