ID: PMRREP25210| 190 Pages | 5 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

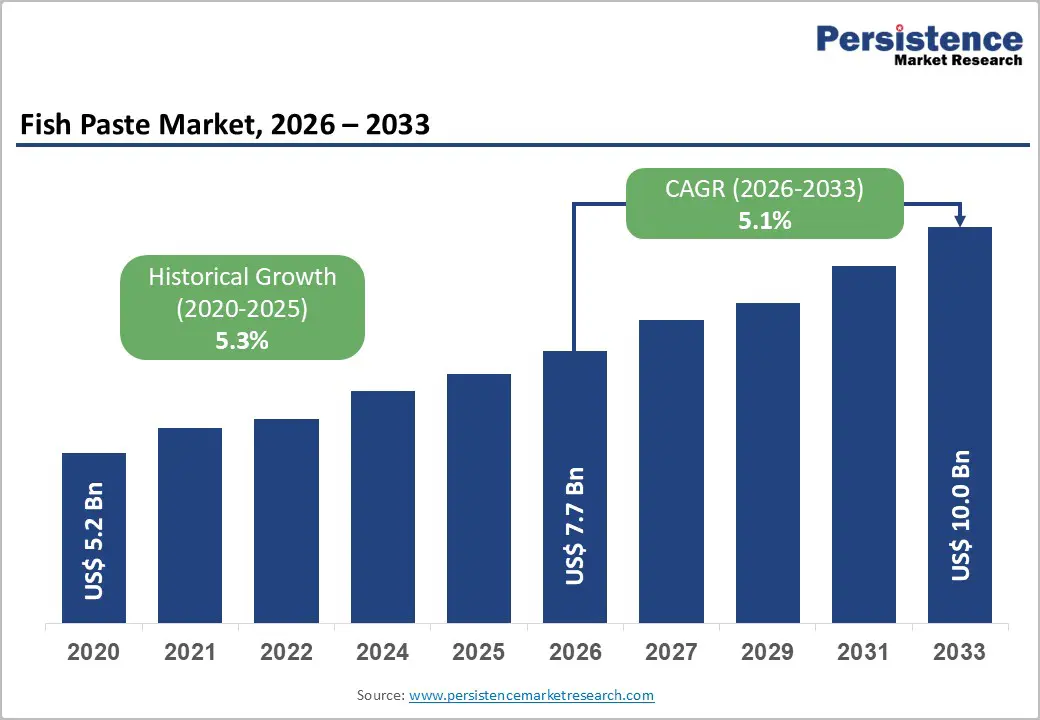

The global fish paste market size is likely to be valued at US$ 7.7 billion in 2026, and is projected to reach US$ 10.0 billion by 2033, growing at a CAGR of 5.1% during the forecast period 2026 - 2033.

This upward path reflects persistent needs fueled by elevated protein intake worldwide, heightened wellness awareness, and versatile roles in food manufacturing. Demographic changes have boosted uptake of nutrient-packed seafood options, especially in developing regions where rising incomes spur varied eating habits. Processing innovations and extended preservation techniques have elevated quality and longevity, facilitating wider distribution. Market players targeting ready-to-eat meals and snacks will gain from fish paste's binding efficiency and flavor enhancement, aligning with convenience trends. Their future strategies should focus on blending the product into plant-seafood hybrids for broader appeal, securing margins in health-driven channels amid intensifying sustainability scrutiny.

| Key Insights | Details |

|---|---|

| Fish Paste Market Size (2026E) | US$ 7.7 Bn |

| Market Value Forecast (2033F) | US$ 10.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.3% |

The aquaculture sector increasingly relies on fish paste products as a critical input in feed formulations, particularly fish soluble paste used in intensive and semi-intensive farming systems. Producers value these ingredients because they improve feed performance by enhancing palatability and nutrient utilization in farmed species such as shrimp, salmon, tilapia, and carp. Fish paste also supports consistent feed quality, which helps aquaculture operators manage growth cycles, reduce feed wastage, and improve overall biomass yield. This creates a predictable, contract-based demand profile that tends to be less volatile than direct consumer markets, giving manufacturers better planning visibility and operational stability.

Fish-based ingredients hold a premium position in aquafeed portfolios due to their balanced amino acid composition and high biological value, which support animal health and survival rates. Suppliers that can provide traceable sourcing, standardized composition, and application-specific formulations are better positioned to build long-term relationships with large feed mills and integrated aquaculture companies. This business-to-business focus complements retail and foodservice channels by diversifying end-use exposure and reducing dependence on any single demand driver. For manufacturers, aligning product development with evolving aquaculture practices and sustainability expectations can unlock higher-margin, value-added opportunities across both established and emerging farming regions.

Regulatory oversight in the fish paste industry covers food safety, product quality, and end-to-end traceability across harvesting, processing, packaging, and distribution. Authorities in major markets require controls for contaminants such as heavy metals, pathogenic microorganisms, and undeclared allergens, along with clear origin and species identification on labels. International frameworks such as Codex Alimentarius encourage producers to implement structured quality management systems that include hazard analysis, preventive controls, and documented traceability. These expectations often require investments in laboratory testing, certification, and audit readiness, which can place particular pressure on small and medium-sized enterprises that aim to supply cross-border or premium channels.

Regulatory compliance and food safety can function as both a barrier and a differentiator. Companies that adopt robust protocols for allergen management, contaminant monitoring, and origin verification can position their brands as lower-risk partners for global retailers and food manufacturers. Growing public awareness of issues such as mercury exposure, microplastic contamination, and unsustainable fishing practices also drives demand for independent certifications and transparent sourcing claims. Manufacturers that treat compliance as part of their value proposition, rather than only as a minimum requirement, can justify premium pricing, access more demanding markets, and reduce the likelihood of recalls or trade disruptions, which ultimately protects brand equity and long-term profitability.

Expansion opportunities in the fish paste category are particularly compelling in emerging economies where rising disposable incomes encourage households to move from carbohydrate-heavy staples to more varied protein sources. Markets in Asia Pacific, Latin America, and Africa benefit from strong cultural familiarity with seafood, longstanding culinary traditions that already use fermented or processed fish products, and young, urbanizing populations that are receptive to convenient packaged formats. Countries such as India, Indonesia, Vietnam, and Thailand combine extensive coastal populations with expanding modern retail networks and foodservice chains, which creates more occasions for fish paste consumption in both home cooking and out-of-home settings. These conditions support a gradual shift from informal, unpackaged products to branded, standardized offerings that can meet higher expectations for quality, safety, and consistency.

Companies can refine their approach by aligning product formats, flavor profiles, and pack sizes with local eating habits and purchasing power. Regional producers can differentiate through authentic taste, understanding of local dishes, and agile responses to channel dynamics in traditional trade and wet markets, while multinational corporations can use their scale in sourcing, marketing, and technology to strengthen their presence in supermarkets, hypermarkets, and e-commerce. Success in these markets also depends on interpreting dietary diversification trends, such as increasing interest in healthier protein choices and convenient ready-to-use ingredients for time-constrained consumers. Firms that invest in consumer education, localized product development, and partnerships with domestic distributors are better positioned to secure early-mover advantages and build resilient, multi-country growth platforms.

Tuna is slated to maintain a dominant position in 2026, with an estimated 45% of the fish paste market revenue share. This leadership stems from tuna’s wide availability, relatively neutral flavor profile, and strong consumer acceptance across a broad range of culinary applications. Tuna-based fish paste offers good binding properties and high protein levels, which makes it well suited for processed food products such as surimi, spreads, and sandwich fillings. The species also benefits from established global supply chains, with key sourcing bases in Southeast Asia, Latin America, and the Pacific Islands, which support reliable raw material access for manufacturers.

Salmon is likely to be the fastest-growing segment during the 2026 - 2033 forecast period. This accelerated growth reflects multiple favorable trends including salmon's premium positioning, rich omega-3 fatty acid content, and association with health and wellness trends. Norwegian and Chilean salmon farming industries provide stable, high-quality supply streams supporting product consistency. Consumers increasingly perceive salmon as a superior nutritional choice, commanding price premiums justified by documented cardiovascular and cognitive health benefits. Product innovation focuses on value-added formats including flavored salmon paste, organic variants, and convenient single-serve packaging targeting urban professionals and health-conscious demographics.

Food products are anticipated to hold the highest revenue share, estimated to touch 65% in 2026. This category covers a wide range of end uses, including sauces, spreads, dressings, soups, and snack products where fish paste functions as either a primary component or a flavor-enhancing ingredient. Its prominence reflects entrenched usage patterns in many Asian cuisines, where fish paste-based condiments play a traditional role in everyday cooking and occasion-based meals. Southeast Asian markets in particular exhibit high per-capita consumption, with items such as Vietnamese fermented fish paste and Thai fish sauce derivatives retaining strong cultural and culinary relevance.

Food processing is expected to be the fastest-growing segment over the 2026 - 2033 period. This segment covers the use of fish paste as an ingredient or additive in processed foods, frozen meals, instant soups, and snack products, where it contributes both functional and sensory value. Manufacturers rely on fish paste for its ability to improve texture, support nutritional fortification, and build depth of flavor in formulations that target mainstream and premium consumer segments. The growth trajectory of this application aligns with broader industry priorities such as protein enrichment in packaged foods and rising interest in clean-label ingredient systems that deliver nutritional benefits without synthetic additives.

Supermarkets are poised to lead with an approximate 55% fish paste market share in 2026. This segment’s strength reflects consumer preference for one-stop shopping. Consumers prefer supermarkets because they can buy multiple items in one trip, physically inspect products before purchase, access regular promotions and loyalty rewards, and get immediate availability without delivery wait times. Large retail chains such as Walmart, Carrefour, Tesco, and leading regional supermarket groups support this behavior by allocating dedicated space in Asian food aisles and seafood sections, which increases product visibility and simplifies choice for time-constrained households.

Online stores are forecasted to be the fastest-growing segment from 2026 to 2033, on account of fundamental shifts in consumer shopping behavior and digital commerce infrastructure development. E-commerce platforms including Amazon, specialized Asian grocery websites, direct-to-consumer brand sites, and food delivery applications have transformed fish paste market accessibility. Consumers benefit from accessing extensive product varieties including artisanal, organic, and imported premium fish paste options rarely available in conventional supermarkets. Detailed product information, ingredient transparency, customer reviews, and recipe suggestions enhance purchase confidence, particularly important for products requiring consumer education.

Asia Pacific market is likely to be the leading and fastest-growing market for fish paste at roughly 55% in 2026, supported by strong cultural, demographic, and structural fundamentals. The region’s dominance stems from the deep integration of fish-based condiments in everyday cooking, large coastal populations that rely on seafood as a primary protein source, and a rapidly expanding middle class that is trading up to packaged, branded products. Within this landscape, China anchors regional demand and supply through its extensive aquaculture base, large-scale processing capacity, and vast domestic consumer market, while Japan contributes as a high-value, technology-intensive hub with advanced capabilities in surimi and kamaboko-style products. Markets such as India and Southeast Asian countries increasingly complement these anchors by combining growing purchasing power with long-standing culinary familiarity with fermented and processed fish preparations.

Asia Pacific offers manufacturers a compelling combination of cost efficiency and demand visibility. Proximity to key fishing grounds and aquaculture centers, along with relatively lower labor costs and established logistics networks, supports competitive production economics for both domestic sales and exports. Policy support for aquaculture and seafood processing in several countries further reinforces the investment case, particularly for capacity expansion, cold chain upgrades, and innovation in value-added formats and applications. Companies that align product portfolios with local taste profiles, invest in quality and food safety systems, and build resilient sourcing relationships are better positioned to capture sustainable growth in this region.

Europe holds for a substantial share of the global fish paste consumption and shows steady, quality-driven growth supported by mature seafood traditions and sophisticated retail and foodservice channels. Northern and Western European countries have long-standing seafood consumption habits and well-developed supermarket networks, which make them natural entry points for both mainstream and premium fish paste offerings. The widespread demand for fish paste signals the growing influence of Asian cuisines in major cities, growing health awareness around omega-3 rich foods, and larger immigrant communities that maintain traditional eating patterns and drive turnover in ethnic and specialty formats. In higher-income markets such as Germany, France, and the United Kingdom, consumers also show strong interest in artisanal and gourmet products, particularly those that emphasize traditional fermentation methods and authentic Southeast Asian sourcing.

Europe offers attractive opportunities for producers that can meet stringent regulatory, sustainability, and quality expectations while differentiating on origin, processing method, and flavor profile. Harmonized food safety rules under European Union legislation simplify cross-border trade within the bloc but require robust compliance systems, including traceability, labeling, and contamination controls. Sustainability criteria, including certifications such as Marine Stewardship Council (MSC), carry increasing weight in purchasing decisions, especially in Scandinavian and Northern European markets where retailers and consumers prioritize responsible sourcing.

North America is likely to capture a considerable share of the fish paste market, as it combines mature demand pockets with underdeveloped growth niches. The United States anchors regional activity, supported by Asian diaspora communities that sustain demand for traditional condiments, sauces, and surimi-based items, alongside a broader shift toward seafood as a perceived healthier protein choice. Canada adds to regional scale through strong seafood-processing capabilities in Atlantic Provinces and growing interest in global cuisines in urban centers, which supports both domestic brands and imported products. Rising visibility of Asian and fusion restaurants, increased retail assortment of international foods, and steady surimi consumption in formats such as imitation crab all reinforce the role of fish paste as a versatile input across foodservice and packaged food applications.

North America offers an attractive but demanding environment where regulatory expectations, sustainability scrutiny, and channel dynamics all shape competitive positioning. Robust food safety oversight by authorities such as the United States Food and Drug Administration (FDA) creates a high baseline for compliance but also underpins consumer trust, particularly for refrigerated, frozen, and ready-to-eat products. The region’s innovation ecosystem, which includes universities, food science institutes, and corporate R&D centers, supports development of new textures, flavors, and formats that use fish paste as a base, including value-added seafood snacks and convenient meal components.

The global fish paste market structure displays moderate fragmentation, where leading companies such as Hakka Pty Ltd, LI Chuan Food Products Pte Ltd, Mannarich Food Inc., Princes Limited, and Blueline Foods Pvt Ltd have collectively secured 25-30% market share. This structure has mirrored diverse regional tastes, distinct product standards, and the prevalence of small processors catering to nearby consumers. Dominance has shifted across areas and categories, as no universal leader has commanded broad control worldwide. Local operators have strengthened home turf advantages via cultural relevance, direct sourcing ties, and time-tested methods. Such dynamics have enabled varied approaches encompassing upscale positioning, volume-based pricing, and targeted expertise.

Business strategies should focus on exploiting this landscape by tailoring portfolios to local nuances while scaling for efficiency in high-demand zones. Blending traditional appeal with modern packaging innovations will differentiate offerings amid intensifying competition. Forward-looking firms stand to gain through supplier alliances and certification pursuits that elevate trust, ensuring resilience in a market favoring adaptability over outright consolidation.

The global fish paste market is projected to reach US$ 7.7 billion in 2026.

The market is driven by a steadily growing demand for protein-rich seafood, expanding aquaculture and feed applications, and wider use of fish-based seasonings in processed foods and traditional cuisines.

The market is poised to witness a CAGR of 5.1% from 2026 to 2033.

Key opportunities lie in clean-label and functional product innovation, and higher-value applications in aquaculture feed, gourmet condiments, and byproduct-based sustainability solutions.

Hakka Pty Ltd, LI Chuan Food Products PTE LTD, Mannarich Food Inc., Princes Limited, and Blueline Foods Pvt Ltd. are some of the key players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Species

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author