ID: PMRREP28513| 186 Pages | 6 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

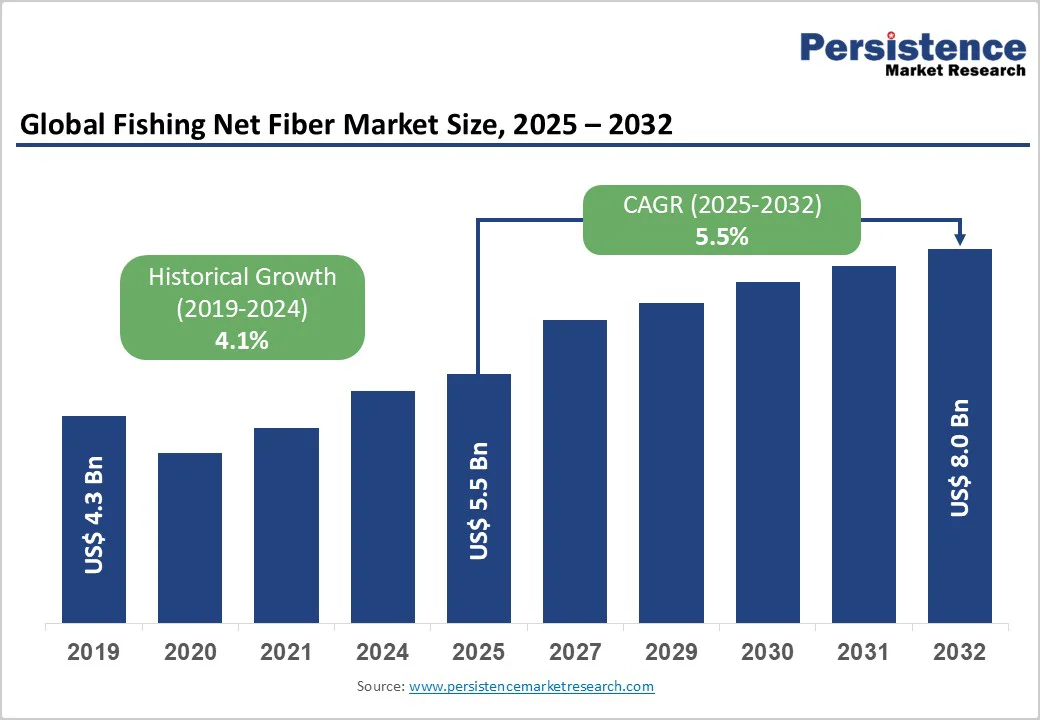

The global fishing net fiber market size is likely to value at US$ 5.5 billion in 2025 and is projected to reach US$ 8.0 billion, growing at a CAGR of 5.5% between 2025 and 2032.

This robust growth trajectory is propelled by the expanding aquaculture sector combined with increasing seafood consumption patterns worldwide.

According to the Food and Agriculture Organization, total aquatic animal production is estimated to reach approximately 202 million tons by 2030, while capture fisheries are forecasted to grow by 6% from 2020 to 2030, reaching 96 million tons.

| Key Insights | Details |

|---|---|

| Fishing Net Fiber Market Size (2025E) | US$ 5.5 Bn |

| Market Value Forecast (2032F) | US$ 8.0 Bn |

| Projected Growth CAGR (2025 - 2032) | 5.5% |

| Historical Market Growth (2019 - 2024) | 4.1% |

The steady expansion of global aquaculture and commercial fishing activities serves as a major catalyst for the fishing net fiber market. FAO data indicates that global aquaculture and fisheries production rose by 1.2% in 2022 to 184.1 million tons, with aquaculture contributing a 2.6% increase.

This surge directly heightens the demand for durable, high-tensile fibers such as polyamide and polyester, which are essential for manufacturing nets capable of enduring continuous marine exposure and heavy operational loads.

Asia Pacific dominates global aquaculture output, led by China, India, and Indonesia, accounting for over 90% of total production. The expansion of offshore aquaculture systems and deeper-water fishing operations further amplifies fiber demand, requiring materials with superior resistance to saltwater corrosion, UV exposure, and mechanical stress.

The rise in per capita seafood consumption, projected to reach 21.4 kg by 2030, continues to support long-term market growth.

Rapid innovations in fiber materials and production technologies are significantly transforming fishing net performance and lifespan. Modern nylon monofilament fibers, extruded at temperatures between 260 °C and 270 °C, provide exceptional tensile strength, abrasion resistance, and dimensional stability, outperforming traditional polypropylene alternatives.

Major chemical manufacturers such as BASF SE have introduced advanced copolyamide grades like Ultramid C37LC, improving tear resistance and knot strength while simplifying processing steps for net makers.

Sustainability-focused advancements are also shaping product development. Royal DSM’s Akulon RePurposed and Toray Industries’ recycled polymer fibers, both derived from discarded nets, offer high mechanical performance comparable to virgin materials.

The adoption of such eco-efficient fiber technologies, alongside innovations in HDPE-based netting for aquaculture, enhances operational reliability and supports the global transition toward durable and environmentally responsible fishing equipment.

The absence of effective recycling infrastructure for synthetic fishing net fibers poses a major barrier to achieving circularity in the fishing gear sector. Although global programs like the Global Ghost Gear Initiative (GGGI) and the Ellen MacArthur Foundation’s Circular Economy Network promote recovery and reuse, less than 1% of nylon waste from marine sources is recycled due to contamination, mixed polymer content, and high costs.

Projects such as Aquafil’s ECONYL® system show progress but remain regionally limited and expensive to operate. Fragmented collection systems in coastal regions further impede recycling at scale, increasing dependence on virgin petrochemical feedstocks and hindering manufacturers’ ability to meet sustainability goals and extended producer responsibility mandates.

The market’s transition to bio-based fishing net fibers such as PLA, PHA, and bio-nylon faces technical and performance-related challenges. While eco-friendly materials gain regulatory traction, they often underperform compared to nylon and HDPE in terms of tensile strength, UV stability, and durability under prolonged seawater exposure.

Frequent replacement needs increase operational costs, while high feedstock prices and limited biopolymer capacity restrict production scalability. Additionally, manufacturers struggle to meet ISO and FAO standards for marine-grade applications. These technological and economic limitations delay the widespread adoption of biodegradable fishing net fibers, constraining sustainability-driven growth despite rising environmental and policy pressures.

The growing global shift toward environmental sustainability and circular economy models presents major opportunities for fishing net fiber manufacturers developing biodegradable and recyclable materials.

Companies such as Aquafil have pioneered ECONYL® regenerated nylon, produced through chemical recycling of discarded fishing nets, reducing CO? emissions by up to 90% compared to virgin nylon production. Similarly, GAIA Biomaterials’ Biodolomer®Ocean offers PBS-based biodegradable nets that naturally decompose within years if lost at sea, unlike conventional nylon that persists for centuries.

Supported by programs such as the Sustainable Manufacturing and Environmental Pollution Programme (SMEP), biodegradable fishing gear development is gaining momentum, offering manufacturers a chance to capture value in a US$ 28.2 billion market by 2034.

The industry’s growing preference for eco-friendly alternatives aligns with tightening regulations and the estimated 640 million kg of fishing gear discarded annually, emphasizing the commercial potential of sustainable net fiber innovations.

The modernization of global aquaculture systems, particularly offshore fish farming and recirculating aquaculture systems (RAS), is accelerating demand for advanced fishing net fibers with high tensile strength, abrasion resistance, and anti-fouling properties. High-performance aquaculture nets can reduce fish escape losses by up to 90% and improve productivity by nearly 20%, making them critical to next-generation farming efficiency.

Companies such as Garware Technical Fibres Ltd. have developed cage netting products like VIKING PLUS and SAPPHIRE EXCEL PLUS, offering superior water flow, abrasion resistance, and extended durability.

With global aquaculture infrastructure investments surpassing US$ 2 billion in 2023, particularly in Norway, India, and Chile, demand for specialized fiber materials is poised to rise further. These innovations support long-term operational cost savings and sustainability-driven expansion in the fishing and aquaculture sectors.

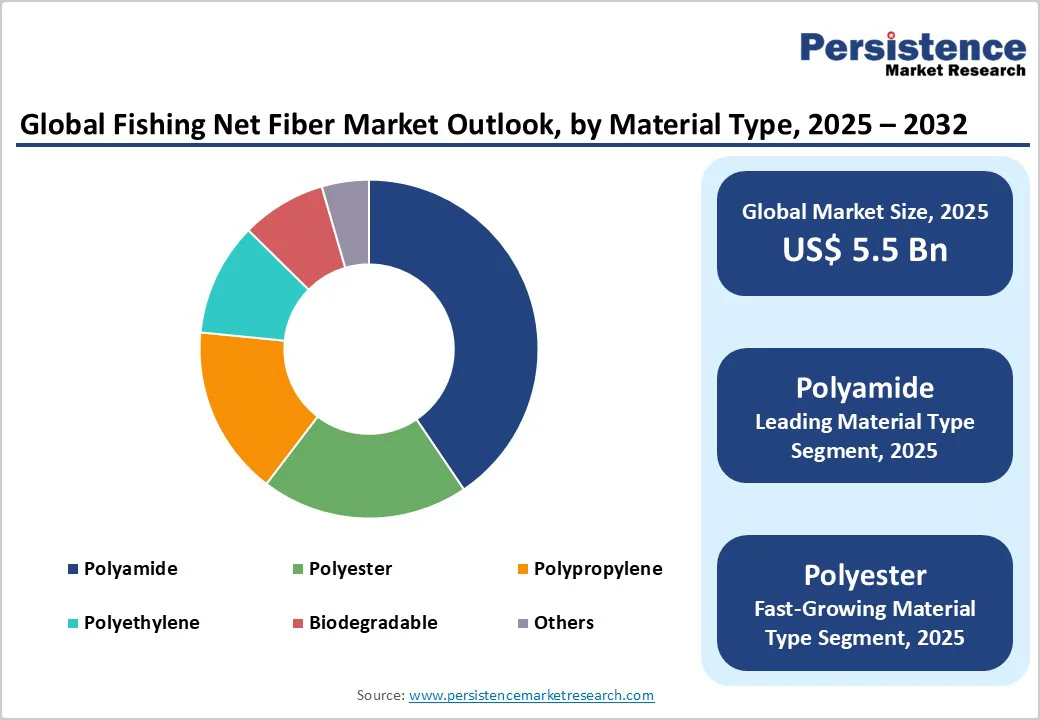

Polyamide (Nylon) remains the leading material with around 42% share, valued for its high tensile strength, abrasion resistance, and cost efficiency in demanding marine environments. Nylon monofilament’s superior performance and recyclability, supported by innovations like BASF’s Ultramid® and DSM’s Akulon RePurposed reinforce its dominance.

Polyester (PET) is the fastest-growing category due to its UV resistance, low water absorption, and dimensional stability. Leading producers such as Toray Industries and Indorama Ventures are expanding PET production and recycled PET (rPET) initiatives for aquaculture nets, trawls, and purse seines. Polyester’s strength, longevity, and sustainability profile are accelerating its adoption across modern fishing applications.

Monofilament nets dominate the market with roughly 38% share, offering optimal strength, lightness, and smoothness that minimize drag and algae accumulation. Manufacturers like Perlon-Monofil GmbH produce advanced variants such as DuraFil® and EasyKleen® that enhance resistance and cleaning efficiency.

Multifilament fibers represent the fastest-growing form due to their flexibility, soft texture, and superior knot strength, ideal for aquaculture cages and gillnets. Recent developments in braided multifilament technology by Garware Technical Fibres and Toray Industries have improved elasticity and durability, enabling use in deep-sea and offshore operations where resistance to tearing and deformation is essential.

Commercial fishing holds the largest share at about 46%, driven by large-scale operations, modernization, and consistent replacement of worn nets. Key markets such as China, Indonesia, and India heavily use nylon and polyester-based trawls and purse seines for high-yield fishing.

Aquaculture is the fastest-growing end-user segment, propelled by expanding fish farming activities in Asia-Pacific and Europe. Offshore aquaculture and recirculating aquaculture systems require advanced fibers with anti-fouling and UV-resistant properties. Manufacturers like Garware Technical Fibres and Aquafil are innovating high-durability cage nets that reduce fish escapes and maintenance needs, supporting the global shift toward sustainable fish production.

Offline distribution dominates the fishing net fiber market with nearly 67% share, driven by the relationship-based sales model that supports custom orders, technical consultations, and after-sales service. Manufacturers such as Garware Technical Fibres leverage localized dealer networks to meet specialized buyer requirements in commercial fishing and aquaculture.

Online channels are the fastest-growing segment, benefiting from e-commerce expansion, transparent pricing, and global accessibility. Platforms like Amazon and specialized fishing gear stores on Shopify simplify product discovery and delivery. As digital adoption rises, online distribution is forecast to grow above 4.5% CAGR, complementing established offline procurement systems.

North America maintains a strong position in the global fishing net fiber industry, led by the U.S. and Canada’s large-scale fisheries and aquaculture operations. The U.S. fishing fleet comprises around 75,231 vessels, supporting 1.7 million jobs across commercial and recreational fishing sectors.

In 2019, U.S. aquaculture production reached 658 million pounds valued at US$ 1.5 billion, while the region’s salmon market continues to expand rapidly. Sustainable fishing remains central, with NOAA reporting 91.1% of 135 fish stocks as sustainable in 2022.

Technological advancements such as RFID-enabled nets, lightweight high-strength fibers, and biodegradable alternatives are shaping the regional market. Companies are focusing on enhancing supply chain resilience amid past disruptions. Rising recreational fishing trends, reflected by the Fishing Reels Market’s projected growth to US$ 7.02 billion by 2028, further support demand for fishing net fibers across North America.

Europe represents a key market driven by strict environmental regulations, sustainability priorities, and advanced aquaculture industries in Norway, Scotland, and the Mediterranean region. Manufacturers are developing eco-friendly fishing gear like biodegradable nets and lead-free sinkers, aligning with the EU’s Common Fisheries Policy emphasizing sustainable yields and reduced bycatch. The European Fishing Apparel and Equipment Market reached US$ 6.47 billion in 2024 and is projected to grow steadily through 2030.

Norway’s salmon aquaculture sector demands durable, biofouling-resistant net materials for harsh conditions, with firms like Garware Technical Fibres Ltd. serving major operations. The European Commission’s proposed updates to Regulation (EU) 1026/2012 promote sustainability and local manufacturing opportunities. Nations like Iceland and Spain, producing 1.5 and 1.1 million tons of fish respectively, sustain strong demand for high-performance fishing net fibers across commercial and industrial applications.

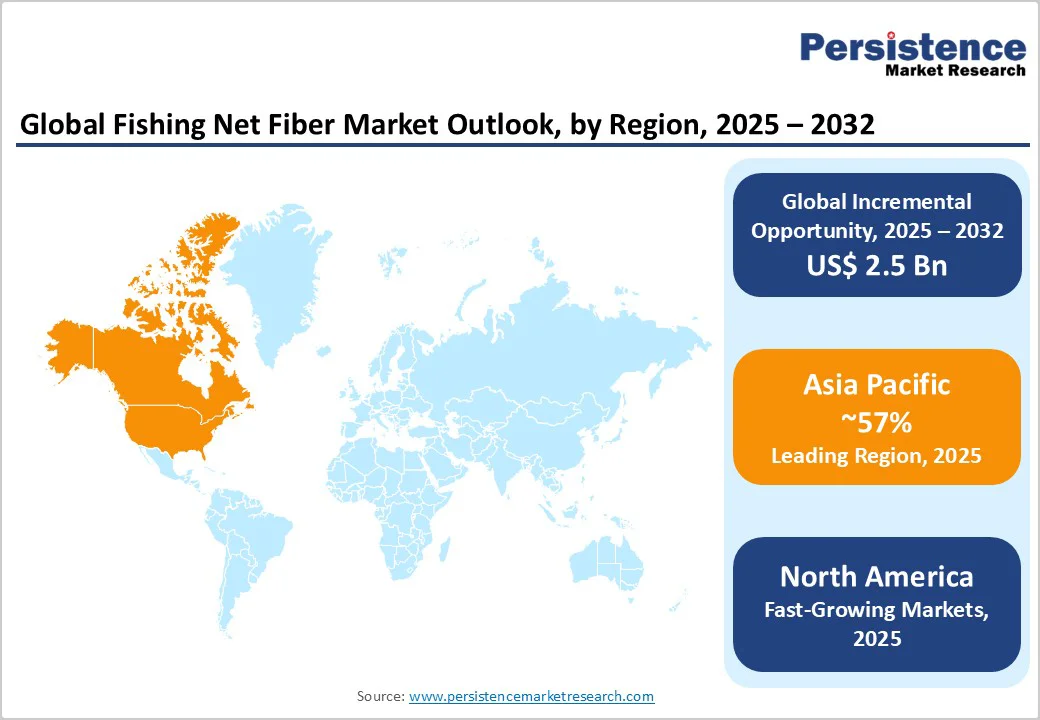

Asia Pacific dominates the global fishing net fiber market, accounting for over half of global capture and aquaculture production. China leads with 88.6 million metric tons of fisheries output in 2022, driven by government initiatives under its 14th Five-Year Fisheries Development Plan. India ranks third globally in fish production and second in aquaculture, with inland aquaculture output growing fourfold since 2000. Indonesia and Vietnam strengthen Southeast Asia’s leadership in brackish water and freshwater aquaculture respectively.

The region’s growth is supported by cost-effective manufacturing, proximity to major fishing grounds, and strong policy support. Companies such as Garware Technical Fibres (India) and Momoi Fishing Net Mfg. (Japan) drive innovation through sustainable fibers and circular economy projects like ECONYL® regenerated nylon. With FAO projecting production to reach 94 million metric tons by 2030, Asia Pacific is set to maintain its dominance in the forecast period.

The global fishing net fiber market is moderately fragmented, with competition among chemical producers, fiber manufacturers, and specialized net makers. No single company holds a dominant share, prompting firms to differentiate through product innovation, technical expertise, sustainability credentials, and regional market presence.

Advanced polyamide and polyester fibers, including recycled and biodegradable variants, are increasingly developed to meet performance and environmental demands.

Strategic initiatives such as capacity expansion, vertical integration, and partnerships for technology exchange strengthen competitive positioning. The growing focus on circular economy models and eco-friendly production creates further differentiation opportunities, enabling both global and regional players to capture niche markets while addressing sustainability and operational efficiency.

The global fishing net fiber market is expected to reach US$ 8.0 Bn by 2032, up from US$ 5.5 Bn in 2025, driven by aquaculture expansion, increasing seafood consumption, and advanced fiber technologies.

Market growth is driven by expanding aquaculture production, rising per capita seafood consumption, innovations in high-performance fiber materials including recycled and biodegradable options, and growing commercial fishing operations, particularly in Asia Pacific.

Polyamide (Nylon) dominates with 42% share due to tensile strength, abrasion resistance, low water absorption, chemical resistance, and recyclability. Innovations include recycled variants like Akulon RePurposed and Regen Ocean Nylon.

Asia Pacific leads with 57% share, driven by China, India, and Southeast Asia’s aquaculture production, strong commercial fishing infrastructure, government support, and high seafood consumption.

Development of biodegradable and sustainable fibers like ECONYL®, Biodolomer®Ocean, and Sensil BioCare addresses ocean pollution and regulatory sustainability requirements, representing the most significant growth opportunity.

Key players include BASF SE, Royal DSM N.V., Toray Industries, Indorama Ventures, AdvanSix, Formosa Chemicals, Hyosung TNC, Aquafil, Garware Technical Fibres, and Momoi Fishing Net Mfg.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Form

By End-user

By Distribution Channel

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author