ID: PMRREP34577| 199 Pages | 8 Oct 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

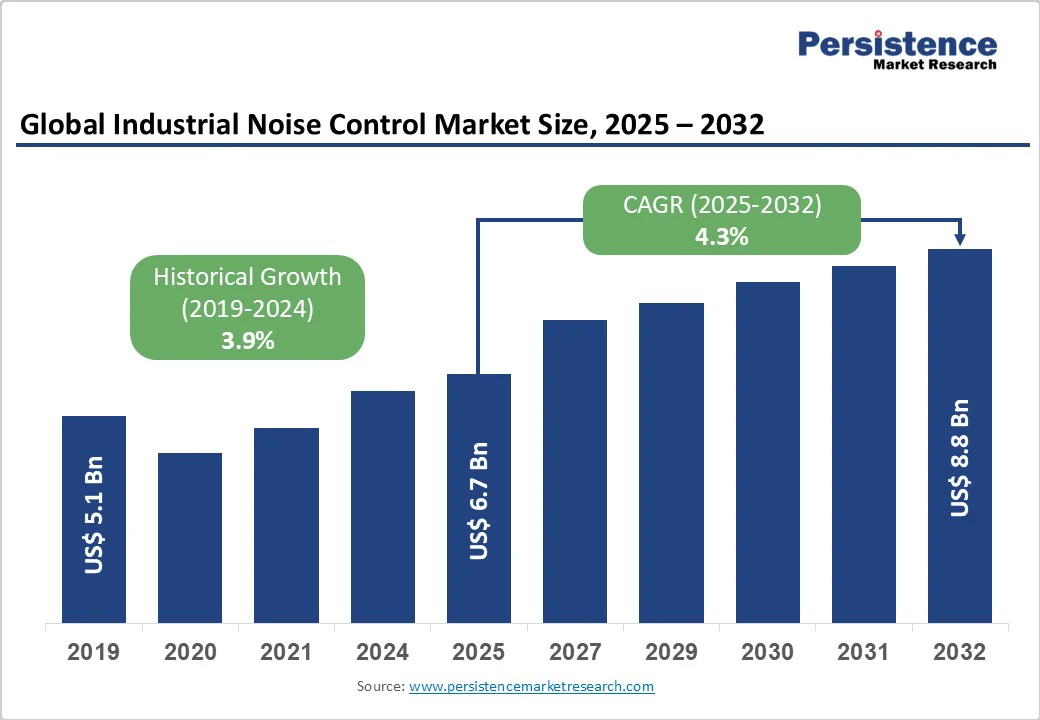

The global industrial noise control market size is likely to value at US$ 6.7 billion in 2025 and is projected to reach US$ 8.8 billion by 2032, growing at a CAGR of 4.3% between 2025 and 2032.

The growth trajectory is primarily driven by stringent regulatory frameworks, heightened awareness of occupational health risks, and rapid industrialization across emerging economies, particularly in Asia-Pacific.

| Key Insights | Details |

|---|---|

| Industrial Noise Control Market Size (2025E) | US$ 6.7 Bn |

| Market Value Forecast (2032F) | US$ 8.8 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.9% |

Government regulations worldwide are becoming increasingly stringent regarding workplace noise exposure limits. The Occupational Safety and Health Administration (OSHA) mandates that employers implement engineering controls when noise levels exceed 90 dBA as an 8-hour time-weighted average, with hearing conservation programs required at 85 dBA.

The European Union's Environmental Noise Directive (END 2002/49/EC) requires regular noise mapping and action planning in urban areas. These regulatory pressures are compelling industries to invest in advanced noise control solutions, with compliance costs driving significant market expansion across manufacturing, construction, and heavy industry sectors.

Rapid industrialization, particularly in Asia-Pacific countries, is creating substantial demand for noise control solutions. China's industrial development investments reached US$ 28 billion in 2024, while India's urbanization is expected to exceed 600 million people by 2032.

The region's construction sector is projected to grow at 6-8% annually, with automotive manufacturing contributing 35% of regional acoustic material demand. This industrial growth necessitates comprehensive noise management systems to protect worker health and meet international safety standards, particularly as multinational corporations establish operations in these markets.

The industrial noise control market faces restraints from high implementation and maintenance costs alongside significant technical complexity. Advanced acoustic systems require substantial capital, with installation costs ranging from $50,000 to $500,000 per facility, while annual maintenance adds 15-25% to operating expenses. Retrofitting older plants often doubles costs due to structural modifications and downtime, limiting adoption in cost-sensitive industries and developing regions.

At the same time, customization requirements add complexity, as each facility presents unique acoustic challenges demanding detailed sound mapping, modeling, and tailored solutions. The absence of standardized practices and the need for specialized expertise is further slow deployment. Integrating systems with existing processes and automation adds to technical hurdles, often causing operational disruptions during implementation.

The growing emphasis on Environmental, Social, and Governance (ESG) initiatives presents significant opportunities for sustainable noise control materials. Companies are increasingly adopting recycled polymers, natural fibers, and low-carbon composites, with the European Union's Circular Economy Action Plan driving demand for eco-friendly solutions.

Green building certification programs like LEED and NABERS are incorporating acoustic performance as key criteria, creating a market valued at approximately $15.3 billion by 2030. This sustainability focus is expected to drive innovation in biodegradable foam panels and recycled rubber barriers, positioning environmentally conscious manufacturers for premium market positioning.

Industrial noise control applications are expanding beyond traditional manufacturing into healthcare, education, and commercial real estate sectors. The healthcare industry's adoption of acoustic solutions for medical equipment noise reduction represents a high-growth segment, with hospitals investing in specialized sound isolation for MRI facilities and surgical suites.

Smart city initiatives are creating opportunities for integrated noise monitoring networks, with urban planning applications requiring sophisticated acoustic management systems. The data center industry's rapid expansion also presents significant opportunities, as cooling system noise management becomes critical for urban facility operations.

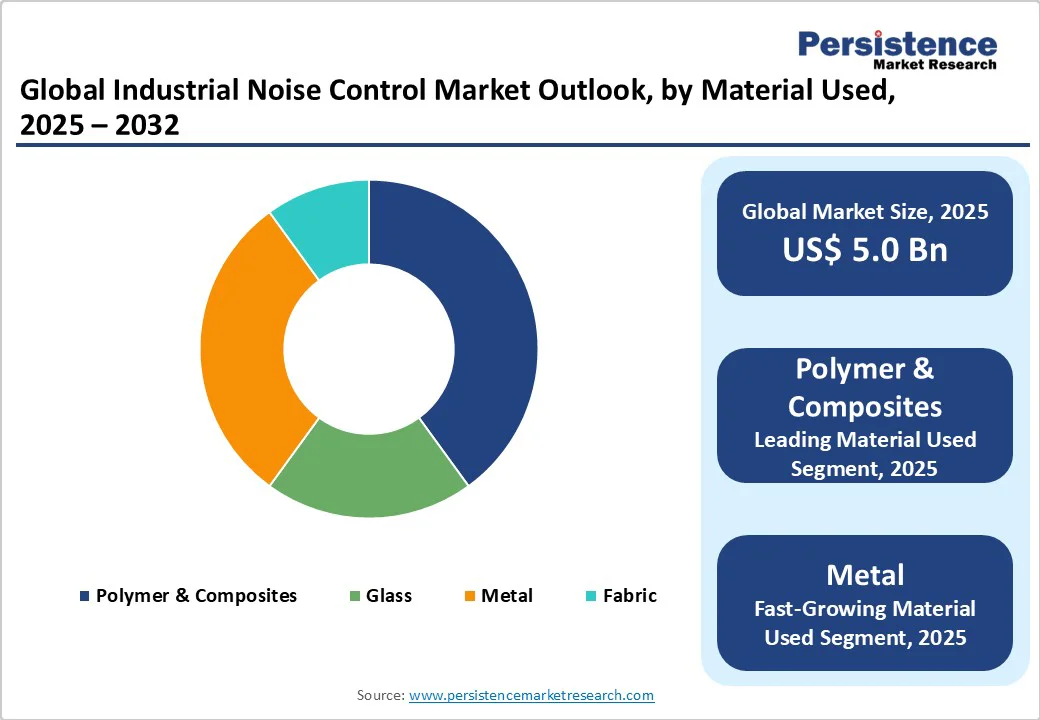

Polymer & Composites maintain market leadership with a commanding 54% market share. These materials excel due to their lightweight properties, superior durability, and exceptional noise absorption capabilities, making them ideal for automotive and construction applications. North American markets particularly favor polymer-based solutions due to stringent regulatory standards, while European adoption is driven by sustainability alignment with composite materials reducing overall environmental impact.

Metal emerges as the fastest-growing material segment, driven by industrial applications requiring high-temperature resistance and structural durability. Metal-based acoustic solutions are gaining traction in aerospace, heavy machinery, and energy sectors where traditional materials cannot withstand extreme operating conditions.

The development of perforated metal panels and engineered acoustic metals is expanding applications in architectural and industrial environments, with growth rates exceeding the overall market average by 1.5-2 percentage points.

Flexible noise control products hold a dominant 44% market share, valued at about US$ 2.6 billion. These solutions, including acoustic curtains, barriers, and membranes, are preferred for their adaptability and ease of installation across varied industrial settings. Demand is strong in North America and Europe, driven by stringent workplace safety standards and the widespread presence of automotive and manufacturing industries.

Vibration Isolation products represent the fastest-growing segment, playing a crucial role in minimizing noise from industrial machinery. They are particularly vital in aerospace, defense, and precision manufacturing, where vibration control ensures operational accuracy. Growth is accelerated by advances in damping materials and integration with predictive maintenance systems in regions with advanced manufacturing ecosystems.

Industrial Machinery applications account for a commanding 41% market share, underscoring the critical role of noise control in manufacturing environments. This dominance is supported by extensive use across automotive, aerospace, and heavy equipment industries, where strict worker safety regulations necessitate robust acoustic solutions. The segment includes noise management for production lines, assembly operations, and material handling, with particular strength in developed industrial regions.

Electrical & electronics equipment emerges as the fastest-growing segment, fueled by the expansion of data centers, telecom networks, and consumer electronics production. Rising demand for cooling systems, server farms, and sensitive electronic environments drives adoption of tailored noise control solutions. These systems also mitigate electromagnetic interference, aligning with digital transformation and IoT integration trends worldwide.

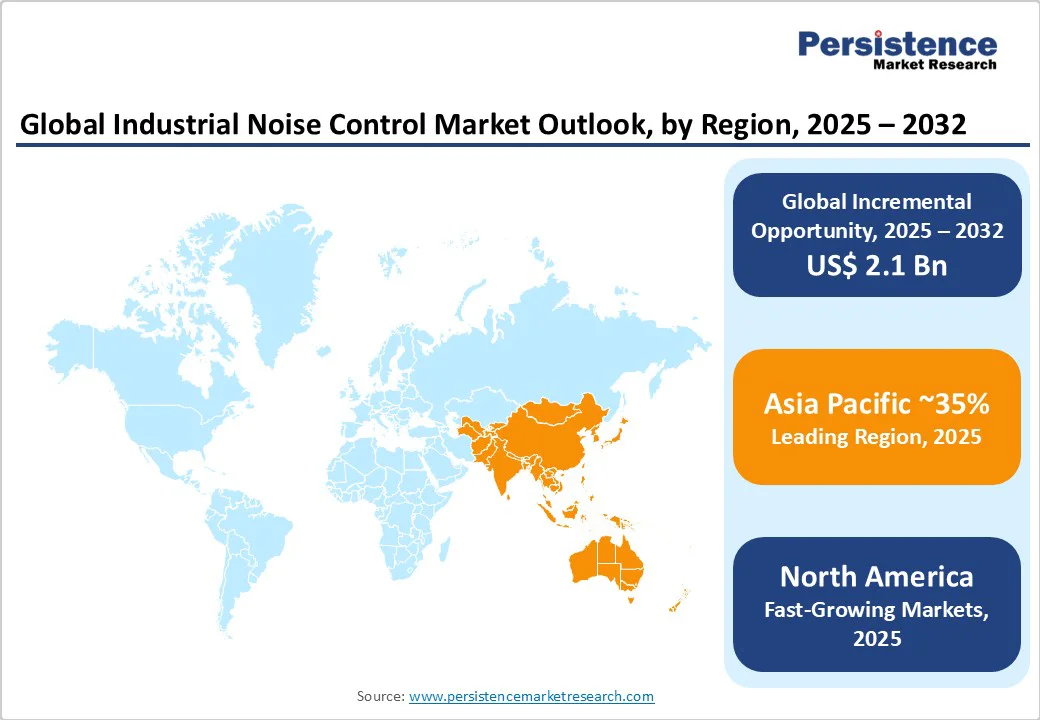

North America holds a strong position in the global noise control market, capturing around 25% share and valued at approximately US$ 2.5 billion in 2025. Growth is driven by OSHA’s strict noise exposure limits of 90 dBA and mandatory hearing conservation programs at 85 dBA, ensuring steady compliance-based demand. The region’s well-established automotive and aerospace industries, coupled with the rising adoption of IoT-enabled monitoring and sustainable acoustic materials, further support expansion.

Investments are increasingly directed toward predictive maintenance capabilities and advanced smart noise control systems. The competitive landscape features leading players such as 3M, Armstrong World Industries, and USG Corporation, with market consolidation fueled by acquisitions and technology-focused partnerships that strengthen product portfolios and regional competitiveness.

Europe industrial noise control market is approximately valued at US$ 2.3 billion in 2025, with Germany, France, and the UK leading regional demand. Growth is driven by the EU’s Environmental Noise Directive mandating urban noise management, Germany’s US$ 52.12 billion semiconductor production requiring advanced acoustic control, and the region’s commitment to green building standards. Harmonized EU noise regulations and certifications like LEED and NABERS reinforce consistent adoption.

The competitive landscape is shaped by leaders such as ROCKWOOL International holding 20% share in mineral wool acoustics alongside Saint-Gobain and BASF, with a strong focus on sustainable innovations. Investment trends highlight eco-friendly acoustic materials, smart city noise monitoring networks, and integration with industrial automation, particularly in Germany’s advanced manufacturing and France’s expanding transport infrastructure projects.

Asia Pacific dominates the global noise control market, holding 35% share and valued at US$ 3.4 billion in 2032. China drives demand through US$ 28 billion industrial investments in 2024, while India’s urbanization toward 600 million residents by 2032 fuels infrastructure expansion. Regional strengths include cost-efficient manufacturing, robust supply chains, and supportive policies such as China’s “Green Building” standards and India’s Smart Cities Mission.

China accounts for 35% of regional demand via automotive growth, Japan advances IoT-based noise control, and India enforces 75 dB daytime limits. Investment focuses on high-speed rail soundproofing, EV noise management, and smart city acoustic systems. The competitive landscape combines global leaders with regional players, offering opportunities in EV acoustics and industrial automation integration.

The global industrial noise control market features a competitive landscape characterized by a mix of established players and emerging innovators striving to expand their market presence.

The key players such as Rockwool International, Saint-Gobain, and 3M Company dominate the market with their extensive product portfolios and strong distribution networks. Such companies focus on continuous product innovation to offer advanced noise control solutions that cater to diverse industrial applications.

Additionally, strategic collaborations, mergers, and acquisitions are prevalent strategies among market players to enhance their technological capabilities and expand into new geographic regions. The competitive environment is further intensified by stringent regulatory requirements and the increasing emphasis on sustainable practices, prompting companies to invest in eco-friendly noise control technologies to gain a competitive edge.

The Industrial Noise Control market is estimated to be valued at US$ 6.7 Bn in 2025.

The key demand driver for the Industrial Noise Control Market is the growing emphasis on workplace safety and regulatory compliance with noise exposure standards set by agencies such as OSHA, NIOSH, and the European Union.

In 2025, the Asia Pacific is likely to dominate with 35% revenue share in the global Industrial Noise Control market.

Among the Product Type, Flexible holds the highest preference, capturing beyond 44.3% of the market revenue share in 2025, surpassing other parts.

The key players in the Industrial Noise Control market are 3M Company, Saint-Gobain S.A., ROCKWOOL International A/S, BASF SE and Armstrong World Industries.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author