ID: PMRREP32832| 210 Pages | 22 Jan 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

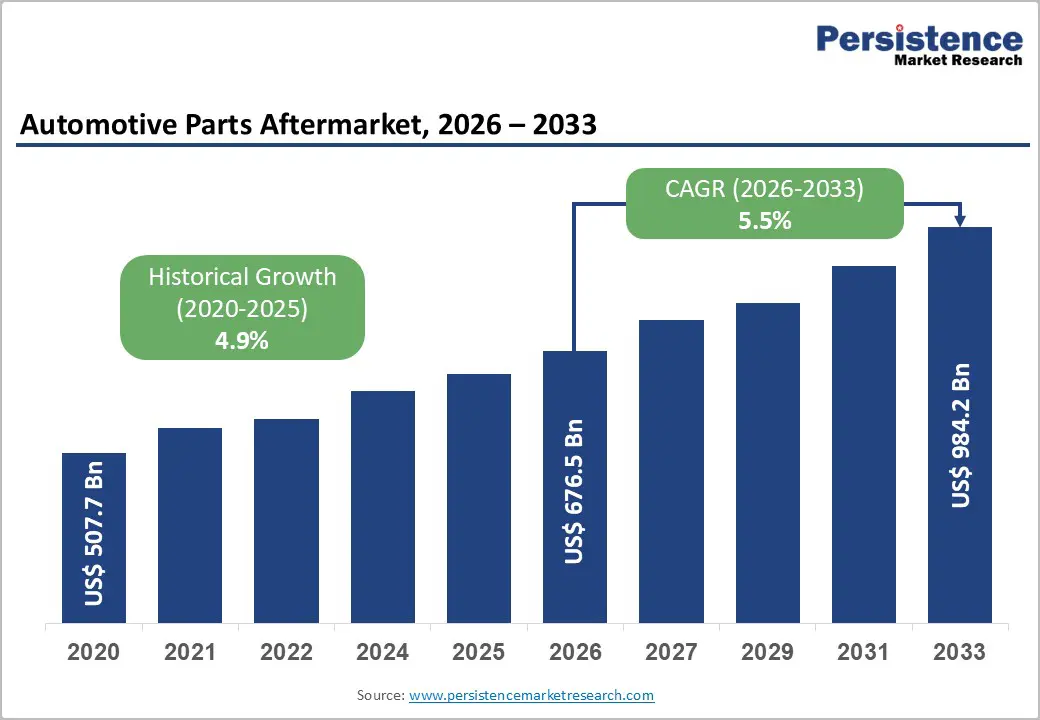

The global Automotive Parts Aftermarket size was valued at US$ 676.5 Billion in 2026 and is projected to reach US$ 984.2 Billion by 2033, growing at a CAGR of 5.5% between 2026 and 2033.

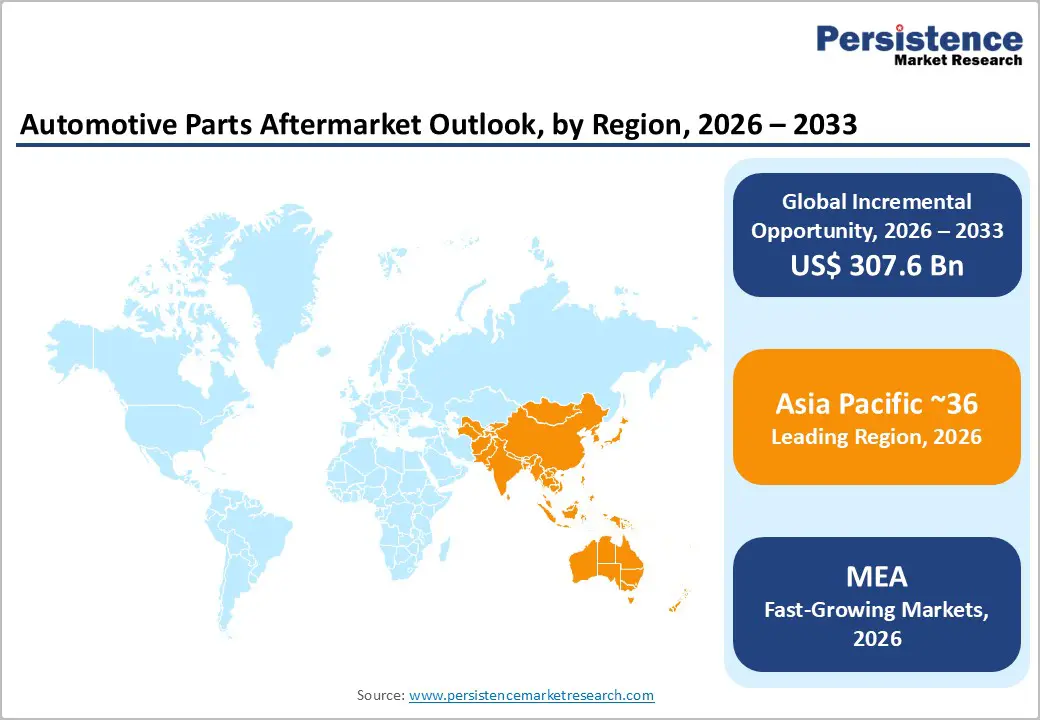

Market expansion is fueled by an aging vehicle fleet needing replacement parts, increased e-commerce for easier access to parts, and the rise of electric vehicles, creating demand for specialized components. North America holds 29% of the global market share, Asia Pacific leads with 36%, and Europe contributes 24%, benefiting from established automotive manufacturing and a 4.6% CAGR growth.

| Key Insights | Details |

|---|---|

|

Automotive Parts Aftermarket Size (2026E) |

US$ 676.5 billion |

|

Market Value Forecast (2033F) |

US$ 984.2 billion |

|

Projected Growth CAGR (2026-2033) |

5.5% |

|

Historical Market Growth (2020-2025) |

4.9% |

Systematic aging of global vehicle fleets is driving sustained aftermarket parts demand, with vehicles in operation averaging 6-12 years old increasingly requiring replacement components and repair services, creating sustained baseline demand across diverse aftermarket segments supporting market growth trajectory. Global vehicle fleet expansion approaching 1.4 billion units, providing a massive addressable market for replacement and repair components. Extended vehicle ownership cycles, particularly in developed markets, support sustained aftermarket demand spanning the vehicle lifecycle. Reliability and durability improvements in modern vehicles extend operational lifespan and support aftermarket service demand. Consumer preference for vehicle repair over replacement, driven by cost considerations and sustainability consciousness, supports sustained aftermarket purchasing. Warranty expiration supports independent aftermarket channel growth, with vehicles beyond manufacturer warranty requiring independent parts and service solutions.

E-commerce platform expansion is systematically transforming aftermarket parts distribution, with online aftermarket channels growing at a 10.9% CAGR and commanding approximately USD 60-65 billion in annual sales, demonstrating substantial digital transformation that supports market accessibility and consumer convenience. AI-powered inventory management and recommendation systems enabling efficient stock optimization and personalized customer experiences. Mobile commerce dominance is supporting smartphone-based purchasing, particularly among younger demographics. Marketplace platforms capturing approximately 40% of online aftermarket share, enabling diverse seller participation and product breadth. Same-day and next-day delivery capabilities supporting consumer convenience and purchase acceleration. Digital payment solutions and flexible financing options reducing purchase barriers and supporting transaction velocity. Real-time inventory visibility and fitment matching technologies are improving customer experience and conversion rates.

Aftermarket market expansion is constrained by consumer and fleet operator preference for OEM parts due to reliability, warranty, and compatibility assurance, with many vehicle owners perceiving OEM parts as superior despite higher pricing limiting independent aftermarket market penetration, particularly for newer vehicles. Warranty implications of non-OEM parts discouraging consumer adoption. OEM direct-to-consumer channel expansion, capturing margins previously controlled by the independent aftermarket. Manufacturer warranty coverage reduces aftermarket penetration during critical early-vehicle lifecycle periods. Quality assurance concerns regarding counterfeit or inferior aftermarket products damaging channel credibility. Integrated vehicle software systems with OEM-exclusive compatibility constraints limiting aftermarket component applicability.

Aftermarket market growth is constrained by the prevalence of counterfeit and substandard parts in certain geographic regions, eroding consumer confidence and damaging the aftermarket channel's reputation, while quality concerns limit purchase migration from OEMs toward independent aftermarket channels. Supply chain transparency challenges enable the infiltration of counterfeit products. Consumer quality verification difficulties in online sales limiting confidence in unknown sellers. Regulatory enforcement limitations against counterfeit manufacturers particularly in developing markets. Legal liability risks for retailers and installers using substandard components. Brand reputation damage from quality issues affecting channel viability. Logistical complexity in managing distributed seller networks ensuring quality standards.

Emerging markets and developing regions represent substantial growth opportunities driven by Asia Pacific, commanding 36% market share, with India and China demonstrating accelerated growth, supporting geographic expansion beyond mature North American and European markets. India's vehicle sales expanded from 0.04 million to 0.05 million units annually, creating a growing aftermarket demand. China's aftermarket market is valued at USD 83.61 billion in 2025, supporting regional leadership. Rising middle-class populations in ASEAN are driving the expansion of vehicle ownership. E-commerce infrastructure development enabling digital channel penetration. Government regulatory focus on vehicle safety and driving component replacement requirements. Manufacturing cost advantages support pricing competitiveness in price-sensitive markets. Meanwhile, the Middle East & Africa is growing prominently, supported by an aging vehicle fleet, extreme operating conditions increasing wear rates, expanding aftermarket networks, and rising vehicle parc across GCC and African economies.

Advanced Driver Assistance System (ADAS) and vehicle connectivity aftermarket represents emerging opportunity with modern vehicles increasingly featuring advanced technology requiring specialized diagnostic tools, sensors, and software management services supporting new revenue streams and specialist positioning opportunities. Camera and radar sensor aftermarket demand for ADAS recalibration and replacement. Advanced diagnostic tools and software supporting technician service delivery. Cybersecurity and software update services supporting vehicle connectivity maintenance. Collision-avoidance component aftermarket support for safety system maintenance. Connected vehicle data services representing emerging business models. Technician certification and training create competitive advantages in service delivery. Additionally, increasing penetration of semi-autonomous features, rising calibration complexity after minor collisions, OEM-driven software architectures, and growing regulatory emphasis on functional safety are accelerating demand for certified workshops and high-margin, technology-intensive aftermarket services.

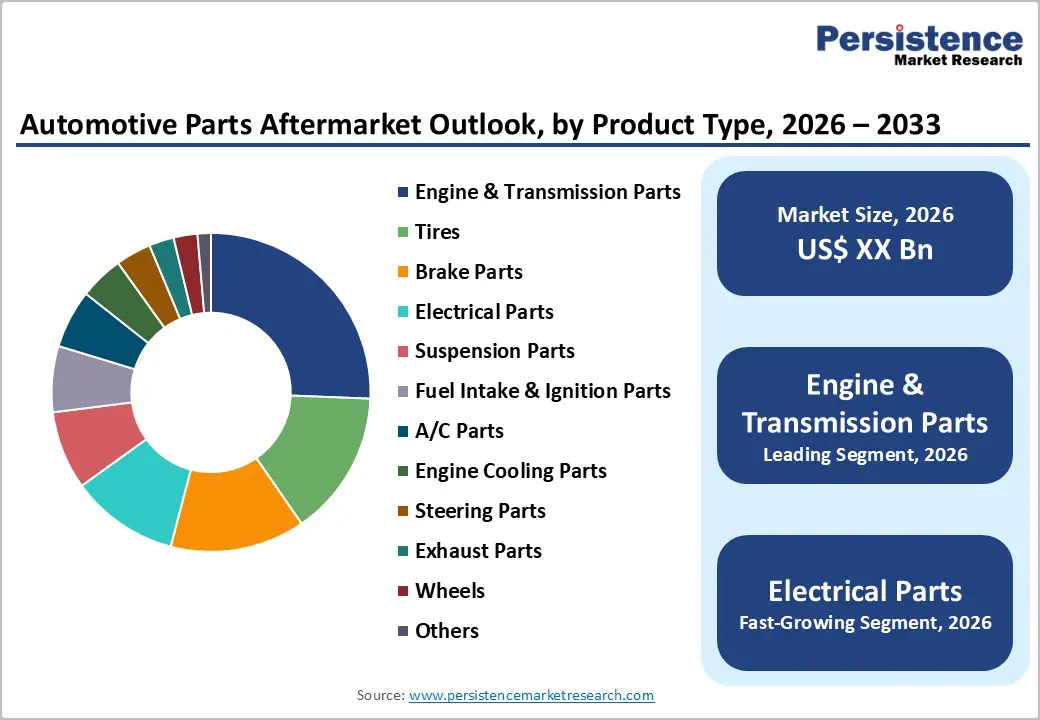

Engine and transmission components command ~26% of global aftermarket market share, representing dominant category driven by fundamental powertrain system criticality supporting sustained replacement demand across all vehicle segments supporting market dominance through established supply chains and broad component availability. Piston and piston ring demand for engine rebuilding and maintenance. Oil filtration systems support routine maintenance requirements. Clutch and transmission filter demand from transmission servicing. Established supply chain maturity enabling cost-effective production and distribution. Broad technician expertise supporting installation and service capabilities.

Electrical components expand at a 6.4% CAGR, driven by increasing vehicle electronic complexity and ADAS system adoption, which require specialized components such as sensors, starters, alternators, and battery systems, supporting expansion of the emerging market segment. Advanced sensor demand for ADAS and vehicle connectivity. Starter and alternator replacement demand from aging electrical systems. Battery market expansion supporting replacement cycles. Vehicle lighting system modernization supporting LED and adaptive lighting adoption. Electronic control unit demand for powertrain and chassis systems. Connectivity module aftermarket supporting vehicle networking evolution.

Passenger vehicles command approximately 66% of the global aftermarket market share, representing a dominant segment reflecting passenger car prevalence in the global vehicle fleet and supporting the largest addressable market for replacement parts and service components across diverse geographic markets. Sedans and hatchback volume dominance support component demand. The SUV and crossover segment growth is maintaining passenger vehicle dominance. Consumer vehicle ownership prevalence supporting highest service demand. Established retail distribution optimized for passenger vehicles. Broad technician expertise supporting service delivery.

Off-road vehicles expand at 6.2% CAGR, driven by specialty vehicle demand for recreational and commercial off-road applications requiring rugged components and specialized aftermarket support, supporting emerging market segment growth and premium positioning. Truck and pickup truck demand support commercial vehicle growth. Specialty suspension components for off-road capability. Protective equipment and underbody components that support harsh-environment durability. Specialized tire and wheel demand for off-road terrain capability. Recreational vehicle aftermarket supporting adventure segments.

Independent aftermarket retailers hold around 39% of market share, representing a dominant channel that reflects established retail infrastructure and consumer convenience, supporting a dominant sales channel across North American and European markets through direct consumer relationships. Local store accessibility supporting consumer convenience. Personal service and expertise supporting customer relationships. Competitive pricing dynamics driving affordability positioning. Cross-selling opportunities through complementary product portfolios. Established brand recognition in regional markets.

Online channels expand at a 10.9% CAGR, driven by digital transformation enabling convenient home delivery, extensive product selection, and competitive pricing that supports rapid digital migration, particularly among younger and urban demographics, accelerating channel growth. Amazon, eBay, and marketplace platforms supporting diverse seller participation. Specialized automotive platforms (AutoZone.com, PartsGeek, Autodoc) are optimizing user experience. Mobile commerce dominance enabling smartphone shopping convenience. Real-time inventory systems supporting product availability. Customer review systems enabling informed purchasing decisions. Fulfillment logistics optimization supporting rapid delivery capabilities.

North America maintains a prominent 29% global market share, driven by mature vehicle infrastructure, sophisticated consumer expectations, established retail networks, and technology innovation leadership supporting market leadership and sustained growth momentum across diversified consumer segments. U.S. market dominance with AutoZone USD 4.6 billion Q1 revenue and O'Reilly USD 4.53 billion Q2 revenue, demonstrating retail scale. Vehicle ownership prevalence supports aftermarket demand. DIY culture supports consumer parts purchasing. E-commerce platform dominance with Amazon and eBay. Regulatory framework supporting product standards and safety. Logistics infrastructure maturity enabling efficient distribution.

The North American market is characterized by retail dominance, with established players such as AutoZone, O'Reilly, and Advance Auto Parts commanding substantial distribution networks. E-commerce integration supporting omnichannel strategies. Consumer confidence in aftermarket products supporting independent channel preference. Advanced vehicle technology adoption requires sophisticated diagnostics and specialized components.

Europe commands 24% global market share with 4.6% CAGR growth, driven by established automotive manufacturing heritage, sophisticated emission standards, environmental policy frameworks, and mature industrial structure supporting sustained market expansion across diverse markets. Germany's automotive strength supports manufacturing and the parts supply ecosystem. UK market development supporting the English-speaking service ecosystem. France and Spain market participation contributing to regional demand. Euro 7 emission standards driving component technology evolution. ADAS and connectivity adoption supporting advanced component demand. Environmental consciousness supporting sustainability positioning.

The European market is characterized by a strong OEM presence and established aftermarket networks. Emission regulation compliance driving component evolution. Advanced technology adoption is particularly prevalent in Northern Europe. Mature logistics and distribution infrastructure supporting efficient supply chains.

Asia Pacific commands a significant 36% market share, driven by expanding vehicle populations, rising middle-class income levels, and ongoing infrastructure development supporting ownership expansion. China’s scale and depth across vehicle parc, manufacturing, and service ecosystems underpin regional leadership, while India’s accelerating vehicle adoption and improving service penetration continue to strengthen aftermarket demand. Japan’s market maturity reinforces technology leadership and quality benchmarks, with ASEAN economies contributing incremental growth through rising urbanization. Mobile commerce prevalence is enabling rapid digital channel adoption, while regional manufacturing cost advantages support competitive pricing and broad market accessibility.

The Asia Pacific market is characterized by rapid growth in emerging markets, particularly India and Southeast Asia. Cost-sensitive consumers supporting price-competitive aftermarket preference. Digital platform adoption accelerating e-commerce channel penetration. Government vehicle safety standards driving component replacement requirements.

The global automotive aftermarket is highly fragmented, featuring multinational leaders such as Bosch, Continental, and Denso, which rely on extensive product portfolios and global networks. These are complemented by regional suppliers such as Dorman Products and Mahle, catering to niche markets. On the distribution side, key players like AutoZone and O'Reilly Auto operate extensive retail networks, while emerging digital platforms like Autodoc and PartsGeek are transforming purchasing behaviors with convenience and data-driven pricing.

April 2025: Delphi Launches 56 New Parts Covering 43 Million Vehicles

Delphi (PHINIA brand) announced a comprehensive new parts launch, including OE replacement sensors, fuel management components, and vehicle electronics covering 43 million U.S. and Canadian vehicles, supporting market responsiveness and first-to-market positioning across major replacement categories.

September 2024: Continental Expands Aftermarket Product Portfolio for EVs and ADAS

Continental AG announced major aftermarket portfolio expansion, including ADAS sensors, chassis components, high-pressure fuel pumps, and brake systems under the ATE New Original brand, specifically tailored for electric vehicles and Euro 7 emission standards, supporting EV market evolution.

2024-2025: LKQ Corporation Completes Uni-Select Acquisition Integration

LKQ Corp completed Uni-Select Inc. acquisition integration, reinforcing market presence and extending service network, supporting supply chain consolidation and geographic expansion, supporting competitive positioning in North America and international markets.

By Component

By Vehicle Type

By Sales Channel

By Region

The global automotive parts aftermarket is likely to be valued at US$676.5 billion in 2026 and is projected to reach US$984.2 billion by 2033.

Market growth is fueled by the rising age of vehicles necessitating more maintenance and parts, the rapid digitalization of parts distribution via e-commerce, enhancing access and pricing transparency, driving demand for specialized components and advanced services.

The market is expected to grow at a 5.5% CAGR during the forecast Period (2026-2033).

Key opportunities include EV component specialization, Asia Pacific expansion led by India and China, and the ADAS aftermarket, where sensors, diagnostics, and software services enable premium pricing and specialized service positioning.

Market leadership includes Bosch, Continental, Delphi (PHINIA), Valeo, and Denso, alongside retail leaders AutoZone, O’Reilly, NAPA, and LKQ. Digital players like Autodoc and PartsGeek are gaining share, supported by recent EV launches, product expansions, and strategic acquisitions.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author