ID: PMRREP12874| 198 Pages | 20 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

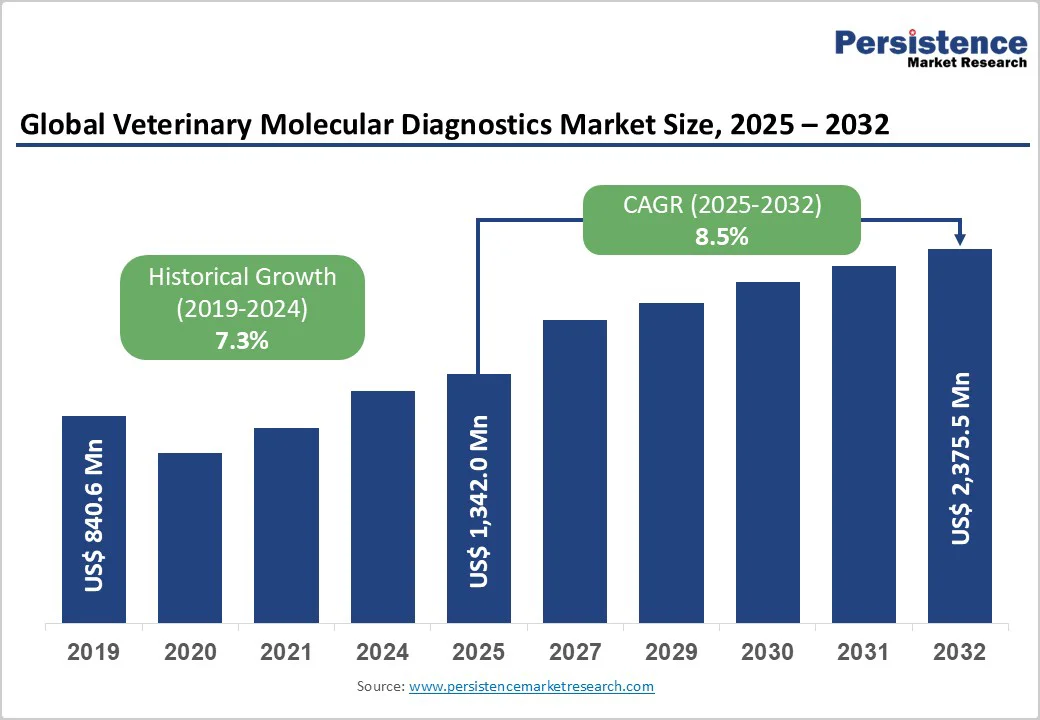

The global veterinary molecular diagnostics market is expected to reach US$1,342.0 million in 2025 and US$2,375.5 million at a CAGR of 8.5% during the forecast period from 2025 to 2032. The global veterinary molecular diagnostics market is expanding steadily, driven by increasing awareness of zoonotic diseases, advancements in PCR and NGS technologies, and rising demand for accurate animal disease detection.

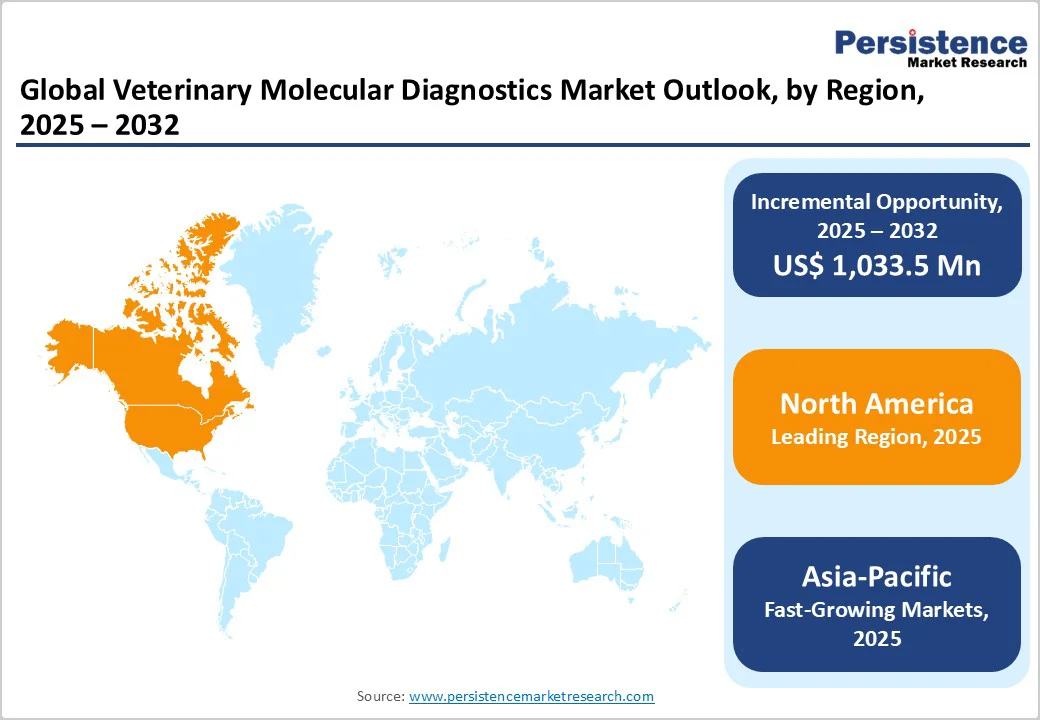

North America leads with a strong veterinary infrastructure, while Asia Pacific is growing fastest, fueled by expanding livestock sectors, government surveillance programs, and improved access to animal healthcare.

| Key Insights | Details |

|---|---|

|

Global Veterinary Molecular Diagnostics Market Size (2025E) |

US$ 1,342.0 Mn |

|

Market Value Forecast (2032F) |

US$ 2,375.5 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

8.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

7.3% |

Increasing pet ownership and growing investments in livestock health are major drivers of the veterinary molecular diagnostics market. According to the American Veterinary Medical Association (AVMA) and the American Pet Products Association (APPA), around 66% of U.S. households, nearly 87 million owned a pet in 2023–24, up from 56% in 1988, reflecting a steady rise in demand for advanced veterinary diagnostics and preventive healthcare. Globally, the Food and Agriculture Organization (FAO) reports continuous growth in livestock populations, with over 1.5 billion cattle and 1 billion pigs recorded in 2022, highlighting the scale of disease surveillance required for food safety and trade. In India, livestock contributed over 30% to the agriculture and allied sector’s GVA in 2021–22, emphasizing the sector’s economic importance. These trends indicate that as both companion and farm animals grow in number and value, molecular diagnostic tools offering faster and more accurate disease detection are increasingly adopted to protect animal and public health.

In the U.S., the American Veterinary Medical Association (AVMA) has identified over 243 rural veterinary shortage areas across 46 states in 2025, signaling pronounced workforce gaps. In the U.K., the Royal College of Veterinary Surgeons (RCVS) projects that the supply of veterinarians in industry and research will meet only ~84% and ~90% of demand, respectively, by 2035, highlighting chronic shortfalls in specialist roles necessary for advanced diagnostics. These shortages are particularly critical for molecular diagnostics, which require technicians with expertise in PCR, NGS and bioinformatics. Without sufficiently skilled personnel, uptake of new platforms is hindered, sample throughput is limited, and operational delays increase, ultimately slowing market growth and limiting access to cutting-edge veterinary testing services.

The expansion of point-of-care (POC) testing solutions is a major opportunity in the veterinary molecular diagnostics market, driven by the global shift toward rapid, field-based disease detection. According to the World Organization for Animal Health (WOAH), over 60% of emerging infectious diseases in humans originate from animals, underscoring the need for real-time surveillance at the animal level.

The U.S. Department of Agriculture (USDA) and Centers for Disease Control and Prevention (CDC) have emphasized on-site diagnostic capabilities to enable faster responses to zoonotic outbreaks such as avian influenza and African swine fever. Similarly, the Food and Agriculture Organization (FAO) supports mobile and portable lab initiatives in Asia and Africa to strengthen livestock disease control and prevent cross-border spread. These efforts reflect the growing role of POC molecular diagnostics, as portable PCR and LAMP platforms allow veterinarians to obtain accurate results within hours, improving animal health management and biosecurity.

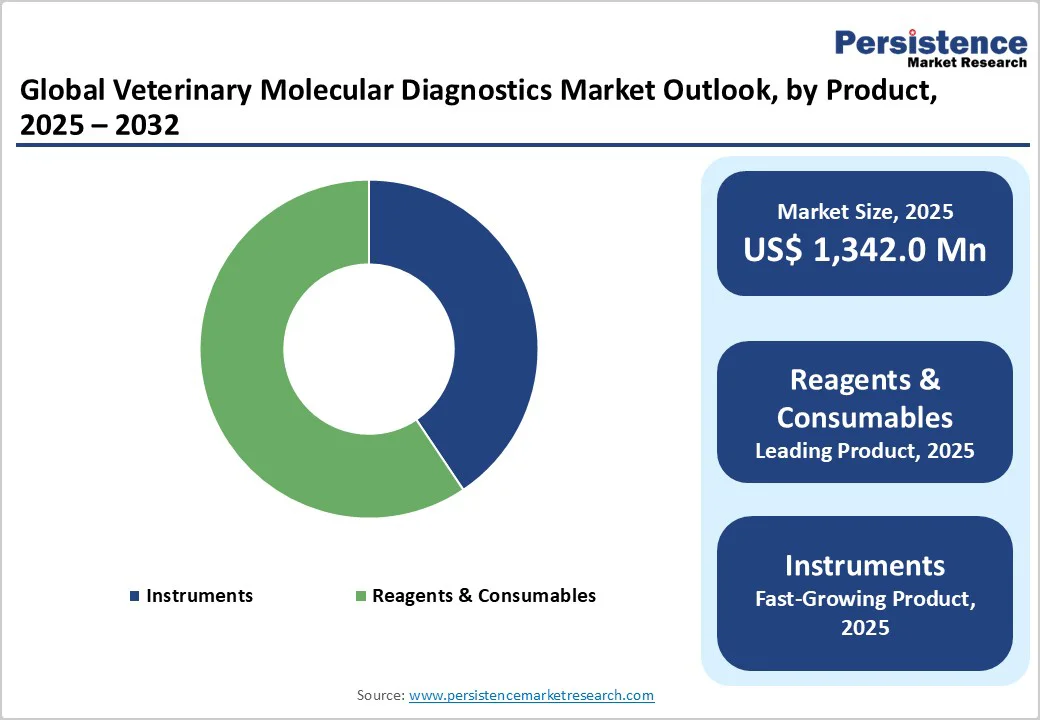

The Reagents & Consumables dominates the market with 59.4% share in 2025, because they are essential for every testing cycle and require continuous replenishment. Unlike instruments, which are one-time purchases, consumables such as PCR master mixes, primers, probes, and extraction kits are used repeatedly across diagnostic processes. According to the World Organisation for Animal Health (WOAH), more than 50% of global veterinary laboratories conduct molecular or PCR-based tests for disease surveillance, reflecting consistent demand for reagents and kits. The U.S. Department of Agriculture (USDA) and FAO also highlight that laboratory testing for diseases like avian influenza and foot-and-mouth disease involves frequent reagent use due to high sample throughput. Thus, recurring testing needs, ongoing disease monitoring, and biosecurity programs ensure that reagents and consumables remain the most consumed and revenue-generating segment in this market.

PCR dominates the market in the technology category due to its high sensitivity and broad pathogen-detecting capability. For instance, a study found that 92% of respondents used PCR regularly for equine pathogen detection in university and state veterinary labs. The Food and Agriculture Organization also notes that PCR-based diagnostics are widely used in animal health surveillance to compare sequence data and trace disease spread in livestock across Brazil, China, India, Mexico and South Africa. Because PCR tests can rapidly identify bacterial, viral or parasitic genetic material, many diagnostic workflows in veterinary labs rely on them, making PCR the preferred technology in this market.

The North America region dominates the global market with a 38.7% share in 2025, due to its combination of high pet-ownership rates and advanced diagnostic infrastructure. In the U.S., approximately 94 million households own pets as of 2025, reflecting widespread demand for veterinary services and diagnostics. Moreover, federal agencies such as the United States Department of Agriculture (USDA) and the Centers for Disease Control and Prevention (CDC) run sophisticated animal-health surveillance and diagnostic programmes that rely heavily on molecular methods. This strong infrastructure, paired with animal-health awareness and investment, means that molecular diagnostics for companion animals, livestock and zoonotic disease are more rapidly adopted in North America than in many other regions.

Europe plays a critical role in the veterinary molecular diagnostics market because of its strong pet-ownership base and substantial livestock sector. Over 90 million European households (≈46 %) own at least one companion animal. At the same time, the region maintains large agricultural animal volumes, with approximately 133 million pigs and 74 million bovines at end of 2023. Such scale in both companion and production animals drives demand for advanced diagnostics. Moreover, the regulatory framework within the European Food Safety Authority (EFSA) and surveillance requirements for animal health support the adoption of molecular tests. Consequently, these factors make Europe an important and evolving region for veterinary molecular diagnostics.

The Asia Pacific region is the fastest-growing in the veterinary molecular diagnostics market, driven by booming livestock expansion and rising pet ownership. Livestock production in the region grew at approximately 3.5-5% annually, according to Food and Agriculture Organization data. Furthermore, countries like China report over 116 million pets in 2023 (58 million dogs and 60 million cats) contributing to increased veterinary service demand. These twin trends, larger livestock herds requiring disease surveillance, and rapidly growing companion-animal populations demanding wellness diagnostics, create a strong pull for molecular diagnostic tools (PCR, multiplex panels). Additionally, investments in diagnostic infrastructure and regulatory pushes for animal health further support the region’s accelerated growth.

Leading companies in the veterinary molecular diagnostics market are focusing on innovation and strategic expansion to meet growing diagnostic needs. Mergers, acquisitions, and collaborations remain key strategies to broaden global presence, enhance product portfolios, and develop advanced technologies such as real-time PCR and sequencing. These efforts enable firms to access new markets, strengthen veterinary partnerships, and leverage existing customer networks to support effective animal disease detection and surveillance.

The global veterinary molecular diagnostics market is projected to be valued at US$ 1,342.0 Mn in 2025.

Rising pet ownership, zoonotic disease prevalence, livestock health monitoring, and advancements in PCR and genetic testing drive market growth.

The global veterinary molecular diagnostics market is poised to witness a CAGR of 8.5% between 2025 and 2032.

Expansion of point-of-care testing, AI-based diagnostics, and increasing veterinary healthcare investments create major market growth opportunities.

Abaxis, Thermo Fisher Scientific, Zoetis, Biochek, BioMérieux, Bio-Rad Laboratories.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Technology

By Animal Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author