ID: PMRREP34432| 205 Pages | 18 Feb 2026 | Format: PDF, Excel, PPT* | Consumer Goods

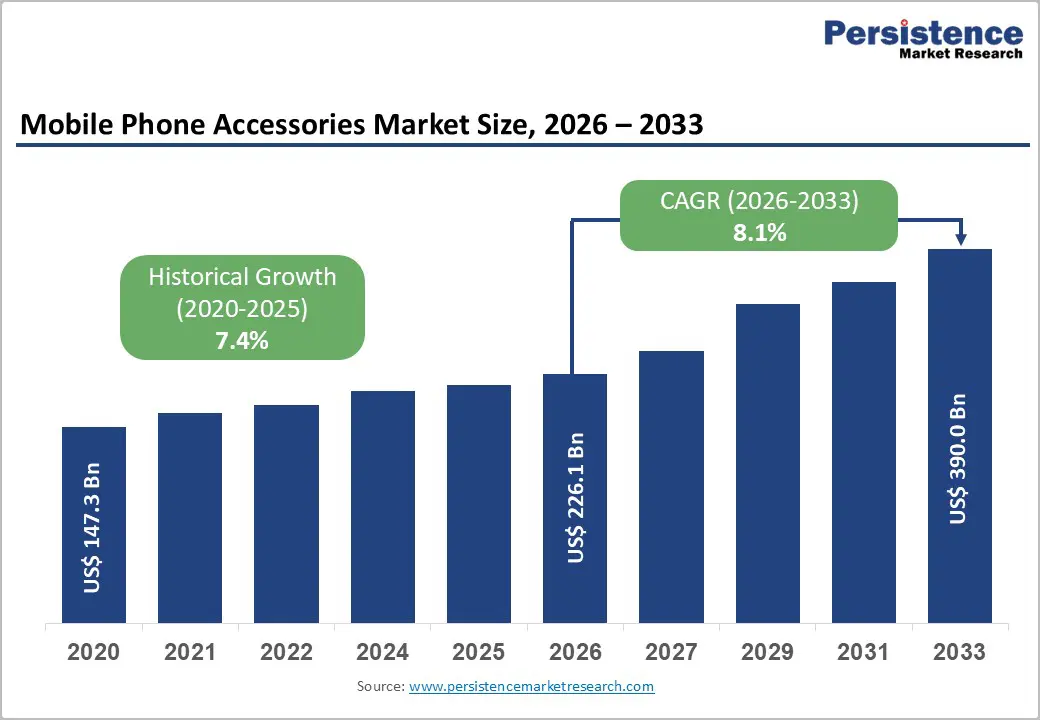

The global mobile phone accessories market size is expected to be valued at US$ 226.1 billion in 2026 and projected to reach US$ 390.0 billion by 2033, growing at a CAGR of 8.1% between 2026 and 2033. Rising smartphone penetration worldwide is a key growth catalyst, supported by expanding digital connectivity and evolving consumer lifestyles.

The widespread adoption of 5G-enabled devices is increasing demand for compatible chargers, power banks, audio devices, and protective cases. Urbanization and mobile-first behavior continue to boost accessory purchases, while innovation in wireless charging and smart peripherals strengthens ecosystem spending across both developed and emerging markets.

| Key Insights | Details |

|---|---|

| Mobile Phone Accessories Size (2026E) | US$ 226.1 billion |

| Market Value Forecast (2033F) | US$ 390.0 billion |

| Projected Growth CAGR (2026 - 2033) | 8.1% |

| Historical Market Growth (2020 - 2025) | 7.4% |

Rapid growth in global smartphone adoption continues to propel demand for mobile phone accessories, as users increasingly invest in products that enhance device functionality and longevity. GSMA reports smartphone connections reached 7.1 billion by the end of 2024, rising steadily from 6.5 billion in 2020, supported by affordable devices across emerging economies and expanding mobile broadband coverage.

The proliferation of 5G technology further accelerates accessory demand, particularly for fast chargers, advanced cables, and high-capacity power banks to support higher energy consumption. In markets such as India, rising smartphone ownership and growing e-commerce penetration are strengthening accessory sales. Manufacturers are responding with innovative, high-performance solutions that improve charging efficiency and overall user experience.

The rapid expansion of e-commerce platforms has significantly transformed the distribution landscape for mobile phone accessories, increasing accessibility and price transparency for consumers. According to global digital commerce trends, online retail continues to account for a growing share of accessory purchases, driven by convenience, competitive pricing, and broad product availability across international and regional marketplaces.

Digital platforms also enable data-driven marketing, flash sales, influencer promotions, and personalized recommendations that stimulate impulse buying behavior. In Asia Pacific and other high-growth regions, online marketplaces have become primary sales channels for accessories. This shift not only broadens consumer reach but also allows brands to quickly adapt to evolving trends, strengthening repeat purchases and overall market penetration.

Ongoing global supply chain disruptions continue to challenge mobile phone accessory manufacturers, leading to production delays and increased operational costs. Semiconductor shortages and fluctuations in raw material prices, including plastics and metals, have significantly impacted components used in chargers, cables, and audio devices, creating procurement uncertainties across key manufacturing hubs.

Geopolitical tensions and trade restrictions further intensify supply instability, affecting cross-border electronics trade flows. Rising logistics expenses and dependency on limited chip suppliers compress profit margins, particularly for small and mid-sized manufacturers. These constraints hinder timely product launches, slow innovation cycles, and create pricing pressures that ultimately influence consumer purchasing decisions.

The widespread availability of counterfeit mobile accessories presents a major restraint, particularly in price-sensitive and emerging markets. Low-cost imitation products, including fake chargers, cables, and cases, compete directly with branded offerings, often attracting consumers through aggressive pricing despite compromised quality and safety standards.

Counterfeit accessories not only erode revenue for legitimate manufacturers but also damage brand reputation and consumer trust. Safety risks such as overheating batteries and substandard materials further complicate the issue. Companies are increasingly investing in anti-counterfeiting technologies, authentication mechanisms, and stricter supply chain monitoring, yet enforcement challenges remain significant across global retail and online marketplaces.

Continuous innovation in wireless charging standards presents strong growth opportunities for mobile accessory manufacturers. The rapid adoption of next-generation wireless charging certifications has improved charging speed, efficiency, and cross-device compatibility, encouraging ecosystem-based purchasing. Expanding compatibility across iOS and Android devices is strengthening consumer confidence in wireless solutions.

Integration of magnetic alignment systems and automotive wireless charging pads further enhances convenience, particularly with the growth of electric vehicles and connected mobility. As premium smartphones increasingly support advanced wireless standards, accessory makers can tap into higher-margin product segments. Investment in research, certification compliance, and ecosystem partnerships will be critical to capturing long-term growth potential.

Increasing environmental awareness among consumers is generating new opportunities for sustainable mobile phone accessories. Demand is rising for biodegradable phone cases, recycled plastic materials, and reduced-plastic packaging solutions. Regulatory frameworks in Europe and North America are also encouraging manufacturers to adopt circular economy practices and improve product recyclability.

Sustainability-driven purchasing behavior is enabling brands to introduce premium eco-friendly product lines with differentiated positioning. Companies investing in carbon-neutral manufacturing, recycled content, and transparent sourcing practices can strengthen brand loyalty. As environmental policies tighten globally, sustainable innovation is expected to become a long-term competitive advantage within the mobile accessories market.

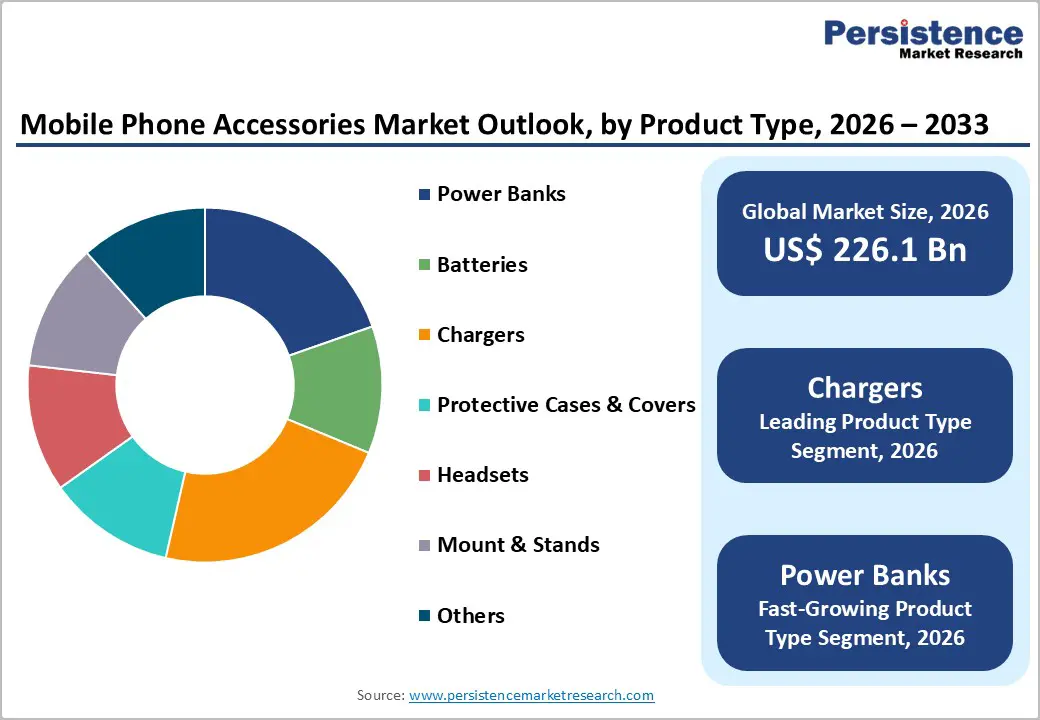

Chargers (Wired and Wireless) lead the product type segment, accounting for 34% of the market share in 2025. Their dominance is driven by increasing smartphone usage, battery-intensive applications, and rapid 5G adoption, which accelerates power consumption. Continuous advancements in fast-charging technologies, including Type-C compatibility and multi-device adapters, further strengthen demand. Consumers prioritize reliable and efficient charging solutions, making this segment a consistent revenue contributor across both developed and emerging markets.

Wireless charging accessories are emerging as the fastest-growing product category. Growing adoption of magnetic alignment systems, ecosystem-based accessories, and clutter-free charging solutions is driving momentum. Integration with premium smartphones and automotive charging pads is expanding use cases. As consumers shift toward convenience-focused and cable-free environments, wireless solutions are expected to witness accelerated adoption globally.

Branded accessories dominate the sales category with a 45% market share in 2025, supported by strong consumer trust and ecosystem compatibility. Established brands such as Apple and Samsung benefit from loyal customer bases that prefer official accessories to maintain device warranty and performance standards. Premium positioning, quality assurance, and consistent innovation allow branded products to command higher pricing and sustained demand across key regions.

Private-label and emerging third-party brands are witnessing rapid growth due to competitive pricing and expanding online visibility. Digital marketplaces enable smaller brands to reach global audiences quickly. Improvements in product quality and aggressive marketing strategies are helping these players attract cost-conscious consumers, intensifying competition within the overall sales landscape.

The Low (Below US$20) segment leads the price range category with a 50% market share in 2025, largely driven by price-sensitive consumers in emerging economies. Affordable cases, cables, and basic chargers experience high-volume sales due to mass smartphone penetration. Large-scale manufacturing hubs enable cost efficiencies, ensuring widespread availability across online and offline retail channels, thereby sustaining this segment’s volume dominance.

Premium-priced accessories are the fastest-growing segment, supported by rising disposable incomes and demand for high-performance products. Consumers increasingly seek durable materials, advanced features, and ecosystem-compatible devices. Growth in wireless charging, premium audio, and sustainable accessories is strengthening demand for higher-value products, particularly in developed markets.

E-commerce leads the sales channel segment with a 40% market share in 2025, driven by convenience, competitive pricing, and broad product availability. Online platforms enable consumers to compare features, read reviews, and access discounts, encouraging higher transaction volumes. Rapid digitalization and smartphone-based shopping continue to reinforce online dominance across both mature and emerging economies.

Direct-to-consumer brand websites and omnichannel retail models are growing rapidly as manufacturers seek greater margin control and customer engagement. Enhanced logistics, faster delivery services, and personalized marketing strategies are supporting this expansion. Brands increasingly leverage digital tools and influencer collaborations to strengthen online sales momentum.

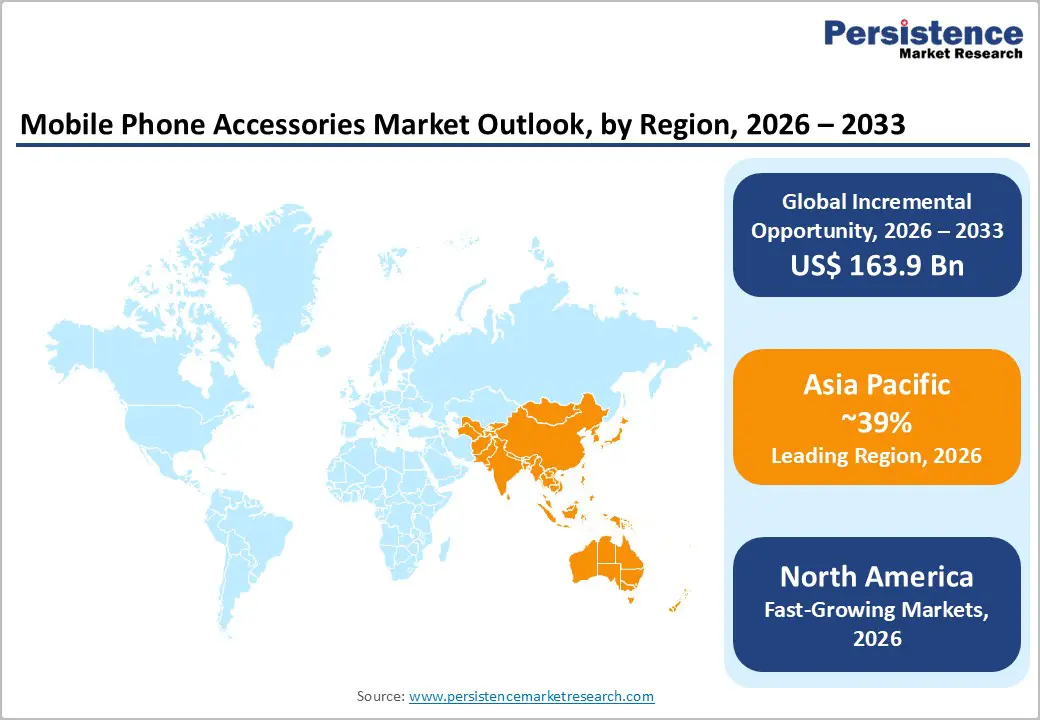

North America holds a significant 31% market share in 2025, driven by high smartphone penetration and strong demand for premium accessories. The United States leads regional consumption, supported by advanced retail infrastructure and strong brand loyalty toward ecosystem-compatible products. Strict regulatory standards for electronic safety and charging devices further enhance consumer confidence, encouraging purchases of certified chargers, power banks, and audio accessories.

Innovation remains a core growth driver across the region, particularly in wireless charging, GaN-based fast chargers, and smart ecosystem accessories. High disposable incomes and early adoption of next-generation smartphones sustain demand for premium and multifunctional products. Expanding direct-to-consumer strategies and technology-focused retail events continue to reinforce North America’s position as a mature yet innovation-driven market.

Europe represents a stable and innovation-focused market and is projected to grow at a CAGR of 6.5% through 2032. Germany, the U.K., and France remain key contributors, supported by harmonized regulatory frameworks such as CE certification standards. Strong emphasis on product safety, quality compliance, and environmental regulations shapes purchasing decisions across the region.

Sustainability trends are accelerating demand for eco-friendly accessories, recyclable materials, and minimal packaging solutions. Growing cross-border e-commerce and digital retail adoption are expanding market accessibility. Consumers increasingly prioritize durable, certified, and environmentally responsible products, encouraging brands to align with circular economy initiatives and long-term sustainability targets.

Asia Pacific leads the global market with a dominant 39% share in 2025 and is also the fastest-growing region. The region benefits from large-scale smartphone adoption, expanding middle-class populations, and strong manufacturing capabilities, particularly in China, India, and Southeast Asia. China remains a global production hub, supporting both domestic consumption and exports.

Rapid 5G rollout, rising digital lifestyles, and supportive government manufacturing initiatives further strengthen regional momentum. India’s expanding local assembly ecosystem and ASEAN’s growing demand for affordable smartphones are driving accessory sales. Increasing premiumization in Japan and South Korea also contributes to diversified growth, reinforcing Asia Pacific’s leadership in both production and consumption.

The mobile phone accessories market remains highly fragmented, characterized by the presence of numerous global brands, regional manufacturers, and unorganized third-party vendors. Competition is driven by product innovation, pricing strategies, and ecosystem compatibility. Leading participants focus on vertical integration, research and development, and proprietary technologies to strengthen brand differentiation and customer loyalty across premium segments.

Companies are increasingly leveraging sustainability certifications, smart app integrations, and enhanced product durability as competitive advantages. Direct-to-consumer e-commerce channels, subscription-based accessory upgrades, and bundled ecosystem offerings are gaining traction. Strategic partnerships, influencer marketing, and rapid product refresh cycles further intensify competition in this dynamic market landscape.

The global Mobile Phone Accessories market is expected to reach US$ 226.1 billion in 2026, driven by smartphone proliferation and e-commerce growth.

Key drivers include surging smartphone adoption with 7.1 billion connections and 5G rollout, alongside e-commerce expansion enabling 40% of sales.

Asia Pacific leads with a 39% market share in 2025, while North America holds 31%, reflecting strong consumer demand and manufacturing strength.

Sustainable eco-friendly accessories, aligned with EU recycled content mandates and 78% consumer preference for green products.

Leading companies include Apple Inc., Samsung Electronics, Anker, Belkin, and OtterBox, focusing on innovation and branding.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Sales Category

By Price Range

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author