ID: PMRREP33937| 191 Pages | 5 Feb 2026 | Format: PDF, Excel, PPT* | Healthcare

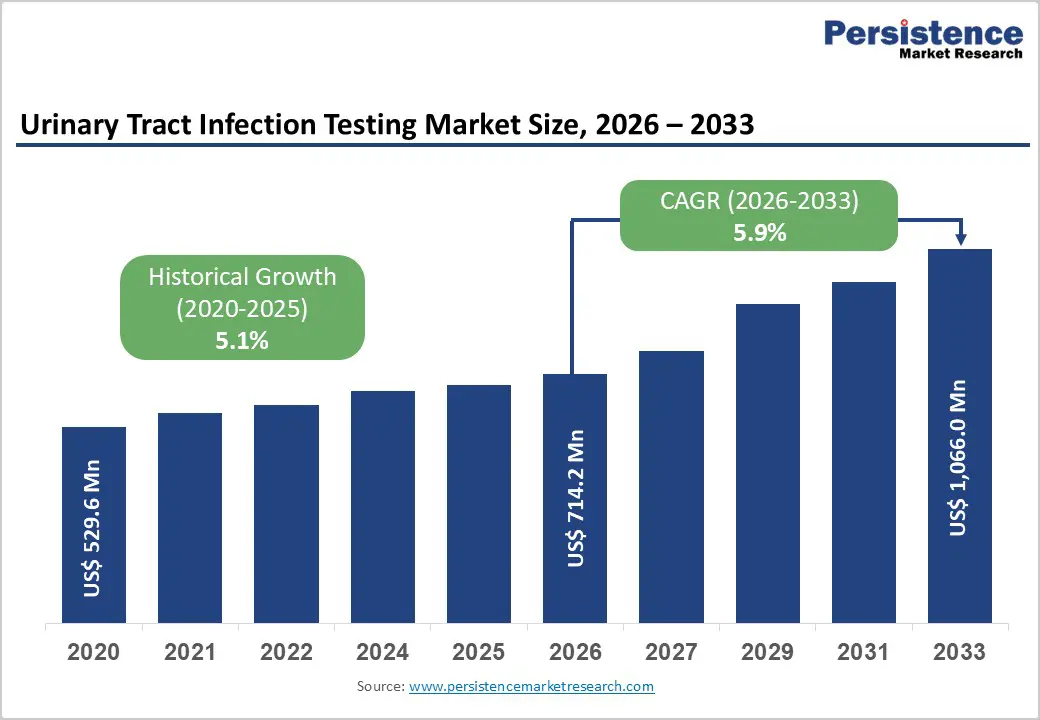

The global urinary tract infection testing market size is expected to be valued at US$ 714.2 million in 2026 and projected to reach US$ 1,066.0 million by 2033, growing at a CAGR of 5.9% between 2026 and 2033.

The market is experiencing robust growth primarily driven by the rise in prevalence of UTIs globally, particularly among women and elderly populations, combined with increasing adoption of point-of-care testing solutions and rapid diagnostic technologies. The rise in hospital-acquired infections, growing awareness about early disease detection, and advancements in diagnostic automation are creating a favorable environment for market expansion. Additionally, the global healthcare sector's emphasis on reducing antibiotic resistance through improved diagnostic accuracy is propelling the demand for sophisticated UTI testing solutions across hospitals, diagnostic laboratories, and home-care settings.

| Key Insights | Details |

|---|---|

| Market Size (2026E) | US$ 714.2 million |

| Market Value Forecast (2033F) | US$ 1,066.0 million |

| Projected Growth CAGR(2026-2033) | 5.9% |

| Historical Market Growth (2020-2025) | 5.1% |

The rise in incidence of UTIs represents a fundamental driver for market growth, with approximately 150 million people estimated to be affected by these infections annually worldwide. Clinical data reveals that women aged 20-40 years in developed nations experience particularly high infection rates, with studies indicating that 25-40% of women in the United States have experienced at least one UTI during their lifetime. The elderly population demonstrates even higher vulnerability, with UTI prevalence in women over 65 years being approximately double the rate seen in the overall female population. This demographic shift, combined with increasing prevalence of comorbidities such as diabetes mellitus and urinary incontinence, is creating sustained demand for accurate and timely diagnostic testing solutions across healthcare systems.

Rapid innovation in urinalysis technology and automated diagnostic systems is significantly enhancing market growth trajectories. The emergence of point-of-care (POC) testing platforms, digital microscopy systems, and integrated laboratory analyzers has revolutionized UTI diagnostics by improving accuracy, reducing turnaround times, and enhancing operational efficiency. Advanced platforms such as Sysmex Corporation's automated urinalysis systems incorporating flow cytometry and digital image analysis technology demonstrate the industry's commitment to precision diagnostics.

Companies like Danaher Corporation and Abbott Laboratories are investing substantially in artificial intelligence and machine learning integration to develop next-generation diagnostic solutions that achieve accuracy rates exceeding 95%, while simultaneously reducing diagnostic errors by approximately 40% compared to traditional methodologies.

Existing diagnostic challenges pose significant restraints to market expansion, particularly regarding the accuracy limitations of conventional dipstick-based testing methods. Standard urinalysis dipsticks, while cost-effective and widely accessible, exhibit variable diagnostic performance with false negative rates that may result in missed infections and delayed treatment initiation. The distinction between asymptomatic bacteriuria and true UTI infections creates clinical ambiguity, often necessitating confirmatory testing through urine culture methods that require 24-72 hours for definitive results. This diagnostic uncertainty frequently leads to empirical antibiotic prescriptions without culture confirmation, contributing to antibiotic misuse and resistance development. Approximately 40-50% of antibiotic prescriptions for UTIs are estimated to be unnecessary or inappropriate, creating clinical challenges and economic inefficiencies that constrain market growth in resource-conscious healthcare systems.

Complex regulatory frameworks and reimbursement hurdles represent substantial market restraints, particularly in emerging healthcare markets. The FDA approval process for novel diagnostic devices, including AI-integrated systems and rapid molecular diagnostics, requires stringent validation protocols and evidence generation, creating approval timelines extending 12-18 months on average. High implementation costs associated with advanced diagnostic infrastructure, ranging from US$ 150,000 to US$ 500,000 per unit for automated systems, create significant capital barriers for smaller healthcare facilities and diagnostic laboratories in developing regions. Furthermore, inconsistent reimbursement policies across different geographic markets and payer systems create uncertainty regarding investment returns, thereby limiting adoption rates among healthcare providers operating under constrained budgets.

The home-based testing segment represents the fastest-growing opportunity within the UTI testing market, driven by consumer preferences for convenience, privacy, and rapid results. The recent market emergence of integrated test-and-treat solutions, exemplified by innovations like Winx Health's UTI Test + Treat kit, combines rapid diagnostic testing with integrated telehealth consultations and same-day prescription capabilities, fundamentally transforming patient engagement models. These innovative platforms enable patients to perform testing at home within 2 minutes and receive immediate virtual medical consultations for treatment initiation, eliminating barriers associated with traditional clinical visits. The market opportunity is particularly pronounced in developed regions where healthcare expenditure supports premium services and telemedicine integration, with home-based testing kits experiencing double-digit growth rates as awareness increases among women-focused health markets.

Emerging rapid antimicrobial susceptibility testing (AST) technologies represent a transformative opportunity to address antimicrobial resistance challenges and optimize treatment outcomes. Advanced molecular diagnostics including PCR-based testing and next-generation sequencing enable precise pathogen identification and antibiotic resistance detection within hours rather than traditional culture timeframes spanning 24-72 hours.

Recent developments in bacterial impedance cytometry technology (BICT) and point-of-care AST devices are generating significant clinical and economic value by enabling targeted antibiotic prescribing, reducing empirical treatment failure rates, and preventing unnecessary hospitalization. The FDA's recent authorization in February 2025 of the VersaTREK Compact System demonstrates regulatory momentum supporting rapid AST innovation. These technologies are projected to generate substantial economic benefits, with clinical modeling indicating potential net monetary benefits exceeding £4.3 million over multi-year implementation periods, creating compelling investment opportunities for healthcare systems prioritizing antimicrobial stewardship.

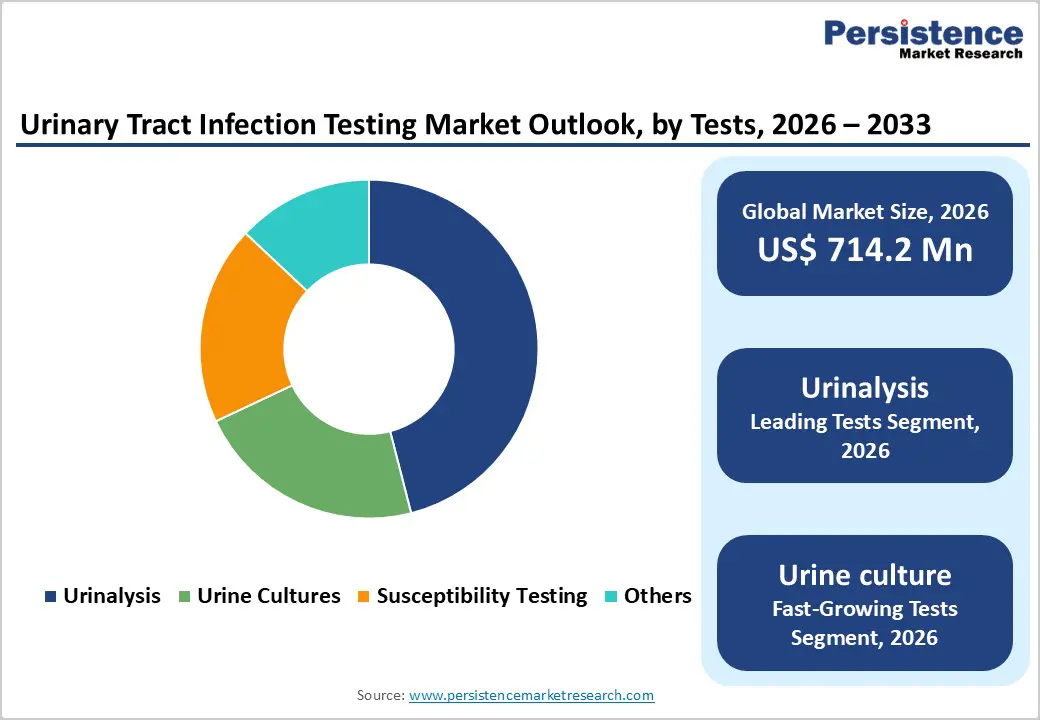

Urinalysis dominates the testing methodologies segment, commanding approximately 46% market share in 2025 and representing the most widely implemented UTI diagnostic approach globally. The dominance of urinalysis reflects its foundational role as the first-line screening test in clinical practice, combining cost-effectiveness with accessibility across diverse healthcare settings including hospitals, clinics, and outpatient facilities. Urinalysis encompasses multiple testing modalities including chemical dipstick analysis detecting leukocytes and nitrites, as well as microscopic sediment examination identifying urinary casts, crystals, and white blood cells. The established clinical utility of urinalysis in disease screening, combined with minimal technical requirements and rapid 2-minute results, sustains its market leadership. However, urine culture testing is emerging as the fastest-growing segment, driven by increasing recognition of its critical importance in identifying specific bacterial pathogens and determining antibiotic susceptibility patterns essential for targeted treatment decisions.

The product category segmentation reveals diverse diagnostic solutions addressing clinical and consumer needs across the UTI testing market. Test kits and reagents constitute the dominant product segment, encompassing dipsticks, immunoassay components, and chemical reagents required for routine diagnostic procedures. Instruments and analyzers represent a high-value segment including automated urinalysis platforms from manufacturers such as Sysmex Corporation, Siemens Healthineers, and Abbott Laboratories, which integrate multiple testing modalities including flow cytometry, digital microscopy, and connectivity solutions for enhanced laboratory workflow integration.

Dipsticks remain the most accessible product format for point-of-care and home-based testing applications, with reagent strips representing the consumable component driving recurring revenue generation. The competitive dynamics reflect differentiation strategies focused on automation levels, throughput capacity, multiplexing capabilities, and integration with laboratory information systems.

Hospitals and diagnostic laboratories collectively represent the dominant end-user segments, with clinical laboratories accounting for approximately 45% market share driven by high-volume testing requirements and advanced diagnostic infrastructure. Hospitals leverage sophisticated urinalysis systems to manage populations of catheterized patients at elevated UTI risk, requiring rapid diagnostic capabilities to guide clinical interventions and prevent complications including sepsis and prolonged hospitalization.

Diagnostic laboratories and independent testing facilities benefit from economies of scale associated with high throughput processing and automated specimen handling, enabling cost-effective delivery of UTI diagnostics across distributed geographic markets. Clinics and point-of-care settings are experiencing accelerated growth as healthcare systems implement rapid diagnostic protocols to enable immediate clinical decision-making. Home-care and self-testing segments represent the most dynamic growth opportunity, driven by consumer preferences for convenience and privacy, supported by FDA-cleared dipstick products and emerging integrated platforms combining testing with telehealth services.

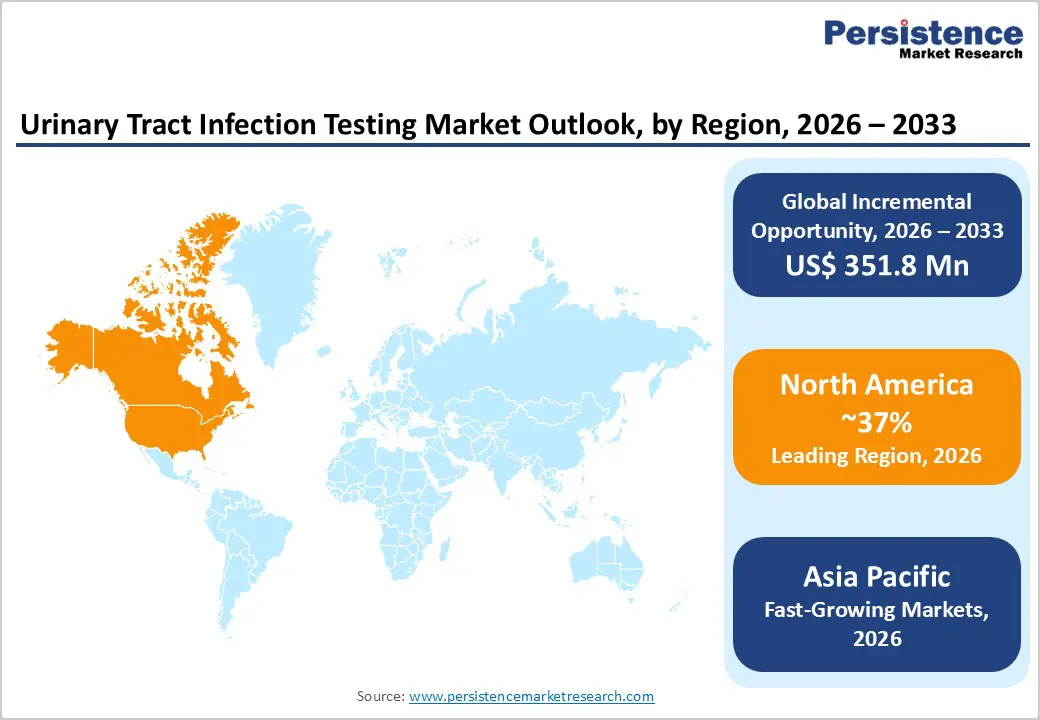

North America maintains market leadership with 37% regional market share in 2025, driven by sophisticated healthcare infrastructure, advanced diagnostic capabilities, and high disease awareness among the population. The United States specifically dominates the region with approximately 82% market share, supported by robust regulatory frameworks, well-established reimbursement mechanisms through Medicare, Medicaid, and private insurance systems, and substantial investments in diagnostic innovation by major healthcare organizations. The region's healthcare expenditure supports adoption of advanced urinalysis platforms incorporating artificial intelligence and automation technologies, with hospitals and diagnostic laboratories prioritizing rapid, accurate diagnostic solutions.

The North American market is characterized by active regulatory support for diagnostic innovation, exemplified by FDA approvals for novel testing platforms and recent clearance of rapid antimicrobial susceptibility testing devices. Major pharmaceutical and diagnostics companies including Abbott Laboratories, Bio-Rad Laboratories, and Roche AG maintain strong market presence through established distribution networks, healthcare provider relationships, and continuous product development initiatives focused on automation and accuracy enhancement.

Asia Pacific represents the fastest-growing regional market, projected to expand at accelerating growth rates driven by healthcare infrastructure modernization, rising healthcare expenditure, and increasing disease prevalence among expanding urban populations. China, India, and Japan are experiencing particularly robust growth trajectories, supported by government initiatives emphasizing diagnostic infrastructure development and precision medicine implementation. China's healthcare system is undergoing significant digital transformation with substantial government investments in advanced diagnostic technologies, while India's expanding diagnostic laboratory network and increasing medical device adoption create substantial market expansion opportunities.

The region benefits from manufacturing advantages including lower production costs and availability of skilled technical workforce, enabling regional manufacturers to compete globally while serving domestic markets. ASEAN countries demonstrate emerging growth potential as healthcare spending increases and awareness about UTI diagnostics expands among healthcare providers. Point-of-care testing adoption is accelerating across the region as healthcare systems seek to improve diagnostic access in resource-limited settings, with portable analyzers and rapid test kits gaining market acceptance among clinics and diagnostic laboratories serving underserved populations.

The competitive landscape in the global Urinary Tract Infection (UTI) Testing Market is highly dynamic and driven by technological innovation, rapid diagnostics, and strategic expansion. Major diagnostic firms are intensifying efforts to improve test accuracy, reduce turnaround times, and broaden geographic reach, particularly in high-growth regions. Competition centers on the development of advanced urinalysis systems, rapid point-of-care platforms, and molecular diagnostic tools that support efficient pathogen detection and antimicrobial resistance profiling.

The global Urinary Tract Infection Testing Market is projected to reach US$ 714.2 million in 2026.

Market growth is driven by the high global UTI burden (~150 million cases annually), higher prevalence among women and the elderly, and advances in rapid diagnostics, including point-of-care testing and automated urinalysis.

North America leads with a 37% market share in 2025, supported by advanced healthcare infrastructure, strong reimbursement systems, and high disease awareness.

Key opportunities include point-of-care and home-based testing, rapid antimicrobial susceptibility testing, and AI-enabled diagnostic platforms improving accuracy and efficiency.

ACON Laboratories Inc., Cardinal Health Inc., Danaher Corporation, SYSMEX CORPORATION., etc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn, |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Tests

Products

End-user

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author